Wind and solar power capacity and generation have been growing steadily for years, as efforts to halt climate change and a desire for clean energy have gained public support around the world. As renewable energy costs have come down, growth is now being driven by economics. New technologies could also find a place in the energy mix over the next decade, as research and development efforts begin to pay off.

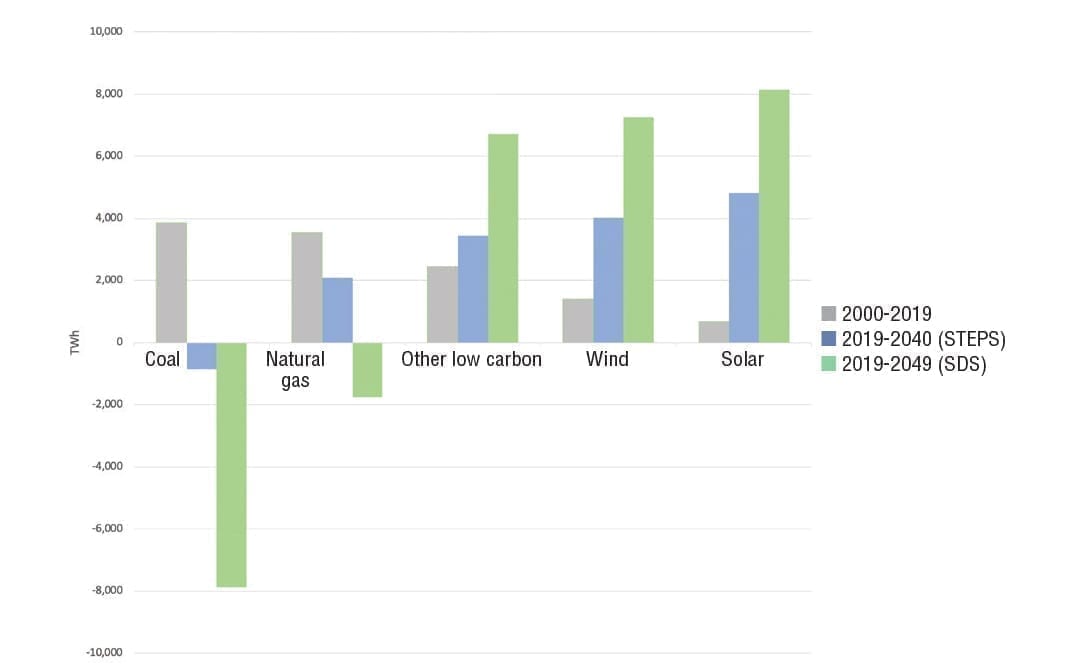

In spite of COVID-19, few trends changed in the power industry over the past year. Renewable energy, namely wind and solar capacity, grew in the U.S., as did natural gas-fired generation, while coal sank and most other resources remained relatively flat. On the global stage, the International Energy Agency (IEA) said in its World Energy Outlook released in mid-October that it expected renewable energy demand to be the only resource that would grow in 2020, and that solar would become “the new king of electricity” by 2040 (Figure 1). Notably, the IEA predicted global energy demand would fall by 5% in 2020 compared to 2019 due to the pandemic, and that investments in energy would plummet more than 18% year-over-year.

|

|

1. This chart shows the change in global electricity generation by source and scenario from 2000 to 2019 with projections to 2040, according to International Energy Agency (IEA) estimates. The “Stated Policies Scenario” (STEPS) reflects all announced policy intentions and targets, insofar as they are backed up by detailed measures for their realization. The “Sustainable Development Scenario” (SDS) incorporates a surge in clean energy policies and investment, putting the energy system on track to achieve sustainable energy objectives in full, including the Paris Agreement, energy access, and air-quality goals. Source: IEA (2020), World Energy Outlook 2020, IEA, Paris |

In a power sector outlook report prepared by CoBank’s Knowledge Exchange Division, Teri Viswanath, a lead economist for CoBank, suggested the economic fallout from COVID-19 could have a lingering effect on energy demand. CoBank is a national cooperative bank serving rural America. The bank is a member of the Farm Credit System, providing loans and other financial services to rural power, water, and communications providers, among others.

“From a U.S. power perspective, the contraction in weather-normalized electricity demand has been dramatic. The load erosion actually began in 2019, meaning the industry has lost the equivalent of a decade of growth since 2018,” Viswanath wrote. “Even under the most aggressive recovery scenario, electricity demand would only return to pre-pandemic levels by 2024. A more conservative pace obviously means a longer recovery.”

Wind and Solar March On

CoBank expects another 100 GW or more of low-utilization coal and high-operating-cost nuclear capacity will shutter by mid-decade. Counterbalancing the retirements will be the accelerated development of renewable generation. Planned clean-energy projects currently outnumber coal capacity retirements by nearly 2-to-1, according to Viswanath.

“The pace of clean energy deployment has accelerated in 2020, with industry poised to add 20,000 MWs of new utility-scale renewable generation by year-end [Figure 2],” the report says. “This pace of resource development is roughly double what was achieved in the prior decade—providing greater certainty that 2020 is not an aberration but rather the beginning of the further greening in the U.S. power sector.”

|

|

2. Danville Utilities, in partnership with CS Energy, Navisun, and TurningPoint Energy, began construction on a 14-MWDC utility-scale solar project in Danville, Virginia, in December 2019. In spite of delays due to COVID-19, the project went live in August 2020. Danville Utilities, which serves about 42,000 electricity customers, has three solar sites in operation and a fourth under development. Courtesy: CS Energy |

Over the summer, the American Council on Renewable Energy (ACORE), a national nonprofit organization that strives to unite finance, policy, and technology to accelerate the transition to a renewable energy economy, issued a report with findings from its annual survey of senior executives with some of the most active renewable energy financial institutions. In 2020, for the first time, the group also polled major renewable energy developers, asking questions concerning their experiences attracting project financing.

“The results reflect a near unanimous sense of optimism, with expectations of strong long-term growth in the renewable sector, despite near-term concern about headwinds posed by supply chain disruptions and other pandemic-related delays,” Gregory Wetstone, president and CEO of ACORE, said in the report.

“While companies are experiencing significant headwinds in 2020, surveyed renewable energy investors remain as confident in renewable energy growth over the next three years, on average, as they were in 2018–2019,” the report says. “Over half of surveyed financial institutions plan to increase their investment in renewables by more than 10% in 2020 compared to 2019.” Topping the list of attractive sectors for investment were energy storage and utility-scale solar projects.

Energy Storage Is Budding

Like the costs for wind and solar projects, prices for energy storage systems have also been on a steady decline. According to analysis released by IHS Markit in late-September, the average cost of a lithium-ion (Li-ion) battery fell 82% from 2012 to 2020. Furthermore, the researchers predicted the average cost of a Li-ion battery cell will fall below $100/kWh in the next three years, and decline to as low as $73/kWh in 2030. Price reductions are a key factor to wider deployment of batteries.

“Cost is the name of the game. Technology advances and competition between the different types of lithium-ion batteries is driving prices down. Ultimately, the two major growth markets—transportation and electric grid storage—depend upon lower costs to make batteries more competitive with the internal combustion engine and fossil fuel power generation,” Youmin Rong, a senior analyst with IHS Markit, said in a statement provided to POWER.

In a report issued in late-October on funding, merger, and acquisition activity, Mercom Capital Group said corporate funding for battery storage companies totaled $3.5 billion in 35 deals during the first nine months of 2020—a 62% increase compared to the same period in 2019. One company that has been attracting significant investment is Northvolt, a European supplier of battery cells and systems. The company reported on July 29 having raised more than $3 billion to date in equity and debt to support, among other things, the development of two Li-ion battery gigafactories being constructed in Skellefteå, Sweden, and Salzgitter, Germany.

“The fact that we have these world-class financial institutions supporting a new industry in Europe is a clear sign of where the markets are headed and the opportunity that brings for sustainable projects. This new industrial landscape will need significant investments over the coming years,” Alexander Hartman, CFO of Northvolt, said in a statement announcing the debt financing.

Potentially Game-Changing Technologies

There are countless research and development initiatives in progress throughout the energy industry. Three technologies that have long been studied and at times even hyped as a potential holy grail for the power sector are hydrogen, fusion, and geothermal energy. Although there is still a lot of work to be done before any of them reach their true potential, much progress has been made in each area, and meaningful advances could be closer than many people realize.

Hydrogen. It seems everyone is talking about hydrogen these days, and in particular, “green” hydrogen. The idea of producing hydrogen through electrolysis using renewable energy has a lot of supporters. However, the devil is in the details.

The method is fairly simple. Electrolysis uses an electrical current to separate water—H2O—into hydrogen and oxygen. If the electricity used in the process is obtained from renewable sources, the hydrogen is considered “green,” that is, produced without emitting carbon dioxide into the atmosphere.

One problem is that electrolysis is not a particularly efficient process. According to Hydrogen Europe, a trade association for the hydrogen and fuel cell industry, the efficiency of water electrolyzers (determined by the amount of electricity used to produce an amount of hydrogen) is currently in the 60% to 80% range based on calorific value. However, research continues to further improve the process.

There are other improvements that could help hydrogen become a more-utilized resource. Specifically, engineers are working to increase the operating life, power density, and stack size of electrolyzer systems; reduce costs (especially material costs); introduce pressurized systems, which could avoid the need for subsequent compression of the hydrogen produced; and importantly, develop flexible systems adapted to intermittent and fluctuating power supplies.

Field validations of some hydrogen technologies are showing promise. In October, one of Europe’s first industrial-scale facilities for the production of hydrogen by proton exchange membrane (PEM) water electrolysis reported favorable results as its demonstration phase concluded. The 1.2-MW HyBalance project in Denmark, led by Air Liquide, Cummins (through its Hydrogenics Europe business), Centrica Energy Trading, Ludwig-Bölkow-Systemtechnik GmbH (LBST), and Hydrogen Valley, said the project had delivered 120 tons of hydrogen since 2018, while demonstrating its ability to balance the electricity grid. In a joint statement, the companies said, the “HyBalance electrolyser has demonstrated that producing hydrogen to store energy at a large scale—including electricity from renewable sources—is technically and economically viable.”

“The facility is already a model for larger scale PEM electrolysers around the world including another Air Liquide plant, under construction, in Bécancour, Québec (Canada) with a 20 MW PEM electrolyser. The success of HyBalance will contribute to making low-carbon hydrogen a key element of the energy transition,” said Diederick Luijten, vice president of Hydrogen Energy Nec Cluster with Air Liquide.

The HyBalance plant reportedly had a high availability and was able to cope with fast power ramps both up and down. It provided 24/7 delivery of 60 tons of hydrogen to an industrial customer connected through a pipeline, with the other 60 tons of production delivered to a variety of customers including a network of hydrogen fueling stations used by a fleet of fuel cell taxis in Copenhagen. The facility was certified by the Danish energy authorities as a bidder in all electricity markets, further validating the technology. Although the demonstration is technically complete, Air Liquide will continue to operate the site and produce hydrogen to supply its customers.

“It is a true lighthouse project to the current multi-MW projects, where a number of technical and electricity market issues were faced and successfully addressed in terms of the dynamic operation of electrolysers for the provision of hydrogen and electricity grid balancing services,” said Bart Biebuyck, executive director of the Fuel Cells and Hydrogen Joint Undertaking, a public-private partnership aimed at facilitating the deployment of fuel cells and hydrogen technologies in Europe.

Fusion. The concept of fusion has been well-understood for years, but capturing more energy from a fusion reaction than it takes to begin the process has evaded researchers throughout history. Some fusion experts believe that may change in the coming decade.

There is a lot of research going on around the world to capture the power of fusion. Perhaps the most notable endeavor is the ITER project in southern France in which 35 nations are collaborating to build the world’s largest tokamak, a magnetic fusion device that has been designed to prove the feasibility of fusion at a large scale. Thousands of engineers and scientists have contributed to the design of ITER since the idea for an international joint experiment in fusion was first launched in 1985. The ITER members—China, the European Union, India, Japan, Korea, Russia, and the U.S.—are now engaged in a 35-year collaboration to build and operate the ITER experimental device.

Yet, there are many other tokamaks already producing fusion reactions. San Diego, California-based General Atomics (GA) has been a leader in magnetic fusion research since the 1950s. The DIII-D National Fusion Facility, operated by GA for the U.S. Department of Energy (DOE), is the largest magnetic fusion research facility in the country, and DIII-D research has delivered multiple innovations and scientific discoveries.

Another company that may be on the cusp of a breakthrough is Cambridge, Massachusetts-based Commonwealth Fusion Systems (CFS). In late-September, the company announced a series of seven peer-reviewed papers validating CFS’s approach to commercial fusion had been published in a special edition of the Journal of Plasma Physics. The papers were written in collaboration with the Massachusetts Institute of Technology’s Plasma Science and Fusion Center.

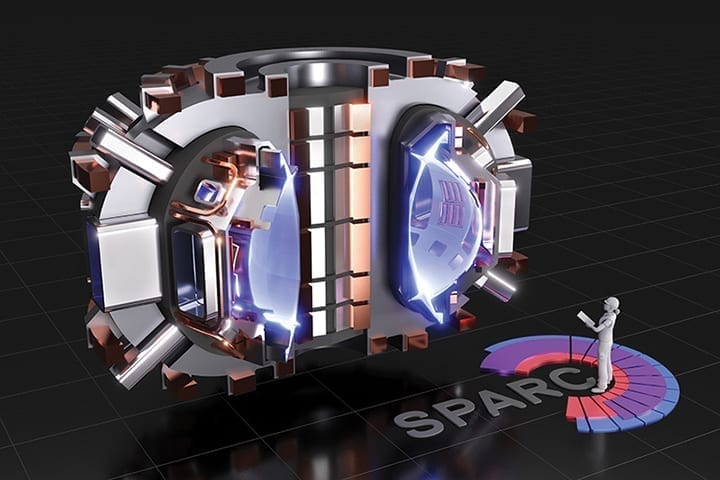

CFS is currently developing and testing new high-temperature superconductor (HTS) magnets, which will allow for smaller, faster, and less-expensive tokamaks. “We’re now starting to assemble a full-scale first-of-a-kind, 20-Tesla, multi-ton magnet that will really push this technology way beyond what anyone has done before,” CFS CEO Bob Mumgaard told POWER. Once the HTS magnets are finalized, CFS will utilize them in a demonstration unit called SPARC (Figure 3), which could be the world’s first fusion device to produce more energy than it consumes. Mumgaard expects construction on that machine to commence this summer.

|

|

3. Commonwealth Fusion Systems (CFS) is collaborating with the Massachusetts Institute of Technology’s Plasma Science and Fusion Center (MIT-PSFC) to build SPARC, which could be the world’s first fusion device to produce plasmas that generate more energy than they consume. Courtesy: T. Henderson, CFS/MIT-PSFC |

Geothermal. Although geothermal energy is not new and there are many commercial geothermal power plants in operation around the world, the development of enhanced geothermal systems and hot dry rock technology could expand the resource immeasurably. In an effort to tap into geothermal’s potential, the DOE’s Geothermal Technologies Office engaged in a multiyear research collaboration among national laboratories, industry experts, and academia. Its goal was to identify a vision for growth of the domestic geothermal industry.

The analysis culminated in a 218-page report issued in mid-2019. Among the key findings was a fairly obvious revelation: “Improving the tools, technologies, and methodologies used to explore, discover, access, and manage geothermal resources would reduce costs and risks associated with geothermal developments,” the report says. Achieving these improvements is the challenge.

One company that has shown progress is San Francisco, California-based GreenFire Energy. In June, the company completed the world’s first field-scale demonstration of closed-loop geothermal energy production. The demonstration was performed using an inactive well at the Coso geothermal field in Coso, California, and funded by a $1.48 million grant from the California Energy Commission, with additional support from Shell Oil, the Electric Power Research Institute (EPRI), and J-POWER—a large Japanese utility and EPRI member.

“At our Coso demo, we were able to insert a tube-in-tube heat exchanger 1,000 feet long into an existing geothermal well that couldn’t be used due to the high concentration of non-condensable gases, and we made over 1 MW of power, even though the project wasn’t really at full commercial scale,” Joseph Scherer, CEO of GreenFire Energy, told POWER. “With these results, we were able to validate the modeling we use to predict the performance of our various closed-loop solutions and a variety of geothermal resources.”

Another style of closed-loop system is being developed by Eavor (pronounced “Ever”), a company with headquarters in Calgary, Alberta, Canada, and offices in the U.S., Germany, the Netherlands, and Japan. On Sept. 30, Eavor announced an agreement with Huisman Equipment B.V. to collaborate on the design and construction of a next-generation highly automated drilling technology, focused on the implementation of the company’s Eavor-Loop geothermal solution.

Eavor said it is working on several potentially disruptive drilling innovations, which could expand the geographic deployment opportunities for its technology, while also improving capital efficiency. John Redfern, president and CEO of Eavor Technologies Inc., said the company has a cost target of $50/MWh or less for clean dispatchable power from its system.

“We have followed the achievements of Eavor and see that their closed-loop geothermal system solution could potentially be competitive with mainstream renewable solutions, as it enhances the complex features of traditional geothermal exploration. Specifically, the fact that the Eavor-Loop system does not rely on subsurface reservoirs is a huge advantage,” said Peter de Vin, director with Huisman Geo.

“Closed-loop geothermal has tremendous potential for electric power generation from vast, and otherwise unproductive, hot, dry rock resources as well as for a variety of other high-value special applications,” GreenFire Energy’s Scherer said. “The field-scale technical data obtained from [the Coso] demonstration project validates our plans to turn this potential into reality.”

While none of these possibly game-changing technologies is likely to become commercially successful in 2021, the solutions are worth keeping an eye on over the coming decade, because one thing the power industry has learned over the years is that change is inevitable. ■

—Aaron Larson is POWER’s executive editor.