The U.S. stands at a critical juncture. We’re experiencing electric load growth for the first time in decades, as fierce global competition reshapes the energy landscape. Nuclear power, both the resurgence of fission and the promise of fusion, could secure our energy future and position the U.S. as the global leader in energy technology for the foreseeable future, but the next five years are crucial.

COMMENTARY

After decades of little to no growth, U.S. electricity demand is expected to increase by 18% by 2033, driven by new data centers, renewed manufacturing growth, and increasing electrification across transportation and industrial processes. Hundreds of new power plants must be built to meet this demand, creating a window of opportunity for the U.S. to relearn how to deploy nuclear technology at scale.

The surge in electricity demand for new data centers has already led to plans to expand nuclear power generation in the U.S. Restarts of two recently retired nuclear power plants are planned—Holtec’s Palisades Nuclear Plant in Michigan, and Three Mile Island Unit 1 in Pennsylvania by Constellation and Microsoft. Restarting these existing plants is much less expensive than building new ones, and is the fastest path to adding nuclear energy to the U.S. grid.

Even with best-case projections, new-build U.S. nuclear power projects started today will come online in the early 2030s. Financing remains a challenge, despite moves by Amazon, Google, and Meta to sign power offtake agreements or issue requests for proposals (RFPs) to power data centers. The timeline for regulatory approval has historically been long, and it is too soon to tell how this will change with the new administration.

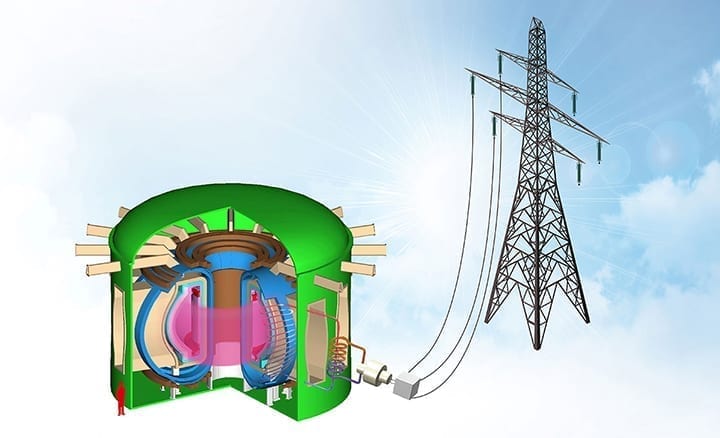

As plans for new nuclear fission plants move forward, private fusion energy companies have emerged with credible plans to put power on the grid in the mid 2030s. Fusion energy, a long-sought power source, is now within reach due to advances in computing, materials, and plasma physics. It has become one of the most exciting and promising areas of new energy generation.

Turning this recent momentum into reality demands both federal support and sustained private investment. Without decisive action in the next five years, the U.S. risks ceding its energy leadership to nations such as China, which is aggressively building both fission power plants and fusion research facilities. To lead, the U.S. must return to building modern nuclear power plants, scale innovative new advanced reactors developed by U.S. companies, and accelerate fusion commercialization by supporting first-of-a-kind demonstrations and critical materials testing. The prize is U.S. leadership in alternative energy globally for the next half century or more.

The Nuclear Race

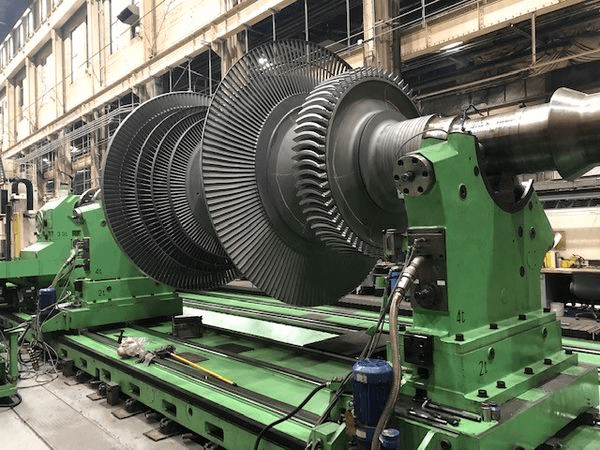

Today’s nuclear power plants produce energy through nuclear fission—heavy atoms like uranium breaking apart to release energy. Fusion, which powers our sun, is the opposite—two small hydrogen atoms fuse together into one larger atom, releasing even more energy. Both can generate on-demand, 24/7 power using a fraction of the land required for solar and wind. Fusion eliminates the need for enriched uranium fuel (a complex supply chain largely located outside the U.S.), and reduces waste and proliferation risks.

The U.S. has pioneered nuclear technology development since the first reactor was built in 1958, and still operates more than 90 commercial nuclear reactors—more than any other country. Most advanced reactor technologies being developed today originated at U.S. national labs in the 1970s and 1980s. However, after Three Mile Island accident, costs skyrocketed. Recent U.S. and European Union builds took 12 years or more to construct, and cost two to four times more than original estimates.

Meanwhile, China has built 34 GW of nuclear power—equal to roughly a third of the total U.S. fleet—in the past 10 years. Even now, China has 26 reactors under construction, 42 planned, and 154 proposed—compared to the U.S.’s 0, 3, and 18, respectively.

Despite this, the U.S. still has opportunities to take the lead. For years, U.S. innovators have been developing improved advanced reactors that are safer, more efficient, and cost effective. Both established nuclear companies (such as Westinghouse) and new advanced technology companies (such as X-energy) have exciting designs to provide from 1 MW to more than 1,000 MW of consistent electricity and/or heat. While not yet commercially operational, advanced reactors’ smaller size enables faster construction and less capital investment to iterate and reach economies of scale.

The U.S. also has opportunities to jumpstart new nuclear power plants through repurposing existing infrastructure. Coal plants and nuclear plants share similar power generation and grid connection infrastructure, and a need for skilled operators. A coal to nuclear conversion could reduce costs for nuclear projects by about 15% to 35%. Recent Department of Energy (DOE) work has already identified 145 coal sites in 36 states and 41 nuclear sites in 31 states (including some recently retired plants) that could support development of more than 260 GW of nuclear power capacity in the U.S.—2.6 times the existing nuclear fleet.

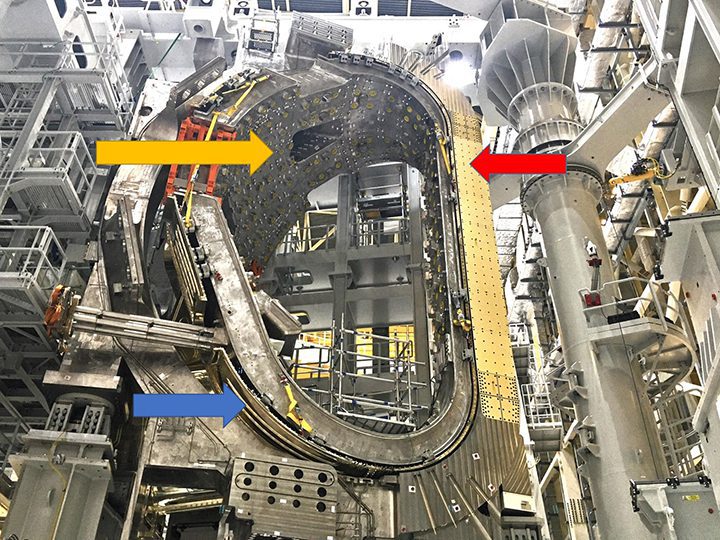

Still, the most exciting future opportunity lies in being the first to commercialize fusion energy. Private fusion companies like Commonwealth Fusion Systems, Helion, and Zap are making strides toward demonstrating powerful prototypes. Emerging players like Xcimer Energy and Thea Energy have found exciting ways to drop the cost and complexity of fusion power plants.

Nuclear Innovations

Innovations in fission technology, including small modular reactors (SMRs) and microreactors, promise to reduce build times and make nuclear power safer and more efficient. SMRs are nuclear reactors designed to produce 50 MW to 300 MW of power, versus 1,000 MW or more for current nuclear power plants. Some SMR companies, including X-energy, TerraPower, and Kairos Power, have been honing their designs for a decade or more and are now seeing demand. With a smaller power output and footprint per unit, SMRs are more flexible and can be deployed incrementally to meet growing energy needs.

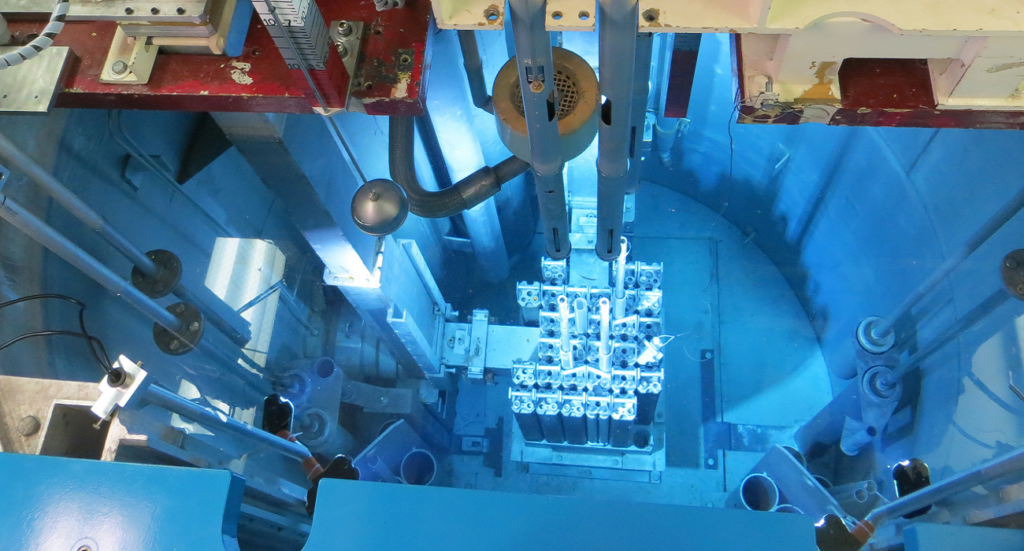

Microreactors (producing 1 MW to 50 MW of power each) have also emerged as a highly scalable solution for some power markets. With much shorter construction timelines, they could be operational as soon as 2030. Several companies, including Oklo, Aalo, and Radiant Nuclear, are demonstrating their designs at the Idaho National Laboratory within the next two years under a DOE use authorization. This helps accelerate development while collecting data for future Nuclear Regulatory Commission applications.

Securing Energy Leadership with Fusion

Meanwhile, in the past five years, the fusion energy landscape has transformed from a sleepy research area into a rapidly evolving technology frontier to be ignored at our peril. In 2022, the National Ignition Facility became the first in the world to achieve net energy gain, meaning that the reaction produced more energy than was used to start it. This showed that achieving fusion is possible, and kicked the race to commercialize into high gear. Since 2020, the private sector has invested more than $6 billion to develop fusion, 80% of which has gone into U.S.-based companies. Several of these companies are now building large prototypes to demonstrate fusion—at a commercially relevant scale—between now and 2030. This was not the case five years ago, and it is a sign of how fast this sector is moving.

To be clear, there is still much more work to do. While the recent breakthroughs are important proof points, the real challenge lies in converting designs and components into integrated power plants. This requires continued innovation in many different areas, and significant engineering advancements. Critically, more funding is needed to bridge the gap, and to continue development of “fusion 2.0” power plant designs that appear even more cost effective.

The U.S. government has led public fusion energy research and development (R&D) since the 1950s, and supports several ongoing research programs at national labs in addition to ITER. Other nations, such as China and the UK, have woken up to fusion’s potential, and have committed billions in government funding for advanced facilities.

Recognizing the power of private U.S. companies to drive technology development, the DOE recently launched a milestone-based fusion public-private partnership program, modeled after the program that helped scale SpaceX. This program has committed $46 million across eight companies if they complete milestones toward pilot plant development. As with commercial space launch, much more capital will be needed to demonstrate the world’s first fusion power plant, but the payoff will be immense.

With sufficient public and private support, these first fusion plants could connect to the grid in the mid-to-late 2030s. This could make large, traditional fission power plants obsolete in 15 to 20 years, and permanently change the energy landscape.

The Road Ahead

Practically speaking, restarting the U.S. nuclear industry will add additional benefits, including job creation and new manufacturing capabilities, in addition to the tools to meet increasing 24/7 electricity demand. For the U.S. to re-enter the market for nuclear fission power plants, and win the race to commercialize nuclear fusion, both federal support and private investment must come to the table. In the next five years, the U.S. has the opportunity to define the future of power generation for the next hundred-plus years.

—Carly Anderson, PhD is a principal at Prelude Ventures.