In little more than a decade, the discovery of economic methods to extract natural gas from shale has exploded traditional assumptions about the world’s energy future and reversed trends across the power business. But the shift has only just begun, and more big changes are on the way.

In the early 1980s, a man named George Mitchell, who owned an independent oil and gas company in Houston, began to see a distressing trend in his company’s future. Mitchell Energy supplied natural gas to a pipeline flowing north to Chicago, but production had been declining and new sources of gas needed to be found. Mitchell had an idea.

It had long been known that shale underlying conventional deposits was the source rock for oil and gas. The problem was the economics: Getting the gas out simply cost too much.

But Mitchell was certain a way could be found. Through the 1980s and 1990s, his handpicked team of geologists and engineers experimented with one method after another, while Mitchell fought his board of directors to keep the project alive.

In 1997, the team finally hit on a combination of water, sand, and guar gum to fracture the shale and draw out the gas. Combined with advances in 3-D seismic imaging, Mitchell’s crew had found the golden egg. When Devon acquired Mitchell Energy in 2002 and the team applied Devon’s expertise in horizontal drilling to the new technique, the shale boom took off (Figure 1).

|

| 1. Going deep. Hydraulic fracturing at a Devon Energy well site in Texas. Courtesy: Irekia-Eusko Jaurlaritza/www.ukberri.net |

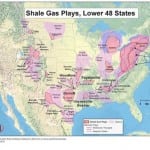

In little more than a decade, the U.S. energy sector has been turned upside down. The enormous influx of shale gas has upended dispatch orders across the country, reversed decades-old flow patterns on interstate gas pipelines, and squelched the much-heralded renaissance of nuclear energy and “clean coal.”

But the shale story is far from over, and has resonated far beyond U.S. shores.

Production Still Climbing

The Energy Information Administration (EIA) projects that U.S. gas production will increase from about 65 Bcf/d in 2013 to 73 Bcf/d in 2020, at which point the nation will be a net gas exporter. This is despite a 75% decline in gas rig count since 2008, reflecting impressive growth in well productivity.

The continued production growth has sparked concerns about pipeline infrastructure, primarily in the Northeast and North Dakota. The growth in North Dakota’s shale oil production has run ahead of its ability to handle the associated gas, leading to widespread flaring. Contrary to public perception, the reason is not low gas prices reducing incentives to build new infrastructure. In fact, the high percentage of wet gas in the Bakken shale makes the region’s production quite valuable.

The reason is simply the ever-increasing volume: Total gas production in North Dakota has nearly tripled since 2011. Despite a flurry of construction in gathering infrastructure—more than 2,000 miles of it in 2012 alone—the total amount of flared gas in North Dakota has continued to increase every year, and reached 160 MMcf/d this past fall.

Six new or expanded gas processing plants are expected to come online in North Dakota in the next few years, which should increase overall capacity by about 50%. Meanwhile, a proposal is in the works from pipeline company WBI Transmission to build a new transmission line that would move gas from the Bakken field to eastern North Dakota or Minnesota.

U.S. Regulatory Hurdles

The shale boom has attracted regulatory attention at federal, state, and local levels. Municipal bans on fracking, though currently few in number, are growing in popularity. While some are purely symbolic gestures in areas with no shale reserves, others have cropped up in the heart of shale country. A conflict is brewing in Colorado between the state government, which favors regulated development, and cities that have enacted bans. Most recently, Boulder, Lafayette, and Fort Collins voted to suspend or ban fracking within their city limits in early November. The city of Longmont enacted a similar ban last year, and the state has filed suit to overturn it. A suit against the three newest bans seems likely, though the state may wait for the outcome from the Longmont suit before acting.

At the state level, New York’s five-year moratorium seems unlikely to be lifted in the near future. Meanwhile, the state’s highest court, New York Court of Appeals, agreed in October to hear a case brought by a drilling company in opposition to a municipal ban. More than 150 New York municipalities have enacted bans or moratoriums on gas drilling, and all of these could be nullified should the case succeed (though such a decision would not affect the state-level moratorium). Moratoriums are also in place in New Jersey and Vermont, though neither has meaningful shale gas deposits.

The biggest overall impact is likely to come at the federal level, where the Bureau of Land Management (BLM) is in the process of revising rules on fracking on public land, including Indian reservations. A draft rule in 2012 drew heavy criticism, but the BLM has argued that the inconsistencies in state schemes warrant federal regulation. However, to the extent a state or Indian tribe can show that its existing regulation scheme meets or exceeds federal requirements, the BLM will issue a variance allowing the local rules to control.

The revised rule was open for public comment through August, and a new revision should be issued in early 2014. Litigation over the proposed rule seems a certainty.

Power Sector Demand in U.S. May Grow, but Slowly

Surging supplies and lower prices are not expected to increase power sector gas consumption in the near term, due to increases in efficiency. The EIA is projecting that consumption for power generation will remain between 22 Bcf/d and 23 Bcf/d through 2020, then begin rising to about 24 Bcf/d in 2030 and 26 Bcf/d in 2040.

Over the same period, the EIA projects that the gas share of power generation will climb to 27% in 2025 and 30% in 2040. Consumption growth will lag behind as older steam plants and less-efficient combustion turbines are replaced with highly efficient combined cycle plants.

Some observers, however, see these projections as overly conservative.

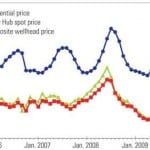

Especially since deregulation of power markets began in the 1990s, gas prices and coal prices have been bound in a symbiotic relationship as generators sought to leverage the least-cost fuel. But that relationship may be coming to an end.

Estimates are that anywhere from 50 GW to 80 GW of coal generation will be retired between 2010 and 2020. Only a handful of new coal plants have come online in the past few years, and only a few more are in development.

A 2012 study by the National Energy Technology Laboratory (NETL) lays out how dramatic the pullback has been. In 2007, NETL reported just over 19 GW of coal projects were planned to begin operation by 2012. Less than 1 GW of that capacity was actually built.

Meanwhile, the EIA projects that nearly 40 GW of gas-fired capacity will be added between 2010 and 2020. The promise of long-term sustained supplies of gas at moderate prices has created enormous economic and regulatory pressure for this switch—even where other requirements for it are not yet in place.

Despite persistent supply constraints, the northeastern U.S. is continuing a strong trend toward gas-fired power, as several of the largest coal plants in the region, and at least one nuclear plant, are poised to shut down in 2014 and 2015. Gas now accounts for around 50% of power generation in the region, and that level is certain to increase.

As a result, the seasonal bottlenecks that caused large price spikes and gas shortages last winter are unlikely to ease until later this decade. Although several expansion projects built to increase takeaway capacity from the Marcellus region are coming online in 2014 and 2015, these are largely designed to transport gas to the New York/New Jersey region. No significant pipeline expansions into New England will come into service before 2016 at the earliest.

What these developments mean for the power industry is that gas may be exiting its price relationship with coal. Fuel switching will become less and less of an option as more generators and regions abandon coal, and do so less from price concerns than from regulation. Gas prices later in this decade and after 2020 are likely to be dictated more by production costs and overall market demand than by coal supplies and prices.

Burgeoning production of shale gas is also creating a wholly unexpected gas export market. Gross U.S. pipeline exports to Mexico have doubled since 2008, and exports to Canada have increased about 50% over the same period. Both markets are expected to grow strongly, both in the near term and through 2040. Net exports to Mexico should top 2.7 Bcf/d by 2020, with substantial increases in cross-border pipeline capacity coming online in 2014 and beyond.

Perhaps the biggest shift in the gas market has been in liquefied natural gas (LNG). As little as five years ago, the Department of Energy (DOE) was considering applications for at least a dozen import terminals. Now, only one LNG import terminal, Everett in Massachusetts, is still receiving LNG, while the DOE has approved four export terminals, with more approvals expected in 2014.

Collateral Damage for U.S. Renewables and Nuclear

The boom in shale gas has handicapped renewable generation, which fell 6% (from all sources) in 2012 as gas prices plummeted, even though installed renewable capacity rose by 10.5%. This caused alarm in some quarters that cheap shale gas would undermine a shift to renewable generation.

These fears are not without basis, as continued cheap gas-fired power represents competitive pressure on wind and solar, which are still more expensive, even with subsidies. Over the long term, however, observers have projected that a reliable source of inexpensive gas is likely to provide support for renewables.

A 2013 report funded by the Mitchell Foundation—yes, the same George Mitchell—argued that natural gas and renewable generation are natural allies. Renewables, with their zero fuel cost, offer substantial hedging opportunities against future gas prices, while gas-fired plants are ideal for balancing intermittent renewable output. This symbiotic relationship is becoming clear in areas with significant renewable generation, such as California, Texas, and Colorado, where generators have rushed to build gas-fired plants, especially the newest fast-start models developed by the major suppliers for precisely this role.

Shale gas has also hit the nuclear industry. Like coal, a long list of new nuclear plants and uprates envisioned in the late 2000s were cancelled as gas prices collapsed. Twelve applications for new plants were filed with the Nuclear Regulatory Commission in 2008 alone; only a handful are under construction, all in regulated markets.

Existing plants were also hit hard: Dominion shut down its Kewaunee nuclear plant in Wisconsin with 20 years left on its license, and Entergy opted to retire its Vermont Yankee plant in 2014, in both cases because the plants were unable to compete in a changed market. Competition from gas also played a part in the decisions last year of Duke and Southern California Edison not to repair the damaged Crystal River and San Onofre plants.

The EIA projects U.S. nuclear capacity to rise from the current 102 GW to 110 GW by 2020 (as the new units come online), but remain mostly flat from there through 2040.

Global Impact

Though exporting the shale boom might seem like a matter of technology transfer, global energy experts have been markedly pessimistic about shale gas outside the U.S. Observers have pointed to a number of factors that created a “sweet spot” for U.S. shale gas, one unlikely to be fully duplicated elsewhere:

- A huge oil and gas sector, with a deep pool of talent and oilfield services to draw on.

- Strong private property rights, making mineral exploitation relatively straightforward.

- A favorable regulatory environment, especially at the state level, and general public support for oil and gas development.

- Unparalleled natural gas processing and transport infrastructure.

- A highly liquid gas market, creating a deep pool of potential financing.

Canada and Mexico

The most immediate impact of the U.S. shale boom has been felt in Canada and Mexico. Ironically, though Canada has several viable shale plays, reduced demand for gas in the U.S. has depressed Canadian gas prices, reducing the economic incentive to drill. Still, Canada is the only other country producing meaningful amounts of shale gas, in part because it most closely mirrors the production environment in the U.S.

About 15% of Canadian gas production in 2012 was from shale, according to the EIA, as compared to 39% in the U.S. Total current production of shale gas in Canada is about 3 Bcf/d. Nearly all of it comes from two plays in British Columbia and Alberta: the Montney Basin and the Muskwa-Otter Park formation in the Horn River Basin. With demand from the U.S. declining, Canada is exploring its own LNG exports to Asia. Several export terminals are under development in British Columbia, three of which have received export licenses.

The political environment for shale gas in Canada is less certain. Though the current Conservative government is strongly supportive of oil and gas development, its policies have deeply angered the nation’s environmental movement. Provincial governments in Quebec and Newfoundland have enacted bans on fracking, and pressure for similar bans is mounting elsewhere.

Though Mexican gas demand is projected to grow strongly, shale exploration in the country is still in its infancy. Mexico is believed to hold substantial shale gas reserves, some of it contiguous with shale plays in Texas. The International Energy Agency (IEA) estimates that Mexico has around 537 Tcf of technically recoverable shale gas. The development environment, however, is much less favorable than Canada’s.

Much of the problem is Mexico’s highly centralized and mostly nationalized oil and gas business, which is handicapped by corruption and inefficiency. The federal government is considering reform of the energy sector, but prospects are uncertain. Though PEMEX, the national oil company, has launched a $200 million exploration program in the Mexican portion of the Eagle Ford Shale, meaningful production is not expected before 2020.

South America

By far the largest untapped shale gas potential in the Americas is in Argentina. EIA and IEA estimates place the nation’s reserves third in the world behind China and the U.S. Early test drilling has shown that Argentina’s shale layers are productive and respond well to fracking. The IEA projects that, with the right policies in place, the country could be the fourth-largest producer of shale gas by 2035.

But the challenges are equally large. The nation’s oil and gas sector is moribund, handicapped by strict price controls that largely eliminate incentives to explore. The other problem is endemic labor unrest, which is certain to increase production costs. Though the national government has expressed interest in exploiting its resources, it has so far shown little willingness to tackle the challenges head-on and risk a public backlash should relaxation of price controls lead to inflation—always a fear in a country that has seen several episodes of ruinous hyperinflation.

Still, there are signs of progress. In September, state-run oil company YPF and the local subsidiary of Dow Chemical signed an agreement to explore for shale gas in the Neuquen Basin, thought to be the nation’s most promising play. The two companies plan to drill up to 16 wells as part of a pilot program.

Brazil’s shale gas reserves appear to be smaller than its southern neighbor’s, but it has moved more briskly to exploit them. Last year it held its first auction of shale gas exploration rights. It has also begun requiring winning bidders for conventional deposits to drill exploratory wells into underlying shale, in hopes of getting a clearer idea of its potential resources. Unlike Argentina, which has traditionally been a difficult partner for foreign oil and gas firms, Brazil has welcomed foreign investment. Nevertheless, commercial shale gas production is years away and is unlikely to be meaningful before 2020.

Europe

The gas market in the European Union (EU) bears little resemblance to that in North America. High prices as a result of long-term oil-linked contracts, declining production, and supply constraints have led to declining consumption and the shuttering of gas-fired power plants. Worse, reduced demand for coal in the U.S. has resulted in increased coal exports to Europe, pushing down the price of coal. A concurrent collapse in the EU emissions trading market has made coal highly competitive against gas for power generation. Gas consumption fell 1.6% in 2012, and the IEA projects flat demand in the EU going forward, largely as a result of regulatory support for renewable energy and continued competition from coal.

Despite high gas prices, prospects for shale gas in the EU are little better. While the IEA estimates of total shale gas reserves in Europe are close to those for the U.S., it is likely that far less of it will be recovered. The shale geology is thought to be more complicated, making the gas more expensive to extract. More significantly, public opposition to fracking in the EU is high in many areas, with bans or moratoriums in place in France, Germany, and the Czech Republic.

The only near-term prospects for shale exploration in the EU are in Poland and the UK About 50 wells have been drilled in Poland, though results have been less than hoped for. Another 200 wells are planned by 2016. The IEA projects about 0.8 Bcf/d of shale gas production from Poland by 2035. The U.K.’s shale reserves are fairly limited, but potentially severe gas shortages have forced the national government to push for exploration despite public opposition. Local firm Cuadrilla briefly attempted to drill for shale gas in Lancashire in 2011, but it suspended operations after several small earthquakes occurred in the region.

Ukraine is thought to have potential for shale gas development, but a challenging business and political environment has handicapped exploration. The IEA estimates production from Ukraine comparable to Poland by 2035, but commercial production should be quite limited before 2020.

Russia

Few countries outside of North America have been as affected by the shale boom as Russia, even though it has no direct connections to the North American market. As recently as 2007, Russian national gas company Gazprom was preparing to spend $30 billion developing a gas field in the Barents Sea in hopes of supplying the U.S. market. That project was abandoned in 2010 when it became clear there was no need for the gas.

Once the dominant supplier to Europe, Gazprom has seen its position undercut from every direction. Cheap U.S. coal exports have reduced the demand for gas for power generation, while the collapse in U.S. gas imports has redirected LNG from Qatar to higher-priced markets in Europe. Gazprom’s long insistence on oil-linked contracts is under siege, and most observers expect spot markets to dominate in the future. So threatened has Russia been by the shale boom that Gazprom has been accused of funding anti-fracking organizations in Europe as a means of slowing its advance. Gazprom officials have loudly denounced shale gas as a bubble due to burst at any moment, and media coverage in the Russian press—some of which is owned by Gazprom—has been highly critical of shale development in the U.S. and elsewhere.

Yet, for all this, Russia is thought to possess substantial shale reserves, though mostly of oil. Gazprom has quietly begun its own fracking explorations, though it is unclear where this will go. It still has substantial conventional reserves, and with the European market in turmoil, it has been looking east for new markets. And it is to the east where shale gas may see the greatest impact of all.

China

No country has greater shale gas reserves, or a greater need for them, than China. Both the EIA and IEA estimate that China’s shale gas potential is as much as twice that of the U.S. The country is also poised for enormous growth in gas demand and is casting its nets wide. It currently has five LNG import terminals in operation and at least 10 more under development. It has secured or is in the process of securing pipeline imports from Central and Southeast Asia and Russia (though negotiations with Gazprom have stalled over prices). But to fully meet its needs, it must develop its domestic resources.

The impediments standing in the way of a Chinese shale gas boom, however, are formidable, and in many ways present a mirror image of the advantages enjoyed in the U.S. Land ownership rules in China are murky, and endemic corruption makes securing clear mineral rights to shale deposits difficult—all the more so because oil and gas data are considered state secrets. The regulatory environment is heavily weighted toward state-owned enterprises and against the sort of independent risk-taking that spawned the shale boom in the U.S. China’s natural gas infrastructure is far short of what it needs, and the domestic gas market is both illiquid and constrained by price controls that have made gas development deeply unprofitable. The geologic characteristics of many of China’s shale basins are thought to be less productive than those in the U.S., and some of the more promising regions are hamstrung by severe shortages of water.

Even so, shale gas in China has made progress in the past year as the central government has sought to cut through red tape and create incentives for development. Two licensing rounds have been completed, and several dozen producing wells have been drilled. The IEA estimates China’s shale gas production by 2035 at more than 11 Bcf/d, but many observers remain skeptical that this level of production is achievable that quickly. (For more details, see “China’s Shale Gas Development Outlook and Challenges,” p. 41.)

Australia

Regardless of the level of shale gas production China is able to achieve, projections are that the nation is poised to become the world’s largest gas importer because of skyrocketing domestic demand, for both power generation and domestic heating. With China and the rest of East Asia becoming a huge market for LNG imports, Australia is moving briskly to meet the demand.

Australia is thought to have significant shale gas resources, though exploitation is still in the very early stages. The nation is handicapped by limited gas infrastructure and serious water shortages in the interior regions. Significant production from shale is thought to be at least five to 10 years away.

Middle East

Given the region’s enormous conventional gas reserves—which also enjoy the lowest production costs—the Middle East would seem to be a strange place for shale gas development. But large shale basins are known to underlie the Arabian Peninsula, and Saudi Arabia is beginning to look at exploiting them. This year, Saudi Aramco began assessing several areas in the country’s northwest, with a plan to use the gas to power a combined cycle plant in Jizan.

The Saudi government estimates that its shale gas reserves could total 600 Tcf, more than twice its conventional reserves. Oddly enough, the nation has had difficulty meeting domestic gas demand because of a focus on oil and price subsidies that make gas production uneconomic. Exploration is also under way in neighboring Oman and the United Arab Emirates, with production possibly beginning as soon as 2017.

Africa

There are known to be several large shale basins in Africa, notably in Libya and Algeria. The Algerian government has expressed interest in exploiting its shale reserves, but so far little has been done. The IEA estimates that Algeria could be producing significant amounts of shale gas by 2035, but little progress is expected this decade.

The greatest near-term potential is thought to be in South Africa. By some estimates, that nation has the world’s fifth-largest shale gas reserves, despite having virtually no conventional reserves. A reliable domestic source of gas would do much to aid the nation’s desire to wean itself off coal while meeting burgeoning electricity demand. At the moment, however, the national government has enacted a moratorium as it considers the appropriate regulatory regime. Other impediments lie in the way: Most of the gas is in the southern Karoo Basin, which is arid and water-poor. The area is also geologically complex, with numerous igneous intrusions that may complicate seismic imaging and fracturing of the shale. As in other nations, political opposition to fracking is growing.

Where We Go from Here

If there has been one constant in the shale business, it is that reality has repeatedly defied expectations. Production levels have leapt past previous estimates every year. Well productivity has climbed, and production costs have fallen. If there is one safe prediction that can be made, it’s that current predictions will be proven wrong in a variety of ways.

How far can it go? If you listen to industry critics, shale is a bubble on the verge of bursting much the way the global financial markets collapsed in 2008. Viewed objectively, these claims have little in the way of support. The gas is clearly there, and the technology for recovering it is becoming more efficient and less expensive every year. While there has been turmoil in the market, this is in many ways an industry being the victim of its own success: So much gas came on the market so fast that collapsing prices wrecked the finances of several early entrants. As the sector matures, financial models will mature with it.

There is every reason to think shale gas is an industry with a long future ahead of it. George Mitchell, who passed away in July at 94, would surely be proud. ■

— Thomas W. Overton, JD is POWER’s gas technology editor.