Small-scale hydro generation stands to benefit from recent congressional action aimed at streamlining what historically has been a challenging federal approvals process. That action, along with technology innovations, could make it easier to develop hydro generating capacity in sources as diverse as navigable rivers, man-made conduits, and water distribution systems.

For the U.S. House of Representatives to agree on anything these days is unusual. For it to agree unanimously on a bill related to renewable energy may strike some as just short of a miracle. But in mid-February, House members voted 422-0 to approve H.R. 267, a piece of legislation aimed at streamlining regulations for small hydropower projects that tap some of the potential generating capacity available in the U.S.

Following passage, the bill moved to the Senate, which is expected to consider it later this year. If passed and signed into law, the bill would promote the development of small-scale hydropower and so-called conduit generation projects, which are powered by the force of water flowing in structures such as irrigation canals and water distribution pipes. It also aims to shorten regulatory timeframes for other low-impact hydropower projects, such as adding power generation to existing nonpowered dams and developing closed-loop pumped storage, which can help to balance intermittent renewable resources such as wind and solar. Under the current license approval regime, project developers have to wait years for approval. Such regulatory lag can be deadly to smaller-scale projects.

“There’s incredible potential right now,” said Cherise M. Oram, a partner in the Stoel Rives law firm and vice president of the National Hydropower Association (NHA). “The industry believes there have got to be ways to meet existing regulatory standards without taking so long, especially for small projects.”

The trade group’s view is that developers should more easily be able to add power generating equipment at existing dam structures when no incremental environmental impact is expected, said Jeffrey A. Leahy, NHA’s director of government affairs. “There are no tremendous additional environmental impacts, so why go through the same environmental process” as new construction, he asked.

Small is beautiful as the industry focuses attention on developing what could be up to 12 GW of hydro generating capacity across the U.S.—provided regulatory reform that has been recognized as needed for years becomes a reality.

The current licensing process for a project 50 MW or smaller can be daunting. The Federal Energy Regulatory Commission (FERC) exercises licensing authority, but the path to federal licensing involves a lengthy application process that may include environmental impact assessments, endangered species and water quality evaluations, and lengthy consultations with state agencies and tribal organizations, with no single decision-maker in the process.

Once a FERC license is obtained, the developer of a project at an existing federal lock or dam must repeat the application process to win approval from the U.S. Army Corps of Engineers or the Bureau of Reclamation, two federal entities whose jurisdiction extends to water resources that include locks, dams, navigable waterways, and related infrastructure. Power generation historically has fallen low on their list of priorities, superseded by uses such as commercial navigation, flood control, and recreation. By the time a hydropower application wins approval from one of these entities, the initial FERC license requirement for the start of construction may have expired.

The net effect has been to dampen small hydro generation development and drive up its cost. And it’s precisely among small-scale developments that much of the potential exists to expand hydroelectric generation in the U.S.

Before there were large-scale wind farms and thin-film rooftop solar, there was hydro. Indeed, the first engines of the Industrial Revolution were driven by water power, a use that today might be labeled “distributed generation.” The ancient Greeks made use of “Archimedes’ screw,” a machine historically used for transferring water from a low-lying body of water into irrigation ditches that is being reexamined as a potentially modern power generation source.

In the U.S., 100,000 MW of installed capacity accounts for about two-thirds of the nation’s renewable electricity and 6.5% of total generation. Hydropower enjoys even more widespread deployment outside of the U.S. Top producers, according to the International Energy Agency, are led by Norway, with hydro providing nearly 98% of generation, and Brazil, where it provides roughly 78%. And although China only provides 17% of its total generation from hydro, its 22,500-MW Three Gorges Dam is the world’s largest hydroelectric facility. Large impoundment reservoirs such as Brazil’s Itaipú and China’s Three Gorges garner a lot of headlines, but the majority of hydroelectric capacity is much smaller in scale.

In the U.S., at least, much of the focus on new hydro capacity is tied to water supplies that include existing reservoirs and man-made conduits, said Rick Miller, senior vice president of renewable energy services at HDR Inc. Many small-scale hydro power projects can connect directly to the local power distribution network, eliminating the need for significant transmission capacity. “The small stuff is very much a distributed generation technology similar to distributed solar,” he said.

Assess the Costs

A June 2012 report by the International Renewable Energy Agency, an organization comprising 158 member states plus the European Union, said that average investment costs for large hydropower plants with storage typically range from as low as $1,050/kW to as high as $7,650/kW, while the range for small hydropower projects is between $1,300/kW and $8,000/kW. Adding additional capacity at existing hydropower schemes or existing dams that don’t have a hydropower plant can be significantly cheaper and can cost as little as $500/kW.

The report considered annual operation and maintenance (O&M) costs and said these are often quoted as a percentage of the investment cost per kilowatt. Typical values range from 1% to 4%. Large hydropower projects typically have O&M costs averaging around 2% to 2.5%. Small hydropower projects lack scale economies and can have O&M costs of between 1% and 6%, or higher.

The cost of electricity generated by hydropower is generally low, although costs are site-specific. The levelized cost of electricity (LCOE) for hydropower refurbishments and upgrades ranges from as low as $0.01/kWh for additional capacity at an existing hydropower project to around $0.05/kWh for a more expensive upgrade project, assuming a 10% cost of capital. The LCOE for large hydropower projects typically ranges from $0.02 to $0.19/kWh, assuming a 10% cost of capital. The report said this makes the best hydropower projects among the most cost-competitive generating options available today. The LCOE range for small hydropower projects for a number of projects in developing countries was between $0.02 and $0.10/kWh, making small hydro a frequently cost-competitive option to supply electricity to the grid or to supply off-grid rural electrification schemes. Very small hydropower projects, however, can have higher costs and an LCOE of $0.27/kWh or more for so-called “pico-hydro” systems.

Many Turbine Options

The most suitable and efficient turbine for a hydropower project depends on the site and the overall power scheme design, with key considerations being the head and flow rate (see the sidebar for definitions).

One type of turbine, known as a Francis turbine, is a reaction turbine that ranks among the most widely used hydropower turbines worldwide. Using guide vanes and wicket gates to control the water’s flow and direction on the turbine blades, Francis turbines are highly efficient and can be used for a wide range of heads and flow rates.

The Kaplan turbine was derived from the Francis turbine and allows efficient hydropower production at heads that are between 33 feet and 230 feet, typically much lower than for a Francis turbine.

Impulse turbines such as Pelton, Turgo, and cross-flow (sometimes referred to as Banki-Michell or Ossberger) designs are also in widespread use. These turbines are driven purely on the impulse of flowing water. Among impulse turbines, the Pelton turbine is most commonly used with high heads and utilizes nozzles to control the water’s flow to the runner buckets—much like a high-pressure nozzle at the end of a hose.

“Equipment innovations in the last 15 years have made it possible to use sites that were not viable because of low-head conditions,” said James Borg, group leader of Small Hydro Projects for MWH Global. Key innovations include low-rpm turbines using permanent magnet generators, fish-friendly technology, and advanced power-converting electronics. Another factor is the supply of economically competitive equipment from Asia, he said.

Hydropower plants can be built in a variety of sizes and with different characteristics. In addition to the importance of head and flow rate, hydropower schemes can fall into one of several categories:

- Run-of-river hydropower projects have no, or very little, storage capacity behind the dam, with generation dependent on the size of river flows.

- Reservoir (storage) hydropower schemes store water behind a dam and so decouple generation from water inflows. Reservoir capacities can be small or large, depending on site characteristics and the economics of dam construction.

- Pumped storage schemes use electricity at off-peak times (often overnight) to pump water from a reservoir located after the tailrace to the top of a reservoir, thus enabling the pumped storage plant to generate electricity at peak times. Fast-reaction pumped storage facilities are being constructed to provide the grid stability needed to address the intermittent influx of energy from wind generation.

Assess the Resource

The industry has said for years, based upon the Corps of Engineers’ National Inventory of Dams database, that only around 3% of the nation’s 80,000 or so dams have electricity generation associated with them. Oak Ridge National Laboratory (ORNL) published in April 2012 a study of hydropower potential in the U.S. It found that many of the monetary costs and environmental impacts of dam construction have already been incurred at these non-powered dams (NPDs), so adding power to the existing structure often can be achieved at lower cost, with less risk, and within a shorter timeframe than through new dam construction. The abundance, cost, and environmental benefits of NPDs, combined with the reliability and predictability of hydropower, make these dams a potentially attractive way to expand the nation’s renewable energy supply.

Of the more than 80,000 NPDs throughout the U.S., 54,391 dams were analyzed by ORNL, with the remainder eliminated from consideration due to faulty geographic information or erroneous flow or drainage area attributes. ORNL said that adding power generation to U.S. NPDs has the potential to contribute up to 12 GW of new renewable capacity—a potential that it said is equal to increasing the size of the existing conventional hydropower fleet by 15%. Most of this potential lies in just 100 NPDs, which could contribute some 8 GW of hydropower; ORNL said the top 10 facilities alone could add up to 3 GW of new hydropower.

The ORNL study also found that 81 of the 100 top NPDs are U.S. Army Corps of Engineers facilities, many of which, including all of the top 10, are navigation locks on the Ohio, Mississippi, Alabama, and Arkansas Rivers, and their major tributaries. The study also suggested that dams owned by the Bureau of Reclamation hold the potential to add another 260 MW of capacity.

Three different small-scale hydropower ventures illustrate the range of projects and technologies that could be deployed across the U.S. One is a series of hydropower installations at Corps of Engineers navigation dams. The second is a repowering of a powerhouse in the Rocky Mountains with a high head. The third represents two new technologies that could expand the distributed nature of small-scale power in water supply systems.

Power from the Ohio River

American Municipal Power-Ohio (AMP) is building five new hydroelectric projects on Corps of Engineers dams along the Ohio River. Altogether, the projects will add more than 350 MW of hydro generation to the region. Voith Hydro is manufacturing the turbines and generators for the first four projects, which include run-of-river generating facilities. Nearly 80 AMP member communities are participating in the projects, all of which consist of an intake approach channel, a reinforced concrete powerhouse, and a tailrace channel.

These projects are among the first to be developed on Corps structures in decades, and AMP had to be patient and persistent to win both a FERC license and Corps approval. The process was “a bit painful” but opened the Corps’ eyes to how the approval process might be streamlined, said Paul Blaszczyk, a vice president and the project manager for MWH, the consulting firm serving as AMP’s engineer for all of the projects. As a nonprofit, AMP was able to secure good interest rates for the projects. What’s more, it considers the projects to be 100-year investments, a point of view that helped improve the projects’ economics and keep the lengthy approval process in perspective.

AMP’s Cannelton Project will divert water from the existing Corps Cannelton Locks and Dam through bulb turbines to generate an average gross annual output of roughly 458 GWh. The “bulb” designation comes from the shape of the upstream watertight casing, which contains a generator located on the horizontal axis. The powerhouse will house three horizontal 29.3-MW turbine and generating units with an estimated total rated capacity of 88 MW at a gross head of 25 feet. A 1,000-foot-long, 138-kV transmission line interconnection is planned to connect to the Midwest Independent Transmission System Operator (MISO).

The Smithland Project will divert water from the Smithland Locks and Dam through bulb turbines to generate an average gross annual output of some 379 GWh. The powerhouse will house three horizontal 25.3-MW turbine and generating units with an estimated total rated capacity of 76 MW at a gross head of 22 feet. A 2-mile-long, 161-kV transmission line interconnection is planned to connect to MISO.

The Willow Island Project will divert water from the Willow Island Locks and Dam through bulb turbines to generate an average of 239 GWh annually. The powerhouse will house two horizontal 22-MW turbine and generating units with an estimated total rated capacity of 44 MW at a gross head of 20 feet. A 1.6-mile-long, 138-kV transmission line interconnection is planned to connect to PJM.

The Meldahl/Greenup projects include the run-of-river hydroelectric generating facility currently under construction at the Captain Anthony Meldahl Dam on the Ohio River and the existing generating facility at the Greenup Dam, also on the Ohio River. More than four dozen AMP member communities are participating in this project. Under a partnership agreement with the member community of Hamilton, Ohio, AMP is overseeing construction of the Meldahl project and will own 48.6% of the facility when it becomes operational. Upon commercial operation of the Meldahl project, AMP will obtain a 48.6% share of the Greenup facility.

The Meldahl Project will divert water from the existing Corps Meldahl Locks and Dam through bulb turbines to generate an average gross annual output of approximately 558 GWh. The powerhouse will house three horizontal 35-MW turbine and generating units with a FERC-licensed rated capacity of 105 MW at a gross head of 30 feet. If interconnected to MISO, an 8-mile-long, 138-kV transmission line is planned. If interconnected to PJM, a 5-mile-long, 345-kV transmission line is planned.

Rocky Mountain Hydro

The Boulder Canyon Hydroelectric Project (BCH) was built in 1910 by the Eastern Colorado Power Co. to generate electricity. During the 1950s, the facilities also began providing water for the City of Boulder’s municipal water supply. Boulder bought the BCH from Public Service Co. of Colorado (Xcel Energy) in 2001. At that time, there were two 63-year-old, 10-MW turbine/generators in the power plant, only one of which was operational. Boulder determined that a new 5-MW turbine/generator, shown in Figure 1, would be needed to keep the facility in operation. The smaller unit would be more appropriately sized for the plant and would extend the life of the hydroelectric project for at least 50 years. In addition, even though smaller, the new turbine/generator would be able to produce 30% more energy because it is more efficient.

|

| 1. Smaller but more efficient. The City of Boulder replaced 1930s-vintage hydro technology with a new 5-MW Pelton turbine, contained in the blue housing. The generator is to the right in a red housing. The new equipment is smaller but more efficient than the retired 10-MW unit, which can be seen in the background on the left. Source: POWER |

In 2009, the U.S. Department of Energy provided a grant opportunity for projects such as the BCH modernization project as part of the American Recovery and Reinvestment Act. Boulder received $1.2 million toward a total estimated project cost of $5.2 million.

The project scope included removing one of the two existing 10-MW turbines, installing a new 5-MW turbine/generator, upgrading wiring, installing a state-of-the-art turbine isolation valve, installing remote monitoring and operation equipment, and removing and replacing several aging, oil-cooled transformers adjacent to Boulder Creek.

A pressure line drops water more than 1,800 feet from a forebay to the powerhouse and delivers its water under a static head of 800 pounds per square inch. Because the water is used as part of Boulder’s drinking water supply, almost all the pressure needs to be removed from the flow before it can be distributed throughout the city. Before the hydro facility was built, a pressure-relief valve accomplished this function. Now the powerhouse can handle this function, provided water supplies are adequate.

Because the water is not used solely for power generation, complex water management issues come into play, said Jake Gesner, hydroelectric manager, pictured in Figure 2. For example, environmental considerations require that the adjacent Boulder Creek have a minimum water flow equal to 4 cubic feet per second. During periods of drought—such as in 2002 as well as early this year—no water is available for power generation as water managers conserve resources in the city’s 64-square-mile mountaintop watershed.

|

| 2. Inside a Pelton turbine. Using a spare 5-MW Pelton turbine that was supplied by Canyon Hydro for the Boulder Canyon Hydroelectric Project, Jake Gesner, hydroelectric manager, explains how one or more needle valves direct water onto clamshell-shaped buckets on the turbine runner. All of the available head is thus converted into kinetic energy that turns the runner and drives the generator shaft. Source: POWER |

Irrigation and Other Supply Sources

Still smaller technologies are being developed for use in low-head, high-flow situations that exist in settings as diverse as irrigation canals and drinking water distribution pipes.

For example, Alameda, Calif.–based Natel Energy developed a fully flooded, two-stage impulse turbine, called the Schneider Linear hydroEngine or SLH, that resembles a series of airplane wings on a conveyor belt (Figure 3). The turbine’s innovation is that it is optimized around flow, not pressure, said Gia Schneider, chairman and CEO. Water conveyed through a pipe or penstock enters the SLH and encounters a cascade of fixed foils, called guide vanes. These guide vanes direct flow into the first cascade of moving blades. After passing over the moving blades, the water flows through a second cascade of guide vanes and then passes through a second cascade of blades moving in the opposite direction. The guide vanes are adjustable in pitch, allowing for direct control of flow rate, thus keeping the machine’s efficiency high across a range of flows.

|

| 3. Wings on a conveyor belt. Water conveyed through a pipe or penstock enters the Schneider Linear hydroEngine and encounters a cascade of fixed foils, which direct flow into a cascade of moving blades. After passing over the moving blades, the water flows through a second cascade of guide vanes and blades moving in the opposite direction. Courtesy: Natel Energy |

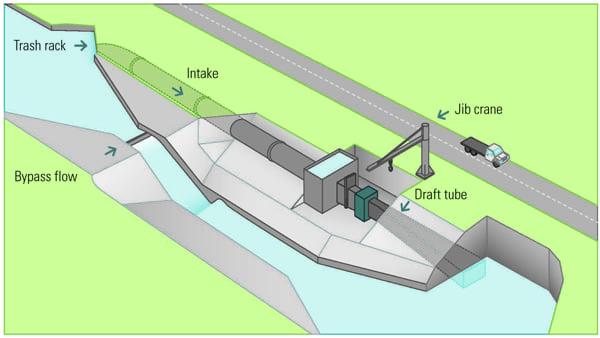

The company has a 50-kW, 4-foot-tall unit on the market, as well as a 0.5-MW, 8-foot-tall unit. Development is under way on a unit with a capacity between 1 and 10 MW that is expected to be available in 2015. In 2009, the company installed a small unit on a canal owned by the Buckeye Water Conservation and Drainage District in Arizona. That project had 6 feet of head, produced 8 kW, and is grid connected. The generating system’s general design is shown in Figure 4.

|

| 4. Power from low-head resource. Water is diverted to an intake conduit before it passes through the turbine to generate electricity and is returned to the main channel. Source: Natel Energy |

A second small-scale technology was developed by Lucent Energy for use inside water distribution pipes. It uses a vertical-axis turbine similar to a wind turbine with the shaft perpendicular to the water flow. The turbine’s design ensures that downstream pressures are maintained. The turbine allows the water to go through it, but at the same time, because of the geometry of the blades, it’s able to turn and lift like an airplane wing and turn a generator. A prototype 20-kW system was installed in early 2012 in a water distribution pipe in Riverside, Calif. A second, four-unit, 200-kW system is being installed in a 42-inch-diameter water pipe in Portland, Ore.

“The shaft can go through the pipe wall without being exposed to water in the pipe,” said Josh Thomas, engineering program manager. The components are all certified for use in drinking water supplies, but Lucent is mindful of water quality issues such as sediment and alkalinity that can adversely affect its equipment.

Two years ago during the economic slowdown and collapse of the price of natural gas in the U.S., Hydro Green Energy, a small-scale hydropower developer, turned its focus toward Latin America, in particular Chile, Colombia, and Panama. Efforts are under way in those markets to shift from fossil fuels for generation to renewable resources such as hydro, said Michael P. Maley, president and CEO. In the U.S., the company has more than two dozen preliminary licenses to install up to 340 MW of generating capacity in 13 states. But the company views the licensing and approval process as inefficient and slow, with little urgency on the part of the Corps of Engineers or the Bureau of Reclamation to evaluate small-scale projects and coordinate efforts with FERC.

In the case of Hydro Green Energy, the focus is on modular design using off-the-shelf equipment that can be readily installed at an existing structure. Both the turbine and the generator are in frames that can be easily removed for maintenance and are designed to run for 75 years, said Maley.

Ready for a Renaissance

To better enable Hydro Green Energy’s installation of technology with a 75-year lifespan, the NHA and its member companies have to get the Senate to approve the small-hydro bill that won unanimous House support in February. Once that happens, the NHA’s Jeff Leahy said a “renaissance” in U.S. hydro development could take place. That’s something of a loaded term in the power generation industry, which heard promises in recent years of a nuclear renaissance that failed to materialize. But hydro’s fortunes may be different, buoyed by comparatively simple technology, readily adaptable existing infrastructure, and an abundant and renewable fuel source whose value as a tool has withstood the test of time. â–

—David Wagman is executive editor of POWER.