China is the largest manufacturer and installer of solar photovoltaic power systems in the world, and the country appears ready to increase its solar installations based on information contained in the country’s 14th Five-Year Plan (FYP). The plan, covering the period 2021-2025, is being developed and expected to be implemented beginning in March 2021.

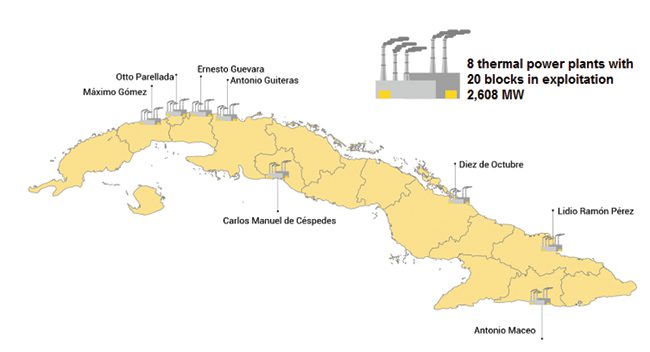

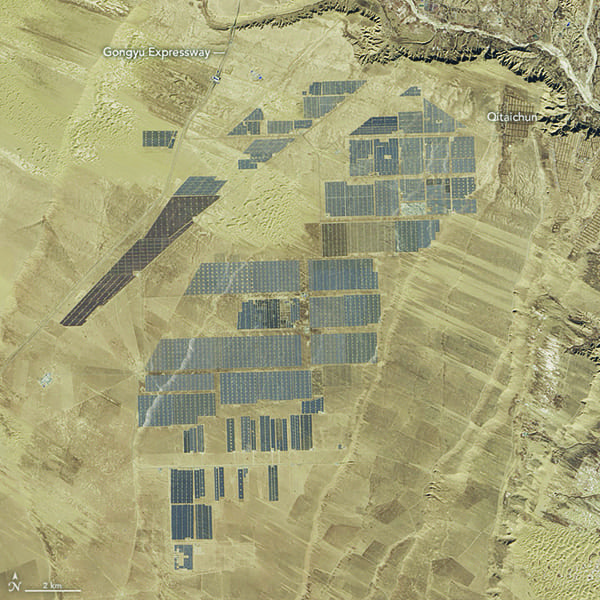

The policy priorities of the plan were revealed in late October 2020, when the 19th Central Committee of the Communist Party of China held its Fifth Plenary Sessions in Beijing. China has set a target to be carbon-neutral by 2060, and the latest plan’s outline for energy shows the country could increase annual installations of solar power generation capacity to as much as 85 GW, about double the country’s current rate. China in October 2020 brought a 2.2-GW solar farm (Figure 1) online—it is currently the world’s second-largest in terms of generation capacity—in the northwest province of Qinghai.

Analysts with UK-based HSBC Bank wrote in a report that China’s “14th Five-Year Plan (FYP) is being revised at the moment because President Xi [Jinping] has set a new strategy for carbon neutrality by 2060. All departments are revisiting their estimates. Wind and solar are core to this.”

The analysts noted that an annual target of 85 GW is more than two-thirds of all global solar capacity (115 GW) installed in 2019. The bank said it likely would be two or three years before China could increase its manufacturing to hit that level of installations. However, the report said increased solar generation capacity will further drive down the cost of solar power, by as much as 50% from current levels by 2025.

Bor Hung Chong, a solar developer and head of business development, managing partner (Malaysia) at NEFIN in Hong Kong, told POWER the 14th Five-Year Plan “emphasized China’s focus on carbon neutrality and their ambition to increase the solar energy coverage by 75-85 GW annually. China’s activities would greatly influence the global energy landscape as it will directly affect both the supply chain and overall demand for solar energy.”

Leung noted China’s “important role in the solar industry supply chain as Chinese solar PV material manufacturers have grown rapidly in the past few years, e.g. LONGi and Huawei. With government support, Chinese manufacturers have prioritized R&D and have both improved system efficiency and lowered the cost of production. Improvements in the solar supply chain have already yielded benefits for solar energy developers internationally as it has improved project economics and returns. As the industry has developed and with a wider selection of suppliers and technologies, enterprises (Figure 2) have greater opportunity to collaborate with solar PV solutions providers and find the best solution for them.”

HSBC said its estimates were based on conversations with the China Photovoltaic Industry Association. Xi announced China’s carbon-neutrality goal in recent speech at the United Nations, though the country has not publicly released details of how it will achieve the goal. Analysts have said China could set a high carbon price in the carbon trading market, which could incentivize carbon-emitters to reduce coal-fired power generation.

“China is expected to reintroduce green certificates and/or carbon trading, but this time with different requirements to ensure enforcement,” the bank’s analysts wrote. “Subsidies and tariffs for existing renewables have been made clear without much changes in the future, so commitment to renewable energy generation is a matter of meeting quotas, not about pricing or availability of subsidies.”

It is expected that the increased deployment of solar power will likely cause China to scale back its planned construction of new coal-fired power plants. The country has more than 1,000 GW of coal-fired power generation capacity, though researchers from Draworld Environment Research Center, and the Helsinki, Finland-based Centre for Research on Energy and Clean Air (CREA), said in a recent report that many of the plants are redundant or underutilized.

“The power section needs to achieve zero emissions as soon as possible,” the report said. “Coal power should be phased out rapidly in a cost-effective manner.” The report said the country could reduce its coal-fired generation capacity to about 680 GW by 2030, instead of increasing its coal fleet to about 1,300 GW, as some in the country’s coal industry have suggested. Zhang Shuwei, Draworld’s chief economist and the report’s lead author, in a statement about the report said building more coal plants—at a time when wind and solar power have become as cheap or even less costly than coal—could result in China having more than 2 trillion yuan ($304 billion) in stranded assets. “A further expansion of the coal-fired power industry would greatly complicate this challenge, requiring a cliff-fall of coal power generation after 2030,” Zhang said.

The report said that in order to meet the carbon-neutral goal, China must immediately halt all new coal-fired power plant construction, and double its level of installed solar and wind power capacity to at least 100 GW each year. “There is no leeway to construct new long-lived fossil fuel infrastructure such as coal power, which would need premature retirement to meet China’s vision to achieve net-zero emissions,” the researchers said in the report. Yuan Jiahei, a professor at North China Electric Power University, in the report said, “As long as coal consumption continues to drop significantly, peaking carbon emissions before 2030 will be a relatively achievable goal.”

Xi at the October meeting said China will emphasize a switch from high-speed to high-quality development, with a key element being “preventing and dissolving the hidden risks and actively responding to the impact and challenges brought about by changes in the external environment,” presumably a reference to climate change. The latest FYP noted four sectors that will benefit from special market-oriented reforms, including energy, railway, telecommunications, and public utilities industries.

The environment and climate change were announced as priorities for the new plan, in line with Xi’s announcement of eventual carbon neutrality. The FYP noted several areas for government support, including green finance, green technological innovation, clean production facilities, and industries involved with environmental protection. It also called for a green transformation of key industries and other business sectors, in part through “clean, low-carbon, safe and efficient use of energy [and] green buildings.” It said China will work toward allocating energy and resources more efficiently, with an emphasis on water conservation and waste classification. There were no details, though, about how the country plans to transition away from coal-fired power generation.

—Darrell Proctor is associate editor for POWER (@POWERmagazine).