A record 400 attendees participated in KEMA’s 22nd annual Executive Forum in San Antonio, Texas, in late April to debate and discuss the “retail resurgence” of competitive electricity sweeping America. Founded in 1927, KEMA is a global provider of business and technical consulting, operational support, measurement and inspection, testing, and certification for the energy and utility industry. With world headquarters in Arnhem, the Netherlands, KEMA employs more than 1,700 professionals globally and has offices and representatives in more than 20 countries. KEMA’s U.S. subsidiary, KEMA Inc., is headquartered in Burlington, Mass., and serves energy clients throughout the Americas and Caribbean.

You may be asking yourself: Why should I be interested in retail electricity markets? You would be wrong to think that you are in the business of making electricity but not selling it. Changing trends in customer retail purchasing are now having significant impact on plant operations. Your plant may now, or soon, be selling into deregulated markets, where customer choice means increased competition. The low-cost generator will make the sale in deregulated areas, while pressure will increase in regulated regions to hold the line on retail rates.

Competition Is the Key

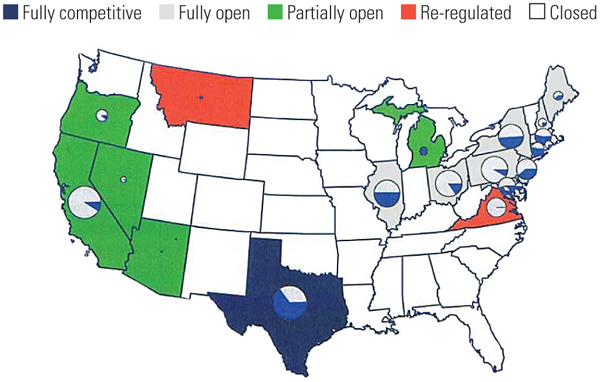

It was about 10 years ago that the wheels came off the original drive to “deregulate” electric power markets in the U.S. Enron was the poster child of the movement and led the state-by-state campaign to turn loose the forces of the marketplace by promising lower prices of electricity for customers, much as in the airline and natural gas industries. California was a leading advocate of the competitive market plan. With 37 million residents, California was a huge target for new sellers of electricity. But Enron’s excesses, which lead to a crash and burn in 2001, were followed by a rash of lawsuits and the bankruptcies of companies such as Pacific Gas & Electric, NRG, Mirant, and Calpine. California lost its confidence in competitive markets and went back to the old regulated model. Figure 1 illustrates the status of the U.S. retail markets today.

|

| 1. U.S. retail markets changing. The size of the pie for each state is based on overall sales volume, and the blue wedge in each pie is the fraction of consumers eligible to switch who are now served by a nonincumbent electricity providers (as a fraction of sales). For example, in Michigan, about 10% of the market (sales volume) is eligible to switch to a nonincumbent provider (the size of the circle) and, as the filled-in blue circle indicates, nearly 100% of those eligible to change from incumbent suppliers have done so. “Open” indicates markets where consumers are eligible to switch. “Fully open” markets are those where all customers are eligible to switch retail electricity provider but where the markets are not competitive. “Fully competitive” markets are those where the entire market has switched and there are technically no incumbents. Source: KEMA |

Texas regulators studied the tough lessons learned in California and adopted a different market structure that includes a choice of competing suppliers for all retail customers, even residential. Although there were new lessons to be learned and digested, the Texas competitive model is widely regarded by experts and, more importantly, by customers, as a huge success. Today, in each of the five major regions of the Electric Reliability Council of Texas, there are more than 30 retail electric providers (REPs) that compete for customers. (In other parts of the country, they may be called RES, retail electric suppliers.)

About 90% of residential customers with access to competition (munis and co-ops to date have not allowed choice) have switched to a new retail provider at least once.

As Barry Smitherman, chairman of the Texas Public Utilities Commission (PUC) noted, “We have lower prices, more choices, and happier customers. We have a good market model in place and try not to interfere. Our job at the PUC is to not screw it up. Today in metro Dallas or Houston, residents can buy electricity on a fixed-price one-year contract for about 8¢/kWh; or if you’re willing to go with a month-by-month plan linked to the price of natural gas, today’s price is about 5¢ per kWh.” (The average retail price of electricity in the U.S. in May 2011 was just under 10¢ per kWh.)

Also speaking at the KEMA conference was Mayo Shattuck, CEO of Constellation Energy. Constellation is the parent company of Baltimore Gas and Electric, and Constellation NewEnergy, a REP. Shattuck recalled Constellation’s seminal moment in 2002 when purchasing NewEnergy from AES. Part of the rationale behind the purchase was to transplant some of the entrepreneurial culture of NewEnergy into the entire Constellation organization.

He attributes Constellation’s success to focusing on the three Cs: costs, customers, and competitors. “We have to be advocates of the competitive market wherever we do business and deliver the promise.” Ironically, Constellation’s metropolitan Baltimore home turf has recently become a battleground for residential customer advocates. It took more than five years after the rate caps were lifted for residential customers en masse to figure out that electricity is something that you shop for. Shattuck notes, “We once had rate payers; now we have customers.”

Exelon announced at the end of April the purchase of Constellation Energy for $7.9 billion. The purchase is expected to be completed in early 2012.

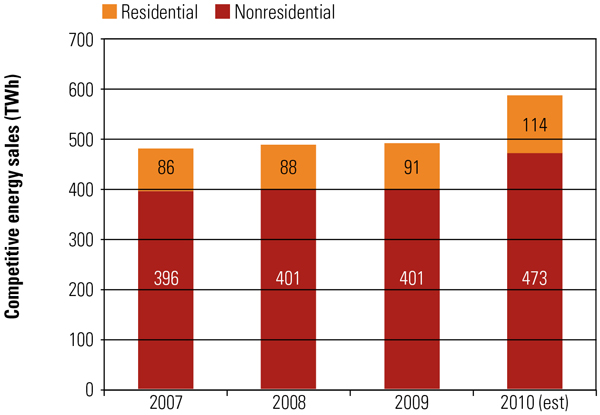

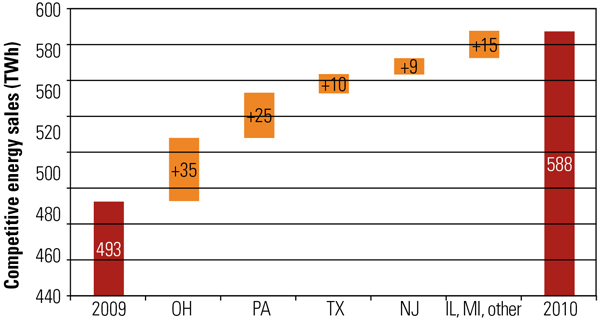

The growth of competitive markets in the U.S. is being driven by the desire of customers to choose their electricity supplier based on price, terms, and service. During 2010, the total quantity of electricity purchased from competitive suppliers by customers who switched suppliers was up 25% for residential customers and 18% for nonresidential customers (Figure 2). The greatest increases in switching rates occurred in Ohio and Pennsylvania (Figure 3). Consumer choice in the selection of REP to reduce the cost of electricity is gathering momentum, but so are opportunities for those same retail suppliers (see the next story).

|

| 2. Fierce competition. Competitive electricity markets continue to grow because residential users are demanding choice of electricity supplier. During 2010, the total quantity of electricity purchased by consumers who switched electricity suppliers was up 25% for residential customers and 18% for nonresidential customers. Source: KEMA |

|

| 3. Change leaders. Ohio and Pennsylvania led the deregulated electricity markets with the number of residential retail customers switching electricity suppliers. This chart illustrates the total competitive retail electricity sales in 2009 on the left, the electricity purchased by customers who switched from the default supplier in selected states, and total electricity sales in 2010. Source: KEMA |

One Million Pennsylvanians Switch

The big buzz at the conference was that in less than a year, more than 1 million Pennsylvania residential customers had switched from the default supplier, and the rate of switching was accelerating in the wide-open Philadelphia market.

PUC Chairman Robert Powelson, a passionate supporter of competitive markets, noted that the debate in Pennsylvania was “what do we do about the default supply?” Customers are not obligated to shop for electricity and change suppliers, but if they do not, they will be served by the default supplier at a price above the competitive market. Often, these non-shopping customers are the ones who can least afford an excessive electric bill.

Powelson said that continuing education is needed to remind residential customers that shopping for electricity is encouraged and that switching will not affect the reliability of service at their home. If there is a storm that causes a major power outage, restoration of service will be no faster or no slower for electricity shoppers.

Illinois Protects Consumers

In the summer of 2007, the Illinois General Assembly created the Illinois Power Agency (IPA), an independent government agency, to develop and manage a new electric supply procurement process for customers of Ameren Illinois and ComEd. After overseeing the procurement of electric supply, the IPA directs the utilities to enter into wholesale electric supply contracts of various durations to purchase electric supply from different sources.

According to a plan developed by the IPA and approved by the Illinois Commerce Commission, Ameren and ComEd purchase the electric supply for customers who have not chosen to receive supply from a REP. The utilities charge customers for the costs of purchasing electric supply, without any markup or profit. Ameren and ComEd also pass through a transmission charge and the regulated cost of delivering the electricity. A typical residential customer in Chicago can currently reduce the commodity portion of the electric bill by 15% to 20% by switching to an REP for a one-year term. Promotional codes are available for further savings on some plans and at least one REP offers frequent flier miles for each $1 of electricity purchased.

Currently, about 75% of the electricity consumed by Illinois’ commercial and industrial customers is provided by a REP. In addition, there are seven REP companies competing for residential customers in Ameren territory and 12 in ComEd territory. Customers in MidAmerican Energy’s service territory also have the right to choose a retail electric supplier. However, no suppliers have registered with MidAmerican to serve these customers, likely because the competitive market is small and has lower retail rates.

According to the Illinois Commerce Commission, residential shopping for electricity increased during the first quarter of 2011, but exact data has not been released. As of November 30, 2010, only 0.3% of residential customers in ComEd’s territory had switched to a REP. It would not surprise me to see as much as 5.0% of the residential load switched over to the competitive market by the end of 2011.

—Mark Axford is the principal of Axford Consultants LP and a POWER contributing editor.