The U.S. should capitalize on China’s formidable experience to put its own domestic solar power sector on a more “economically sensible” path, researchers from Stanford University said in a new report.

The March 21–released report, “The New Solar System,” which was funded by a research grant from the U.S. Department of Energy (DOE), offers a number of recommendations for putting U.S. solar policy on an economically sustainable tangent, which, the authors say, requires acknowledging and learning from China’s approach.

“It is by recognizing China’s key role, rather than resisting it, that the United States will contribute most profoundly to the expansion of cost-effective solar energy globally and, in the process, grow a solar sector in the United States that is significant in scope and profitable over the long term,” it concludes.

China Basks in its Achievements

The report points out that, even though several myths prevail about China’s solar industry, the country has transformed its solar industry to become the biggest global solar player today.

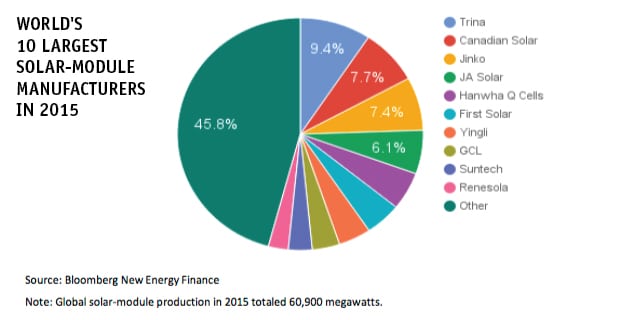

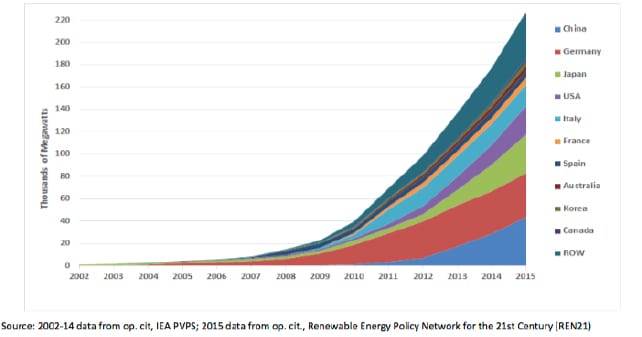

In 2016, China produced 71% of the world’s solar modules—compared to 1.3% produced in the U.S.—the report says, citing IHS Markit estimates. It has also witnessed a stunning increase in solar energy deployment. At the end of 2010, China had just 800 MW of solar capacity installed within its borders, but by the end of 2015, that number had shot up 50 times—to 43,500 MW, the largest installed solar base of any country in the world.

“The Chinese are not only leading the world in terms of the manufacturing of solar equipment, but they are also the largest deployer of solar energy,” said Dan Reicher, executive director of Stanford’s Steyer-Taylor Center, which is a joint research center involving Stanford Law School and the Stanford Graduate School of Business. “And they are getting increasingly competitive in the research and development area, which the U.S. has historically been dominating. With a new federal administration and a new Congress, this is the time to be thinking about what we want the U.S. role in solar industry to look like five, 10 years from now,” added Reicher, who co-authored the report.

The report chronicles the maturation of China’s solar enterprise over three broad stages. First, the country commoditized the manufacture of “vast quantities of solar equipment,” it says. Next, it deployed “vast quantities of that equipment within its borders.”

And now, China is attempting to reform both its solar research and development effort and its massive solar deployment apparatus in an attempt to make them more economically efficient, it says.

The transformation hasn’t been smooth, the report notes. “Through a combination of aggressive government support and rough-and-tumble entrepreneurialism—both of which have created friction with the West—China over the past decade has trained its formidable manufacturing supply chain and banking system on capitalizing on the solar opportunity.”

The Shadow Over U.S. Solar

The U.S. solar sector has flourished, though not to its potential, the report says. Deployment of solar in the U.S. surged over recent years in certain areas of the U.S.—particularly the Southwest, Mountain West, and California—which “have some of the best solar resources on the planet,” it notes.

In 2015, the U.S. was the third-largest deployer of solar modules in the world, behind China and Japan. It installed 7,200 MW of solar capacity in 2015, up 16% from 2014. And, cumulatively, the U.S. has installed 25,600 MW of solar capacity as of 2015, placing it fourth globally, behind China, Germany, and Japan. In 2016, new U.S. solar deployment increased to 14,600 MW—essentially twice the figure for 2015.

Bipartisan U.S. support for solar has also risen of late, as was evident with a December 2015 vote by Congress to extend the investment tax credit for five more years, and the establishment of more ambitious renewable portfolio standards in many states.

Yet, the U.S. solar industry is currently facing enormous uncertainty, the report notes.

One setback is the election of President Donald Trump, “who has disputed the link between human activity and climate change and who has characterized efforts to scale up solar and other forms of renewable energy as uneconomic because of the subsidies involved,” it says. Trump has also pledged to cancel the Paris Climate Agreement, and on March 28, he signed an order calling for a review of the Clean Power Plan and other Obama-era climate initiatives. And nearly as significant, Trump has criticized China, calling for a tougher trade stance with the country.

Meanwhile, the U.S. solar sector is seeing a major shakeout. After two major solar generators sought bankruptcy in early 2016, later that year, two of its largest solar manufacturers—SunPower and FirstSolar—announced restructuring in an effort to cut costs.

Recommendations for Robust U.S. Solar Future

The report acknowledges crucial structural differences between the U.S. and China in how they promote new energy sources. China has an autocratic central government, a deep manufacturing base, a rapidly growing population, and it has recently stepped up efforts to tamp down air pollution nationwide. “At the same time, much of China’s support for solar has been, by the admission of Chinese officials themselves, scattershot and inefficient, resulting in large sums of wasted money,” it notes.

China also entered the solar sector as a manufacturer, whereas the U.S. entered it by focusing overwhelmingly on research and development. Only after China’s solar manufacturing industry saw debilitating hurdles amid global overcapacity did it move in a “significant, nationally coordinated” way to ramp up research and solar deployment.

Some important ways the U.S. could learn from China’s approach is to better understand its long-term energy policy (China’s five-year planning system), its public-private technology partnerships, and technology commercialization, the report says.

One key recommendation offered in the report is for the U.S. to prioritize low-cost power over domestic solar-manufacturing jobs. The Energy Department’s SunShot Initiative in 2011 launched an effort to render solar power without subsidies cost-competitive, the report notes, and it has accomplished part of that by setting targets. At its inception, the initiative targeted costs at $0.06/kWh for utility-scale solar, $0.07/kWh for commercial rooftop solar, and $0.09/kWh for residential rooftop solar by 2020. In May 2016, the DOE announced that the solar industry had realized 70% of those cuts. In November 2016, the DOE announced new unsubsidized-cost targets for 2030: $0.03/kWh for utility-scale solar, $0.04/kWh for commercial rooftop solar, and $0.05/kWh for residential solar.

But reducing the cost of solar will require even more research and development spending, as well as a reduction in wasteful spending everywhere across the solar value chain, the report says. It might also require increased international cooperation and significant advances in energy storage and transmission.

A second priority, according to the researchers, should be to leverage solar’s globalization. “The United States has much to learn from China about efficient solar manufacturing and about improving the real-world performance of silicon solar cells, the technology that dominates today’s market and that is dominated by China,” it says. But China, too, has much to learn from the U.S. about “next- generation solar technologies and, crucially, about innovative methods of solar finance.”

Scaling up solar power in the U.S. may also require placing a price on carbon, advancing climate policies, achieving “an equitable outcome to intensifying disputes” over net energy metering, and extending tax credits, the report says. Other recommendations include making solar manufacturing a priority and approaching research and development more strategically.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)