As our January 2017 cover image of a dynamic Rubik’s Cube suggests, the power industry, especially in the U.S., is dealing with something akin to solving a 3-D puzzle whose pieces are being added and subtracted as the game is being played.

Although shares of traditional, regulated electric utilities remain some of the most predictable investments, little else in the industry is stable. Policies, markets, technologies, and new industry players are all operating in a state of multidimensional, multivariate complexity. In this extended editorial, I share some of the trends and new playing pieces I see as likely to shape the power industry in the year ahead.

The Trump Effect

As I write this editorial in December, we are roughly between when Donald J. Trump was elected to be the next president of the United States and when he takes office. Whether you’re an American who voted for or against Trump or an international reader who hoped for his win or loss, one thing most will agree upon is that Trump’s presidency will be unpredictable.

Keeping the focus on the power sector, just before this issue went to press, Trump named former Texas governor Rick Perry—who said in 2011 that he’d eliminate the Department of Energy (DOE) if he became president—as energy secretary. E. Scott Pruitt (Figure 1) will be the new Environmental Protection Agency (EPA) administrator. Pruitt, as Oklahoma’s attorney general, has (like many state attorneys general) repeatedly sued the EPA over emissions regulations, including the Clean Power Plan, and has said he questions the degree of climate change and its relationship to human actions.

What effect will the new president and his appointees have on energy and environmental policy and business? Because he ran as a Republican (even though he has previously been a Democrat), most pundits assume Trump will back a more deregulated energy sector, and his initial cabinet picks appear to bear that out. Beyond that, given his record of saying things that have been taken literally, which he then disavowed as not to be taken seriously, it’s difficult to predict with any level of accuracy what the Trump administration will commit to and follow through on.

Trump campaigned most notably on reviving the coal economy. He repeatedly promised to bring back coal jobs, cancel the Clean Power Plan, and roll back other environmental regulations. Numerous experts more versed than I in the president-elect’s legal options agree that there are limits to the practical effect of any executive orders and other regulatory maneuvers Trump may make on those fronts; how quickly he can move on them is another question. That’s likely to result in a lot of disappointment in coal country. Re-engineering the global markets for coal, regardless of Trump’s promises to renegotiate a range of international trade agreements, is also unlikely.

As for coal-fired power generation, it’s not disappearing any time soon, but neither is new U.S. generation likely in the near term (see sidebar). Most of the older, less-efficient units have already been retired or marked for closure or repowering. Even if all federal coal-fired plant environmental regulations were reversed immediately (something that would require an act of Congress rather than executive action), state and regional regulations, as well as technical and market realities, would make new coal builds unlikely.

Even ignoring the competition posed by low natural gas prices, gas plants can be sited, permitted, and constructed in far less time than coal plants. And they provide more flexible generation that is better suited to playing a strong leading or supporting role on today’s (and tomorrow’s) grid. Gas plants also require much smaller staffs—something that may be unwelcome news to plant workers but that represents a clear economic benefit for both regulated and independent power generators.

The Trump administration’s noteworthy energy and environmental actions are yet to be recorded (see this issue’s “THE BIG PICTURE: Presidents on Power” for a short history to date by presidential administration). But there may be some surprising ones to come in the future. Though Trump campaigned on resurrecting coal (a classic political move to win voters in traditionally coal-dependent states, despite his rhetoric about not being a traditional politician), he’s not necessarily anti-renewables. If he tries to make good on promoting energy independence and keeping jobs in the U.S., policy support (aka, tax credits, grants, and subsidies) for wind and solar manufacturing and construction jobs may not be as endangered as some expect.

As for nuclear, the president-elect’s interest in nuclear military power (that is, weapons) is clearer than his interest in nuclear electric power. As Kennedy Maize wrote in the POWERblog “Trump: Bad News for Nuclear Power?” Trump mentioned building more nuclear plants while he was on the campaign trail, but he also was dismissive of climate change. Without valuing the zero-carbon attributes of nuclear power (an idea gaining traction at the state level), building new nuclear units remains a daunting financial proposition. Should Trump surprise his voters and support a lower-carbon energy policy, he may funnel more money to nuclear research and development and loan guarantees. Solving the problem of lengthy construction times and cost overruns is guaranteed to be tougher.

Whether decisions about department and agency budgets and priorities have significant short- or long-term effect is a wide open question.

Regulation and Policy Beyond D.C.

Despite the significance of federal environmental regulations, they aren’t the only ones shaping the power industry in the U.S. States, and even cities, control the levers of energy policy to a large extent. We’ve seen that over decades now with state-level renewable energy standards, efficiency mandates, carbon-trading programs, and net metering regulatory decisions.

California has often been in the lead with efforts to reduce energy industry–related pollution and efforts to encourage cleaner modes of power production and transportation. But other states and regions have their own political, economic, and resiliency reasons for adopting policies that promote everything from renewable power and energy storage to new market structures and hardened distribution infrastructure. On either side of the country, Hawaii and New York are just two examples of states taking action independent of federal regulation.

Hawaii’s goal is to use 100% clean energy by 2045, and the state was already generating 23.4% of its power from renewables in 2015. Reducing dependence on expensive imported fossil fuels is the primary driver on the island state.

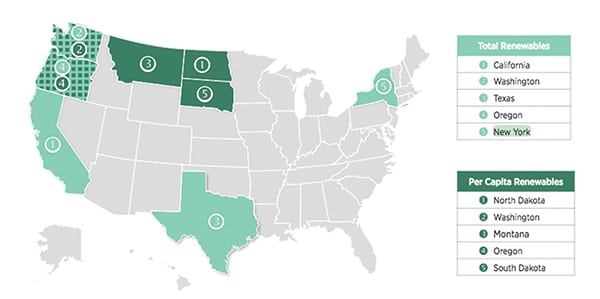

In New York, the goals of the state’s energy strategy, Reforming the Energy Vision (REV), include lowering greenhouse gas emissions 40% from 1990 levels by 2030 and obtaining 50% of the state’s electricity from renewable sources by 2030. REV provides incentives for more solar and wind generation, microgrid development, and even (currently contested) subsidy support for zero-carbon nuclear plants. Already, New York ranks fifth for total renewables deployment, according to a November report from the National Renewable Energy Laboratory (NREL), “Renewable Electricity in the United States” (Figure 3).

|

|

3. Empire State leader. New York ranks fifth on the latest list of states that are home to the largest amount of renewable generation. The data behind this map includes grid-connected solar, wind, geothermal, hydropower, and biopower. A de-rate factor of 77% has been applied to convert photovoltaic installed nameplate capacity from MWdc to MWac. Source: National Renewable Energy Laboratory |

What Gets Built?

Regardless of any potential climate change–denying officials or policies in Washington over the next four years, renewables are here to stay. As you’ll see from the Q&A with our Generating Company Advisory Team in this issue, power producers are committed to adding more clean energy not just to comply with regulatory mandates—customer demand and cost are also powerful drivers.

The DOE’s “Revolution Now: Update 2016” report notes that decades of investments by the federal government and industry have contributed to significant cost reductions in renewable generation. From 2008 to 2015, the cost of land-based wind power dropped 41%, distributed solar photovoltaic (PV) dropped 54%, utility-scale PV dropped 64%, and modeled battery costs fell 73%. The report adds that over two-thirds of all new U.S. capacity in 2015 came from wind and solar PV, with wind accounting for 41% of all new capacity.

Given those numbers, short construction timeframes, and low load growth, it’s no surprise that the Energy Information Administration (EIA) projected in December that “U.S. wind power capacity is expected to increase by 11% next year, while utility-scale solar power capacity is set to grow by 27%.”

Beyond new solar and wind capacity of various scales, natural gas is still favored as the fuel for dispatchable generation, for several reasons (Figure 4). Gas, at least in North America, remains relatively cheap; prime mover choices run from large to small—enabling right-sized capacity additions closer to load (something that’s becoming increasingly important in areas with low to no demand growth); adding capacity or multiple small units is relatively easy; and new gas-fired turbine generators and engines are designed to cycle and ramp with greater flexibility than other thermal technologies—a capability that will continue to be highly attractive.

|

|

4. Coal-country gas plant. Cane Run Generating Station Unit 7 was profiled as a gas Top Plant in our September 2016 issue and is the first combined cycle plant in Kentucky, where it provides clean, inexpensive electricity for a traditionally coal-dependent region. Courtesy: Louisville Gas and Electric Co. and Kentucky Utilities |

In addition to those attributes, gas plants use familiar, reliable technology. Though nuclear power can say the same, ballooning timeframes and budgets for projects around the world are making new conventional nuclear builds in developed nations increasingly uncompetitive—even with government loan guarantees and other sweeteners. Small modular reactors are finally making their way through the new technology gauntlet and could provide a new model for the industry, but they’re still a long way from being familiar, reliable technology.

Meanwhile, whether it’s deployed via electric vehicle batteries, facility-sited or grid-scale batteries, or the more familiar pumped-hydro and compressed-air, storage is becoming a routine “utility player,” where only a couple of years ago it was seen as untested and uneconomic. Legislative mandates are part of the story. California is the leader here, with, most recently, a bill passed in 2016 requiring the state’s investor-owned utilities to obtain 1,825 MW of storage by 2020 (when added to the 2013 mandate); however, NREL reports that more than 10 states have at least introduced legislation in support of energy storage. Deployment of storage is uneven, as is true of most power technologies, but storage is no longer a novelty. Regardless of federal or state policies, generators and their customers are likely to continue developing use cases based on some combination of economics, convenience, and reliability.

Fuel Prices Still Matter

The fuel for renewable generation is free, but that alone hasn’t usually made wind and solar the most economic choice. However, we’re now at the point where, as noted above, lower costs (that are increasingly competitive with traditional generation, even without subsidies) and shorter construction times can make these renewables an easier choice. That’s especially true in countries and regions where other fuels are expensive or environmental concerns dominate.

As for dispatchable generation fuels, in recent years, the U.S. has come to take low natural gas prices for granted, but those prices are rising. The EIA said in December that, “Growing domestic natural gas consumption, along with higher pipeline exports to Mexico and liquefied natural gas exports, contribute to the Henry Hub natural gas spot price rising from an average of $2.49 per million British thermal units (MMBtu) in 2016 to $3.27/MMBtu in 2017.” That’s one reason the agency projects that coal generation will exceed gas-fired generation this winter. Nevertheless, the EIA’s latest short-term energy forecast projects that, although “more electricity is expected to be generated from coal than natural gas this winter, the share of total annual generation from natural gas is forecast to exceed coal during 2016 and 2017.”

Another reason coal could maintain its traditional edge during the heating months: continued challenges in supplying gas to generators. As this month’s Legal & Regulatory column notes, recent efforts to build and finance new interstate gas supply pipelines are running into formidable roadblocks. Despite the desire most Americans share with the next president to see infrastructure development, energy infrastructure remains challenging, even when the need is clearly demonstrated.

Markets Form, Falter, and Reform

In recent decades, POWER has focused mostly on “Business and technology for the global generation industry,” as our tagline says. Market issues—from wholesale to retail market design—have generally been beyond our purview, especially given how much there is to attend to just on the generation side. But market issues are increasingly affecting the generation business in ways previously unseen. We now have not just markets for wholesale power and fuels like coal and gas but also markets for fuel-burning byproducts, like carbon dioxide (CO2 or “carbon” in common parlance). The latter can be found in jurisdictions ranging from the European Union, the U.S. Northeast, and multiple Canadian provinces to Japan, South Africa, and Kazakhstan.

Beyond the wholesale market issues related to fuel prices, the industry now faces a whole host of new market design questions raised by everything from new types of generation to new types of generation owners. For example, you’ll read in this issue about differing views regarding the efficacy of capacity markets shared by a system operator in “U.S. Electric Markets in Transition” and a Midwest generator in “Power Generators Agree: The Future Grid Will Be Cleaner.” And then there are the controversies over market incentives for specific generating units, as we’ve seen over the past year in New York State with nuclear and in the Midwest for coal and nuclear. These new market issues aren’t completely surprising, but they have developed more quickly than the industry, its regulators, and legislators are used to addressing power-related transitions.

Though we can’t follow all the twists and turns of wholesale and retail market changes, we will occasionally address them, as in the December 2016 issue’s coverage of energy storage markets and this issue’s “U.S. Electric Markets in Transition” and the Commentary, which addresses a unique way to think about the myriad market design pieces.

I’m no markets expert, but it doesn’t take an expert to predict that power market issues will get more unpredictable and contentious before they reach any sort of equilibrium.

Technology Innovation Supports and Disrupts

Remember when you got your first mobile phone? The new technology—even before it was as “smart” as it is today—provided multiple benefits over fixed-location landline phones. Suddenly, you could make or receive calls and text messages from almost any place your service provider covered, whether you were walking the dog, waiting for a commuter train, or (not a good idea in the pre-Bluetooth era) driving in your car. But having a cell phone could also be disruptive in a potentially bad way: If you forgot to keep it charged, you would miss that career-altering call or relationship-altering text. Remembering to recharge your phone was a routine disruption that soon became a new routine.

New mobile and other digital technologies in the power industry require similar adjustments. I wrote last January about how big data and analytics are finally emerging in this slow-to-adopt-new-technologies industry. Over the past year, the volume of companies promoting their “digital,” “connected,” “Industrial Internet,” or “Fourth Industrial Revolution” devices and services has continued to increase.

GE, as I noted last year, has been a leader in developing and promoting next-generation digital technologies and services, but its Predix platform isn’t the only offering in the market. Long-time equipment and services rival Siemens launched its Digital Services for Energy, based on its Sinalytics platform, in 2016. ABB’s latest digital offering for power plants and the Internet of Things (IoT) ecosystem is called ABB Ability. And Schneider Electric announced its EcoStruxure architecture and platform, designed to deliver IoT-enabled solutions, in November. And this is by no means an all-inclusive list. As we cross the threshold from 2016 into 2017, I can almost guarantee that every major multinational equipment and service vendor has some sort of new branded digital offering available or in the works.

These new monitoring, diagnostic, and optimization technologies are not just for new plants. In fact, they may be even more critical for existing ones—whatever their age, technology, or fuel. The majority of global installed capacity is still conventional thermal generation, with coal holding the lead. As those units age—especially when they find themselves in changing markets or in regions requiring more stressful operating profiles—they will need extra assistance from smart, fast, responsive digital technologies to remain viable.

The proliferation of new sorts of digital technology and service offerings might seem overwhelming to some generators, especially smaller ones. But ignoring the new capabilities won’t make them disappear—it will only cede market advantage to competitors, who may include customers. Try to imagine not having a mobile phone today. That’s how restricted power assets and businesses will be in the very near future if they don’t start adopting digital technologies now.

That’s not to say that generators should adopt any and every new technology or solution “stack” a vendor proffers with promises of reduced maintenance, easier staff compliance, or increased profits. Just as generators have always had to conduct due diligence before making large purchases, so too with everything from the latest wireless sensors to cloud computing and analytics.

What may be different is the number and diversity of parties required at the table—especially from both operational and information technology (OT and IT) functions. One disruption that the new digital tools introduce is the need to remove OT and IT siloes. Such cultural changes can be challenging, but the business-wide payoffs can’t be fully realized without them. (For more on the tools, issues, and questions around these connected technologies, see the promotion in this issue for POWER’s Connected Plant Conference or visit connectedplantconference.com.)

Cybersecurity Gets a Higher Profile

One obvious concern about adopting new digital technologies—particularly if they are connected to the internet—is cybersecurity. Bad actors don’t need to be able to control a turbine generator to disrupt plant operations or take down a portion of the grid, as we saw in Ukraine last year. And, as we saw in the U.S. with the October Mirai botnet-enabled distributed-denial-of-service attack on Dyn, which provides key internet services for many popular sites, the simplest consumer IoT devices can be commandeered to wreak havoc on targeted networks or industries.

What does this mean for power generators? If you think your plant doesn’t have any cyber-vulnerable devices, you’re probably wrong.

An increasing number of vendors throughout the supply chain are advertising that their designs, devices, or processes are cybersecure. Even if generators hear security pitches from previously trusted vendors, the proliferation of interconnected technologies argues for a trust-but-verify posture.

There will always be cybersecurity alarmists who hype any number of power sector vulnerabilities—often in a bid for publicity or consulting fees—but I’ve seen enough comments and reports from level-headed power industry experts to know that the probability of some level of power grid disruption from a cyber attack in the next year is greater than zero. The severity and duration of any such attack is a matter of debate. What’s not debatable is that greater industry education, preparedness, and vigilance about cyber vulnerabilities should be on every generator’s strategic plan for 2017 and beyond.

As for a potential silver lining: Highlighting the integration of digital technologies and cybersecurity functions at power facilities, and the need for more digitally savvy employees at all levels, could be a strategy for attracting new workers to this sector.

Global Power Trends

It’s old news that the greatest demand growth and need for electrification is beyond North America. Though we don’t have room to cover all the factors shaping the power sector everywhere around the world in the near future, here are a few that cut across multiple nations and that have international implications.

Slower Growth.In May 2016, the EIA released its International Energy Outlook 2016, which predicted continued decoupling of power demand and economic growth, saying, “The world’s frenzied economic growth through 2040 won’t be matched by electricity demand growth.”

That’s not to say there won’t be growth, but even China, the poster child for power infrastructure booms, is learning that unmanaged, runaway growth has unintended consequences. POWER has published stories over the past several months about pullbacks on both renewable project development and coal-fired units, including some already under construction, resulting from excess coal and even hydro capacity. That’s one reason China is promoting the possibility of more interconnections with other countries on the continent.

Competitive Advantages for Newer Fuels and Technologies. Around the world, the declining cost of wind and solar technologies has resulted in economics, not just environmental policy, driving the decision to add these renewables, despite their variable output. With the Paris Agreement coming into force on November 4, 2016, the 115 nations that ratified it by October 5 (out of the 197 total) will be looking at both their commitments to lower greenhouse gases and at the economics of meeting those commitments. That’s why even if a Trump administration somehow extricates the U.S. from the agreement, it’s likely to have little to no effect on either U.S. generation decisions (see above) or the decisions of other countries. It could, however, give the U.S. less leverage in a range of international negotiations, especially over energy-related technologies.

None of the advantages for renewables will lead to a rapid decline for fossil fuels. A November report from McKinsey & Company, “Energy 2050: Insights from the Ground Up,” comports with most similar projections (which assume a “business-as-usual” scenario) when it finds that “Fossil fuels will dominate energy use through 2050. This is because of the massive investments that have already been made and because of the superior energy intensity and reliability of fossil fuels. The mix, however, will change. Gas will continue to grow quickly, but the global demand for coal will likely peak around 2025.”

The report continues, “By 2050, the research estimates that coal will be down to just 16 percent of global power generation (from 41 percent now) and fossil fuels to 38 percent (from 66 percent now). Overall, though, coal, oil, and gas will continue to be 74 percent of primary energy demand, down from 82 percent now. After that, the rate of decline is likely to accelerate.”

The EIA makes similar projections. It expects net power generation to increase 69% by 2040 compared to 2012, with slower growth in Organisation for Economic Co-operation and Development countries. China and India are expected to account for 69% of the projected increase in coal-fired generation over that time period, and renewables are the fastest growing source of electricity (Figure 5).

|

|

5. Renewables increasing fastest. This chart projects world net electricity generation by fuel from 2012 to 2040. Source: EIA, International Energy Outlook 2016 |

Policies Promoting Clean Energy. One policy trend that’s developing could assist the acceleration of declining fossil fuel use: countries pledging to go coal-free and/or to phase out all fossil-fueled cars.

For example, the Canadian federal government recently announced a plan to phase out all coal-fired generation (currently about 7% of the national total) by 2030 unless it includes carbon capture and sequestration, though it subsequently created a carve-out for Saskatchewan coal-fired plants (which provide nearly half of the province’s electricity) as long as the province achieves comparable emissions reductions by other means.

Meanwhile, Germany has taken initial steps to allow the sale of only zero-emissions cars by 2030. That’s a mere 13 years from now. Should Germany reach that goal (unlikely on that timeframe, given the political clout of automakers BMW, Mercedes-Benz, and Volkswagen), it would reduce air pollution from diesel engines in particular; “as of 2013, about 1.4 out of 2.9 million new German passenger cars were diesels,” according to an October IEEE Spectrum story. A wholesale transition to electric vehicles (EVs) would add load to the electric grid, potentially assisting grid-balancing efforts if EVs charge when variable renewables generate power and if vehicle batteries can be aggregated for demand response programs.

Late last year, there were signs that Norway, whose national economy is heavily financed by oil exploration and development, was poised to adopt an even more aggressive goal of selling only zero-emission cars by the end of 2025, though it will not technically “ban” fossil-fueled vehicles. About a quarter of Norway’s cars are currently electric, and the country’s grid is nearly 100% hydropowered.

It’s not just Europe moving in this direction. Greentech Media reported that, “In March, India’s Power Minister Piyush Goyal confirmed his government was planning for India to become a 100 percent electric vehicle nation within 14 years.” Given his goal for the plan to be self-funding, and considering the state of India’s power infrastructure, this seems overly ambitious, but the announcement itself is noteworthy.

China also has plans to promote EVs in order to control air pollution, and it is addressing the problem from the supply side by developing its EV manufacturing industry.

I mention these EV goals for a couple of reasons. Obviously, should EV use grow substantially, as many nations hope, power grids will have new load and, potentially, new energy storage devices that could help balance an increasingly complex grid of distributed and variable energy sources. In some instances, the balance could shift from grid-supplied power to self-generation and storage, particularly at the microgrid level. The larger, underlying trend is the move toward cleaner energy systems—not just power generation.

The Rules of the Game Are Changing

For awhile now, POWER has been publishing stories about how traditional power generators are no longer the only game in town when it comes to supplying electricity. To close, I leave you with two final comments about that new reality.

Corporate and Local Leadership. While Americans wait to see what the new Trump administration will do that might affect power markets, and while Europeans wait to see how the Brexit transition and near-term federal elections shake out, it’s important to remember that national governments, though important, aren’t the only forces shaping the energy industry.

Regardless of your political or market views, the fact is that we live in an increasingly globalized world. The largest companies in the power business are multinationals. Turbines—whether for thermal plants or wind farms—are being built around the world by companies whose headquarters are often not in the same country as their factories and customers. Global companies will invest where they can grow and make money, and large corporations rarely favor international trade wars.

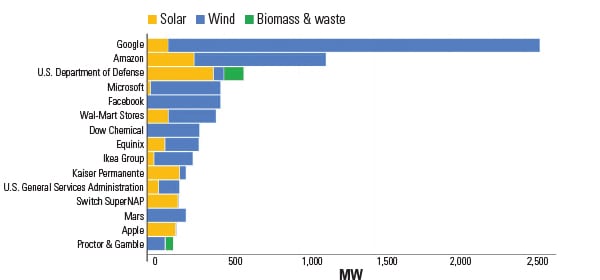

Aside from the vendor and generator sectors, other large corporations and organizations are helping to drive the trend toward cleaner energy supplies, especially those in the digital and web world. You may have noticed that one of our December Top Plant Award winners in the renewables category was a wind farm developed and owned by Pattern Energy but named for its offtaker, Amazon Web Services. Amazon is not alone.

In early December, Google announced that it would reach its 100% renewables goal for its global operations in 2017 (Figure 6). The Google press release, signed by Senior Vice President of Technical Infrastructure Urs Hölzle, says, “This is a huge milestone. We were one of the first corporations to create large-scale, long-term contracts to buy renewable energy directly; we signed our first agreement to purchase all the electricity from a 114-megawatt wind farm in Iowa, in 2010. Today, we are the world’s largest corporate buyer of renewable power, with commitments reaching 2.6 gigawatts (2,600 megawatts) of wind and solar energy. That’s bigger than many large utilities and more than twice as much as the 1.21 gigawatts it took to send Marty McFly back in time.”

|

|

6. Cumulative corporate renewable energy purchasing in Europe, the U.S., and Mexico, as of November 2016. The Google total includes one project in Chile for 80 MW. Source: Google/Bloomberg New Energy Finance |

Renewables won’t power all those data centers and offices around the clock, but that’s not the point. (The announcement adds that, “we’ll also broaden our purchases to a variety of energy sources that can enable renewable power, every hour of every day. Our ultimate goal is to create a world where everyone—not just Google—has access to clean energy.”) Large customers like Google are helping to create a stronger market for clean energy—independent of government regulation.

Google says it is buying all renewable energy not just to reduce its carbon footprint and address climate change but also because it makes business sense: “Over the last six years, the cost of wind and solar came down 60 percent and 80 percent, respectively, proving that renewables are increasingly becoming the lowest cost option. Electricity costs are one of the largest components of our operating expenses at our data centers, and having a long-term stable cost of renewable power provides protection against price swings in energy.”

Beyond its self-interests, Google is promoting its energy purchases in the same way as traditional utilities have promoted their central station generation over many decades—as a community asset. Google’s announcement continues by noting, of its energy investments from the U.S. to Chile and Sweden, “To date, our purchasing commitments will result in infrastructure investments of more than $3.5 billion globally, about two-thirds of that in the United States. These projects also generate tens of millions of dollars per year in revenue to local property owners, and tens of millions more to local and national governments in tax revenue.”

Local governments on every inhabitable continent are another lever moving markets for everything from energy efficiency to smart grids and microgrids. Many have 100% renewable goals, which they can help advance legislatively and/or through their own energy purchases. A 2011 report (the most recent) by REN21 lists 38 large and midsize U.S. cities as having local renewable energy policies, including some you might not expect, like Houston and Knoxville. Numbers for other regions were: Canada—20, Europe—46, Japan—41, Australia—15, New Zealand—5, China—11, India—5, Korea—5, Other Asia—5, Africa/Middle East—6, Latin America (selected locales)—10. A few, albeit smaller locales, have already achieved 100% renewables, including Dardesheim, Germany; Güssing, Austria; and Kuzumaki, Japan.

Reframing the Game.What’s interesting to me about the overarching trends of greater uncertainty, more variables, and new players in the power sector is that the regions with the most advanced power generation, transmission, and distribution infrastructures—North America and Europe—are those that in many ways are undergoing the most transition in both types of generation and the market constructs, as you’ll see from the features in this issue. In order to resolve the complex challenges posed by the transition from a largely predictable industry to a far more dynamic one, some industry participants are turning to game-playing (see “Newtonian Shift Game Helps Power Industry Comprehend Transition” in this issue). It’s an intriguing approach.

In the real world, power generation—an essential component of thriving economies worldwide—is no trivial game. Whether your metric is money, physics, or politics, power generation is a large-stakes game whose moves have serious consequences for both the players and the public. ■

—Gail Reitenbach, PhD is POWER’s editor.