The power generation market continues to evolve due to fundamental changes in market forces. Ongoing opportunities exist to partner with utilities to support this evolutionary process.

Leadership Is Key for U.S. Market Players

A strategic leadership vision will be critical to thriving in the U.S. power generation market over the next 10 years. Utilities can no longer follow market trends and expect to be successful. Long-term financial success will only be achieved through implementing strategies that optimize operational and capital spending to capture market opportunities and hedge against market upsets.

Utility executives must choose a strategy of engaging the market either as a “market-maker,” owning generation resources, or as a “market-taker,” exposing ratepayers to both the benefits and whims of ever-evolving power markets. While power markets have proven their ability to realize efficiencies by incorporating larger and more diverse generation resources, the risk of financial and political exposure due to reliability challenges or an event similar to the California energy crisis continues to pose significant risk. Planning has always been part of the regulatory process; however, due to the Environmental Protection Agency’s (EPA’s) proposed Clean Power Plan, state regulators, regional transmission operators, and utility executives are now being forced to engage in a more comprehensive discussion of all aspects of power generation and delivery.

Smaller utilities must no longer rely on the strategies of larger utilities, but must learn to operate within power markets by hedging existing portfolios, balancing operational issues against environmental constraints, and managing capital projects in an industry landscape with questionable long-term returns. Any utility, regardless of size, lacking a strategic leadership vision will be subjected to market pressures that may eventually lead to acquisition. Today, even identifying market trends is more difficult, as numerous local drivers—such as fuel mix and renewables integration—are resulting in seemingly conflicting market strategies.

Asset Optimization Is Critical

Identifying more-efficient strategies to derive value from existing assets is necessary for every utility, but it has never been more challenging than it is today. As existing fossil capacity retires, power markets appear oblivious and fail to reflect the change via price signals to ensure continuous investment in new and existing assets. Instead, generation plants must operate reliably even with minimal power sales revenue. Most generators are considering options for reducing operational costs through creative measures such as exploring alternative fuels, using more contract staff, optimizing plant efficiency, and benchmarking performance against top performers.

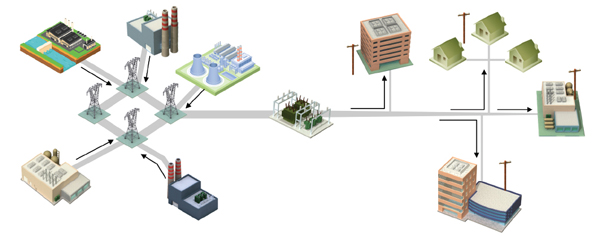

Without power market pricing signals to support longer-term investments, many utilities are now focused on short-term methods for delaying large capital investments in their generation fleets. The rapid growth in transmission and distribution spending in the U.S. market is a result of efforts to redirect investment away from generation assets while eliminating transmission constraints and realizing the benefits of a larger, more-efficient power market. Even with these additional benefits, the markets remain challenged with accommodating new intermittent renewable wind and solar generation, additional environmental constraints limiting plant operations, fuel delivery challenges, and integrating nuclear power as a baseload resource.

Many plants have been operated for years primarily as a source of baseload megawatt-hours. Utilities now face the need to meet stringent new emissions regulatory requirements, leading to integrating complex air quality control, water treatment, and solid waste treatment systems into existing facilities. The consequence of an emission exceedance is significant and can risk the viability of an asset’s continued operation. The EPA continues to march forward with many regulatory initiatives, most of which are unlikely to be dampened by the recent change in political direction, with the potential exception of the regulatory approach to addressing climate change.

GDP Growth Fuels International Markets

Many international markets continue to experience accelerated gross domestic product (GDP) growth, leading to expansions of power generation and distribution systems. While renewables will play an expanding role in U.S. and European markets, the vast majority of capacity additions in the rest of the world will be new fossil fuel or nuclear generation. Coal will remain the economic fuel of choice for larger facilities, supplied through substantial growth in mining capacity, particularly in China, India, and Indonesia.

Air quality has degraded significantly in many international markets over the past 20 years with the rapid expansion of manufacturing and fossil generation facilities. Consequently, the market for incorporating lower-emissions environmental technologies in both new and existing facilities continues to expand. Technological successes that led to significant improvement in U.S. air quality are being implemented in numerous international markets. New generation will focus on the most efficient fossil fuel generation technologies that not only reduce greenhouse gas emissions but also reduce fuel costs. While nuclear remains an economic choice in many markets, its future is uncertain.

The World Energy Outlook finds that almost 18% of the world population lacks access to electricity. That translates into huge market expansion potential for the entire power industry and requires a diverse array of generation technologies to meet the challenge. ■

— Grant Grothen (ggrothen@burnsmcd.com) is principal, Energy Global Practice, and Block Andrews (bandrews@burnsmcd.com) is strategic environmental solutions director, Energy Global Practice at Burns & McDonnell.