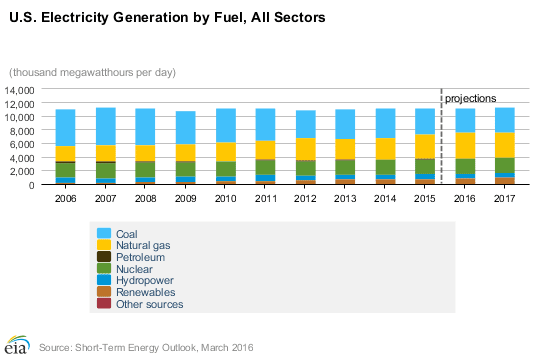

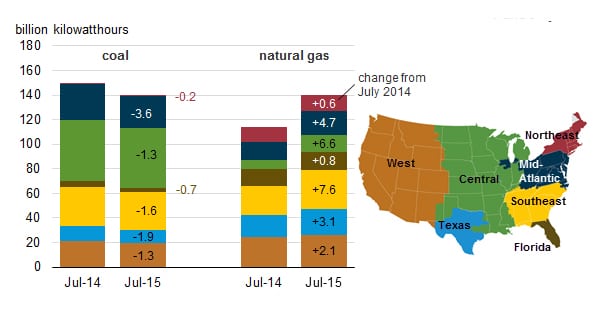

Battered by stubbornly low natural gas prices and regulatory headwinds, coal-fired generation fell into a near-tie with natural gas in 2015, according to data released on Feb. 26 by the Energy Information Administration (EIA).

For all of 2015, coal generated 1,356 TWh, while gas-fired generation produced 1,335 TWh, giving coal a slight 33.2% to 32.7% advantage for the year.

But numbers for coal were boosted by a big advantage last winter. In the second half of the year, coal produced only 668 TWh against 726 TWh for gas, giving gas a 34.8% to 32% edge.

Analysts view the switch as primarily price-driven, as natural gas has spent much of the year near $2/MMBtu. That’s well below levels at which coal loses its traditional price advantage over gas. Gas prices began 2015 around $2.50/MMBtu, but have fallen steadily since despite the increased demand.

Capacity factors for coal- and gas-fired power plants also underwent a dramatic shift. Coal fell from 61% in 2014 to 54.6% in 2015, while gas rose from 48.3% to 56.3%. Again, the monthly data for coal shows a big drop from the end of last year, falling from 56.6% in December 2014 to just 43.1% at the end of 2015.

There are few signs that the trend will change. U.S. natural gas production has continued its steady rise since 2005. Despite challenging prices, 2015 dry natural gas production set records every month through November. And despite the increased power burn, gas in storage also hit record highs for October and November, the latest months for which data is available.

Last year was also a challenging one for coal on the regulatory front. The nation’s coal fleet lost 14.6 GW of installed capacity, much of it retiring as a result of the April 2015 compliance deadline for the Mercury and Air Toxics Standards. EIA projects that another 5.5 GW will retire in 2016. That will cut the nation’s total capacity to just 278 GW, the lowest its been in decades.

Gas, meanwhile, added 6.6 GW in 2015, and is projected to add another 7.8 GW in 2016, while utility-scale renewable generation from all sources is projected to add 16.9 GW, reaching 200 GW by the end of 2016.

—Thomas W. Overton, JD is a POWER associate editor (@thomas_overton, @POWERmagazine).