Energy market dynamics in the U.S. continue to evolve. Regulatory developments, advancements in power plant technology, and fuel dynamics are transforming the industry. Although the outcome of these developments has yet to be seen, the potential for higher power and fuel prices, volatile markets, and increased dependency on natural gas are factors to consider in 2015.

Volatile Fuel Prices Lead to Generation Mix Shift

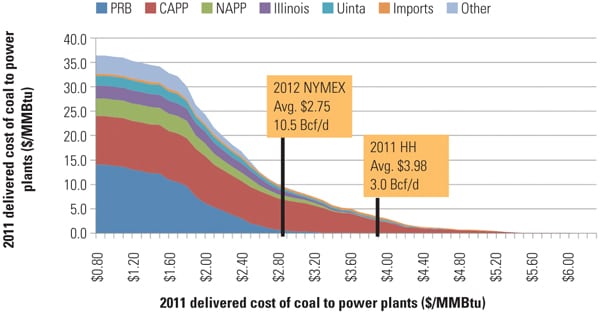

After touching historic lows in 2012, Henry Hub spot gas prices averaged $4.49/MMBtu through October 2014, about 22% higher than the same period in 2013. At the same time, major benchmark Eastern coal ranged from $2.1 to $2.7/MMBtu at mine mouth, which allowed coal generation to rebound in 2014. The ICForecast projects average Central Appalachian mine-mouth pricing in 2015 to remain in the range of $2.41 to $2.59.

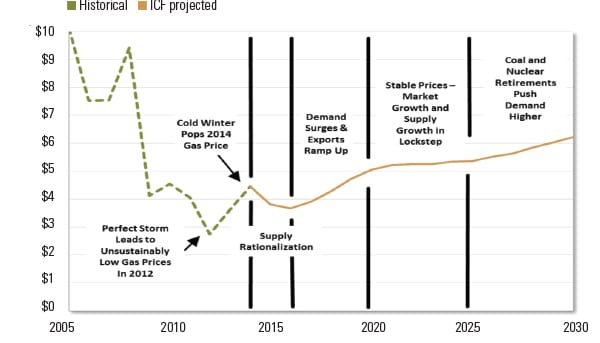

Mild summer weather and record natural gas production and injections have contributed to driving natural gas storage just short of the five-year average. The ICForecast for natural gas prices has Henry Hub projections averaging $3.62/MMBtu in 2015, which is lower than the $4.55/MMBtu forecast average in 2014. Starting in 2016, there is a widely held expectation for accelerated growth in gas demand due to gas builds replacing retiring coal units, aging nuclear units, and growth in U.S. exports to Mexico as Mexico replaces its aging fleet of oil-fired generators with gas-fired combined cycle units (Figure 1).

|

| 1. Actual and projected average Henry Hub natural gas prices per MMBtu. Source: ICF International |

Coal Retirements Lead to Higher Energy Prices

According to ICForecast projections, in addition to nearly 6 GW of coal capacity that retired in 2013, nearly 62 GW of coal capacity is expected to retire between 2014 and 2016, primarily due to Mercury and Air Toxics Standards (MATS) regulation, low gas prices, and low real-demand growth in some regions.

The majority of these retirements will be older units (>45 years) lacking controls for SO2 and NOx. Retirements in the MISO, PJM, and SERC regions will account for over 75% of total projected coal retirements. Increasing CO2 allowance prices over time, along with compliance costs for coal ash and water intake rules, will contribute to additional retirements beyond those prompted by MATS.

The effect of near-term coal retirements, driven by MATS, on electricity prices is more pronounced in coal-dominant regions such as PJM COMED and MISO Indiana, where electricity prices from 2013 to 2016 are expected to increase by over 20%. On the other hand, gas-dominant regions, such as New York City, are expected to remain more stable and show relatively smaller increases in electricity prices.

Gas Dependency

The retirement of older, less-efficient units, is expected to drive coal’s share of total generation down to slightly above 35% by 2016, according to projections from the ICForecast. Remaining coal units will be newer, more efficient, and will run at relatively higher capacity factors.

In 2015, the U.S. is expected to add nearly 11 GW of natural gas–fired generation to replace retiring coal generation. The majority of combined cycle builds, mainly dedicated to baseload supply, will be located in PJM, FRCC, and ERCOT. In addition, combustion turbine builds will be needed to meet peak and reserve margin requirements. The majority of combustion turbine builds will be in PJM, SERC, and MISO regions.

The need for natural gas from the well to the burner tip is providing huge opportunities for companies in the exploration and production space, pipeline infrastructure development, and other natural gas–driven functions. A recent report from the INGAA Foundation projects that more than 432,000 jobs will be required to build out sufficient infrastructure between now and 2035.

Renewables are not expected to vastly change the generation landscape or affect the predominance of gas in the immediate future. Wind and solar technologies will continue to dominate the renewable build mix, but lower capacity factors keep their expected share of total generation nearly constant over time. The ICForecast projects an additional 3.8 GW of wind and 3.5 GW of solar capacity in 2015.

Beyond the two nuclear projects currently under development, which are suffering from cost overruns and delays, nuclear is not expected to play a major role in the future. Prohibitive build costs, extensive regulation, low gas prices, and low expected CO2 prices make nuclear generation economically infeasible in the long run.

In short, natural gas continues to be the driver of market dynamics, both for price and generation build. There are many business opportunities for market participants to engage in infrastructure-related development and support activities in 2015 and beyond. ■

— Lalit Batra and Vinay Gupta are associates at ICF International.