With more countries announcing net-zero plans for 2050 or sooner, hydrogen’s time has come to play a major and integrated role in our energy infrastructure.

The energy industry has shown an increased interest in understanding the opportunities, challenges, and economic realities in integrating hydrogen into their energy portfolios. The March 2020 BloombergNEF Hydrogen outlook estimates an optimistic growth from 70 million tonnes annually of hydrogen production in 2020 up to 700 million tonnes by 2050—a ten-fold increase within 30 years. But within one year—and some significant changing political and climate change landscapes—Bloomberg released another hydrogen projection report. The second report indicated potential growth of up to 1,300 million tonnes by 2050, practically doubling its previous estimate.

Whether this growth is 10 times or 20 times more by 2050, the world is going to need a lot more hydrogen. But what is driving this interest? Hydrogen can supplement our energy supply while reducing our reliance on fossil fuels like coal, oil, and natural gas.

Where Will the Hydrogen Come from?

Hydrogen can be derived from natural gas or renewable energy sources like solar, wind, or hydropower. Either of these methods require significant quantities of water. The rule of thumb for electrolysis is nine kilograms of water to one kilogram of hydrogen (9:1).

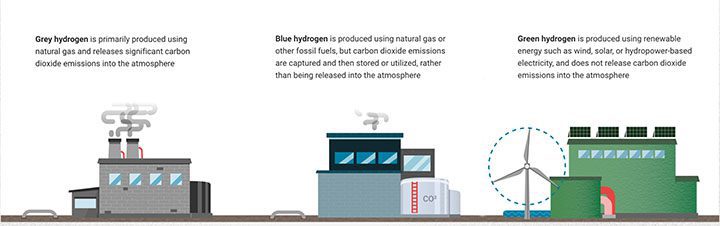

Right now, more than 90% of hydrogen is produced from natural gas. In many instances, carbon dioxide is not captured in the process and is still emitted into the atmosphere. This is called grey hydrogen. However, when this carbon is effectively captured and sequestered, we call the product blue hydrogen.

This brings us to green hydrogen. Green hydrogen is produced using renewable energy sources and does not release any carbon emissions into the atmosphere. But currently, it is more expensive to produce than grey or blue hydrogen. The cost is highly contingent on the renewable energy source, regardless of whether it comes from solar, wind, or hydropower.

From a commercial perspective, the combined cost of intermittent energy (solar and wind) coupled with emerging electrolyzer technology puts green hydrogen at a significant cost disadvantage to either grey or blue hydrogen (Figure 1). Our analysis would indicate it’s around three times more expensive on average.

Not All Green Is the Same

To nobody’s surprise, renewable energy is the fastest-growing energy source globally. Renewable energy made up 26% of global electricity generation in 2018. That’s expected to rise to 45% by 2040. Most of the increase will likely come from solar, wind, and hydropower.

Of the three, hydropower currently constitutes the largest energy source of renewable energy at 17% of market share. Hydroelectric power is also currently the cheapest renewable energy source, costing $0.05 per kilowatt-hour on average. Hydroelectric power is the cheapest because the infrastructure has been in place for a long time and it produces electricity consistently, rather than only when the sun is shining or the wind is blowing. This makes hydropower an excellent source of energy for hydrogen production—not only because of the access to water needed for electrolysis but because of cost.

It also helps asset owners utilize assets that are already in place. Building on assets already in place is likely a critical aspect of green hydrogen development that has yet to be fully realized. In contrast to building new fit for purpose solar and wind facilities, utilizing existing spare large-scale hydropower capacity to produce hydrogen theoretically alleviates the need to build new assets—to a certain extent. After all, just about every power and utility producer is surely interested in producing more with less.

Utilization Rates

The fact that hydropower assets are controllable and predictable months in advance is heavily advantageous also. Unlike solar and wind, where the weather can have significant impacts, hydropower is produced reliably and consistently. In fact, in North America hydropower assets have a utilization rate of between 30% and 50%. For evaluation purposes, if we were to use a utilization value of 60%, that is to say, they can provide unutilized power to produce hydrogen.

Theoretically, if we strategically look at utilization, power production can continue to be diverted to produce electricity for electrolysis. The operational flexibility of electrolyzers lends itself to being able to be ramped up or ramped down when needed. Assuming a total hydropower production capacity of 1,308 GW, not utilizing 40% of the total capacity is equal to 523 GW of power available for hydrogen production. This equates to a total of 104 million Nm3/h or 214,000 MTPD of hydrogen or approximately 100% of the world’s present hydrogen production capacity, a staggering number.

Of course, this is a theoretical value and not every hydropower facility would be located favorably to provide hydrogen. However, the case needs to be made that adding hydrogen production can take advantage of excess power at hydroelectric facilities.

Water

Over the past 18 months, there have been significant announcements of green hydrogen developments. Some announcements related to world-scale, solar-powered hydrogen projects that utilize strong solar locations on the surface make sense. That is until water sourcing and treatment costs are evaluated as part of the overall project development.

Similarly, implementing economically attractive offshore wind power generation seems logical. However, access to fresh water is always critical. Desalinating water specifically for hydrogen production would certainly have significant cost and greenhouse gas (GHG) implications. This will likely render most offshore wind hydrogen projects too expensive or not viable.

Hydropower is leveraging water for power generation. In practically all cases, this hydropower is generated from fresh water. Water quality specifications differ whether using alkaline electrolyzers or proton exchange membrane (PEM) electrolyzers. Alkaline-based units have some tolerance for water impurities, while PEM units require a more stringent water quality. This means that freshwater access and its treatment costs are critical elements of producing green hydrogen. By now, the associated advantages of hydropower-hydrogen (HH) are becoming increasingly obvious.

Scalability

One of the few current advantages of green hydrogen is the ability to start small with a few megawatts (MW) and scale up in a modularized manner. Electrolyzers lend themselves to modularized packages, starting small and adding in increments to grow in the future. As such, piloting a small-scale HH project is a relatively easy undertaking. That’s why we encourage any size of power provider to consider hydrogen production—it doesn’t have to be a megaproject to make a difference. Start small and build up.

Alternative Revenues

Behind the premise of the hydrogen economy is the ability to use hydrogen for all major areas of the economy—natural resource developments, power generation, manufacturing, and the full range of transportation applications such as personal, public transit (Figure 2), or fleet vehicles. Finding a use for hydrogen is typically not the issue. However, finding the right customer is not necessarily straight forward. Our rule of thumb is that the economics behind hydrogen developments should be the primary driver.

Maximizing revenues from current assets makes a lot of sense. And understanding the utilization factor and producing hydrogen when no current power offtake is available can provide a great opportunity to not only generate an alternative revenue but reduce emissions in the process. Whether the hydropower asset holder is a long-established public entity or private company, driving more value and alternative sustainable revenues makes tremendous sense—especially when also reducing GHG emissions.

Global Opportunity

Hydropower-hydrogen can play a significant role in transitioning economies to meet net-zero GHG goals. Consider countries in the world today where there is an abundance of hydropower in place or potential hydropower that can be developed, such as Ethiopia and Nepal for example. Both countries have plentiful nominal and potential hydropower capacity. However, both countries are currently importing oil and gas to be utilized in different parts of their respective economies, principally in the automotive sector.

There is also a strong argument for island economies with available hydropower, such as New Zealand and Puerto Rico, where reducing fossil-fuel imports would also have a significant impact. In these cases, bringing together an ambitious plan to not only produce hydrogen but also to reduce—and eventually stop—the import of higher GHG producing fuels is fundamentally logical. Switching public transportation in congested cities from diesel to hydrogen would yield many other economic, health, and social benefits as well.

Hydrogen is not going away. Indeed, it will grow significantly in the coming years. Current hydropower producers are uniquely placed to play a very significant role in the transition to the hydrogen economy. As technology improves and costs come down for green hydrogen, hydropower-hydrogen can be the single most important accelerator for the energy transition.

—Nathan Ashcroft is a strategy and business development leader at Stantec and Pietro Di Zanno is a hydrogen subject matter expert.