Utilities across the Pacific Northwest are bracing for exceptional stress on the grid as record-breaking temperatures continue to fester across the region, and at least one utility—Avista Corp.—this week began rolling outages as a measure to alleviate strain on the electric system.

Despite pleas to customers to reduce their power consumption, Avista, which supplies power to 340,000 customers in eastern Washington and northern Idaho, initiated “proactive and targeted protective outages” on Monday and Tuesday in the Spokane area as part of a “protective measure intended to minimize the customer impact, alleviate strain on the electric system and prevent extensive damage to the system that could result in prolonged outages.” It also urged customers to conserve electricity through Friday from 1 p.m. to 8 p.m. local time each day.

“While we plan for the summer weather, the electric system experienced a new peak demand, and the strain of the high temperatures impacted the system in a way that required us to proactively turn off power for some customers,” said Dennis Vermillion, Avista president and CEO on Monday. “This happened faster than anticipated.”

Meanwhile, the Bonneville Power Administration (BPA), a nonprofit federal power marketing administration that provides about 28% of the Northwest’s power, on Monday informed utilities in Washington state’s Tri-Cities region (Kennewick, Pasco, Richland, and West Richland) that this week’s extreme heat is straining the regional electric energy transmission system’s capacity. “If total load approaches maximum system capacity, BPA will require [Richland Energy Services] to shift or shed load on its distribution system,” the city of Richland warned its residents. But though the Tri-Cities hit a new peak demand record on Monday, BPA said it averted load shed. Utilities including Benton PUD (Public Utility District), which serves Kennewick among others, continued to urge conservation, however, to prepare “in the event one of BPA’s major lines or crucial equipment fails.”

Conservation pleas also came from Oregon and Idaho utilities as temperatures soared into the triple digits. Marking 115F in Portland on Monday—an event that prompted the public transit operator to suspend service as power cables melted—Oregon’s largest power provider Portland General Electric grappled with outages as it urged customers to stay alert during “peak time events,” which span from 5 p.m. to 8 p.m Pacific time. Idaho Power, an investor-owned utility that serves southern Idaho and eastern Oregon, also urged conservation from 4 p.m. to 9 p.m. Pacific time over the next few days.

In case you’re wondering why we’re canceling service for the day, here’s what the heat is doing to our power cables. pic.twitter.com/EqbKUgCJ3K

— Portland Streetcar (@PDXStreetcar) June 27, 2021

Conditions Are Precarious

According to the National Weather Service (NWS), the unprecedented heatwave has spurred “numerous all-time temperature records falling throughout Washington and Oregon.” The NWS expects hot conditions will continue through the rest of this week for the Northern Great Basin and Northern Rockies until it slides eastward along the U.S.-Canada border and eventually weakens by Thursday. “High temperatures are expected to soar into the 100s and 110s across this region (20–30+ degrees above average),” NWS said on Tuesday. “Cities such as Spokane, Washington, and Boise, Idaho could threaten monthly temperature records.”

Conditions are especially precarious in the region owing to “abnormally dry or drought conditions, with conditions worsening in recent weeks,” the National Integrated Drought Information System warned earlier this month. According to the federal body’s June 8, 2021, U.S. Drought Monitor, 78.1% of the Pacific Northwest is already in drought, up from 40.8% at the start of 2021. “The drought situation in the western U.S. continued to worsen after another mostly hot and dry week,” the agency said in its most recent update, released last week. “Wildfires and increasing wildfire danger, water restrictions, and damage to agriculture are very common across the west region.”

For the third straight week, Extreme (D3)/Exceptional (D4) Drought in the West has set a #DroughtMonitor record.

49.7% of the West is in D3/D4 compared to 48.9% last week

The high prior to the 2020/2021 drought was July 23, 2002, at 45.3%.

https://t.co/HtSRATnpTz @NOAA pic.twitter.com/E5BNYO7bfk— NIDIS Drought.gov (@DroughtGov) June 24, 2021

Current Turmoil Not a Power Supply Issue

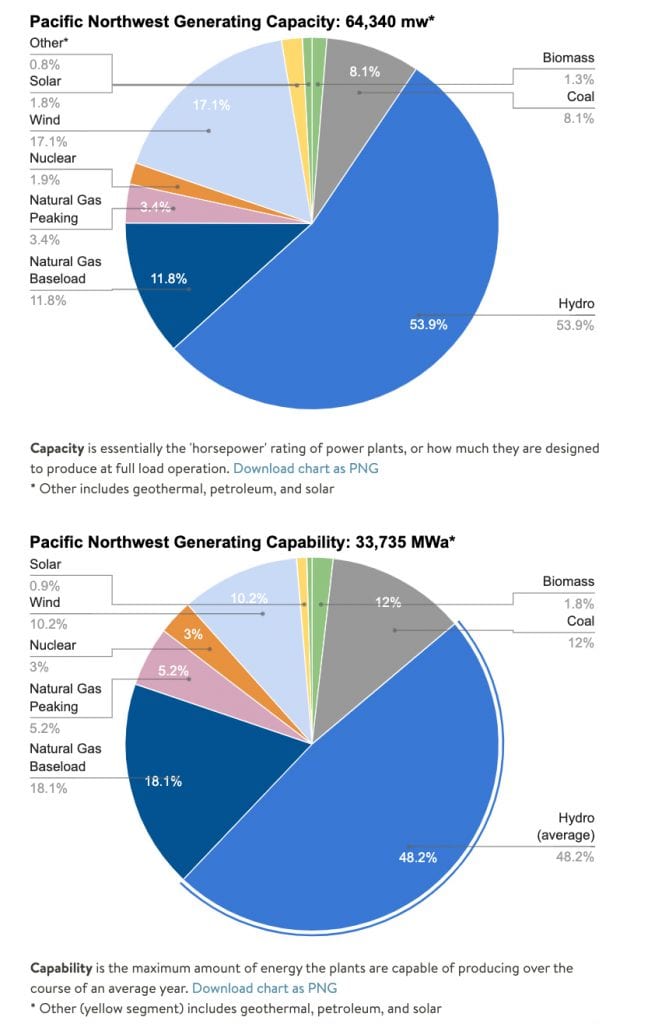

For the Pacific Northwest, drought is especially significant because the Northwest depends on hydropower for nearly half of its generated power, according to the Northwest Power and Conservation Council, an entity tasked with developing a regional power plan (and fish and wildlife) program.

But as Carl Imhoff, an energy researcher who manages the Electric Infrastructure market sector within Pacific Northwest National Laboratory’s (PNNL’s) Energy and Environment Directorate, told POWER on Tuesday, the Pacific Northwest’s current turmoil isn’t being caused by a supply issue. Despite the “very significant drought in the West at large,” there “seems to be good hydropower supply in the Northwest,” he said. That stems from good planning that takes into account uncertainty around snowmelt, he said.

To prepare for the unprecedented event, the BPA said it transitioned its programmed fish spill on the lower Columbia and Snake rivers from spring to summer operations, increasing the federal hydropower generation from those facilities. The Bureau of Reclamation, meanwhile, positioned the Grand Coulee reservoir to meet its refill target in early July, “freeing up the remaining water flow to pass through the system for both power and non-power purposes,” the BPA said.

“Despite the lower-than-average water year, there is plenty of water behind Grand Coulee Dam and some snowpack left in the Canadian Rockies. Unlike 2015 and 2001, years with a similar volume of water, the shape of this year’s runoff has been slower with snow gradually melting above Grand Coulee,” it said.

The region’s supply is also bolstered by Energy Northwest’s 1.1-GW Columbia Generating Station, which returned online on June 20 from its spring refueling outage to produce crucial power marketed by BPA.

PNNL’s Imhoff suggested the current strain on the regional grid may be weather-related. “I think what we’re seeing is that it’s more of a local issue where some of those lower voltage distribution circuits are probably being overloaded and causing them to overheat.” However, higher temperatures may also have an impact on the region’s high-voltage transmission lines, which relay power to the region’s big load centers from Wyoming and Montana. “Some of those assets are probably getting close to their full loads” as demand surges, he said. Higher temperatures also “tend to put pressure on the rating of the transmission lines themselves,” he noted.

BPA, which operates 15,000 circuit miles of transmission lines across the Northwest and small amounts in Nevada, Utah, and California, anticipated these constraints, and it has worked to ready its system for the event.“We’ve put all maintenance projects that we can on pause to ensure our transmission system can handle increased flows and meet our customers’ demands,” said BPA Transmission Services Senior Vice President Richard Shaheen.

The Larger Issue: Resource Adequacy in a Rapidly Changing Environment

Still, the current disruptions underscore new resiliency challenges that may be compounded by the West’s multiple and ever-shifting state policies and power profiles. “The West has a strong history of collaboration—how they plan and operate collectively—to meet reliability standards,” Imhoff noted. However, looking ahead, “it gets more challenging as we get more renewables in the system because they will tend to be weather-dependent,” he said.

According to the Western Electricity Coordinating Council (WECC), the entity that promotes reliability for the Western Interconnection system, the Pacific Northwest mostly falls into a subregion it monitors that is overseen by the Northwest Power Pool (NWPP). The Northwest is a winter-peaking area that typically sees its highest demand of about 39.3 GW in mid-January, WECC notes. In 2021, available generation in NWPP-Northwest (NW) subregion is expected to be about 44.3 GW.

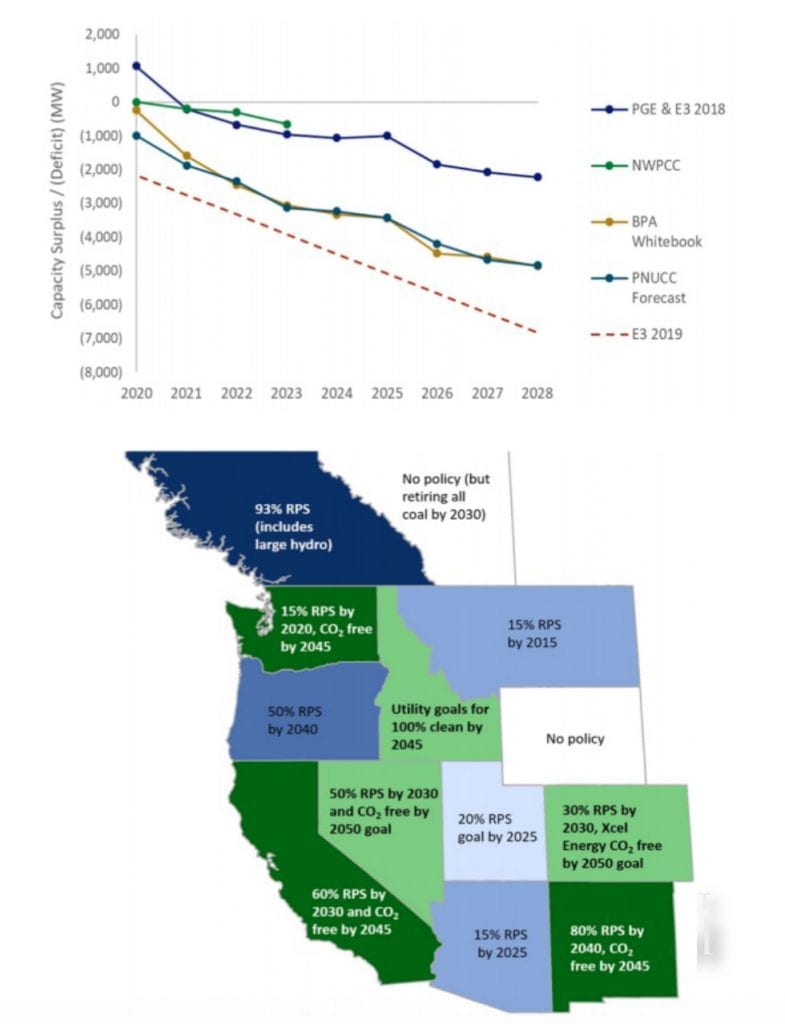

But, influenced by state clean energy policies and costs, the region (like much of WECC) has already retired a significant amount of coal generation since the early 2000s, and by 2025, it is set to lose another 500 MW. However, planned Tier 1 and 2 resource additions may boost its peak hour generation availability to 44.8 GW, WECC says. Today, while baseload resources account for about 33% of available generation in the Northwest, the region’s planning reserve margin in 2021 ranges from 10% to 42%, with the lowest value occurring in September and the highest value occurring in March and May.

As the North American Electric Reliability Corp. (NERC) warned in its May 26-issued 2021 Summer Reliability Assessment (SRA), the region—and the entirety of WECC—faces elevated risks during extreme events, when demand surges overwhelm resource capacity. “Conditions such as wide-area heat events can reduce the availability of resources for transfer as areas serve higher internal demands. Additionally, transmission networks can become stressed when events such as wildfires or wide-area heatwaves cause network congestion,” NERC cautioned. The growing reliance on transfers within the Western Interconnection and falling resource capacity in many adjacent areas also increases the risk that extreme events will lead to load interruption, it said.

Summer 2021 has already been a hotbed of activity in WECC. The California Independent System Operator (CAISO), whose region suffered rolling blackouts last summer owing to an extreme heatwave, last week issued several Flex Alerts, citing “high heat” throughout the state and parts of neighboring states. On Sunday, as the Pacific Northwest heatwave began scorching the region, CAISO issued a heat bulletin, projecting potential resource shortfalls on Monday, owing in part to “less energy” that may be available “across the West for sharing.”

During a press conference on June 16, CAISO executives told reporters the California grid’s summer assessment showed its electricity supplies are “in better shape than last year, but the power grid is still susceptible to stress during extreme heat waves that extend across the West, because that could cut off import supplies and make energy scarce at certain times.”

However, the issue has deeper roots, as WECC’s analysis of last year’s heat event suggests. California’s debacle last summer stemmed from specific challenges posed by “sudden heightened demand” at all levels of the bulk power system. “Not only do demand forecasting methods need to adjust with changing demand patterns, but also strategies to supply that demand need to consider factors beyond traditional resource planning including the variability of resources, the limited generation caused by large increases in demand, the influence of extreme temperatures on certain forms of generation, as well as anticipating congestion on transmission lines,” WECC found.

WECC recommended that balancing authorities become familiar with the WECC Western Assessment of Resource Adequacy report, which examines how resource adequacy challenges can affect their footprints.

Why Western Entities Are Doubling Down on Resource Adequacy

Resource adequacy—the ability of supply-side and demand-side resources to meet the aggregate electrical demand—in the Western Interconnect has morphed into an especially hot button issue owing to the grid’s “immense transition,” Jordan White, vice president of Strategic Engagement and Deputy General Counsel at WECC, told attendees at a technical conference hosted by the Federal Energy Regulatory Commission (FERC) last week.

While the Western Interconnection has historically benefited from a diversity of generation, peak load seasons, and climate zones, today, “load patterns are shifting due to changing climate and weather patterns,” White said. “New clean energy commitments are drastically altering the generation mix now and will continue to do so for years to come. New technology, wildfires, distributed energy, and other factors challenge the industry in ways never experienced,” he said. “Until recently, there was little concern that the hydro system in the Northwest would have ample capacity to provide to California and the Desert Southwest during hot summer months when load was high. There was also rarely a time where generation could not be moved across the interconnection to meet load.”

That has all changed. “We can no longer rely on our abundance of resources to ensure resource adequacy. This means we need to re-examine and update our strategies, analytical frameworks, and approaches to ensuring resource adequacy,” White said.

The challenge ahead is formidable, he noted. Currently, the resource adequacy approach in the West “is a patchwork of different practices, timelines, and requirements.” CAISO administers its own formal resource adequacy planning and procurement process with California regulators. Outside the state, state-regulated and non-jurisdictions load-serving entities approach it through integrated resource planning (IRP) processes that are either overseen by public service commissioners or other authorities. Compounding this is that resource adequacy plans span many time frames, from the long term (five to 10 or more years) to near-term (one to four years) to real-time horizons.

Put another way, “the resource portfolio in the Western Interconnection in August 2020 was largely planned several years in advance, but the potential reliability risks could not be identified until much closer in time—a year in advance—too late to build new resources,” White said. As capacity margins get smaller across the interconnection, “so does the room for error,” he warned. “To ensure the reliability of the system, this issue must be addressed, which will take coordination, analysis, and communication.”

At the technical conference last week, Gregg Carrington, chief operating officer at the Northwest Power Pool, described his organization’s efforts to coalesce Northwestern entity participation into a workable capacity resource adequacy program.

“Why are we doing this? We expect to go from what we consider to be a capacity-rich scenario to a capacity deficit in the very near future, if not today,” he said. “When we originally did our survey of the utilities, we quickly came to the conclusion that all utilities are looking at reliability differently—they all use different metrics, they use different modeling, they assess the value and the contribution of different resources in different ways. Our goal is to develop a uniform set of standards, a uniform way of looking at load and resources. And if we do it right … we’re going to increase the reliability of the region,” he said.

New Markets, New Tools, New Prospects

Spearheading yet another approach is the Northwest Power and Conservation Council, which is developing a regional 2021 Power Plan, a five-year forward-looking plan that takes into account key challenges and investment priorities. This June, Gillian Charles, senior policy analyst in the council’s Power Planning Division, noted during a council meeting that utility IRPs suggest a significant, near-term need for new resources, primarily solar, wind, solar plus energy storage, and some new natural gas power. IRPs generally also show a need for standalone, short-term (two to four hours of discharge) battery storage, and a smaller amount of energy storage that can discharge for eight to twelve hours, such as pumped-storage hydropower facilities. In addition, utilities are exploring utilizing existing or new combustion turbines powered by alternative fuels such as biodiesel and hydrogen, she said.

The council last year notably scrapped a modeling approach that relied on traditional utility planning inputs because it forecast 50 GW of new natural gas generation would be needed on the Western grid to replace aging coal generation. The Power Committee reportedly asked for an alternative perspective that limited new natural gas generation, and a revised model instead predicted “thousands of megawatts of new renewable resources.” The council is expected to release its draft Power Plan in August, while adoption of a final version is expected in February 2022.

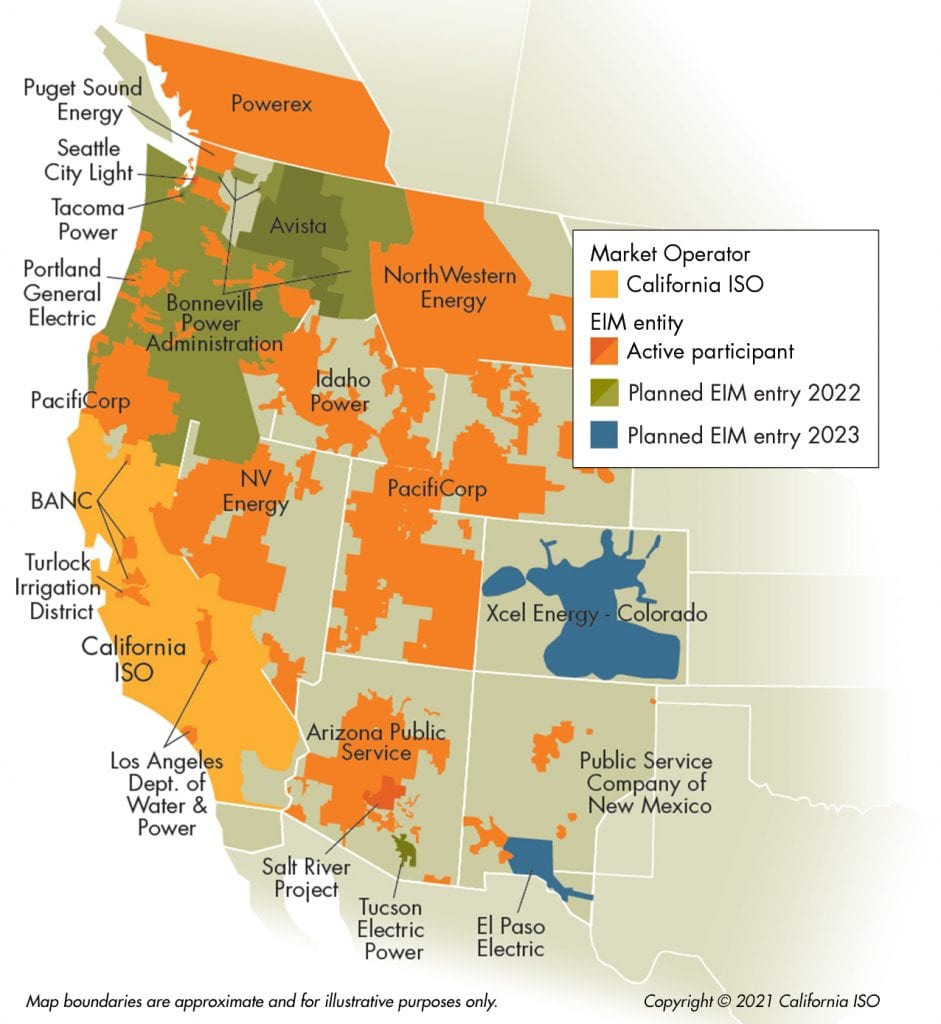

Meanwhile, collaboration on a larger level continues, for example, on efforts to expand the Western Energy Imbalance Market. The real-time energy market launched in 2014 has so far garnered 15 members, including Northwestern Energy, the Los Angeles Department of Water and Power, and Public Service Co. of New Mexico this year.

In tandem, some utilities are reportedly exploring membership in the Southwest Power Pool (SPP), which would expand the regional transmission organization (RTO) into the Western Interconnection. SPP, which has served as one of 10 NERC-certified reliability coordinators in the Eastern Interconnection since 1997, currently serves a swathe of North America’s middle regions, from the Canadian border to the Texas panhandle. SPP launched its western reliability coordination service in December, and so far six Western electric service providers have announced interest in joining the RTO.

Reliability efforts across the West and throughout the U.S. are also bolstered by a federal push, led by the Department of Energy, to plan for and implement resiliency. That effort was kicked off by the National Academies of Sciences, Engineering, and Medicine’s landmark 2017 consensus report that examined the resilience of the nation’s electricity system.

The report underscored that “The extent and the frequency of weather extremes over the last five and 10 years has increased dramatically,” Imhoff noted. “And oftentimes, those come in concert with another sort of threat or extreme, and that creates the unexpected challenge like they faced in California last summer or in Texas over the winter,” Imhoff said.

However, today the industry has many more “powerful tools” at its disposal to analyze complex threat profiles and interdependencies between different sectors, he said. PNNL, a national lab whose mission includes providing grid-related emergency response, for example, has developed a Dynamic Contingency Analysis Tool, which helps utilities anticipate and manage power and grid instability during extreme events. The software enables operators to see and reinforce weak spots on the grid to stop cascading power losses or blackouts, Imhoff explained. Other PNNL-developed software tools may help determine whether microgrids can operate successfully with their current generation and load mix under extreme scenarios, he said. PNNL has also developed tools that seek to mitigate wildfire threats to the grid using RADR (Rapid Analytics for Disaster Response) image analysis software and capability.

“I don’t want to minimize the fact that it’s going to be a really different ballgame over the next decade than what it has been,” Imhoff said. But with industry working together and new tools that provide more visibility over grid vulnerabilities, “I think we’re doing all of the right things,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).