On Dec. 19, the Federal Energy Regulatory Commission (FERC) directed PJM Interconnection to dramatically expand its Minimum Offer Price Rule (MOPR) to nearly all state-subsidized capacity resources, including renewables backed by state portfolio standards. It’s the latest of a series of dramatic revisions to the grid operator’s rule, which essentially functions to provide a minimum offer screening process to bar new market entrants from artificially depressing capacity auction clearing prices.

See why the recent order is significant here, “The Significance of FERC’s Recent PJM MOPR Order Explained.” |

The barrage of news reports about the order that followed its release focused heavily on the divided 2–1 vote, noting it fell along the commissioners’ political affiliations: Chairman Neil Chatterjee and Bernard McNamee are Republicans, and Richard Glick is a Democrat. As Cheryl LaFleur, a commissioner who left FERC in August, told POWER, FERC—an independent regulatory government agency that is officially organized as part of the Department of Energy—has increasingly been mired in partisanship and politicization. But partisanship and politicization are clouding state energy and environmental priorities too. As POWER reported in October, for example, state targets—which are often designed to support clean energy and address climate change—have increasingly been championed from a broader pulpit in Congress, and by attorneys general in the courts.

A Victory for Competitive Generators; A Threat to Public Power Business Models

Along with states, however, the most prominent players blockaded by FERC’s rulemaking are perhaps the resource owners that participate in PJM. For the competitive generators that filed the 2016 complaint, the order is a small victory in a long and bitter battle to retain their standing in competitive markets. As the Electric Power Supply Association (EPSA)—a trade organization that represents some of the country’s largest independent power producers, and a group which suffered a crippling legal defeat in its fierce fight against nuclear subsidies in federal courts (up to the U.S. Supreme Court)—told POWER on Thursday, FERC’s efforts would bolster a “durable and sustainable market design that meets the needs of the 21st century.”

EPSA President and CEO Todd Snitchler noted that the competitive wholesale markets have delivered tangible benefits both for energy consumers and the environment by “maintaining system reliability but also by encouraging efficiency, flexibility, and innovation in the power generation sector that has led to lower costs and reduced emissions through retirement of outdated facilities and investment in new technologies.” This “centralized procurement” shouldn’t be minimized or abandoned, he said, but opportunities still exist for further reform of the PJM capacity market.

“As our energy landscape evolves to incorporate new resources and meet our shared goals surrounding reliability, cost, and our environment, so too must the market. Continued progress toward these goals relies on building a durable and sustainable regulatory framework that supports well-functioning electricity markets. Any market design should be transparent, open, and non-discriminatory—providing all market participants and investors clear pricing signals and granting sufficient confidence that they will have the opportunity to recover their investment and pursue new investments,” Snitchler said.

General reactions from non-IPP generators, however, indicated disappointment with the order.

The American Public Power Association (APPA), the trade group for not-for-profit, community-owned utilities, told POWER on Monday that the expanded MOPR is especially dismal for public power. “It is the ultimate irony that the public power business model has been deemed a subsidy and a threat to competitive markets,” said Marc Gerken, PE, American Municipal Power president and CEO. “Our approach to new resources is closer to a true market than PJM’s Reliability Pricing Model has ever been. This order leaves no question that RPM is nothing more than an administrative construct with prices set in Valley Forge, [Pennsylvania,] with no enduring features of a competitive market.”

APPA President and CEO Sue Kelly also railed against what she called protections for a “select group of sellers.” The expanded MOPR means that every new resource built in the future—whether it is a renewable, storage, or energy efficiency resource—“will run the risk of not clearing the capacity auction (even after they have initially cleared an auction), causing public power utilities and their customers to face the risk of paying twice for that resource every year and directly interfering with public power’s fundamental business model,” the group explained. “Similarly, state-sponsored resources will be subject to the MOPR, raising the same risks for the states and impeding the states’ rights to make their own resource choices.”

Coal Group Calls for More Action; Nuclear Group Underscores Intrusion on State Rights

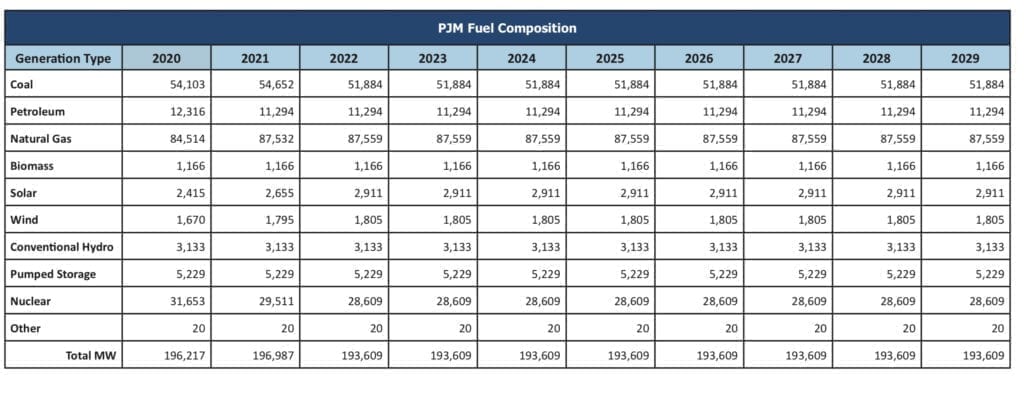

Reactions from trade groups representing the nation’s different power generating fuel types was also mixed, owing in part to an expected (and unprecedented) capacity shift in PJM over the next decade.

In its latest long-term reliability assessment (released on Dec. 19, the same day as FERC’s order), the North American Electric Reliability Corp. (NERC) said the capacity shift is being driven by “federal and state public policy and broader fuel economics including new generating plants powered by Marcellus and Utica shale natural gas, new wind and solar units driven by federal and state renewable incentives, generating plant deactivations and market impacts introduced by demand resources and [energy efficiency] programs.” Especially notable is that natural gas generation capacity within PJM’s footprint now exceeds coal—and more than 50.5 GW of new gas plants are in the planning queue, making up more than 80% of generation currently seeking capacity interconnection rights. In contrast, if formally submitted deactivation plans materialize, more than 27 GW of coal-fired generation will be deactivated between 2007 and 2021, NERC said.

America’s Power, a partnership of industries involved in producing coal power—and a group that fiercely backed the Department of Energy’s September 2017 measure that sought competitive market valuation for reliability and resiliency attributes (which FERC ultimately slapped down but for which it still has an open docket)—on Thursday commended FERC for supporting a “level playing field for all electricity resources.” However, America’s Power President and CEO Michelle Bloodworth said PJM still needs to address flaws that are contributing to a loss of coal resources in the market, and she again specifically urged PJM to consider fuel security and other resilience attributes. “Taking such a step is necessary because of the Commission’s statutory obligation to ensure just and reasonable rates under the Federal Power Act. In addition, we continue to urge the Commission to take action on its almost two-year old resilience docket,” she said.

The order was also lambasted by the nuclear sector, which garnered significant victories when state rights to back generation that meets specific environmental, economic, or political goals were recently upheld in two federal appeals court decisions regarding nuclear subsidies that were enacted in Illinois and New York. Those decisions have emboldened Connecticut, New Jersey, and Ohio to enact nuclear subsidies, and Pennsylvania, at least, to consider similar measures. Maria Korsnick, president and CEO of the Nuclear Energy Institute (NEI) on Thursday said the order “intrudes on states’ authority to protect the environment by undermining policies that support carbon-free, reliable electric generation for their residents while keeping prices low. We are disappointed that FERC’s effort to ensure a competitive capacity market does not also value the important contributions that nuclear energy provides to PJM and the entire nation.”

Meanwhile, Exelon, a utility that lobbied for many of the legislative measures to keep its uneconomic nuclear plants in Illinois and New York open—and that failed to clear a record amount of nuclear capacity at PJM’s last base residual auction—framed the order as catering to requests by fossil generators. “Given this stunning decision, it’s critical that PJM now give states enough time to react and protect families and businesses,” the company told POWER in a statement on Thursday.

‘Bad’ for Renewables

The American Wind Energy Association (AWEA) on Thursday also noted that the order was detrimental to state rights. “It undermines Congressional authority established under the Federal Power Act,” explained Amy Farrell, AWEA’s senior vice president for Government and Public Affairs. “Going forward, AWEA will consider all available options to ensure that states’ clean energy policies can be fully accommodated in PJM’s market. The only glimmer of light from today’s Sunshine meeting was FERC’s reaffirmation requiring the Southwest Power Pool (SPP) to eliminate the membership exit fee, allowing for a more inclusive stakeholder process that will lead to better outcomes for consumers,” she noted.

Likewise, the Solar Energy Industries Association (SEIA), in sharp language, said the decision was “bad” for renewables, states, and customers. Katherine Gensler, vice president of regulatory affairs for SEIA, said it would set up barriers that “make it more difficult and expensive to choose renewable resources in the PJM capacity market. This action is misguided and does a disservice to states that are listening to their constituents’ demands for clean energy,” she said.

Perhaps the most brutal criticism for FERC’s order came from environmental groups. The Sierra Club called it “disastrous”—and cited disputed figures from energy experts when it said the order “could cost the Midwest, Appalachia, and Mid-Atlantic regions almost $6 billion annually and increase dangerous fossil fuel emissions.”

The Natural Resources Defense Council (NRDC), meanwhile, sounded the optimistic note that justice would prevail. “We are confident the courts will overturn this misguided decision, which represents federal overreach into the authority of states to determine their energy priorities. Until the courts act, however, this action will make it harder and more expensive for states to meet their clean-energy goals,” said Tom Rutigliano, a senior advocate at NRDC’s Sustainable FERC Project.

Legal Challenges Certain, Could Take Years to Resolve

According to some legal experts who have been watching the case closely, however, the order’s lack of clarity on some issues will likely prompt requests for rehearing. Among key issues is how PJM will treat renewable energy credit (REC) purchases by commercial and industrial partners, as Jason Johns, a partner at Stoel Rives who advises on matters arising in power markets and state and federal energy regulatory arenas and appears regularly in proceedings before FERC, told POWER. “[A]lthough we had certainly wished for a clearer position from FERC here, the Commission importantly did not say that such transactions will cause a market participant to be MOPR’d (like it had for others that are impacted).”

Attorneys at Troutman Sanders, a firm that regulatory contributes to POWER’s Legal and Regulatory columns, also said they expect “significant activity on rehearing and clarification of the order over the next 30 days; significant protest activity at the compliance filing stage; and appeals following rehearing.”

Law firm Davis Wright Tremaine, another frequent POWER contributor, also predicted legal challenges, but it went further, suggesting challenges “could take years to resolve.” Disputes will likely be rooted in FERC’s widely criticized expansion of its definition of “state subsidy.”

“FERC defined ‘State Subsidy’ in extremely broad terms to include all renewable generation that receives support from a state renewable portfolio standard. Thus, in FERC’s view, renewable generators that sell renewable energy credits receive a State Subsidy, so they must abide by the MOPR if they seek to participate in PJM’s capacity market,” the law firm explained.

“According to critics, expanding the MOPR in this manner creates an artificial price floor that does not reflect the actual (i.e., lower) marginal costs of renewable resources.” That could ultimately limit opportunities for renewables to earn revenue from the PJM market for the value of their capacity, it said.

Renewable generators, however, aren’t bereft of options, the firm suggested. The expanded MOPR exempts renewables that have already cleared a capacity auction, executed an interconnection agreement, or had an unexecuted interconnection agreement filed by PJM by the order date. And, finally, “Renewable resources—like all other resources—can also receive a unit-specific exemption from the MOPR if the resource can demonstrate, based on its costs, that it would be competitive even in the absence of a State Subsidy,” it noted.

Read POWER’s in-depth coverage of the MOPR issue here:

The Significance of FERC’s Recent PJM MOPR Order Explained (December 2019)FERC Nixes PJM’s Fixes for Capacity Market Besieged by Subsidized Resources (July 2018)States to FERC: Promote Market Designs That Recognize State Priorities (October 2019) |

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

Updated (Dec. 30): Adds comments from law firms, adds subheads.