An analysis by the University of Texas at Austin’s Energy Institute shows wind power generation capacity in Texas may already have surpassed coal-fired capacity in the state, and wind almost certainly will have leapfrogged coal by early next year, as wind farms continue to dot the landscape while more coal plants in the state are shuttered.

The report from the Energy Institute comes on the heels of last week’s announcements of the closing of three large Vistra Energy coal plants in Texas—Big Brown, Sandow, and Monticello, operated by Vistra subsidiary Luminant. All three plants are set to close in early 2018.

Vistra said the plants no longer are economic to operate, noting they are “economically challenged in the competitive ERCOT [Electric Reliability Council of Texas] market.” The three plants represent a whopping 4.2 GW of coal-fired generation capacity. Vistra Energy President and CEO Curt Morgan in a statement said “the market’s unprecedented low power price environment has profoundly impacted [Vistra’s] operating revenues and no longer supports continued investment [in the coal plants].”

The Energy Institute in an October 13 release said “New coal retirements announced by Luminant means ERCOT will soon lose significant coal generation capacity. At the same time, wind capacity is expected to increase by nearly 4,000 [MW] by 2018, meaning wind capacity will soon exceed coal capacity in Texas. Given current capacity factors for the respective technologies, it’s conceivable that energy generation from wind could possibly overtake coal in the near future.”

Joshua Rhodes, a research fellow at the Energy Institute, told POWER on October 16 that wind capacity overtaking coal “may already have happened. By the end of 2018, wind may have as much as 10 gigawatts more generation capacity than coal in ERCOT.”

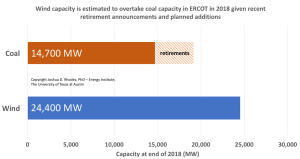

Rhodes produced a graphic (Figure 1) that shows wind capacity at 24,400 MW at year-end 2018, with coal at just 14,700 MW after planned retirements. Texas already leads the nation in wind generation capacity with more than 21,000 MW installed as of the second quarter 2017, according to the American Wind Energy Association (AWEA).

Wind is not the only the renewable energy source growing in Texas; Rhodes said “I think we’re about to have an explosion of solar in ERCOT.” He noted the state has added, and is continuing to add, miles of transmission lines across West Texas.

“ERCOT built out lines in West Texas to serve the wind farms,” Rhodes said, “and there is room on those lines for solar capacity. There is very large interest in getting solar projects on the ground in West Texas.”

A report from the Energy Institute in December 2016 said that wind and natural gas-fired power generation “are the lowest-cost technology options for new electricity generation across much of the U.S. when cost, public health impacts and environmental effects are considered.” The group’s analysis included the costs of generation from coal, natural gas, nuclear, solar, and wind.

Administration Seeks to Prop Up Coal

The latest announcements of coal-plant closings come as the Trump administration maneuvers to prop up the coal industry. The Environmental Protection Agency, led by former Oklahoma Attorney General Scott Pruitt, has called for a repeal of the Clean Power Plan (CPP) that was written by the Obama administration. The CPP was designed to curb power plant emissions, primarily from coal-fired plants, and critics cite it as part of the “war on coal”—which Pruitt last week declared was over.

“It’s ironic that this news [of more closures] comes the same week the Trump administration chose to roll back the Clean Power rule that would have reduced power plant climate-altering pollution,” Ilan Levin, the Texas director of the Environmental Integrity Project, a Washington, D.C.-based group that advocates for enforcement of environmental laws, said in a statement October 13.

Former Texas Gov. Rick Perry, now head of the U.S. Department of Energy (DOE), has spearheaded an effort to implement an electricity market plan that would help coal and nuclear plants that have been challenged economically by increased generation from natural gas-fired power plants, as natural gas prices have remained historically low, and also from renewable sources such as wind and solar. Perry has asked for a formal rule from the Federal Energy Regulatory Commission (FERC), which oversees U.S. wholesale electricity markets.

Perry was grilled on the issue by a House subcommittee on October 12. Perry’s notification of proposed rulemaking issued in late September directs FERC to “establish just and reasonable rates for wholesale electricity sales” for power plants that show “reliability and resiliency attributes.” The rule would allow generators that meet certain requirements, such as keeping a 90-day supply of fuel onsite, to recover production costs.

In effect, such a rule would favor coal and nuclear plants, which have fuel storage capabilities that natural gas, wind, and solar do not.

13.6 GW of Coal Generation Set to Close in 2018

A POWER magazine analysis based on publicly announced closures of coal plants shows more than 13,600 MW of generation capacity is scheduled to be retired in the U.S. next year. That’s on top of the expected retirement of 7,600 MW in 2017, the nearly 13,000 MW retired in 2016, and almost 18,000 MW of coal-fired generation capacity that closed in 2015.

Both opponents and proponents of coal are awaiting a decision on the fate of the 2,250-MW coal-fired Navajo Generating Station (NGS) in Arizona, which is scheduled to close in 2019 unless new owners can be found. The NGS is the largest coal-fired plant in the western U.S. in terms of nameplate capacity. Industry analysts point to the NGS as a test of whether the Trump administration can use its influence to keep plants open despite market forces. Interior Secretary Ryan Zinke has met with the station’s current owners, which include the Salt River Project (SRP), in an effort to keep the plant operating.

“Since the first weeks of the Trump administration, one of Interior’s top priorities has been to roll up our sleeves with diverse stakeholders in search of an economic path forward to extend NGS and Kayenta Mine operations after 2019,” Zinke said in June, after the Navajo Council supported a plan to keep the station and its neighboring coal mine open for another two years. “Operating NGS and the Kayenta Mine through 2019 is the first step to meet this priority.”

The Navajo plant in Page, Arizona, began operating in 1974, authorized by Congress as part of a government trust for the Navajo and Hopi tribes. The workforce for the plant and the adjacent mine is almost entirely Native American.

—Darrell Proctor is a POWER associate editor. (@DarrellProctor1, @POWERmagazine)