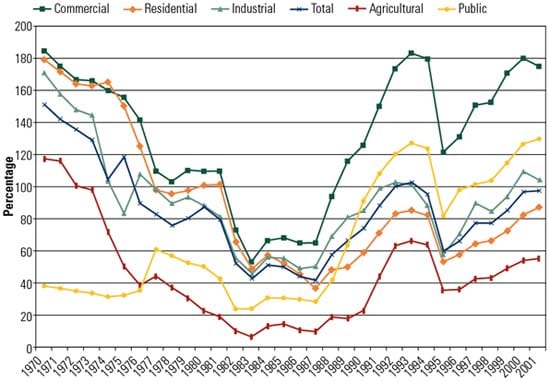

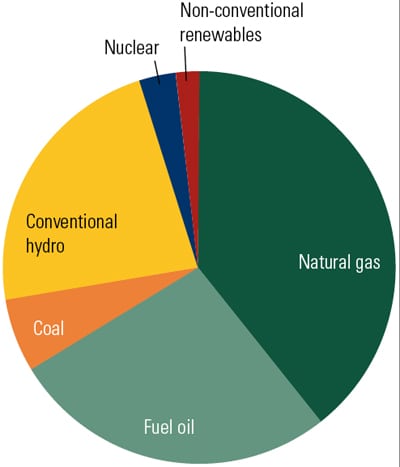

In 2013 the Mexican government passed historic reforms that eliminated the state’s monopoly on the energy sector in an effort to attract private investment. In the electricity sector, reform was sold on the promise of reducing prices: Electricity tariffs for industry are 80% higher in Mexico than in the U.S. due to high oil prices, aging plants, and elevated losses. The Federal Electricity Commission (CFE), the sole distributor of electricity in Mexico, operates at a loss, recovering roughly 80% of its costs through tariffs.

In addition to amendments to the constitution that ended the monopoly, the government has passed sector-specific legislation, such as the Law of the Electricity Industry. Regulations for this law are being debated in Congress, and the Market Rules, which will fill in the details that matter most to private investors, are still in the works.

The reforms so far create a wholesale market for electricity operated by an independent entity, where independent power producers (IPPs) can participate freely. Large customers, with a demand greater than 3 MW, are also allowed to contract their electricity supply directly from generators. Together, these changes aim to create a competitive market for generation where all producers, private and public, compete for long-term contracts with large customers and for spot sales in the wholesale market. (For a discussion of what Mexico can learn from the experience with competitive electricity markets in other countries, see “Mexico’s Electricity Sector Reform in Perspective,” associated with this issue in the archives at powermag.com.)

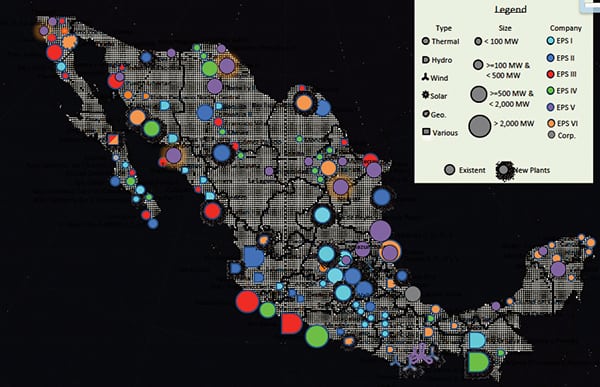

IPPs that have been selling their electricity to CFE account for 75% of currently installed combined cycle capacity, all built within the last 10 years. They, and new IPPs, should easily displace CFE in a competition for large customers. The prospects for this scenario becoming reality hinge on two conditions being met.

The Players and the Field

The first requirement is creating a level playing field between existing IPPs and CFE and between them and new generators. IPPs currently sell all of their energy to CFE under 25-year contracts. The law says that the new CFE will inherit these contracts, which would continue at least until 2025, as IPPs were incorporated into the electricity sector beginning in 2000. As long as these contracts remain in place, any new capacity would exist at the margins of a system that looks very much like the current one. If existing contracts with IPPs are revoked, then existing and new IPPs will be able to participate in the market and compete for large customers. Private generators, however, will still have to interact with CFE to reach their customers, because CFE continues to own the transmission and distribution systems through which all users must operate.

In order for all generators to compete on equal footing, regulatory authorities will need to guarantee adequate access to transmission and distribution systems. This includes a pricing mechanism that does not discriminate against any generator or large user, while taking into account the investment needed to address existing transmission bottlenecks and accommodate new generation. This is particularly important for new generators wishing to enter the market to take advantage of the difference between their production costs and system prices. With two-thirds of installed capacity, including the least efficient oil-fired units, CFE will set the marginal cost of the system. High spot prices should signal investment from new firms and prompt existing IPPs to add new capacity to their plants; any barriers to new firms, such as permitting and transmission pricing, will create an advantage for incumbent generators, who benefit from keeping spot prices high and competition out.

Also, in order for the market to send the right signals to new investors, CFE’s prices would need to become more transparent. Dispatch in a competitive electricity market is based on declared costs, which are difficult to ascertain as long as CFE continues to operate a vast array of generating plants as one commercial unit. Subsidies, if not clearly separated from the rest of CFE’s operations, also put CFE in a position to undercut the competition for long-term contracts with large users.

Got Gas?

The second condition for the successful entry of new IPP generation into the Mexican electricity market is the availability of natural gas. Most recent capacity additions have been combined cycle plants fueled by cheap natural gas imported from the U.S. Pipelines are currently operating at full capacity, and electricity generation has been competing with industry for natural gas supply, forcing industry to resort to expensive imports of liquefied natural gas. A new pipeline from Agua Dulce, Texas, is expected to come online by the end of 2014, and applications for additional pipelines are aiming to more than double the previous volume of imports (about 1.8 billion cubic feet per day in 2013). The timing of these additions will determine the pace of new generation coming online.

Whether Mexico offers attractive opportunities for private investment in electricity will be determined by the Market Rules due to become public in 2015. These rules should focus on adequately addressing CFE’s market position such that new generation can be built on the basis of long-term contracts with large consumers at competitive rates. ■

—Sylvia Gaylord, PhD is an assistant professor at the Colorado School of Mines and an energy consultant.