U.S. production of coal has continued to decline since peaking in 2008, according to a report from the U.S. Energy Information Administration. The EIA–on the same day earlier this month when President Trump signed executive orders designed to increase U.S. coal production and coal-fired power generation—released data showing the U.S. produced 578 million short tons (MMst) of coal in 2023, or less than half of the amount produced in 2008. It’s a trend that has continued as U.S. power generators move away from coal and increase their use of natural gas and renewable energy resources to produce electricity.

The EIA in its report noted that the agency’s “latest Short-Term Energy Outlook forecasts U.S. coal production to decline from an estimated 512 MMst in 2024 to 483 MMst in 2025 and 467 MMst in 2026 because of coal’s continued competition with natural gas and renewables in the electric power sector.”

The EIA said the production decline is spread almost evenly across each type of coal—anthracite, bituminous, subbituminous, and lignite—and continued across the past year. Energy analysts have said that while environmental regulations have contributed to coal’s decline, most of the drop in the use of coal for power generation has been due to economic factors, as natural gas and renewable energy resources have proved less costly to produce electricity.

“Over the last 15-plus years, coal production in the U.S. has steadily lost ground to natural gas, solar, and wind, all of which are now cheaper forms of energy production,” said Gilbert Michaud, a professor at Loyola University in Chicago, Illinois. Michaud told POWER, “While there are some regulatory drivers for the decline in coal, it’s also been market-driven. Coal is now less economic than other forms of energy, and it also faces public scrutiny as corporate and governmental demand for clean energy continues to rise. In short, reviving coal faces many barriers, and policy alone may not be enough to increase production.”

The EIA estimates that as of November 2024, about 138 million tons of coal—about the same amount the Appalachian Basin is expected to produce this year—was in stockpiles at U.S. coal-fired power plants. The agency said it expects those stockpiles will remain high, at more than 100 million tons through the rest of this year.

Declining Share of Power Generation

Government data shows there are just more than 200 coal-fired power stations in operation across the U.S., accounting for about 16% of total U.S. electricity generation capacity. Coal has about a 15% share of the U.S. electricity supply, which is now less than natural gas (more than 40%), renewable energy (24%), and nuclear power (19%). Nearly 300 coal-fired power stations closed in the U.S. from 2010 to 2019.

Trump’s executive orders, issued April 8, open up new leases for mining coal on federal lands. The measures also loosen emission standards for coal-fired power stations, and direct the Justice Department to take legal action against state laws and regulations that impede energy development.

Proponents of the coal industry have said coal-fired power generation is needed as demand for power increases due to technology advances such as artificial intelligence. Michelle Bloodworth, CEO of America’s Power, a coal industry organization and a contributor to POWER, in a statement said of the executive orders, “For decades, most people have taken electricity and coal for granted. This complacency has led to damaging federal and state policies that have caused the premature retirement of coal plants, thus weakening our electric grid and threatening our national security. Today’s Executive Orders recognize that the nation’s coal fleet and its supply chain are essential to maintaining a healthy and secure electricity supply.

“So far, bad federal and state policies have led to the retirement of one-third of the nation’s coal fleet, and electricity generators have announced tentative plans to retire more coal plants,” said Bloodworth. “We urge electricity generators to reverse their plans to retire more coal plants.”

Bloodworth has said that 120 U.S. coal plants in 32 states have plans to retire in the next five years.

Grid Reliability is ‘Non-Negotiable’

David Naylor, president and CEO at Rayburn Electric Cooperative, a Texas-based energy provider, told POWER his group recognizes the importance of coal and other generation resources. “We believe in an ‘all of the above’ approach to power generation,” said Naylor. “Coal, natural gas, renewable, and emerging technologies all have a role to play in supporting a reliable and resilient grid.

“For electric cooperatives like ours, reliability is non-negotiable. As policymakers and market participants weigh future investments, it’s important to recognize that different resources serve different purposes—and flexibility, fuel diversity, and dispatchability all matter,” said Naylor. “While Rayburn doesn’t own any coal generation, we believe it can continue to be a valuable market resource and provide essential baseload capacity. We’re not in the business of picking winners and losers. Our focus is on ensuring that whatever mix we rely on, it delivers reliable, affordable power to the members we serve.”

Allan Schurr, chief commercial officer at Texas-based microgrid provider Enchanted Rock, told POWER: “The continued decline in coal-fired power generation reflects a clear long-term shift towards more flexible, lower-emission and cost-effective solutions. Our country’s natural gas infrastructure is a strategic asset, and one that enables us to reduce reliance on coal while supporting both America’s energy dominance and cleaner energy future. Natural gas plays a critical role in balancing renewable generation, especially as we work to scale newer technologies like advanced nuclear. Reliability and sustainability don’t have to be at odds.”

Schurr said his company is “focused on using low-emissions natural gas microgrids to deliver resilience to mission-critical sectors like data centers while ensuring reliability alongside low carbon generation like solar.”

More Coal Plant Retirements

The EIA in February said it expects that power generators will retire 12.3 GW of capacity this year, a 65% increase in retirements compared with 2024, when 7.5 GW was taken off the U.S. power grid. The 2024 total was the smallest amount of generation retired in a single year since 2011, according to the agency. The EIA said U.S. power generators plan to retire 8.1 GW of coal-fired capacity this year, or 4.7% of the total U.S. coal fleet that was operating at year-end 2024. The agency said retirements of coal-fired generation were just 4 GW last year, well below the average 9.8 GW of coal-fired capacity retired annually in the past decade.

The agency said the largest U.S. coal-fired plant planned for retirement this year is the 1,800-MW Intermountain Power Project in Utah. An 840-MW natural gas combined-cycle power station is expected to enter service there in July.

Two other large coal-fired plants—the Campbell Generating Plant (1,331 MW) in Michigan, and Brandon Shores (1,273 MW) in Maryland—also are expected to close this year. Trump at a ceremony celebrating his executive order said, “All those plants that have been closed are going to be opened, if they’re modern enough, or they’ll be ripped down and brand-new ones will be built.”

Coal-Producing Regions

The EIA in its report writes that “Coal mining companies produce bituminous coal primarily from the Appalachian and Illinois Basins, both of which cover large areas in the eastern United States. Subbituminous coal is found in various parts of the western United States, especially in the Powder River Basin in northeastern Wyoming and southeastern Montana. Mining companies produce lignite coal across several parts of the Midwest, mostly in North Dakota and Texas.

“Coal producers mine and sell the four ranks of coal mined in the United States primarily as thermal coal, which operators at power plants burn to produce steam for electricity generation. Bituminous coal, particularly from the Appalachia region, also has metallurgical characteristics, making it a critical raw material used in blast furnace steelmaking. In 2023, the United States exported 51 MMst of bituminous coal as metallurgical coal.

“Coal producers tend to sell subbituminous coal to coal-fired power plants across the United States, or, less often, export the coal to countries in Asia. Subbituminous coal’s low mining costs and relatively low heating value are partially offset by the high cost of transporting coal long distances, usually by rail. Coal producers tend to sell lignite almost exclusively to power generating plants located near mines. This proximity is a key economic factor given the low heat content of lignite coal.”

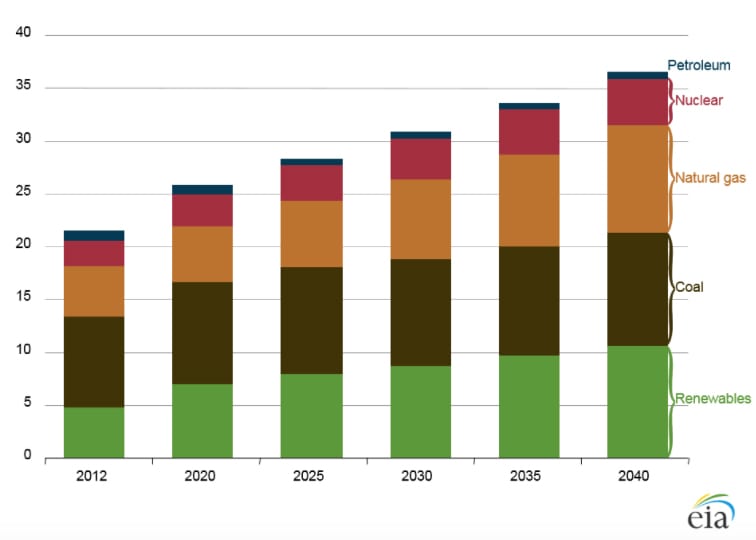

Coal-fired power generation produced about half of U.S. electricity 25 years ago. As coal use has declined in the U.S., it has increased in other areas. The International Energy Agency (IEA) in a recent report said global coal use has rebounded strongly after falling during the coronavirus pandemic. The IEA said coal consumption hit an estimated 8.77 billion tonnes in 2024, an all-time high, and the group said it expects demand will remain close to that level at least through 2027.

The IEA noted that “In most advanced economies, coal demand has already peaked and is expected to keep decreasing through 2027. Meanwhile, demand for coal is still increasing in some emerging economies where electricity demand is rising sharply along with economic and population growth, such as India, Indonesia and Vietnam.”

—Darrell Proctor is a senior editor for POWER.