In the absence of a comprehensive federal renewable energy policy, many states have established regulatory frameworks that incentivize or require utilities to purchase or develop a percentage of renewable electricity (a renewable portfolio standard, or RPS) or else pay a penalty, and progress toward renewable energy targets tracked by renewable energy certificates (RECs).

COMMENTARY

At least 29 states and Washington, D.C., have adopted some version of an RPS or REC program, though each jurisdiction has different requirements regarding generation eligibility. These state programs have generally limited the inclusion of many hydropower projects, particularly large-scale hydropower, instead favoring wind or solar resources. With many states now increasing RPS mandates to incentivize more renewable energy generation and capacity, it is time for states to re-evaluate how they approach hydroelectric generation to maintain and advance their clean energy resource goals.

In 2019, hydroelectric generation comprised about 6.6% of total U.S. utility-scale power generation. However, much of this generation may not be generating RECs, and may never have been eligible to generate RECs. In many states with an RPS, eligible projects are only those that provided additional carbon reduction benefits over the baseline, or “additionality.” Many hydro-rich states that have RPS programs (for example, California and New York) generally included pre-existing hydroelectric power as part of the baseline upon which additional renewable capacity would be built, and did not make large-scale hydropower eligible to generate RECs.

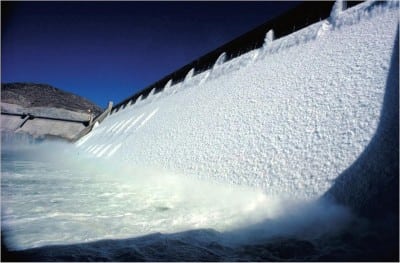

Yet, as many hydroelectric projects enter the lengthy and complex relicensing process, and face additional economic pressure from falling energy prices, the clean energy and grid benefits provided by hydro projects (including resiliency, energy storage potential, and ancillary services) are not assured, and are sometimes disadvantaged in the competitive state marketplace.

Some states, such as Pennsylvania, have always included “large-scale hydroelectric power” as a component of their renewable energy program. On the other hand, many states have only included small hydro (under 30 MW) as eligible, and some states will only permit incremental efficiency improvements at older hydropower facilities (also below 30 MW) to be counted. While these additions to state programs have been helpful for small-dam retrofits and low-head hydro, larger projects and utility-scale hydro-pumped storage have largely not received the same treatment.

Many states that are moving to a 100% RPS, however, recognize the need to reconsider hydropower’s RPS eligibility to ensure that existing hydro projects remain online, and place new projects on a more even playing field with other clean energy sources. For example, Washington’s new 2019 RPS allows incremental improvements at existing hydropower projects to be used for RPS compliance without a megawatt cap, as long as the improvements do not create new impoundments. Additionally, in 2020, California Assemblyman James Gallagher introduced a bill (AB-1941) to revise the eligibility of hydroelectric resources from 30 MW to “include all hydroelectric generating facilities in operation as of January 1, 2021.” Some measures, such as Vermont’s 2017 RPS, allow both in-state and out-of-state hydroelectric under 200 MW to receive RECs.

While critics say that incentivizing existing projects would disincentivize new ones, some states recognize the importance of holding the baseline against slippage. In 2018, the New York State Public Service Commission (NYPSC) issued an order that expressly recognizes that while hydropower projects in existence before the initiation of the state’s RPS in 2003 were originally counted in the baseline, those projects up to 10 MW will now be eligible to receive RECs. While the New York order represents a modest step toward preventing backsliding, notably, the NYPSC has recognized the critical necessity of large-scale hydropower to meet renewable goals, including the New York Power Authority’s Niagara Falls project.

As states begin to develop strategies to achieve 100% renewable energy, new hydro-pumped storage projects, especially in support of solar and wind power, deserve serious review as current state policies may be hampering this resource. In 2019, the University of Massachusetts found that more than 70% of Massachusetts’ pumped-hydro storage at two facilities (600-MW Bear Swamp and 1,168-MW Northfield Mountain) are currently under-utilized due to the lack of market incentives.

The Massachusetts RPS, in this instance, presents a barrier to unlocking this storage with its 30-MW limit on eligibility for hydropower resources. While ample hydro storage is available in Massachusetts, the state’s energy storage initiative only provides that lithium-ion batteries can meet the Commonwealth’s 1,000-MW storage goal. In the same vein, Virginia, with its newly passed mandatory RPS, has not updated its eligibility parameters and currently only hydro-pumped storage associated with run-of-river hydroelectric would qualify. At the same time, and seemingly in conflict, in 2019 the Virginia General Assembly passed a bill to create a state authority to support the development of hydro-pumped storage in southwest Virginia.

As states increase their RPS mandates, leveling the policy playing field for large-scale hydroelectric projects and pumped storage hydropower with other renewable resources provides states another tool to meet RPS targets and prevent backsliding. Such measures could improve the ability to finance large-scale hydroelectric projects, and allow states to both backstop the baseline and support their renewable goals. ■

—Angela Levin is a partner in Troutman Sanders’ Environmental and Natural Resources (ENR) practice, and is general counsel for the Northwest Hydroelectric Association. Morgan Gerard is an associate in Troutman Sanders’ ENR practice, focused on environmental and energy regulatory compliance.