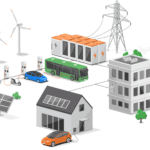

Historically, the relationship between energy producers and consumers has been straightforward—energy companies produce energy, grid operators deliver that energy, and end users consume the energy they receive. Energy flowed in one direction, from generators to homes and businesses. Producers and consumers were easy to identify in this market because there was no overlap, and they never switched sides. As rooftop solar entered the market, things began to change. Utility customers began producing and consuming energy—i.e., they became “prosumers.” For customers, the benefits of becoming a prosumer are clear—energy independence, security and bill savings. For utilities, this evolution presents both a challenge and an opportunity: how to harness the power of prosumers to complement traditional power generation while minimizing the resulting burden on the grid.

How Prosumers Became a Key Demographic

While utility leaders began pioneering customer rooftop solar programs in the early ’90s, residential solar adoption didn’t take off for another 20 years. In 2015 the share of U.S. single-family homes with solar was less than 1%. Fast forward a decade and today that figure is approaching 5%, with Hawaii (33%), California (20%) and Arizona (12%) leading the curve. Energy providers in these states began recognizing the importance of prosumers as the infamous “duck curve” emerged in load forecasts, revealing the increasing overproduction of mid-day solar year over year. As prosumers began adopting residential battery systems to store solar energy generated during the day for around-the-clock use and adopting electric vehicles and other distributed energy resources (DERs), their interactions with the grid became increasingly complex. Utilities could no longer afford to ignore prosumers as a key demographic.

Prosumers Unmanaged—None of the Benefits and All of the Costs

Unmanaged, prosumers pose numerous challenges for energy companies and distribution grid operators. The most salient issues involve intermittency and overproduction. High solar penetration creates a glut of generation mid-day but ceases production abruptly at sunset causing a sharp ramp in evening demand. Peaker plants called on to satisfy this sudden ramp are typically less efficient and more expensive, increasing the cost of providing service. Especially in shoulder months when energy demand is low, this phenomenon can significantly impact wholesale energy markets, contributing to negative prices. The California Independent System Operator’s (CAISO) price hub covering much of Southern California experienced more than 1,100 hours of negative electricity prices in 2024, more than doubling year-over-year from 2023.

DER penetration contributes to grid instability and power quality issues as well. From voltage sags and spikes to problems with frequency regulation, utilities increasingly struggle to adapt to the unpredictable, localized effects of unmanaged prosumer grid participation. The introduction of new EV loads into congested corners of the grid can lead to circuit overloads, accelerating the timeline for costly distribution system upgrades by the utility and further increasing the cost of service. A final wrinkle involves cost allocation—though prosumers typically rely on the grid for backup power and leverage distribution lines to feed excess power back into the system, their monthly bills, lowered by self-production, may not fully cover associated transmission and distribution costs incurred by the utility.

Introducing Advanced Grid Solutions

Imagine playing a game of Jenga where the other players’ moves are invisible to you—as they add load and remove pieces from the structure, you can only guess whether the system will be able to support your next move. Until recently, much like the Jenga player, utilities have had little visibility into, and even less control over, prosumer behavior and grid-edge resources. Utilities and grid operators are charged with balancing the grid while delivering high-quality, reliable power to consumers—a job made exponentially more difficult by new DERs coming online without the tools to manage them.

Leveraging digital tools and solutions that have emerged over the past decade, grid operators are not only managing the impacts of customer-sited resources, but transforming them into robust and reliable grid-supporting assets. Advanced grid solutions form the functional layer between energy companies and prosumers, benefiting both.

Harnessing Flexible Load

Advanced grid solutions allow energy companies to aggregate, control, optimize and dispatch energy from prosumers and grid-attached devices, providing power and ancillary services such as frequency regulation to the grid. Virtual power plants (VPPs) are software platforms that aggregate flexible capacity across DERs such as battery energy storage systems (BESS) and smart thermostats, dispatching that power when and where it is needed on the grid. Emerging vehicle-to-grid (V2G) technology allows managed EV charging companies to co-optimize EV charging at the site and grid-level, leveraging dispersed fleets of EV batteries as VPPs. With 30 GW of capacity enrolled in VPPs today, the Department of Energy (DOE) suggests VPPs could expand to meet 10 – 20% of peak demand in the U.S. by 2030. While the V2G market is still emerging, advances in the commercialization and deployment of this technology could further accelerate the growth of VPPs.

Grid-to-Grid-Edge Visibility, Optimization and Control

Advanced software systems allow grid operators to effectively integrate customer-sited resources into the grid. Many of these systems are AI-enabled, optimizing grid performance through sub-secondly dynamic load shifting and decision making. Advanced Distribution Management Systems (ADMS) and utility Distributed Energy Resource Management Systems (DERMS) systems allow utilities to load balance and manage power quality across their service territory, while integrating VPPs and DERs alongside traditional generation assets. While some utilities are just implementing these systems, others are upgrading to AI-enabled systems, fueling market growth exceeding 20% CAGR.

Emerging grid-to-grid-edge energy orchestration platforms hold the potential to provide visibility, optimization and control from site-level DERs up through the utility control room through a single pane of glass. Merging utility and grid-edge DERMS capabilities, these next-generation solutions could unlock substantial value for energy companies and prosumers.

The traditional energy grid, with electrons flowing in a single direction from power plants to homes and businesses no longer exists. It has been replaced by a decentralized, multi-directional, digitized energy system designed for flexibility and resilience. This new grid’s superpower is the prosumer—harnessing the vast array of behind the meter assets on the grid, today’s system operators have a full suite of grid-to-grid-edge resources at their fingertips. Strategic investment and deployment of private capital into advanced grid technologies supports a win-win future for energy companies and prosumers.

—Molly Podolefsky is managing director with Clarum Advisors. Leveraging her expertise in utilities and the power sector, demand response, VPPs and the grid-edge software ecosystem, in tandem with market research, competitive analysis, go-to-market strategy advising, product positioning and value proposition definition, strategic partnership and network development, she enables companies to thrive in rapidly evolving, competitive markets.