Over the next two decades, the U.S. power profile will be markedly different as generation from coal declines, natural gas power and renewables surge, and nuclear generation decreases slightly, said the Energy Information Administration (EIA) in its early release version of the Annual Energy Outlook 2012 on Monday. The full report, scheduled to be released this spring, presents updated projections of U.S. energy markets through 2035.

The early release version of the report includes data only for the reference case, which takes into account the effects of policies that have been implemented in law or final regulations passed before December 2011. Estimates made by the EIA, for example, do not include effects of the Environmental Protection Agency’s (EPA’s) Mercury and Air Toxics Standards issued at the end of December 2011.

As is consistent with the EIA’s short-term outlooks, according to the AEO2012 report, electricity consumption in the U.S.—including both purchases from power producers and onsite generation—is estimated to grow from 3,879 billion kWh in 2010 to 4,775 billion kWh in 2035, increasing at an average annual rate of 0.8%, about the same rate as in the Annual Energy Outlook 2011 (AEO2011) reference case.

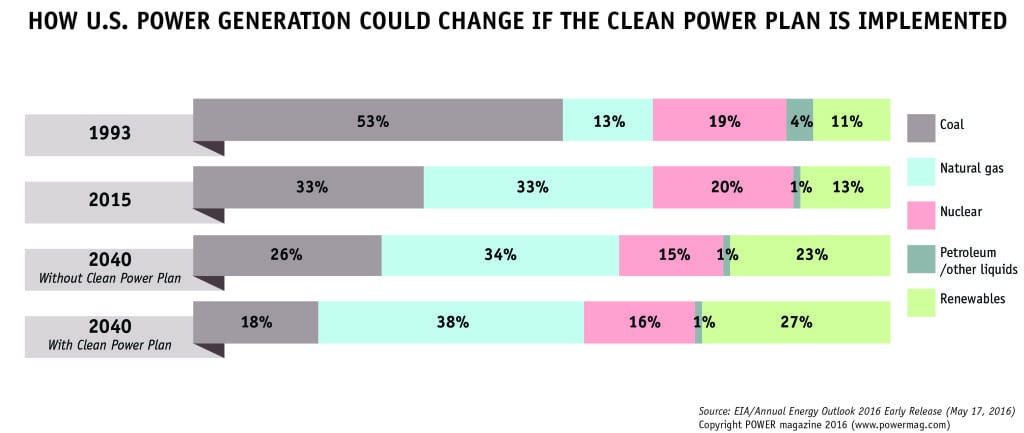

But among the report’s highlights is a projected “dampened” use of coal in the future, which the EIA attributes to a combination of “slow growth in electricity demand, competitively priced natural gas, programs encouraging renewable fuel use, and the implementation of new environmental rules.” One rule with clout, the EIA says, is the EPA’s Cross-State Air Pollution Rule (CSAPR), which was finalized in July 2011 (but whose implementation was stayed indefinitely by a federal court in December) and requires reductions in sulfur dioxide and nitrogen oxide emissions in roughly one-half of the states. Given the effects of that rule, coal generation will decline from 45% in 2010 to 39% in 2035, the report says.

Market concerns about greenhouse gas emissions will also continue to slow the expansion of coal-fired generation, the agency says. “Low projected fuel prices for new natural gas-fired plants also affect the relative economics of coal-fired capacity, as does the continued rise in construction costs for new coal-fired power plants.” Of particular note is that the EIA sees retirements outpacing new additions closer to 2035, causing total coal-fired generation capacity to fall from 318 GW in 2010 to 301 GW in 2035.

Generation with natural gas will be higher in the AEO2012 reference case than in AEO2011—particularly over the next decade, when natural gas prices are expected to stay low. “New natural gas-fired plants also are much cheaper to build than new renewable or nuclear plants,” the EIA notes. In 2015, natural gas-fired generation in AEO2012 is 13% higher than in AEO2011, and in 2035 it is still 6% higher.

Despite concerns about a plummeting of public support for nuclear power following the Fukushima catastrophe last year, nuclear generation will also surge—by an estimated 11% according to the AEO2012, from 807 billion kWh in 2010 to 894 billion kWh in 2035, accounting for about 18% of total generation in 2035 (compared with 20% in 2010). Nuclear generating capacity increases from 101 GW in 2010 to a high of 115 GW in 2025, after which a few retirements result in a decline to 112 GW in 2035.

About 10 GW of new nuclear capacity will be added in the U.S. by 2035, the EIA suggests, as well as an increase of 7 GW from uprates at existing units. This compares with 200 GW of new nuclear capacity estimated in China by 2030. In the U.S. about 6 GW of existing nuclear capacity will be retired by 2035, primarily in the last few years of the projection.

Increased generation from non-hydro renewables will account for a stunning 33% of overall growth in electricity generation from 2010 to 2035, booming in response to federal tax credits, state-level policies, and “federal requirements to use more biomass-based transportation fuels, some of which can produce electricity as a byproduct of the production process,” the EIA suggests. Solar energy market growth will especially be marked, stemming from significantly reduced costs in the reference case.

The share of U.S. electricity generation coming from renewable fuels (including conventional hydropower) grows from 10% in 2010 to 16% in 2035—even though in the AEO2012 reference case, federal subsidies for renewable generation are assumed to expire as enacted. “Extensions of such subsidies could have a large impact on renewable generation,” the EIA forecasts.

Sources: POWERnews, EIA