A partnership of companies seeking to build twin AP1000 reactors as part of the Vogtle nuclear expansion in Georgia will seek to complete the project, even as costs could surge well beyond $20 billion.

Southern Co. subsidiary Georgia Power on August 31 said the Vogtle project owners—Georgia Power, Oglethorpe Power, Municipal Electric Authority of Georgia (MEAG Power), and the City of Dalton—filed a recommendation with the Georgia Public Service Commission (PSC) to continue construction of the project, which has been financially crippled by the bankruptcy of Westinghouse, its former engineering, procurement, and construction contractor.

Significantly, project partners on August 31 also announced they had contracted with global engineering, construction and project management firm Bechtel to manage daily construction efforts. Bechtel is to work under the direction of Southern Nuclear, the Southern Co. subsidiary which operates the existing units at Plant Vogtle.

An “Economic Choice”

While Westinghouse has pegged its bankruptcy in March to delays and resulting cost increases at the AP1000 construction projects at Vogtle as well as at V.C. Summer in South Carolina, the recommendation is based on results of comprehensive schedule, cost-to-complete and cancellation assessment.

The PSC will review the recommendation and make a decision as part of the 17th Vogtle Construction Monitoring proceeding. For now, at least, the project partners may have the PSC’s backing. The regulatory body on August 15 signaled its support for the nuclear expansion, provided it can be done economically.

According to Georgia Power, completing both units “represents the most economic choice for customers and preserves the benefits of carbon-free, baseload generation.”

Executives from Southern Co., Georgia Power’s parent company earlier this month told investors in a second-quarter earnings call that costs to build the two Vogtle AP1000 units could range between $18.3 billion and $19.8 billion. But on August 31, the company said that based on new assessments, the total estimated capital cost forecast for 100% of the project is about $19 billion.

According to Southern Co., the assessment suggests Unit 3 will be placed in service in November 2021, and Unit 4 in November 2022. The total rate impact, meanwhile, “remains less than the original estimate, after including anticipated customer benefits from federal production tax credits, interest savings from loan guarantees from the [Department of Energy (DOE)], and the fuel savings of nuclear energy,” Georgia Power said in a statement on August 31.

“Once the project is online, the company should still be able to offer retail rates below the national average with the additional long-term benefits from this new source of clean and reliable energy,” it said.

The assessment included “robust economic analyses; evaluation of various alternatives including abandoning one or both units or converting the units to gas-fired generation; and assumptions related to potential risks including future payments from Toshiba, availability of production tax credits and extension of loan guarantees from the [DOE],” it added.

Seeking Support

On August 25, Oglethorpe Power Co., which owns 30% of the Vogtle nuclear plant and has secured a $3 billion loan guarantee from the DOE, indicated in investor documents that it will seek $1.6 billion in additional federal loan support to continue the project.

The DOE at the end of July approved a new service agreement finalized by Westinghouse and Georgia Power for the Vogtle AP1000 units, though the agency reached a separate deal with Georgia Power on a loan guarantee agreement that will require Southern Co. to provide it with a solid cost assessment by the end of the year.

Terms of that agreement may require that Georgia Power cannot request any advances under the loan guarantee until it has completed cost assessments and made a determination to continue construction of Units 3 and 4. Georgia Power must also give the DOE an updated project schedule, construction budget, and other information. It also requires the DOE’s approval of new agreements made with contractors with a primary responsibility for building the two AP1000 units.

Georgia Power, which owns 45.7% of the new units, said it has invested approximately $4.3 billion in capital costs in the project through June 2017, and estimates that its cost to complete the project is approximately $4.5 billion (for a total Georgia Power capital cost forecast of about $8.8 billion).

“The Georgia PSC has already approved $5.68 billion in capital costs for Georgia Power’s share of the project. With $1.7 billion in anticipated payments from Toshiba, the company’s potential additional capital costs are approximately $1.4 billion,” the company said.

In Oglethorpe’s last 8-K filing dated August 24, the power cooperative noted that total costs were projected to range between $6.5 billion to $7.3 billion, compared to its previous estimate of $5 billion (including financing costs and contingency). A spokesperson from Oglethorpe on August 30 confirmed that the figures were based on the completed final cost assessment, which has yet to be publicized, and assume Toshiba fulfills its obligations under the settlement agreement.

Those figures, however, indicate that total costs for the project may approach closer to $25 billion.

Moving Quickly for Tax Credits

Part of the impetus to finish the Vogtle project may stem from congressional action to extend a key nuclear production tax credit. Under current law, nuclear reactors can only receive the credit if they are active by Dec. 31, 2020.

The House of Representatives in June passed a bill (H.R. 1551) to extend that deadline; it would allow reactors going into service after 2021 to receive the credit, making Vogtle eligible. Greg Jones, a spokesman for Oglethorpe Power, said earlier this year “Passage of the nuclear production tax credit legislation is a fundamental piece of Oglethorpe Power’s evaluation of the future of Vogtle [units] 3 and 4.”

The Senate has been working on a way to move that legislation forward, either as a standalone bill or as part of a rider to must-pass legislation. Republican Sens. Lindsay Graham and Tim Scott of South Carolina, along with Republican Sen. Tim Isakson of Georgia, introduced S. 666, the Senate’s version of the nuclear tax bill, in March of this year.

Construction Is Making Progress; Bechtel In, Fluor Out

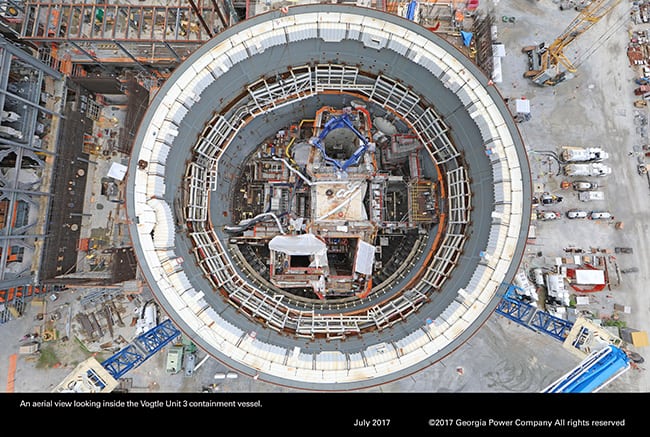

More than 6,000 workers from across the country remain onsite today, Georgia Power said. Over the past month, the construction team also checked off several construction milestones. These include placement of a steam generator into Unit 3, placement of the Unit 4 pressurizer compartment, and placement of the second of four accumulator tanks for the project.

Paul Bowers, chairman, president and CEO of Georgia Power remarked in a statement that the project partners have seen a “marked increase in productivity throughout this year with the best improvement being the most recent improvement, and our experience provides every indication that we can do a better job than Westinghouse alone as we move forward to complete the project.”

He added: “Since Southern Nuclear assumed control of the site from Westinghouse at the end of July, momentum has accelerated with a consistent focus on safe, high-quality construction. We expect this trend to continue with Bechtel,” he said.

The selection of Bechtel to manage construction on the project followed an evaluation of bids from potential construction contractors, including Fluor Corp.

Fluor transitioned to construction contractor at the beginning of 2016 following the ouster of CB&I in a major shakeup of contractors. As construction contractor, Fluor began the process of developing a basis of estimate for Westinghouse to determine what resources would be required to meet the revised schedule agreed upon in the settlement agreement with the owners.

In its filing with regulators, Georgia Power said its selection of Bechtel was based on its performance to date at the project. “Bechtel brings to the Project a well-qualified, talented team with strong leadership and senior-level engagement,” it said. Bechtel, it said, performed an independent study to support its bid for the construction contract of the Vogtle project, undertaking the “arduous task of reviewing Westinghouse’s subcontracts to determine which subcontracts should be retained and which should be renegotiated or terminated when it took over construction of the Project.”

Fluor Corp. on Thursday told POWER that project partner’s decision to proceed with Bechtel was disappointing. “We are disappointed in Southern Company’s decision to move forward with another construction company for the nuclear power units at Plant Vogtle. We will work with Southern Company to support an orderly project transition,” it said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine); Darrell Proctor is a POWER associate editor (@DarrellProctor1)

Updated (Aug. 31) to include details about Fluor Corp.