The U.S. Department of Energy (DOE) has named six companies that will compete for 10-year contracts totaling $2.7 billion for the supply of low-enriched uranium (LEU) to support the nation’s nuclear power fleet. The initiative seeks to reduce reliance on Russian imports and foster strong commercial sector investment to build out a resilient fuel supply chain for the U.S. nuclear industry.

The selected companies, which can now compete for future work to supply LEU to the DOE, include American Centrifuge Operating LLC; General Matter Inc.; Global Laser Enrichment LLC; Louisiana Energy Services LLC; Laser Isotope Separation Technologies Inc.; and Orano Federal Services LLC.

The selections stem from a July 2024 request for proposals (RFP), in which the DOE sought LEU through indefinite delivery, indefinite quantity (IDIQ) contracts. According to the RFP, the DOE anticipates it will award “two or more contracts” lasting up to 10 years. After awarding contracts, the DOE intends to sell the procured LEU to utilities operating U.S. reactors “to support clean energy generation and sever reliance on Russian imports.”

A key requirement underscored in the RFP is that all LEU acquired must be enriched and stored within the continental U.S. The DOE specified that enrichment for commercial use must come from new domestic capacity, either through new enrichment facilities or expansions of existing ones. Additionally, the DOE prioritized LEU sourced from existing U.S. mining, milling, and conversion facilities. As a secondary preference, the agency indicated it would consider materials from newly permitted domestic facilities or allied nations.

U.S. Embroiled in a Tit-for-Tat With Russia on Enriched Uranium

The company selections are part of a concerted effort by the U.S.—spanning both the outgoing Biden administration and the previous Trump administration—to establish a stable nationally rooted source of uranium under its Domestic Uranium Enrichment Program.

The initiative seeks to sustain adequate fuel for the nation’s 94 nuclear reactors, which generate 20% of the country’s power, as well as to support its future fleet of nuclear reactors, including large reactors, small modular reactors, and microreactors. Efforts are also in step with the December 2023 “Sapporo 5” multilateral commitment made at COP28 by the U.S. alongside Canada, France, Japan, and the UK to mobilize $4.2 billion in government-led investments to boost enriched uranium production capacity “free from Russian material and establish a resilient uranium supply market free from Russian influence.” That agreement notably followed a pledge by the U.S. and 21 other countries to triple nuclear capacity globally by 2050.

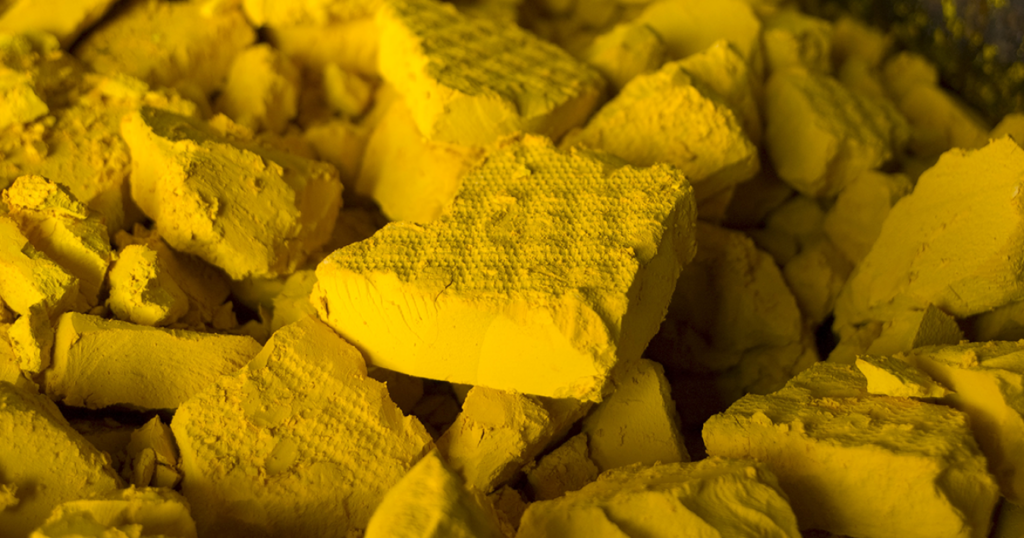

However, according to the Energy Information Administration (EIA), the U.S. today still imports most of the uranium it uses as fuel, as part of a trend it has followed since 1992. In 2023, owners and operators of U.S. civilian nuclear power reactors purchased 51.6 million pounds of U3O8e from U.S. and foreign suppliers, a 27% increase from the 40.5 million pounds purchased in 2022, with a weighted average price of $43.80 per pound—the highest since 2015.

About 27% of enriched uranium in 2023 used by U.S. civilian reactors came from Russia, which currently holds about 44% of the world’s uranium enrichment capacity and remains a significant supplier of nuclear fuel globally. U.S.-based enrichment plants provided 28% of the total, while Western European plants—including those in France, the Netherlands, and the UK—supplied the remaining 45%.

In May 2024, however, President Biden signed into law the Prohibiting Russian Uranium Imports Act (H.R. 1042), which bans imports of unirradiated LEU produced in Russia. The law, which went into effect in August 2024 and will apply through at least 2040, prohibits the import of uranium products—including uranium hexafluoride (UF6) and uranium oxide (UO2)—from Russian entities into the U.S., with exceptions for national security purposes.

To ensure U.S. nuclear power plants do not experience operational disruptions, the DOE in May 2024 established a waiver process that grants temporary waivers for specified quantities of Russian LEU. Waivers, however, are subject to strict annual import limits and must terminate no later than January 1, 2028. Media sources suggest at least two companies have received waivers: U.S. uranium enrichment company Centrus, and Constellation, the largest nuclear generator in the U.S.

Stakes for the U.S. have only gotten more precarious, given that Russia on Nov. 14 announced its own ban on exports of enriched uranium to the U.S. in retaliation to U.S. restrictions. Russia’s temporary export ban, per Resolution No. 1544, introduces restrictions on uranium exports either directly to the U.S. or through foreign trade agreements involving U.S.-registered entities, though the measure includes exceptions for supplies approved under one-time licenses issued by Russia’s Federal Service for Technical and Export Control. The directive, notably, follows Russian President Vladimir Putin’s September 2024 order for a comprehensive review of Russia’s export strategies for strategic raw materials, including uranium, in response to Western sanctions.

While Russia’s uranium product export ban was not unexpected, uranium market experts have suggested it may have implications starting in 2025, potentially leaving some reactor operators without alternative suppliers.

The DOE did not address a timeframe for when it expects to finalize LEU contracts with the companies named on Tuesday, or when LEU production incentivized by a contract could begin. It suggested, however, that the measure was just one part of a broader response.

“These contracts generated from this action will help spur the safe and responsible build-out of uranium enrichment capacity in the U.S.,” said Principal Deputy Assistant Secretary for Nuclear Energy Dr. Michael Goff on Tuesday. “We must increase our capacity to produce enriched uranium domestically to support the energy security and resilience of the nation.”

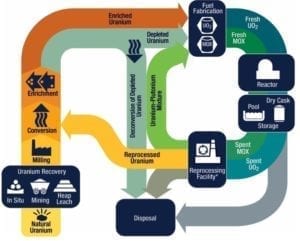

Rebuilding America’s Nuclear Fuel Supply Chain to Meet Future Demands

The recent company selections mark just one facet of a broader, coordinated effort to strengthen the U.S. nuclear fuel supply chain, including for LEU, necessary for the existing reactor fleet and new light-water cooled reactors, and high-assay, low-enriched uranium (HALEU), needed for non-lightwater-cooled SMRs and microreactors. As outlined in the White House’s Nov. 11-released U.S. Nuclear Energy Deployment Framework, initiatives span every stage of the nuclear fuel cycle, from exploration and recovery to enrichment and fabrication.

However, the scale of the nuclear fuel supply chain’s expansion required to support a tripling of nuclear capacity (from 100 GW in 2024 to 300 GW by 2050) will be unprecedented, as the DOE acknowledges in its October 2024 update to the Pathways to Commercial Liftoff: Advanced Nuclear report.

Domestic Uranium Mining. The U.S. currently has only 2,000 metric tons (MT) of annual U3O8 production capacity but procured 22,000 MT in 2023 to meet demand. Achieving the necessary 55,000–75,000 MT per year for 300 GW would require a dramatic scale-up, especially given that domestic mining peaked most recently 2014 at 2,263 MT.

As the EIA notes, in the 1940s and 1950s, the U.S. introduced financial incentives, procurement programs, and trade policies to help spur domestic uranium production, which lead to a historic peak of 18,200 MT in 1980. Domestic U3O8 production has since significantly declined, as production incentives and subsidies ended, trade barriers were removed, and uranium prices fell.

At the end of 2023, Energy Fuels commenced uranium production at three permitted mines in Arizona and Utah and was preparing two additional mines in Colorado and Wyoming in response to strong uranium market conditions. This year, most uranium production occurred at five facilities: four in Wyoming (Nichols Ranch ISR Project, Ross CPP, Lost Creek Project, and Smith Ranch-Highland Operation) and one in Texas (Rosita).

Domestic Uranium Conversion and Enrichment. This year, Congress allocated $2.72 billion through the Consolidated Appropriations Act of 2024 to boost enrichment capacity for LEU (enriched to about 5%) and high-assay, low-enriched uranium (HALEU, enriched to about 19.75%). These funds complement the $700 million provided by the 2022 Inflation Reduction Act (IRA) for the DOE’s HALEU Availability Program, originally established under the Energy Act of 2020.

Still, according to the DOE’s Pathways report, the U.S. currently only has 10,400 MT per year of UF6 conversion capacity, and it would need access to 70,000–95,000 MT per year to support 300 GW. While Honeywell in 2023 reopened Metropolis Works plant in Metropolis, Illinois, it remains the U.S.’s sole uranium conversion facility.

Meanwhile, the DOE suggests that supporting 300 GW of nuclear capacity will require a dramatic expansion of U.S. enrichment capabilities, which currently stand at 4.4 million SWU. While U.S. demand already exceeds this emphatically at 15 million SWU, a 300 GW fleet would require 45 million to 55 million SWU per year, it says.

Today, Centrus Energy and Urenco currently host the nation’s only enrichment capacities. In September, ORANO USA selected Oak Ridge, Tennessee, as the preferred site to build a new centrifuge uranium enrichment facility, which it has since named “Project Ike.”

On Nov. 20, meanwhile, Centrus announced it would resume centrifuge manufacturing activities and expand its manufacturing capacity at its Oak Ridge facility to potentially expand uranium enrichment at its Piketon, Ohio, American Centrifuge Plant. “This announcement follows Centrus’ recent success in securing over $2 billion in contingent purchase commitments from customers to support future production of LEU, as well as two awards from the U.S. Department of Energy aimed at enrichment and deconversion of HALEU,” Centrus noted.

On the HALEU front, the DOE this year closed two separate RFPs for the purchase of HALEU enrichment and deconversion services. On Oct. 8, it announced the complete list of successful bidders that will provide deconversion services to deconvert HALEU from UF6 to uranium oxide and/or uranium metal forms. Selections include: Nuclear Fuel Services, part of BWX Technologies; American Centrifuge Operating, part of Centrus Energy; Framatome; GE Vernova; Orano; and Westinghouse. On Oct. 18, it announced contracts with a total potential value of $8 million with four nuclear fuel companies to further HALEU enrichment capabilities: American Centrifuge Operating, URENCO’s Louisiana Energy Services, Orano Federal Services, and General Matter.

The selections on Tuesday will incentivize a build-out of new LEU enrichment capacity. Selections, as reported above, include American Centrifuge Operating, General Matter, Global Laser Enrichment (GLE), Louisiana Energy Services, Laser Isotope Separation Technologies, and Orano Federal Services. Laser Isotope Separation Technologies, a notable newcomer, is developing Condensation Repression Isotope Selective Laser Activation (CRISLA) technology, an advanced U.S.-origin laser enrichment solution. General Matter, a San Francisco firm, is a startup founded by former SpaceX engineer Scott Nolan, Reuters recently reported.

Domestic Fuel Fabrication. While the U.S. currently has a fabrication capacity of 4,200 MT per year of uranium oxide (about 3,700 MTU), it would need to access about 6,000-8,000 MTU per year to support 300 GW of nuclear capacity. Today, only Westinghouse, Framatome, and Global Nuclear Fuel-Americas fabricate fuel domestically and export fuel internationally.

On the HALEU front, TerraPower has partnered with GNF to develop metallic fuel required for Natrium reactor deployment, while X-energy is working to begin operating its TRISO-X facility in 2025 in Oak Ridge, Tennessee. Its initial capacity is expected to be 8 MTU/year, with capacity expansion expected in the early 2030s to 16 MTU/year.

Industry Reactions Express Optimism for Long-Stalled Domestic Sector

On Wednesday, some companies selected under multiple DOE solicitations expressed optimism about the incentives. French company Orano highlighted its unique position as one of only two companies (alongside Urenco) currently producing and supplying commercial quantities of enriched uranium to U.S. nuclear reactors from its facility in Tricastin, France. It said plans to build the multi-billion dollar Project Ike are already making significant progress, including steps toward DOE land transfer, a license submittal with the Nuclear Regulatory Commission, and active hiring for open positions.

“Since the process for HALEU enrichment includes LEU/LEU+ enrichment, receiving a sufficient level of DOE contract funding would enable Orano to co-locate both production facilities on Orano’s Project Ike site and perform the uranium enrichment with significant cost, efficiency, and security benefits,” the company said.

Centrus, which received its third selection under the DOE’s three solicitations, meanwhile highlighted its longstanding U.S. operations. The company evolved from USEC, a government corporation created in 1992 (and ultimately privatized in 1998) to restructure the government’s uranium enrichment operations. While USEC successfully demonstrated its advanced U.S. gas centrifuge uranium enrichment technology in 2013 (in a three-year project that ended in 2016) at the American Centrifuge Plant in Piketon, Ohio, USEC struggled to remain financially viable amid snowballing cost pressures, and in 2016, it emerged from bankruptcy rebranded as Centrus.

The company’s re-emergence began in 2019 with a Trump administration’s HALEU Demonstration Contract, which tasked it with demonstrating the production of HALEU with a 16-centrifuge cascade at its Piketon, Ohio facility. Under that $173 million contract, Centrus successfully demonstrated its ability to produce HALEU, culminating in the delivery of 20 kg of HALEU UF6 in November 2023.

Building on the success, the DOE awarded Centrus the $150 million HALEU Operation Contract in late 2022 to scale up production to 900 kg annually through 2024. While Centrus began enrichment operations on schedule and completed Phase 1 of the contract, supply chain delays—specifically related to DOE-provided 5B Cylinders for collecting enriched uranium—have impacted Phase 2 timelines.

Centrus’ November 2024–announced efforts to expand its operations with a $60 million investment to resume centrifuge manufacturing over an 18-month period marks another significant milestone for the company. ACO “will manufacture the centrifuges and supporting equipment exclusively in the U.S., relying upon domestic engineering and a domestic supply chain that currently spans 14 major, American-owned suppliers in 13 states and is expected to grow,” the company said on Wednesday. “The only other Western centrifuge technology in commercial operation today is the European centrifuge design, which is exclusively manufactured in the Netherlands.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Editors note: Updated on Dec. 11 to add reactions from Centrus and Orano.