The world’s first wind farms are reaching the end of their expected lifetimes. As they become outdated, or just inefficient, many developers are considering repowering. Here’s a look at where repowering activity is happening the most and why.

Since the world’s first wind turbine used to convert wind energy into electricity was built by Professor James Blyth of Anderson’s College (now University of Strathclyde) in 1887, wind turbine technology has seen a gust of advancement (see “Changing Winds: The Evolving Wind Turbine” in POWER’s April 2011 issue for more). Turbines have evolved from tiny 50-kW generators to mammoth 8-MW machines in just 30 years. And now, turbines with nameplate capacities of 10 MW to 20 MW are in the design stage.

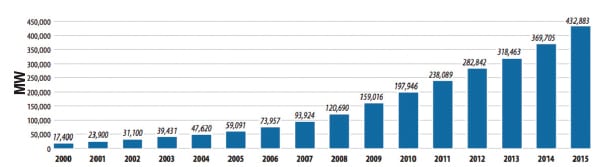

Over the past couple of decades, thousands of wind turbines have been installed around the world. According to the Global Wind Energy Council (GWEC), at the end of 2015, 432,883 MW of wind capacity had been commissioned globally—mostly over the last decade (Figure 1). But as wind technology rapidly improves, a substantial portion of the world’s fleet is becoming obsolete. By 2015, nearly 17% of capacity (73,957 MW) was at least 10 years old, and 9% (39,431 MW) was at least 13 years old. Some pioneering commercial wind turbines in northern Europe and California are even older.

If, per industry estimates, wind turbines are designed with lifespans of between 20 and 25 years, roughly a fifth of the world’s installed wind turbines may be halfway through their lives.

One consequence of this technology’s aging is reduced performance. According to some experts, wind turbine load (or capacity) factors decline markedly with age. A 2014 study from the UK’s Engineering and Physical Sciences Research Council of load factors recorded for 282 onshore wind farms in the UK between 2002 and 2012 found that wind turbines lose 1.6% (±0.2%) of their output per year, with average load factors declining from 28.5% when new to 21% at age 19. The council noted that the trend is consistent for different generations of turbine design and individual wind farms.

Wind turbine operators faced with the prospect of an aging fleet typically have three options: dismantling the turbine, embarking on a lifetime extension, or repowering. According to Acciona Energia’s Mercedes Irujo Espinosa de los Monteros, a wind turbine generation life-extension expert, each option has its drawbacks.

Life extensions—which entail reconditioning of major components, mainly by enhancing their constituent parts or by replacing these elements with the latest technology—could extend wind turbine availability and revenues, but the “new business approach needs to be proved,” he said. “Operators are aware that reliable figures are essential to a well-structured end-of-life plan. Initial experiences show that the weakness of [lifetime extension] lies in the apparent difficulty of estimating the remaining life of turbines and its related [operations and maintenance] plan.”

Reliability can be improved with measures such as retrofitting modern control systems. There’s also the option of partial repowering, but this approach has serious limits. Installing a 3-MW nacelle on top of a 250-kW tower is generally not recommended. The increase in blade size will often cause rapid wear in gearboxes and other rotating machinery and bearings as the early infrastructure’s parameters are exceeded.

Repowering—which often requires the complete dismantling and replacement of turbine equipment (including the tower and foundation) at an existing project site or just installing a new drivetrain and rotor and replacing peripheral components—has been established practice for some time. And, as Hans Kerkvliet, a consultant at Bosch & Van Rijn, noted at an April European Wind Energy Association technology workshop, “Repowering a wind farm may be a financially viable option, as some of the decommissioning and installation expenses can be shared, and the wind resource is well known, which lowers the risk of the project.” Another important consideration is that “wind turbine technology has substantially developed over the last decades, and repowering a site can considerably increase production.”

However, as both Monteros and Kerkvliet noted, the decision to repower a site is often complicated by red tape, technical constraints, and several other economic, environmental, and social factors (see the sidebar, “Why Repower?”). Some of these factors have made repowering a non-feasible option in some countries. In other countries, however, it has flourished.

|

Why Repower? Manufacturers’ warranty periods typically last between eight and 20 years, and the desire to avoid potentially expensive repairs is often a motivation for replacing older turbines. As they age, reliability drops and any scarcity of spare parts also drives up operating and maintenance costs. As well as generating both more power and greater financial returns, modern turbines fail much less often than their predecessors. Additionally, “sometimes turbine technology doesn’t perform as expected, or the wind conditions on the site are not what was assumed. Or perhaps developers want to better exploit that wind resource,” said Guenter Steininger, head of Repowering and Projects for German wind turbine manufacturer Nordex SE in an interview with POWER. One challenge is that as the first developers constructed their initial wind parks, they naturally built in the most favorable places—that is, the windiest. Now, “in Germany and Denmark, virtually all the good wind resource sites have already been taken. There are very few new areas left to exploit,” said Steininger. So in order to maximize financial return and make the best use the wind, those early turbines should “be taken down and replaced with newer, much higher performing machines,” he said. In order to repower a turbine, you generally have to replace the whole machine, including the tower. You might even need to rebuild the grid connection if you have more machines or more power. Even though you are using an existing site with a functioning permit, a developer might need to apply for a new permit because of operational changes. However, because new wind turbines generally are taller, have more exposure to faster winds, have longer blades, and cover a larger “swept” area, by replacing older turbines with newer units, one can often generate the same or more energy with fewer turbines. In areas where the viewshed has been affected and aesthetics are an issue, this change can go a long way toward appeasing local residents. In comparison to greenfield sites, projects that could be repowered already have long-term wind resource data available, which facilitates the tailoring of turbine size to the local wind conditions and further optimizes power output. Repowering, as opposed to decommissioning, preserves local jobs and continues to provide municipalities with tax revenues from the farms. Modern turbines have much better grid compliance, something that communities previously affected by voltage spikes and frequency shifts will appreciate. Additionally, many original equipment manufacturers like Nordex offer long-term maintenance and service contracts that, at least for the future, will ensure longer service lives for new turbines. |

EU Efforts Waft Ahead

Repowering first emerged in the California and Danish wind power markets during the early 1990s. It was followed by a new wave of repowering in the Dutch and German markets in the 1990s and 2000s.

Since the beginning of the millennium, wind energy growth has exploded throughout the European Union (EU). Installed capacity has increased tenfold from 12.9 GW in 2000 to 146 GW in 2015. Today, the EU accounts for roughly 40% of the global market for wind turbines. As both turbine installations and development have continued, wind energy has emerged as a competitive alternative to conventional generation.

In terms of levelized cost of energy, onshore wind is currently the cheapest power generation technology in Europe, covering over 11% of EU electricity demand. However, as these wind assets age and newer, higher-capacity turbines come on the market, replacing the oldest turbines is becoming increasingly cost effective, especially because many of the pioneering turbines are nearing the end of their expected service. (See the sidebar “Offshore Wind Turbine Repowering” for the different circumstances in that market.)

“European policy is on a one-way track towards the de-carbonization of electricity supply with the assumption that affordable renewable energy will increase year-on-year,” said WindEurope CEO Giles Dickson in an exclusive interview with POWER. But, according to WindEurope, of the 135 GW of onshore capacity that exists today, 76 GW will reach the end of its operational life between 2020 and 2030. In 2020 “roughly 3 GW will reach this point. In 2022, it’s 6 GW. By end of decade, roughly 10 GW a year will come to the end of their operation life.” To avoid “all that energy falling out of the system,” Dickson said, developers should begin to find ways to repower now.

Though turbines are being repowered all over the continent, including in central and southern Europe, Germany and Spain are by far the two largest markets for older installed capacity. In total, Spain has 23 GW of capacity and Germany has almost 40 GW. Though Denmark was the first pioneering wind developer, its market is much smaller: only 5 GW of onshore and offshore capacity combined. While the UK is rapidly developing its wind capacity and currently has roughly 8 GW offshore and 10 GW onshore, its wind farms are generally much younger; thus, it will be some time before they need to be repowered.

Repowering in the Netherlands

Despite its small wind market, developers see the Netherlands as a large growth opportunity because many of the onshore turbines there are older and of smaller capacities. During 2016, RWE Energy, along with several partners and original equipment manufacturers, began installing 86 modern turbines at the Noordoostpolder wind farm on the banks of Lake IJsselmeer (Figure 3). The newly repowered area will have 48 Siemens 3-MW offshore turbines and 38 huge Enercon 7.5-MW E-126 turbines. At this site, RWE will remove its 50 WindMaster 300-kW turbines once installation of the first 12 Enercon E-126 models is complete. The WindMasters’ hub height of 30 meters (m) and rotor diameter of 25 m are dwarfed by Enercon’s 135-m hub height and 127-m rotor.

|

|

3. Revamp. A project to repower a wind farm along the dikes of the IJsselmeer on the western side of the Noordoostpolder, a municipality in the Netherlands, will entail putting up 86 onshore and near-shore wind turbines. Courtesy: RWE |

According to reports from RWE and WindPower Monthly, the foundations, which were completed in April, had to be specially designed for installation on the manmade dike. Only 0.5 m is below ground level, so to secure the base, 60 concrete piles were driven into the dike below it. Each foundation is 26.5 m in diameter and is made up of 180 metric tons (mt) of steel and 1,200 cubic meters of concrete.

The 156-mt Enercon nacelle was placed on top of the concrete tower using a lattice-boom crane. Then the 220-mt generator and the hub with central rotor section, weighing 350 mt, were placed on top, said RWE construction manager Rick van Mensvoort. The rotor, with a diameter of 127 m, has a swept area of 12,500 square meters—the equivalent of more than 1.5 soccer fields.

An Eye on Germany

Today, Germany remains by far the largest wind energy market in the world. The nation installed more than 1,892 MW of new onshore wind capacity in the first half of 2016 alone, 73% more than a year ago. However, when repowering projects are added to that, the figure increases to 2,053 MW, according to a report by Deutsche Windguard. Germany’s wind industry association, BWE, predicts that the annual German repowering market will grow to 1 GW over the next few years and be worth around €1.5 billion ($1.68 billion) in turbine sales. But now, with a slate of renewable energy laws coming into effect next year, many developers are rushing to get projects in the pipeline under the old regime so as to take advantage of the existing feed-in tariffs. This includes repowering projects. While the new laws do not differentiate between new builds and repowers, repowering projects can often yield a fantastic increase in capacity. And with so many older, low-power turbines exploiting the best wind resources, they can yield a substantial increase in feed-in tariffs as well.

As an example, in late June, Nordex announced that it would supply nine of its modern N117/3000 machines to the 27-MW repowering of the 20.8-MW Altenbruch I wind farm in Lower Saxony. At the time, the company said it would replace the existing 16 legacy N60/1300 wind turbines at the site with the new ones by the end of the year. Nordex noted that the repowering business model offers considerable potential for the future and accounted for 18% of all new installations in the country in 2015.

Meanwhile, one of the largest repowering projects in Germany is under way in Schneebergerhof in the Rhineland-Palatinate region. Here, Juwi has replaced five Enercon E66 1.5-MW turbines with five 7.5-MW E126 machines, the largest operational wind turbines in the world today. These generate more than six times the power of the old turbines—around 20 GWh annually instead of 3 GWh.

An Emerging Market in the U.S.

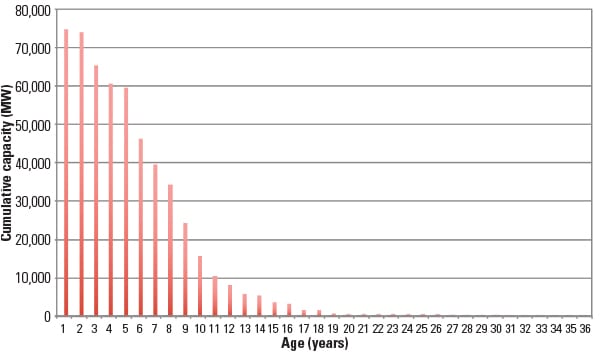

Though California was also at the forefront of the world’s first efforts to repower wind turbines in the early 1990s, the North American wind repowering industry is minuscule compared to Europe’s. That is mostly a consequence of the fleet’s age. According to John Hensley, manager of Industry Data and Analysis at the American Wind Energy Association (AWEA), only about 3,371 MW (5%) of a total 74,813 MW of wind capacity is older than 15 years, and 620 MW is approaching 20 years (Figure 4). AWEA records only 17 repowered projects; all are in California except for two, which are in Hawaii.

|

|

4. The age of the U.S. wind fleet. Cumulative capacity represents operating capacity that is at least as old as the age indicated in the graph. For example, there is 3,371 MW of operating wind capacity 15 years or older. Similarly, 59,461 MW is four years or older. Source: AWEA |

Companies that have chosen to repower include Leeward Renewable Energy, NextEra Energy Resources, Terra-Gen Power, EDF Renewable Energy, BP Wind Energy, Apollo Energy Corp., GE Energy Financial Services, San Gorgonio Farms, and Marubeni. Decisions to repower continue to be anchored on various factors, Hensley said. In an earnings call earlier this year, for example, NextEra outlined plans to repower a pair of Texas wind facilities, a total 327 MW, for roughly $250 million to take advantage of federal production tax credits for repowered wind farms per a guidance issued by the Internal Revenue Service (IRS) this May.

The IRS guidance essentially “opens a short window of opportunity for turbine manufacturers to make a vigorous push to upgrade turbines at older U.S. wind farms,” explained Keith Martin, a partner at law firm Chadbourne & Parke. Developers must have projects under construction by December 2016 to qualify for full tax credits. But there are caveats: “In general, the owner must spend at least four times [as much] on the repowering [compared to] the value of the equipment that the owner retains from the original project in order for the repowered turbines to qualify for new tax credits,” he said. “This test is applied on a turbine-by-turbine basis, meaning that each turbine, pad and tower is considered a separate facility. Thus, if $300,000 in equipment value is retained from the original turbine, pad and tower, then at least $1.2 million must be spent on the upgrade to claim another 10 years of production tax credits on the electricity output or an investment tax credit on the new spending.”

Key Takeaways from Completed Repowering Projects

Although the current repowering market outside Europe is small, it will undoubtedly grow as turbines reach the end of their lives. That’s why it’s increasingly important for developers to adopt a repowering design strategy. In the past, most operating designs were created “to match the output with the space. Developers were far more focused on short-term results and not looking 20 years ahead,” said WindEurope’s Dickson. “Today the industry is much more focused on repowering for the future,” he said.

One of the clear lessons learned regards permitting: “It’s vital to ensure that the permitting regime for brownfield repowering projects is no more challenging for developers than the permitting for greenfield sites. There have been some examples in Europe where paradoxically the permitting is easier sometimes for green than repowering. That’s ominous. The industry needs to work closely with regulators to remove those obstacles. There has to be a level playing field for both investments,” he added.

Though previous governments in Germany and Denmark experimented with repowering bonuses, “they were not terribly well designed and had the perverse effect of encouraging developers to perhaps repower too prematurely. There were some windfall profits that resulted as part of those systems,” said Dickson. Now that they have been rescinded, Germany and Denmark are reluctant to introduce retooled incentives.

In the U.S., as individual states put together their compliance schemes for the Clean Power Plan (assuming it comes into effect), it’s also important to factor in repowering projects. “A clear lesson from the European experience is the importance of ensuring that your regulatory measures and incentives are in place to help you unlock the potential of repowering. It’s important that you not only factor in what volume of your existing assets will be ready, but that you have measures in place to allow for the repowering of those sites where it makes economic sense,” Dickson said. ■

—Lee Buchsbaum (www.lmbphotography.com), a former editor and contributor to Coal Age, Mining, and EnergyBiz, has covered coal and other industrial subjects for nearly 20 years and is a seasoned industrial photographer. Sonal Patel is a POWER associate editor.