Stricken by falling prices, producers of liquefied natural gas (LNG) are looking to exploit an emerging trend that integrates the fuel source with power generation.

According to Houston-based international law firm Baker Botts, an increasing number of LNG power projects are emerging worldwide as a “new, viable medium” that offers a rapid but long-term power solution. Last year, Sri Lanka moved to finalize its first LNG power plant, though that 300-MW project proposed for Kerawalapitiya hadn’t been approved as of January. Last year, Chile also approved an initial 600-MW gas-fired power plant that will use LNG exported from the U.S. by Cheniere Energy. In November, the government of Pakistan invited bids for a 1,200-MW LNG-fueled power plant at the existing Muzaffargarh thermal power station. And in early February, the South Jamaica Power Co. signed an engineering, procurement, and construction contract with Spanish firm TSK Group for a turnkey 190-MW LNG-fueled plant. Meanwhile, LNG producers Cheniere Energy Inc. and Total SA are separately looking to package LNG production with power generation, Bloomberg reported in January.

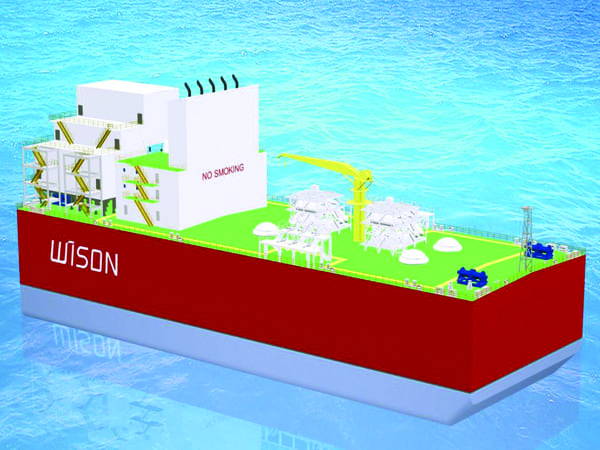

Interest in the latent market is also evident by recent technology developments. Chinese firm Wison Offshore & Marine in January unveiled a range of floating solutions that integrate LNG loading and storage facilities, regasification, and power generation (Figure 1). The smallest unit starts at 10 MW and the largest accommodates an 800-MW power plant. “We can see increasing demand from the regions in South East Asia, West Africa, Caribbean areas, West Coast of India etc., where electricity demand is growing and onshore solutions may not be commercially feasible or preferable,” said Wison CEO Ying Cui.

A prominent driver behind the project development is a global plunge in LNG prices since mid-2014 that has moved in tandem with oil prices, to which many LNG contracts are tied. Global dynamics have improved lately, though prices remain well below previous peaks. An influx of U.S. LNG supplies, as well as new market entrants, notably from East Africa, could put more pressure on the market. Meanwhile, forecasts show global LNG supplies could see explosive growth through 2035. According to BP’s January-released energy outlook, LNG will grow seven times faster than pipeline gas trade. The company projected that by 2035, LNG could account for around half of all globally traded gas—a fairly significant increase from the current 32% share it has today.

However, Baker Botts cites several other critical drivers behind the LNG-to-power trend. These involve a lack of gas infrastructure to support conventional independent power projects, technical evolution, environmental protection, and the need to meet demand for gas-fired power generation.

Developing countries, especially, could benefit from the trend, the law firm noted. “However, it presents new and interesting challenges to those involved in this gas value chain as LNG to power combines certain traditional elements of the LNG value chain with a potentially new and different element, the downstream power market,” noted Mark Rowley, a Baker Botts partner in the London office. Robin Mizrahi, another partner in London, explained that the integration of LNG and power could create a “new inter-disciplinary area of work” with potentially wide-reaching business and economic implications. “It’s not just buying LNG, it’s selling electricity as well—and in many respects the power market and the LNG market may reshape each other, which could have a major impact on their future direction,” he said.

—Sonal Patel is a POWER associate editor.