Partners developing the 800-MW Vineyard Wind 1 offshore wind farm have announced they will swap assets jointly owned by their 50/50 Vineyard Wind joint venture to allow each party to focus on its separate expansion within the burgeoning U.S. offshore wind industry once the 800-MW Vineyard Wind 1 offshore wind farm is operational.

The Vineyard Wind joint venture is equally held by Connecticut-based AVANGRID subsidiary Avangrid Renewables—a company whose majority (81.5%) shareholder is Spanish renewables giant Iberdrola—and Danish fund management company Copenhagen Infrastructure Partners (CIP). Restructuring will enable both companies “to leverage their strengths and expertise to continue to grow the U.S. offshore wind industry” and “better align project timelines with their separate strategic objectives,” the partners said on Sept. 21.

The development is noteworthy given that the partners recently raised $2.3 billion of senior debt to finance the construction of the Vineyard Wind 1 project. That project is poised to become the first commercial-scale offshore wind project in U.S. waters when it delivers first power to Massachusetts beginning in 2023.

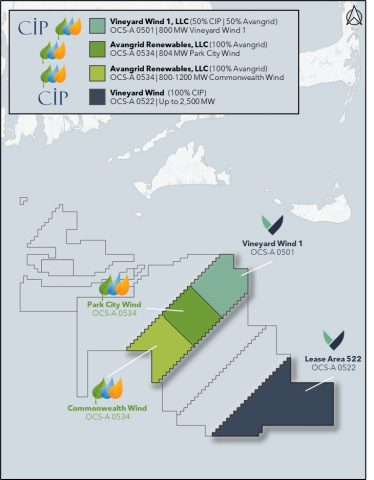

The joint venture says it is developing 5.3 GW of combined offshore wind project capacity. Another project, the 804-MW Park City Wind, was selected by Connecticut and is in the early stages of stage and federal permitting. Both Vineyard Wind 1 and Park City will interconnect to the New England electricity grid.

Vineyard Wind last week also submitted two proposals in response to Massachusetts’s third offshore wind competitive solicitation. Those proposals outline a new project, “Commonwealth Wind,” offering options of about 800 MW and 1,200 MW. The new project will be developed in an area just south of the Vineyard Wind 1 and Park City Wind projects.

Restructuring for Better Opportunity

Reaching financial close for Vineyard Wind 1 marked a major milestone for the project that was conceived in 2009, the partners acknowledged. While Avangrid and CIP will continue to work together under their joint venture on the 800-MW wind farm, once restructuring is finalized, Avangrid will have an option to gain operational control of the commercially operating plant. Specifically, Avangrid Renewables will take full ownership of lease area OCS-A 0534. The lease area includes Park City Wind and Commonwealth Wind.

Meanwhile, CIP will take full ownership of lease area OCS-A 0522, the easternmost offshore wind area, which could deliver more than 2,500 MW into New England and New York. According to Christian T. Skakkebæk, senior partner at CIP, lease area 522 “has the highest wind speed of any lease area in the northeast. It “will be a very competitive site for solicitations from New York to Massachusetts,” he noted. Overall, the lease area will require an investment of more than $10 billion, he said.

Once the restructuring is finalized, Avangrid Renewables will make a net payment of $167.5 million to acquire 100% of OCS-A 534 containing Park City Wind and Commonwealth Wind. In exchange, CIP will acquire 100% of OCS-A 522. However, the transaction is subject to consent from key stakeholders and regulators, which include the Bureau of Ocean Energy Management (BOEM), as well as the Connecticut electric distribution companies. “The transaction could close in approximately six months during which the parties have agreed on a transition plan,” the partners said.

Bright Prospects

Looking ahead, CIP will also be looking to secure more offshore wind capacity through the upcoming lease auctions to be held by BOEM in the New York Bight area and California.

Avangrid, meanwhile, is currently developing the Kitty Hawk offshore wind project, which could deliver 2,500 MW into Virginia and North Carolina. Next year, Avangrid expects more developmental opportunities, including for 3 GW in Rhode Island, New York, and Connecticut. “BOEM also plans for release new lease areas in the New York [area] between Long Island and the New Jersey coast. We expect to participate in most of these auctions, but as I’ve noted before, we’ll continue to be disciplined in our bidding approach,” Avangrid CEO Dennis Arriola said during an investor call in July.

Arriola noted recent federal measures are buoying Avangrid’s prospects. Along with progress for the infrastructure plan in Congress, the Biden administration this March also laid out measures to deploy 30 GW of offshore wind in the U.S. by 2030, an ambitious target that it said could unlock “a pathway” to 110 GW by 2050.

“Offshore Wind is taking the leap from concept to reality in the U.S. with a national goal to deploy 30 GW of offshore wind by 2030,” Arriola said. “The new coordination plan directs various federal agencies to identify wind energy areas released in the New York—the work to complete permitting reviews of 16 pending projects by 2025, and open funding opportunities for wind and transmission developers are also upgrading U.S. ports. These definitely are exciting times in our sector and AVANGRID is poised to play an important role in leading the clean energy transition.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).