A surge in energy infrastructure demand—and the parallel squeeze on labor, supply chains, and environmental pressures—may be rewriting the EPC rulebook. EnergyLink International, a Calgary-based engineering, fabrication, and construction firm known for its clean technology and building systems, is taking that shift head-on.

The engineering, procurement, and construction (EPC) sector may be undergoing its most profound transformation in decades. While backlogs for tier-one contractors now stretch beyond 2030, looming workforce shortages across North America threaten execution timelines. At the same time, project owners are demanding tighter environmental controls, faster delivery, and new financing models that share risk rather than simply shift it.

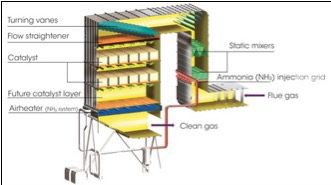

As POWER’s reporting has shown, several trends are taking shape. Modularization, early-stage environmental integration, and artificial intelligence (AI)-driven project tools and controls have moved from experimental to essential. Fixed-price EPC contracts are giving way to collaborative frameworks that reward predictability and innovation over the lowest bid. And as the energy transition accelerates, developers increasingly seek partners who can deliver not only steel and concrete, but also a deep understanding of decarbonization economics and regulatory compliance (Figure 1).

EnergyLink International—a firm with more than 25 years of experience in air emissions control, noise management, and turnkey building and modular solutions—embodies this evolution. Through its research and development (R&D) programs, push toward hyper automation, and acquisition of UECompression Inc. (UEC), the company is aligning technical execution with efficiency and performance to close the gap between engineering feasibility and project delivery.

Building on its legacy of environmental and modular innovation, the EnergyLink is also automating project controls and using AI-driven technology to optimize engineering, purchasing, logistics, and onsite performance. Its collaborative contracting approach—combining early engineering integration with transparent risk-sharing models—seeks to ensure projects stay on schedule and within budget. Finally, the company is also fielding a growing global footprint and strategic partnerships with original equipment manufacturers (OEMs), EPCs, and data center developers, leveraging deep engineering expertise and data-enabled insights to de-risk every phase of delivery. The fusion of technical execution, financial strategy, and advanced digital tools positions EnergyLink at the forefront of next-generation EPC partnerships.

POWER spoke with Harold Wong, president and CEO at EnergyLink International, about how EPC partnerships are being redefined—and what it now takes to deliver complex energy infrastructure in a fast-changing market.

POWER: Project pipelines across the power and industrial sectors have expanded sharply while execution risks have multiplied. Have you seen owners’ priorities shift—from lowest cost to delivery certainty—and what does that reveal about how the EPC value chain itself is changing?

Wong: EnergyLink International’s primary market is gas-fired power plants, where we sell our air and noise emissions control equipment and structures. Our clients are the EPCs, OEMs, and, less often, utilities and independent power producers. As a supplier to the power sector, we have seen owners’ priorities shift, but the extent of that shift depends on the power plant application. For example, cost remains king for large utility-sponsored combined cycle and cogeneration projects. However, on backup peaking and highly reliable data center power projects, speed and delivery certainty are most important. Speed and delivery certainty, particularly on the number of megawatts, are also a priority for data centers.

This shift in owners’ priorities—from low cost to speed and volume of delivery, almost at any cost—has had a significant impact on our EPC and OEM clients. What we are noticing is that project kickoffs are beginning more often with incomplete engineering—two power plant projects in 2024 for EnergyLink, on which our powerhouse and administration building scopes were 50% and 60% engineered, respectively. The same holds for our OEM clients who are cutting out the “balance of plant” scope they had taken on in the past to focus on equipment manufacturing.

What this has meant for EPCs and OEMs is the need to find suppliers who can do more. On the two building projects last year, EnergyLink completed the design and drawings in addition to the supply and construction. Another example is an OEM of large reciprocating engines that is directing its clients to EnergyLink for start-to-finish noise control, a function it had handled before. Another OEM/power developer has executed a long-term agreement with EnergyLink for prioritized supply and delivery of selective catalytic reduction (SCR) units for their increasing fleet of peaking power plants.

A challenge in meeting this demand and expanded scope from our EPC and OEM customers is finding experienced engineers and design drafters for our highly engineered products. We’re hiring this expertise from all over the US, Canada, and globally, and supporting home offices and outsourcing when required. We typically outsource to local individuals or companies we’ve known for a long time, who add to our expertise. We’ve also developed fabrication shop management skills that allow us to deploy multiple third-party shops to accommodate our high manufacturing volumes. Automation is also supporting our growth. For example, we are halfway through our next-gen software development for purchasing, material tracking, fabrication, and delivery.

While speed and volume of delivery matter more than ever, keeping costs down—or at least not increasing them—gives a supplier like EnergyLink considerable advantages over competitors. We have implemented measures to sustain our price advantages, including innovative low-cost designs, bulk ordering of materials from mills, consolidating shipments, and managing low-cost fabrication. Some of our fabricators had never built our type of equipment, but were successful the first time with the guidance of our fabrication experts helping to manage use of efficient jigs and shop sequencing. Most importantly, the effort in both time and money we allocate to R&D. As an example, EnergyLink built, at our own cost, a full-sized SCR behind one of our clients’ LM6000 gas turbines to test our new direct injection (DI) technology. The test unit demonstrated that we could ensure compliance with air emissions laws while achieving a significantly smaller footprint and much lower cost.

In terms of the changing EPC landscape, we notice that their supply options have narrowed, and they need to rely on suppliers who can support them more effectively.

POWER: Fixed-price EPC contracts are giving way to shared-risk or reimbursable frameworks. What’s driving that shift, and how does early integration of modular or environmental systems change how risk is actually distributed between owner and contractor?

Wong: As a supplier of equipment to OEMs and EPC companies, we primarily enter into fixed-price contracts. Fixed-price contracts help eliminate risks for both the owner-operator and the EPC. Additionally, these contracts often include performance guarantees, which add further reassurance.

One of the most appealing aspects for our EPC customers is EnergyLink’s noise guarantee. This make-good noise guarantee entails fixing or replacing any faulty silencing equipment and structures at our own expense to ensure compliance with site noise guarantees.

Another risk mitigation strategy our EPC clients employ is bonding. Bonding provides complete coverage for the purchaser in the event of the supplier’s nonperformance. However, the monetary value of the bonds—and, consequently, the size of the project awarded—is limited by the supplier’s safety record, credit score, experience, and revenue.

Over the past five years, the EnergyLink team has worked diligently to position ourselves with increasing bonding capacity to undertake large projects, including the entire Champlain Hudson Power Express (CHPE) building scope in Astoria, New York, on behalf of Kiewit. Kiewit selected EnergyLink because of our team’s successful project delivery for both Phases 1 and 2 of the Astoria Generating Station in Queens. Completing the CHPE project in the heart of New York City using union labor was no easy task, but the EPC aptly managed its risk through bonding and insurance in the event of any supplier defaults and by selecting the right vendor partners.

POWER: Modularization is widely viewed as the strongest hedge against schedule and labor risk, yet, adoption still varies by project type and region. What’s making modular delivery the default approach—and what structural or logistical barriers still limit how far it can go?

Wong: The push to limit installation time is driving the adoption of modular designs for our noise and air emissions equipment. For example, EnergyLink has optimized our SCR ductwork to be shipped on standard-sized truck beds in the fewest possible pieces. Once onsite, our quick-connect designs expedite the erection process, allowing each SCR ducting system to be installed in just seven hours with an experienced field crew.

Additionally, EnergyLink is developing modular SCR units for mobile power applications. These compact, modular SCR systems can remain on a truck and be easily relocated from site to site. We are co-developing this product with several mobile power companies.

Acoustic products in our lineup are also modular, including enclosures, combustion inlet and discharge systems, ridge vents, panelized wall systems, and more. By utilizing modularization, we help reduce transportation and installation costs for EPC contractors and owners alike.

POWER: Labor shortages have become a permanent constraint rather than a temporary challenge. How is EnergyLink redesigning around that reality—through automation, digital tools, or new fabrication strategies—and what long-term changes do you expect in workforce composition and culture?

Wong: A challenge is meeting the high-volume demand for our air and noise emissions products—as an example, we are involved in 35 data centers as I speak. In actual SCR orders, we have gone from three or four units per month to 15 or more. The same applies for our noise management products—where we used to build one to two acoustic powerhouses per year, we may shortly be booking as many as 10.

To meet this demand, staffing correctly has been critical. Finding experienced engineers, design drafters, construction managers, site superintendents, and project managers for our highly engineered products is an entire company effort. We’ve been able to acquire expertise by hiring from all over the U.S., Canada, and globally, supporting home offices and outsourcing when required. Outsourcing is typically to local individuals or companies who we’ve worked with successfully. We’ve also developed fabrication shop management skills that allow us to deploy multiple third-party shops to accommodate high volumes.

Automation also plays a big role. In fact, we are halfway through our next-gen software development for purchasing and tracking of materials, fabrication, and delivery, which will dramatically reduce the number of manual inputs and save time.

We also have a one-year program to automate all facets of our company. I believe the term is “hyper automation.” The aim of this project is to reduce manual inputs prone to error as much as possible, improve our response times to our customers, and refocus our staff from paperwork to what matters in our project-based company. Key performance indicators (KPIs) have been established for all major functions including project management, human resources, finance and accounting, estimating, purchasing, manufacturing, transportation, and business development to gauge the success of this effort.

Two important KPIs we use are project margin variance and contingency usage, and revenue per employee. These KPIs are particularly important to securing necessary bonding capacity to take on our large building and acoustic projects for our EPC clients. Our low project margin variance and low use of contingency caused one bonding company to comment that our performance is the best they have seen in the EPC business. Our per employee revenue value is benchmarked against 20 “like” companies including EPCs, general contractors, and specialty manufacturers and contractors. Against this benchmark, EnergyLink’s revenue per employee is much higher than the average for construction services ($1.8 million) or specialty manufacturing ($479,000), and even better than Netflix or Apple ($2.4 million).

We are enormously proud of our efficiency, which is a tribute to our experienced staff and automation programs. When we started building our company after the power industry downturn from 2018 to 2020, our average age of employee was 49.5 years. As we’ve grown to catch this new wave of power plant buildouts, our staff is becoming younger every year. This poses its own challenges and the need to transfer knowledge quickly from our senior team members to our new hires. We are facing this challenge with a new employee onboarding and training platform. As a result, a software platform for onboarding and training is under development along with our whole-company automation effort.

POWER: Noise and emissions control have evolved from regulatory boxes to value drivers as siting pushes closer to populated loads. How early are owners integrating environmental engineering into project scopes, and what measurable impact does that have on cost, schedule, and permitting outcomes?

Wong: Noise and air emissions control have become essential considerations in the siting of power and industrial plants. Owners and producers are taking environmental regulations seriously, as failure to comply can lead to significant consequences, including the potential shutdown of facilities. As a result, owners engage EnergyLink as early as the site selection phase and when making financial investment decisions. They need to ensure that their power plants, data centers, or industrial facilities will meet emissions limits—whether regulatory or otherwise—while staying within budget.

At EnergyLink, we conduct modeling and design for noise and air emissions control at our own expense during the pre-front end engineering design (FEED) and FEED stages. We also provide pricing for these solutions. As designers, fabricators, and installers of this equipment, we offer accurate and low-cost pricing that enables owners, developers, and EPCs to make informed decisions about the budget required for noise and air pollution controls. And, our designs for noise control are guaranteed right from the start.

The cost of these controls varies depending on the project type and the level of mitigation required. For example, for a single simple-cycle LM6000 power plant, air pollution control measures—including a post-combustion SCR system and an exhaust stack with sound attenuation—constitute approximately 1% to 2.5% of the total cost of the power unit.

Noise control costs also vary, ranging from simple solutions like acoustic blankets or equipment enclosures to larger structures like acoustic engine or turbine halls. In combined cycle gas turbine (CCGT) plants, turbine halls represent the most significant noise-control expense, accounting for an average of 2% to 3% of the overall project cost. Acoustic elements can add about 10% to a building’s price, and for highly specialized acoustic applications, this can increase to 30% or even 40%.

For instance, we provided noise control for a 150-MW reciprocating internal combustion engine (RICE) station with nine 18-MW engines, located 1,000 feet from residential homes. Each engine emitted sound at a power level of 128 decibels (dB)—comparable to the sound of a jet engine at takeoff. The EPC requested that EnergyLink guarantee noise levels of no more than 55 dBA (the sound level of a refrigerator hum) at the nearest homes, as well as a maximum of 70 dB at lower frequencies (31.5 and 63 Hz) to prevent structural vibrations and rattling of windows and doors. To achieve this noise attenuation, we housed the engines within a building. The cost of this building—between the initial precast concrete design by the owner’s acoustic consultant and the metal-clad structure featuring EnergyLink’s acoustic walls and roof—was balanced out, and we expedited the delivery time by six months.

POWER: New low-carbon facilities—especially for blue hydrogen and sustainable fuels—demand EPC partners who understand both emissions systems and evolving permitting frameworks. How is EnergyLink adapting its environmental and modular expertise to address those complexities in real projects?

Wong: In 2022, EnergyLink acquired UEC in Denver to enhance its capabilities in clean energy projects. This acquisition aims to support initiatives in areas such as carbon capture and storage, hydrogen fuel utilization, and other advanced gas projects. UEC is an authorized dealer for leading compressor manufacturers, including Ariel, and is among the few dealers worldwide authorized to package specialty gases. Additionally, UEC is a significant supplier of methane-reduction equipment through its UECleanAir brand.

As a global company, EnergyLink is also engaged in projects across Europe, Canada, and other regions as an emissions management provider for fuels beyond natural gas. In Europe, for instance, hydrotreated vegetable oil (HVO) is increasingly being adopted as the preferred fuel for power plant projects utilizing simple-cycle turbines. Although nitrogen oxide (NOx) emissions limits in Europe are higher than those in the U.S.—approximately 8 parts per million (ppm) compared to 2 ppm to 2.5 ppm—Selective Catalytic Reduction (SCR) technology is required when using HVO. This is because HVO tends to produce higher NOx emissions at full load and elevated temperatures compared to natural gas, and European Union authorities designate SCR as the Best Available Control Technique (BACT).

Lastly, EnergyLink’s gas turbine OEMs are hydrogen-ready and our SCR technology can handle the higher NOx emission levels from the gas turbine using H2 fuel.

POWER: Supply chain volatility remains a drag on schedules, with some components still on multi-year lead times. What concrete strategies have proven most effective for EnergyLink—whether design sequencing, parallel procurement, or domestic fabrication—and how are clients recalibrating expectations around delivery?

Wong: As a supplier of noise and air emissions control equipment for companies like GE, Siemens, Solar, and Baker Hughes, we understand that waiting times for gas turbines can be as long as three to four years. Consequently, power producers are exploring options worldwide for the necessary drivers or turning to innovative solutions. For instance, one of our clients is utilizing three different gas turbine models from three separate OEMs for a total of 16 SCRs at a data center in Texas. Another long-time client of EnergyLink is converting decommissioned aircraft engines into power generators, while yet another client has obtained turbines from a retired pipeline.

We do not anticipate a decrease in the demand for gas turbines in the near future. According to a recent S&P Global study, U.S. electricity consumption is projected to double by 2040, with much of the immediate demand driven by data centers and renewable energy backups. This poses a challenge for EnergyLink, as well as our OEM and EPC clients, regarding how we can scale our operations and accelerate delivery to meet this growing demand.

So far, we have successfully navigated equipment and material shortages. One strategy involves pre-ordering carbon steel in bulk directly from mills and warehousing it, which helps reduce price volatility and ensure the availability of materials. Additionally, we have established strategic, long-term agreements with suppliers for critical components and services. This essentially locks in our most reliable suppliers, integrating them more closely with EnergyLink’s operations.

EnergyLink has a vast network of fabricators in low-cost countries around the world. Significant efforts were made in prior years to build up this network of fabrication subcontractors and EnergyLink’s in-house fabrication management team to handle increases in load and geographies.

POWER: As capital costs rise and accountability deepens, EPC excellence may no longer mean scale but adaptability. Looking five years ahead, what traits—technical, financial, or cultural—will truly define the next generation of high-performing EPC partners?

Wong: EnergyLink has been in business for over 25 years, with key personnel boasting more than 40 years of experience. Throughout this time, we have observed several exceptional EPC companies come and go, often due to projects that failed to meet their financial targets. Currently, only a handful of EPC companies in the U.S. continue to thrive in the power industry. The successful ones either have strong infrastructure or defense divisions that support their industrial work or have chosen to focus on the “E” (engineering) and “P” (procurement) aspects by outsourcing the “C” (construction) to general contractors that are less risk averse. Moving forward, the future of high-performance EPCs will hinge on establishing strong working relationships and partnerships between EPCs and their suppliers and contractors.

POWER: Many EPC firms describe this period as a structural reset. Do you think the changes underway—contracting models, digitalization, financing—represent an evolution or a fundamental reinvention of the EPC business model?

Wong: In EnergyLink’s world of power and industrial projects, the EPC model for contracting and financing has remained consistent. Whenever possible, our EPC customers rely on suppliers who can provide a lump sum scope backed by financial instruments, including bonding and lines of credit (LOC). Like many businesses, our customers are striving to do more with fewer resources. They aim to improve efficiency by automating processes from project initiation to completion. EnergyLink is well on its way to digitalizing all functions within our company, and we see that our customers are also working diligently toward this goal.

—POWER