All aspects of system operations are tested by unique challenges as more variable energy resources are connected to the grid.

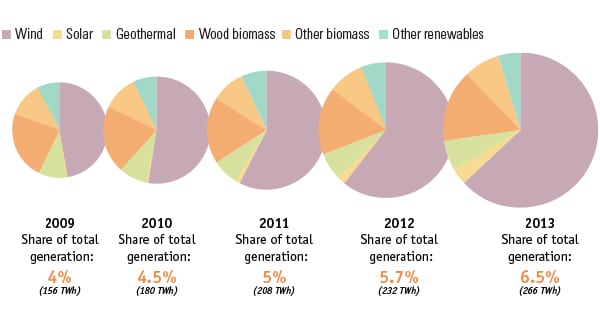

The share of non-hydro renewables in total U.S. power generation shot up to 6.5% in 2013 from 2.4% in 2003, according to the Energy Information Administration (EIA). The past five years alone have been specifically marked by a growth spurt for wind and solar power—so-called “variable energy resources” because the power they produce is less predictable compared to power from conventional technologies. Combined, wind and solar power generation soared to 4.4% of the nation’s total generation in 2013, compared to 1.49% in 2009 (Figure 1).

But, while the growth of these variable resources is “a blessing for the planet and for people,” it poses myriad challenges for grid operators who must deal with inherent swings, or ramps, in power output, said ABB Director of Marketing Francisco Tacoa at the ELECTRIC POWER 2014 renewables track session on integrating renewables.

Generators, too, are being forced to tackle a host of issues, he said. These include factoring in the need for more flexible generation resources, meeting demand for real-time energy requests, and evolving plant key performance indicators to accommodate variable renewables. Then they must minimize damage to assets not designed for intermittency, run power plants not designed for highly variable generation, and coordinate an automated and wide generation dispatch.

These issues will only gain more urgency in the future, Tacoa noted. Backed by renewable portfolio standards (RPS) and federal tax incentives, more than 50 GW of wind capacity is projected to be installed in the Western Interconnection while about 20 GW are expected to be installed in the Eastern Interconnection by 2020.

An Energy Imbalance Market

Tacoa outlined an interesting proposal in the Western Interconnection to address the anticipated increase in variable generation over the next several years that calls for its smaller balancing authority areas (BAAs) to pool their variable and conventional generation resources to improve operational efficiency over a wider area. This sub-hourly, real-time “Energy Imbalance Market (EIM)” would provide centralized, automated, and regionwide generation dispatch for imbalances. A working group comprising several western BAAs, the Western Governors Association, and a number of other stakeholders is making plans to link the entire Western Interconnection to the EIM.

The idea is gaining backers on a smaller scale, too: In mid-April, MidAmerican Energy’s newly purchased NV Energy filed a request with the Nevada Public Utilities Commission to voluntarily participate, starting in October 2015, in a regional 5-minute EIM agreed to in 2012 by the California Independent System Operator (CAISO) and MidAmerican’s northwestern utility PacifiCorp. NV Energy has said its EIM participation could benefit all participating parties in the range of $9.2 million to $29.4 million annually.

Nevertheless, the EIM concept isn’t without its critics. Beyond concerns about exorbitant startup costs, cost shifting, and new reliability problems, the American Public Power Association points out that an EIM has the potential to quickly evolve into a regional transmission organization—which historically “developed incrementally, with continual additions of more complex and costly centralized market features.” And, it says, an EIM could suffer similar problems: complex and costly market-pricing mechanisms, price volatility, and an absence of cost-effective measures to ensure resource adequacy. (See “tablet” sidebar next page.)

The proposed Western Interconnection EIM “does not require any formal coordinated unit commitments, but it does not preclude it down the road,” said Tacoa.

There also are other options to balance generation and load in BAAs, he said, including area-control error pooling, advanced dynamic scheduling, or an intra-hour transaction accelerator platform.

More Flexible Generation Resources

For generators, the growth of variable generation has underscored the need for more flexible generation resources, Tacoa said, and if two key considerations were to be identified, they are speed and efficiency. Gas turbines are at least 20% more efficient than steam boilers, which can take up to 12 hours to warm up. And, while today’s gas turbines can get up to 150 MW in 10 minutes, next-generation aeroderivative gas turbines promise even faster starts. Gas-fired engines win on a number of fronts beyond the efficiency factor, including ambient temperature operation without a derating factor, lower water consumption, flex fuel, heat rate, and lead time, Tacoa said.

But gas, too, has its shortfalls, as Jeff Kopp, business consulting manager at Burns & McDonnell explained. Kopp presented a case study highlighting CAISO’s efforts to address integration issues that are imminent in its operation region, though he underscored that California’s challenges are unique compared to other states because the state has an RPS of 33% by 2020. That means forecasted high levels of variable resources are becoming a reality: CAISO projects that it will need to reliably meet net load, manage about 3 GW of intrahour load-following needs, and provide nearly 13 GW of continuous up-ramping capability within a 3-hour time period.

That will require more frequent dispatches and the starting and stopping of flexible gas-fired generators, which will potentially incur more wear and tear and increase failure on generation components, leading to increased forced outages. (For more on the long-term effects of increased cycling, see “Managing the Changing Profile of a Combined Cycle Plant” in this issue.) Added to that, lower capacity factors for dispatchable generation combined with potential reduced energy prices could result in decreased energy market revenues for the gas fleet.

Ultimately, CAISO’s efforts to stabilize wind through gas generation—where gaps were filled using market purchase or engine dispatch, whichever was cheaper—showed that the annual levelized cost of energy (LCOE) from wind, gas, and the market was less pricey ($51/MWh) than from wind and gas only ($55/MWh), Kopp showed. These and factors such as a high sensitivity to gas prices determined that moving toward marketwide balancing may be a better practice, he said.

Other Options

Yet another option to accommodate variability is through power storage. ABB’s Tacoa outlined several existing approaches such as pumped storage hydropower, compressed air energy storage, and several forms of distributed battery-based power storage. (For more on the state of energy storage, see our May cover story “The Year Energy Storage Hit Its Stride,” online at powermag.com.) However, a number of roadblocks to deploy storage alternatives exist, he said, such as siting and permitting storage facilities, negative environmental impacts, taxing land demands, long lead times, and investment needs that must be ascertained without a clear return on investment.

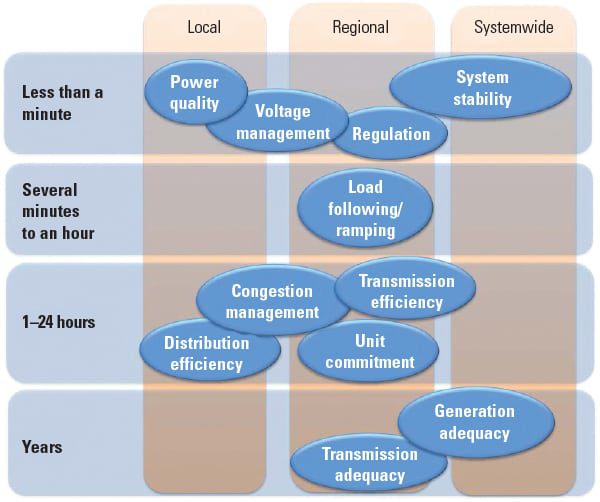

For Steve Fine, vice president at ICF International, the challenges of operating a grid with high renewable penetration span different time scales for all system operation entities—from less than a minute to years (Figure 2). Different variable resources will also require unique responses, he suggested. Higher penetrations of photovoltaics, for example, lead to increased ramping requirements that could stress system resources.

But renewable generators, too, bear risks, Fine pointed out. Transmission congestion and inflexible supply exacerbated by intermittent generation increase risks to investments in renewables owing to a higher likelihood of negative energy revenues—forcing the generator to pay to produce power—or economic and involuntary curtailment.

So many dynamic challenges to the integration of variable resources will ultimately require “a fresh approach to managing the grid,” said Fine. ■

— Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine).