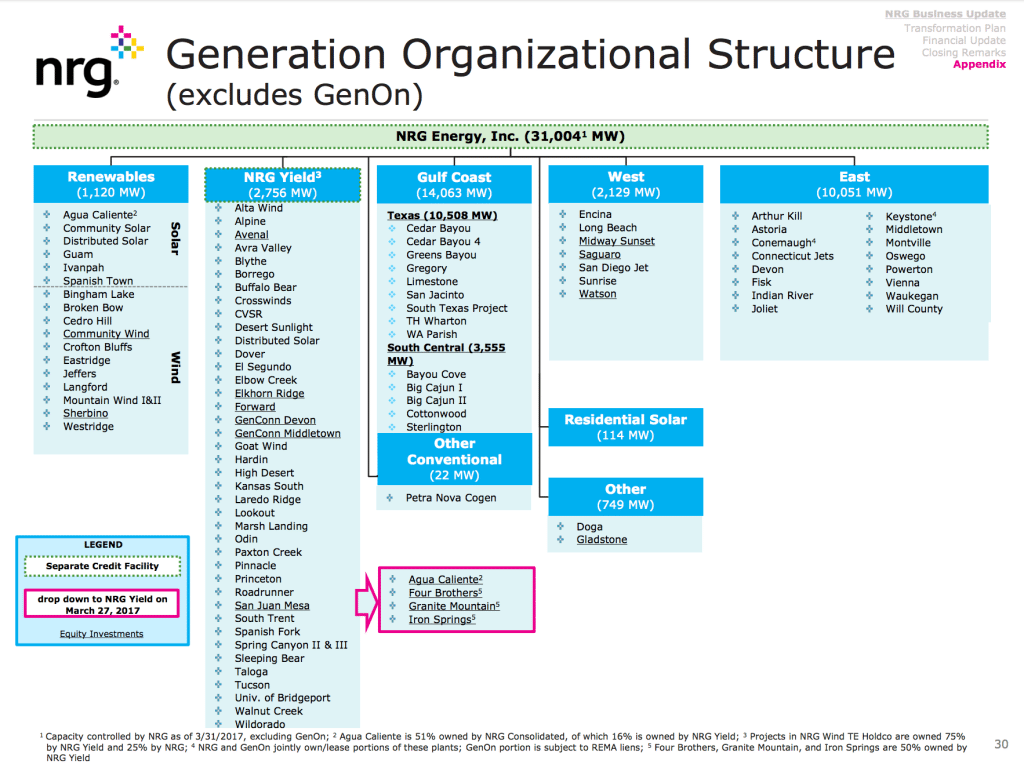

NRG Energy, in a bid to shed $7 billion in consolidated debt, is selling the bulk of its renewable assets and development platforms along with several coal and natural gas power plants worth 3.6 GW tied to its South Central Generating business.

The independent power producer, which recently relinquished bankrupt wholesale generator GenOn Energy to bondholders and has embarked on a transformation plan to cut costs and generate profit, even with sustained low wholesale prices for power, wants to cast off $13 billion in debt and generate more free cash flow. The plan is designed to help the company cut generating costs by 25% and sell about 6 GW of coal and gas generation, as well as to divest its ownership in NRG Yield.

A Renewables Egress

In line with that plan, the company on February 7 announced it struck a $1.375 billion deal with investment firm Global Infrastructure Partners (GIP) for the purchase of NRG’s full interest in NRG Yield, a company through which it owns, operates, and acquires contracted renewables and conventional generation assets. GIP will also buy NRG’s renewable assets and development pipeline, which includes 500 MW of assets in operation and 6.4 GW in backlog and pipeline.

In a separate $407 million deal announced Wednesday, NRG Yield will also take on NRG Energy’s gas-fired 527-MW Carlsbad Energy Center—a California plant that is expected begin commercial operations in the fourth quarter of this year—and its 154-MW Buckthorn Solar project, which it bought from SunEdison in November 2016.

As part of the sale of NRG’s interest in NRG Yield, NRG and NRG Yield also agreed to maintain a right of first offer (ROFO) agreement for NRG’s remaining 102-MW ownership in the Agua Caliente solar photovoltaic facility, and also amended the ROFO agreement to remove the Ivanpah solar thermal plant as a ROFO asset. Ivanpah effectively remains an NRG asset.

Exiting the Louisiana Business

NRG Energy also Wednesday said it had cemented a $1 billion deal to sell 100% of its Louisiana assets and associated load contracts to Cleco Corporate Holdings. Plants include the 1.3-GW Cottonwood natural gas plant, the 1.5-GW coal and gas–fired Big Cajun II, and three gas-fired peaking plants: the 430-MW Big Cajun I plant, the 225-MW Bayou Cove plant, and the 176-MW Sterlington plant.

NRG also entered into a sale-leaseback with Cleco through May 2025 for the Cottonwood plant. The transaction is expected to close in the second half of the year, assuming it clears various closing conditions, approvals, and consents.

For Cleco, a regulated utility which owns nine generating units with a nameplate capacity of 3,310 MW, the deal will more than double its generation capacity and increase the number of end-user customers by more than 70%. “Furthermore, this investment highlights the commitment of Cleco and its owners to customers, communities, employees and the state of Louisiana,” Jennifer Cahill, a spokesperson told POWER on February 7.

Stemming Competitive Market Volatility

According to NRG, the deals will bring in $2.9 billion in cash proceeds anticipated as part of the transformation plan. More asset sales are expected over the course of this year as the company said it would revise its total asset sales cash proceeds target to about $3.2 billion.

In a statement on February 7, NRG president and CEO Mauricio Gutierrez said the deals signified a major step in the company’s efforts to simplify its value proposition, optimize its portfolio, and strengthen its balance sheet to create significant shareholder value. Gutierrez, who has been widely quoted for saying in March 2017 that “the competitive power sector is in a period of unprecedented disruption,” and that the independent power producer model “is now obsolete and unable to create value in the long term,” has more recently adopted a more optimistic stance on the state of the markets.

In a November earnings call, Guiterrez noted that while NRG was on track to achieve targets provided in the transformation plan, core markets had recently provided “positive catalysts,” such as a recovery in the Electric Reliability Council of Texas driven by asset retirements, and multiple regulatory initiatives that pointed to imminent power market reform. “This is certainly a time to be optimistic about competitive power,” he said.

On Wednesday, Guiterrez said the deals were reached after rigorous and highly competitive processes. “I am pleased with the outcome and confident in our ability to work with our counterparties to bring these transactions to a swift close,” he said.

NRG Yield, too, hailed the deals as a positive financial development. Since the company’s initial public offering in July 2013, NRG Yield has noted an increase of 186% in cash available for distribution (from $91 million to $260 million), and an expansion of NRG Yield’s quarterly dividend per share by 150% to $1.15 per share annualized at the end of 2017, said Christopher Sotos, president and CEO of NRG Yield. “With today’s announcement, NRG Yield can now look forward to its next phase of growth, including solidifying near-term objectives through the most recent drop down transactions and, most importantly, aligning with GIP, whose strategy and breadth of global investment capabilities are well suited to our business model and long-term objectives.”

From an investment perspective, according to GIP Chairman and Managing Partner Adebayo Ogunlesi, the acquisition of NRG’s three businesses—its interest in NRG Yield, its renewables operations and maintenance business, and its development business—is “well-positioned to capitalize on the increasing market demand for low cost, clean energy.”

It is unclear how the asset sales will affect NRG’s November 2014–announced commitment to reduce its carbon dioxide emissions by 50% by 2030 and by 90% by 2050 below a 2014 baseline. That information may be forthcoming in the company’s fourth quarter earnings documents, which are scheduled for release on March 1.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)