The world added 33 GW of new hydropower capacity in 2015, including 2.5 GW of pumped storage, the International Hydropower Association (IHA) said in a recent brief.

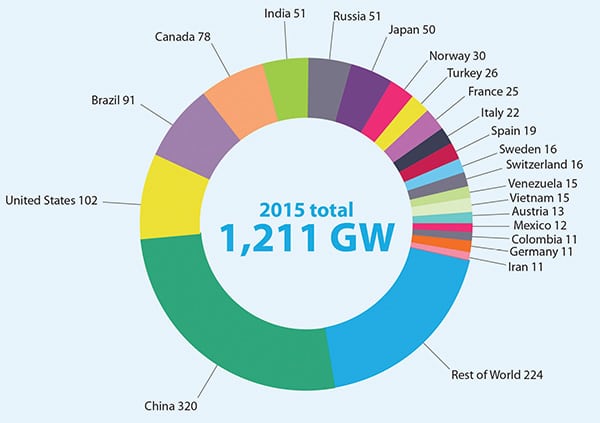

The new capacity made up only 3% of the world’s total installed hydropower capacity of 1,211 GW (Figure 2) at the end of 2015, and it is less than the 37.4 GW added in 2014. In 2015, China led the world in new projects, adding 19.4 GW, including 1.2 GW of pumped storage. Other countries leading new deployments were Turkey (2.3 GW), Brazil (2 GW), India (1.9 GW), Iran (1 GW), and Vietnam (1 GW).

According to the IHA, drivers for hydropower’s growth include a general increase in power demand as well as the global shift away from fossil fuels and toward renewables. It predicted that new international policy and agreements like the Paris accord signed last December to curb anthropogenic greenhouse gas emissions will drive more growth.

Another sometimes overlooked driver is the advancement of hydropower control technologies that has allowed generators to compensate for real-time variations of wind and solar power on the grid. In 2015, for example, China put online the second phase of its 850-MW Longyangxia solar park, which is coupled directly to one of four turbines at a nearby 1,280-MW hydropower station. “The advanced control system allows the turbine to regulate the variable supply from the solar park before dispatching firm power to the grid,” said the IHA.

A notable trend is an increase of private sector financing. Historically, public utilities have taken up the responsibility of financing large hydropower projects. While financing based on “build, own, operate, and transfer” models has not been successful for hydro due to larger capital requirements, longer gestation periods, and greater development risks, more multi-lateral agencies are now backing private sector finance. “World Bank guarantees are leveraging relatively limited resources to mobilise private sector finance; the International Finance Corporation is now participating in equity as well as debt finance, injecting risk capital, providing development experience and adding investor confidence; public–private partnership models are enabling concessionary public funds to be blended with private finance, with shared ownership of risk,” the IHA said.

All over the world, meanwhile, a number of state-owned hydropower assets and concessions were transferred to the private sector in 2015. Brazil sold its operating rights for 29 hydropower plants for $4.51 billion, while Turkey announced tenders for the privatization of 10 hydropower plants worth 538 MW. On the industrial side, General Electric acquired hydropower-equipment maker Alstom’s power and grid business, the IHA noted.

Also in 2015, China’s hydropower clout flourished globally. Chinese firms bagged the 720-MW Karot project in Pakistan, while the State Power Investment Corp. agreed to buy Pacific Hydro in a reported $3 billion deal. And as State Grid Corp. of China won a lucrative contract to build and operate Brazil’s longest transmission line connecting the 11.2-GW Belo Monte project to Rio de Janeiro, the Three Gorges Corp. bought operating rights for the 1.6-GW Jupia and 3.4-GW Ilha Solteira hydropower plants for $3.7 billion.

Major projects also got their start or were completed in Africa over 2015. Ethiopia brought the first two of 10 units online at the 1.87-GW Gilgel Gibe III plant. In 2016, the remainder will come online while the country will commission the first two 375-MW turbines of its 6-GW Grand Ethiopian Renaissance Dam. And as Zambia began building the 750-MW Kafue Gorge Lower project in late 2015, the Democratic Republic of Congo announced it would start construction of the mammoth 4.8-GW Inga 3 project in 2017.

—Sonal Patel, associate editor