Well over half of North America faces a potential shortage of electricity supplies in the coming years, compounded by surging demand growth, accelerating generator retirements, and delays in resource development, the North American Electric Reliability Corporation (NERC) has warned in its latest 2024 Long-Term Reliability Assessment (LTRA).

The designated electric reliability organization’s (ERO’s) annual 10-year outlook focused on the North American bulk power system’s reliability paints a sobering picture riddled with interrelated risks. The grid, already grappling with shrinking reliability margins and operational stress from the rapid pace of the energy transition, is ill-equipped to handle the forecasted demand growth, it suggests. Mounting vulnerabilities are rooted in uncertainties, including weather variability and extreme temperatures, the rapid addition of large new loads such as data centers, and persistent delays in generation replacement and transmission development.

“Simply put, our infrastructure is not being built fast enough to keep up with the rising demand,” said John Moura, NERC’s director of Reliability Assessments and Planning Analysis. “Collaboration, urgency, and foresight are really not negotiable. Policymakers, industry leaders, and stakeholders across North America must work together to enable the expansion of the bulk power system [and] ensure new resources can interconnect effectively, reliably, and also maintain reliability that society depends on,” he said.

Following are the assessment’s most remarkable findings.

- Over Half of North America Is at Elevated Risk of Energy Shortages

- Generator Retirements Outpace Resource Additions

- Electricity Demand is Growing Faster Than Ever

- Natural Gas Infrastructure Remains a Reliability Concern

- Transmission Development Shows Promise But Faces Barriers

1. Over Half of North America Is at Elevated Risk of Energy Shortages

NERC’s LTRA, a critical tool that informs decision-making across the energy industry, is this year even more dismal than in 2023. In its 2023 LTRA released last year NERC first signaled a reversal of a decades-long trend of falling or flat growth rates for forecasted demand and energy, but it flagged resource adequacy concerns emerging in areas like the Midcontinent Independent System Operator (MISO) and SERC-Central.

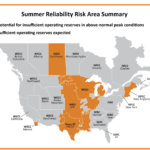

This year’s report suggests risks are pervasive and escalating. NERC identified MISO as the only region considered “high risk”—where established resource adequacy targets may not be in the next five years. However, it marked 10 other regions as “elevated-risk” areas—including some of the largest in the U.S.: PJM, the Electric Reliability Council of Texas (ERCOT), California-Mexico, Southwest Power Pool (SPP), and SERC-East. In Canada, all regions—with the exception of WECC-Alberta and NPCC-Quebec—fell into “elevated risk” category, including Ontario, Manitoba, SaskPower, and British Columbia. While these areas will generally meet resource adequacy criteria, “analysis indicates that extreme weather conditions are likely to cause a shortfall in area reserves,” NERC explained.

A specific concern for NERC is that, for several regions, initial shortfall years are slated to begin over the next three years—2025 to 2028. The report cites varying risks, ranging from inadequate resource additions and accelerating generator retirements to extreme weather vulnerabilities.

- MISO (High-Risk). Coal-fired generator retirements and delayed resource additions are expected to drop reserve margins below Reference Margin Levels (RMLs) starting in 2025, with a projected 2.7 GW shortfall by 2029, despite 56 GW of planned solar and battery projects.

- NPCC-New England (Elevated Risk). Unprecedented demand growth driven by electrification, coupled with persistent winter natural gas constraints, could raise risks of supply shortfalls by 2026, and extreme cold spells could further challenge reliability.

- NPCC-Ontario (Elevated Risk). Reserve margin gaps projected to begin in 2027 are tied to nuclear refurbishment outages, expiring resource contracts, and rising demand, though 1.8 GW of battery projects and 600 MW of imports from Hydro-Québec seek to address these shortfalls.

- Texas RE-ERCOT (Elevated Risk). Explosive demand growth driven by 20 GW of new large loads, alongside a more variable and less dispatchable resource mix, could significantly increase the risk of long-duration winter shortfalls by 2026, despite robust solar and battery additions.

- WECC-California/Mexico (Elevated Risk). Resource adequacy improvements from battery and solar PV additions and the Diablo Canyon nuclear extension reduce risks, but supply shortfalls during evening solar downramps and gas-fired retirements could remain a concern by 2028.

- WECC-British Columbia (Elevated Risk). While moderate demand growth and hydroelectric reliance maintain stability under normal conditions, extreme cold weather by 2028 could lead to up to five hours of unserved energy due to limited imports from neighboring areas.

NERC noted that one reason for its expanded risk profile this year is that it used both a probabilistic assessment and a reserve margin analysis to assess the risk of future electricity supply shortfalls. “For this year’s assessment, we incorporated more application of energy risk metrics that are capable of finding shortfall risks as the resource mix is changing and there’s more variability in resource output, and also as the demand is becoming more variable in it in future years,” NERC Manager of Reliability Assessments Mark Olson explained on Tuesday.

2. Generator Retirements Outpace Resource Additions

A specific concern underscored in the report is that—keeping pace with the 2023 LTRA—confirmed generator retirements over the next decade will reach 52 GW in 2029 and mark 78 GW over the 10-year period. “Announced retirements, which include many generators that have not begun formal deactivation processes with planning entities, total 115 GW over the 10-year period,” it notes. (That represents about 10% of the 1,189 GW of total installed capacity in the U.S. at the end of 2023.)

The additional generator retirements—of about 37 GW—”would spur a need for more resources, even more than what we see to address the energy and capacity shortfalls already shown, and that could lead to a reserve margin shortfall in pretty much every area of the North American system between now and the next 10 years,” said Olson. “It really points to the critical need that generator retirements need to be managed in an orderly way and ensure that the reliability and energy needs of the system are taken care of.”

Meanwhile, though the LTRA finds while the overall resource capacity on the system has grown slightly since the previous LTRA, it is “significantly less” than what the LTRA expected,” Olson said. “That creates concerns that as demand is increasing at a greater pace, resource growth is not increasing and not keeping up with the projection.”

At the same time, the interconnection queue has grown by about 12% over the past year, but the actual integration of those resources into the system has lagged, he noted. That is particularly evident in solar PV, where connections were 14 GW lower than projected in last year’s LTRA. The exception so far has been for battery storage, “which connected more capacity than was projected in last year’s LTRA,” he said.

Variability Impacts. For now, solar PV still remains “the overwhelmingly predominant generation type” being added to the BPS, the assessment notes, echoing previous LTRAs. “As older fossil-fired generators retire and are replaced by more solar PV and wind resources, the resource mix is becoming increasingly variable and weather-dependent. Solar PV, wind, and other variable energy resources (VER) contribute some fraction of their nameplate capacity output to serving demand based on the energy-producing inputs (e.g., solar irradiance, wind speed),” it says.

The 2024 LTRA, however, points out more reliability implications that have come to the fore in recent years—and are slated to remain a concern. “The new resources also have different physical and operating characteristics from the generators that they are replacing, affecting the essential reliability services (ERS) that the resource mix provides,” it explains. “As generators are deactivated and replaced by new types of resources, ERS must still be maintained for the grid to operate reliably.”

‘Energy Drought’ Concerns. Finally, the report underscores the uncertainty posed by “energy droughts,” where simultaneous below-normal output from wind, solar, and hydro resources could lead to supply shortages during abnormal weather. Historical U.S. generator data reveals regional patterns in energy droughts, characterized by varying duration, magnitude, and seasonality, the report says. These events, which are more likely during high-load periods, highlight a critical need for resource adequacy and storage planning, it suggests.

3. Electricity Demand Is Growing Faster Than Ever

Power supply concerns are meanwhile being compounded by a surge in electric demand, which is being driven by the rapid build-out of data centers, industrial development, and electrification. “We are seeing demand growth like we haven’t seen in decades,” Moura noted. “That growth is exciting—it’s a signal of innovation and economic momentum. But as we all know, growth must be met with reliability readiness.”

The forecast used in the LTRA notably shows a 15% increase in summer peak demand over the next 10 years—a significant acceleration of 132 GW in the 2024 LTRA compared to the 2023 LTRA. The winter peak growth is higher—at 18% over the 10-year period: 149 GW, up from 92 GW in the 2023 LTRA.

A Dual-Peaking Trend. The BPS is already seeing a “dual-peaking” trend, where peak season goes from summer to winter, the LTRA says. “In the U.S. Southeast, SERC-Central and SERC-East became dual-peaking systems in recent years. SERC-Southeast recently began experiencing slightly higher peak demand in winter compared to summer,” it notes. As electrification of heating systems and transportation continues, New England could transition to dual peaking in the mid-2030s, New York in the late 2030s, and Ontario in 2030, it says. However, that could have implications for planning and operations. “For example, resource output and fuel risks are significantly different in winter, requiring the focus of resource adequacy processes to change,” it notes.

Large Load Growth Uncertainty. The LTRA also hones in on large commercial and industrial (C&I) demand growth and implications for their rapid connections to the BPS. For NERC, a big concern is visibility. “Emerging large loads, such as data centers (including crypto and AI) and hydrogen fuel plants, present unique challenges to forecasting and planning for increased demand,” it explained. “Earlier this year, NERC’s RSTC established a Large Loads Task Force to better understand the reliability implications of growth in large loads and develop solutions.”

Adding large parcels of load, such as data centers and industrial facilities, introduces various uncertainties for system planners and operators, the report notes. Data centers, for example, operate longer hours and require extensive heating and cooling, leading to more persistent demand compared to other commercial buildings. In areas like Texas, cryptocurrency mining facilities have demonstrated the ability to scale operations based on electricity prices, complicating forecasting even more. Additionally, customer-initiated, automatic disconnection of sizeable loads during grid faults poses reliability risks akin to issues observed with inverter-based resources (IBRs).

As Olson explained, “The forecast we’re using for our assessment shows that accelerated growth—and the indicators are there with the types of change, with the ability for data centers to be constructed and built quickly—that some of these drivers are likely to continue to shape the demand projection well into the future.”

While industry works to pin down assumptions and estimates related to connections, NERC’s task force will work with industry on “some technical practices around the large data center loads,” he said. “And I think more will happen next year as a work plan gets underway with NERC and the industry on addressing reliability issues with those.”

4. Natural Gas Infrastructure Remains a Reliability Concern

Yet another emerging reliability challenge highlighted in the LTRA is the growing reliance on natural gas-fired generation and the critical interdependencies between gas and electric systems. The issue has evolved into an industry-wide imperative due to the pivotal role natural gas plays in meeting electricity demand during peak periods, especially in winter.

“Over the years, we’re going to become more reliant on natural gas as a primary generating fuel. We use it for baseload, mid-range, and peaking conditions [because it’s] very flexible, but we’ve noticed it has challenges, both in [terms of] mechanical operations during winter weather, especially in your southern states, Texas included. [Additionally], there’s also limited gas to go around on the days that you need it,” said Moura.

Natural-gas-fired generators provide critical attributes for grid reliability, such as inertia, frequency response, and ramping flexibility. However, they often rely on interruptible, non-firm fuel supply contracts that can be cut off during periods of high demand. “What we find is that when there’s not enough gas to go around, a lot of those generators that are on it get interrupted. [They can’t] supply electricity, can’t generate electricity, and even some firm customers have challenges getting gas because production wells that are very far away might freeze up,” Moura explained.

The challenge was underscored by severe winter weather events in 2021 and 2022, which highlighted the vulnerability of natural gas supply chains during periods of extreme electricity demand. Compounding the problem is the increasing use of natural gas by power generators—projected to exceed 40% of delivered natural gas in 2024. During extreme weather events, natural gas demand spikes not only for electricity generation but also for heating, straining supply lines and creating the potential for supply shortfalls, the LTRA notes.

Addressing these gas-electric interdependencies will require a collaborative, system-wide approach, Moura added. Collaboration is already underway. Earlier this week, the American Gas Association (AGA) convened the inaugural Natural Gas Readiness Forum in Atlanta, bringing together energy trade associations, government representatives, and industry stakeholders. NERC officials participated in the forum.

The forum, notably, was a recommendation by the National Association of Regulatory Utility Commissioners’ (NARUC) Gas-Electric Alignment for Reliability (GEAR) Working Group. It emphasized operational education, situational awareness, and collaboration to bolster reliability during extreme weather events, NARUC said in a statement sent to POWER. “GEAR was established not to produce a report, to do additional analysis, or to look at the past, but to look to the future and look for ways to get alignment and put forward solutions,” said NARUC President and Georgia Public Service Commissioner Tricia Pridemore.

5. Transmission Development Shows Promise But Faces Barriers

According to Olson, a bright spot in this year’s LTRA is the outlook for transmission development. More than 28,000 miles of transmission (>100 kV) either under construction or in various stages of development over the next 10 years—a dramatic increase from the 18,675 miles projected in the 2023 LTRA. That represents a significant leap compared to the past five years, during which an average of 18,900 miles of transmission projects were planned each decade, the report notes. However, much of this increase remains in the planning stages, with limited progress in actual construction.

“The miles of new projects that have actually moved into the construction phase really [have] not increased compared to last year,” Olson noted. He highlighted ongoing challenges, including siting and permitting delays, which continue to hinder over 1,200 miles of transmission projects. Another significant barrier is cost-sharing for projects that deliver reliability benefits across multiple regions.

To address these challenges, federal and regional planning innovations are emerging, such as the joint transmission planning construct launched by MISO and SPP, which aims to streamline development along their shared borders. While reliability remains the primary driver for most of the reported projects, the LTRA highlights the growing importance of transmission infrastructure in integrating renewable energy and enhancing transfer capability. That capability will be critical to ensure energy can flow from areas of surplus to areas of scarcity during extreme conditions, the report notes. It underscores an the urgency to advance stalled projects to bolster grid resilience and reliability.

Priority Actions to Address Emerging Risks

To address the pressing challenges outlined in its 2024 LTRA, NERC emphasizes a range of actionable priorities:

- Accelerating Infrastructure Development. A critical focus should be on expediting the addition of resources and transmission to mitigate shortfall risks, the report says. This includes streamlining siting and permitting processes, which are often the primary barriers to timely infrastructure development.

- Carefully Managing Generator Retirements. To manage over 115 GW of retirements projected within the next decade, NERC urges planners and regulators to proactively extend the service of essential generators to maintain reliability. Independent System Operators (ISOs), Regional Transmission Organizations (RTOs), and regulators must use all available tools to balance retirements with infrastructure replacement, it says.

- Enhancing Planning Protocols. NERC also calls for integrated planning between the natural gas and electric sectors. This should include frameworks to address the interconnected risks of the systems, alongside better communication and training for winter readiness.

- Improving Consistency in Long-Term Assessments. NERC advocates for the adoption of standardized methods and assumptions across all regions. The annual Probabilistic Analysis (ProbA) should incorporate energy-risk metrics to better evaluate extreme weather and regional fuel supply disruptions, it suggests.

- Maintaining Essential Reliability Services (ERS) As the grid transitions to renewables, NERC stresses a need for market mechanisms and policies to ensure that voltage, frequency, and ramping capabilities remain intact. Planning considerations must prioritize technologies that support these services, it says.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).