As hydrogen production scales up, power professionals must weigh where—and when—it fits into a decarbonized grid. For now, experts say real progress may depend on addressing structural bottlenecks: project bankability, policy clarity, and demand certainty.

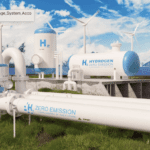

For some years now, hydrogen has been hailed as a critical piece of global decarbonization and a potential link between renewables and reliability. Progress has been tangible: To date, more than 4 million metric tons per year (MMt/y) of low-carbon hydrogen capacity has passed final investment decision globally (Figure 1), Brian Murphy, head of Hydrogen and Low Carbon Gas Research at S&P Global Commodity Insights, reported at the S&P Global World Hydrogen North America 2025 conference in April. But development has been uneven. While China and Europe lead in electrolysis capacity, North America is advancing rapidly in carbon capture, utilization, and storage (CCUS)-based hydrogen. Most global projects remain in early-stage development, though momentum is building as select efforts begin to move through feasibility studies and into execution.

|

|

1. More than 4 million metric tons per year (MMt/y) of low-carbon hydrogen capacity has passed final investment decision (FID) globally. While the bulk of announced projects remain in early-stage development, a growing number are now entering advanced planning and execution phases, with North America gaining traction in pathways linked to carbon capture, utilization, and storage (CCUS). Source: Brian Murphy, S&P Global Commodity Insights, Clean Hydrogen in North America, World Hydrogen North America 2025. |

Still, how the future plays out for hydrogen remains uncertain, Murphy suggested. Despite mounting project announcements and supportive policy frameworks, clean hydrogen remains uncompetitive in most markets. Long-term bankability still hinges on production cost visibility and offtake certainty—factors that remain elusive, particularly in the power sector. Electrolysis-based projects are advancing only where co-location, subsidies, and creditworthy offtakers align.

Given shifting geopolitical priorities and growing investor skepticism, resolving these challenges has become more urgent. Consulting firm PwC, in its February global energy trends outlook, cautioned that momentum is already fading in some regions. “In the Middle East and Europe, the momentum for hydrogen is waning due to poor returns on investment—primarily because of logistical hurdles and weaker financial returns compared to [liquefied natural gas (LNG)],” it noted. “Many stakeholders are diverting resources toward more lucrative options like natural gas.” The challenge of linking large-scale hydrogen production centers to significant offtakers “has dampened the enthusiasm of investors who are now looking elsewhere,” PwC added. Returns on hydrogen-integrated projects still “pale in comparison to those of, say, an integrated LNG project, making the choice of capital placement obvious.” The year ahead will be defining. “In 2025, we will either hear big news of breakthroughs in hydrogen or we will witness the beginning of the end of the hype, putting hydrogen back in its place as an opportunistic play and not a disruptive participant in the energy value chain.”

A Season Change for Hydrogen

The fog is especially disillusioning for the burgeoning U.S. hydrogen industry, which expanded rapidly over the past year in response to major federal incentives—including the Inflation Reduction Act’s 45V $3/kilogram (kg) Production Tax Credit (PTC) and billions in public investment to establish regional hydrogen hubs. Energy Transition Finance CEO Paul Browning referred to that moment, shaped by Congress and President Biden, as the “U.S. Hydrogen Summer.” The industry is now seeing a “U.S. Hydrogen Winter,” created by rulemakers in Biden’s own Treasury. He pointed to the 45V preliminary guidance’s “three pillars,” which “knee-capped some projects,” and the prolonged delay in finalizing the rules, which “made remaining projects unbankable.” While final guidance was issued in January 2025, it is “on the way out the door,” he said. “Now, the important question isn’t what the Trump administration has done, it’s why they’ve done it,” he said. “Some people want to believe they don’t know what they’re doing. That may have been true in January 2017, but it’s not true this time around.”

The U.S. Department of Energy (DOE), however, suggests it will remain focused on the fundamentals. In remarks delivered at the conference, Dr. Sunita Satyapal, director of the DOE’s Hydrogen and Fuel Cell Technologies Office, said this remains “a pivotal time for hydrogen.” She stressed the agency’s continued push to reduce costs, expand infrastructure, and enable commercial scale-up.

The U.S. currently produces about 10 million metric tons of hydrogen annually—roughly 10% of global capacity—primarily for refining, ammonia, and chemicals, she noted. And it continues to see significant growth ahead: the national hydrogen strategy outlines a goal of 10 MMt by 2030, doubling by 2040, and reaching 50 MMt by 2050, driven by strategic deployment in high-impact sectors.

“The key challenge really is cost,” Satyapal said, noting that while innovation is accelerating and commercial deployments are emerging, clean hydrogen must fall below $4 per kilogram—ideally closer to $2—to compete broadly with incumbent fuels. The DOE has continued to back innovation, which has unfolded with more than 1,000 hydrogen-related patents stemming from federal investment over the past two decades, and new consortia focused on hard-to-abate sectors like long-haul trucking, steel, and backup power. “Our main focus areas are really reducing costs and enabling scale—affordable, abundant hydrogen,” she said. “The key really is to enable that offtake and commercially viable scale-up by the private sector.”

From Promise to Product

For the power sector, the uncertainty surrounding hydrogen production has reinforced skepticism about its viability as a fuel—especially at the scale, speed, and cost required to contribute meaningfully to grid decarbonization. Still, hydrogen’s potential is gaining prominence in key applications such as long-duration energy storage, resiliency for critical loads, and demand-side flexibility. At least one defining project appears to be making headway: the ACES Delta facility in Utah (Figure 2), backed by a $504 million DOE loan guarantee, is slated to begin operations later this year. The project is among the first real-world examples of green hydrogen production designed specifically for seasonal power-sector storage.

|

|

2. ACES Delta’s 220-MW electrolyzers, manufactured by HydrogenPro at a production plant in Tianjin, China, include 40 5.5-MW high-pressure alkaline electrolyzers. This image shows electrolyzers delivered to the giant renewable hydrogen hub in Delta, Utah, in October 2023. Courtesy: Business Wire |

At the World Hydrogen North America conference, experts broadly agreed that electrolyzer technology has matured enough to support commercial-scale deployments. Proven technologies like alkaline and proton exchange membrane (PEM) electrolyzers are increasingly being selected for their relative efficiency, system flexibility, and supply chain availability. Some speakers also addressed emerging technologies like solid oxide electrolyzers, which remain in early commercial phases due to their high operating temperatures and integration complexity.

Still, developers emphasized that the challenge ahead lies less in technology performance than in execution. “What people need are bankable, investable technologies, and they need to see that electrolysis can be delivered in multiple tens of megawatts. Can we deliver on time, to budget, and is it going to work for the lifetime of the plant?” said Tim Calver, vice president of Commercial at ITM Power. “So, for me, bankability and credibility is fundamental at the moment, and it has a bit of a higher priority than short-term performance or cost improvements.”

Policy backing and secure offtake sit squarely in the gap between maturity and market viability, Calver noted. That gap will define the financial architecture and spur engineering, procurement, and construction confidence, he suggested. “The reason that my colleagues and I are [at the conference] is to better understand what policy looks like going forward in the U.S. market. And right now, I think we’re pretty cautious. None of our prospective customers will take an investment decision—even on large-scale development costs—without that level of clarity.”

Electrolyzer manufacturers and project integrators echoed the message, urging deeper industry collaboration to smooth deployment. Unlike combined cycle turbines or LNG terminals, electrolyzers are only now being embedded into power-sector environments at commercial scale—with major implications for layout, operations, and installed cost. “It’s not like a gas turbine or an LNG plant, which has been done 2,000 times,” said Gautam Chhibber, senior manager of Hydrogen Sales at Siemens Energy. “We have to learn together and work together to reduce the total installed cost of these sites.”

Integration with the Grid: Flex Loads, Curtailment, and Resiliency

For now, hydrogen’s integration into the power sector remains niche and highly localized—dependent on grid conditions, energy pricing, permitting dynamics, and co-located infrastructure. That presents economic constraints for hydrogen producers, who are effectively caught between high electricity costs and limited operating windows. Matt McMonagle, CEO of NovoHydrogen, was blunt about the core tradeoff. “If your power is free but you’re running an electrolyzer a couple hours a year, your hydrogen is going to be really expensive,” he said. “On the flip side, if you’re running your electrolyzer 100% of the time but your power is expensive, then your hydrogen will also be expensive.”

For green hydrogen, “the biggest cost is your cost of power,” he noted. Grid interconnection further complicates deployment. “In my career, the vast majority of renewable projects that die are because of interconnection,” McMonagle said. “That’s the nice thing about not being dependent on the grid—you can site for [permitting potential], not just generator connection. But we still need water and a customer, and grid interconnection is really the hard part.”

That tension between optimal siting and infrastructure availability has emerged as a defining challenge for developers. Keith Wipke, who leads the Fuel Cell and Hydrogen Technologies program at the National Renewable Energy Laboratory (NREL), said regional viability varies widely. “We modeled the optimal wind, solar, and electrolyzer size, and then calculated the levelized cost of hydrogen,” he said. “There’s some really good spots in the central part of the U.S. But the challenge is, how do you move the energy? Until we have a hydrogen pipeline that’s as good as our electric and natural gas systems, it’s going to be hard.”

Even where location isn’t a barrier, market fit must be carefully considered. “There’s a lot of value in a molecule that contains energy you can move around and use later,” Wipke added. “It’s very stable for long duration. But for grid storage, you compete with cheap electricity, so you have to be careful where you deploy.”

At scale, grid integration also poses technical risks. “One aspect we haven’t talked about enough is grid connectivity,” said Chhibber of Siemens Energy. “If you want to connect 125 MW of load to the grid and want a stable load, you really need to understand how these loads are going to impact your grid,” he said. “It might have an impact on harmonics, might have an impact on transient loads. So, I’ll encourage the team members to think about it a bit more and earlier in the project—not later.”

Despite these challenges, McMonagle said curtailment in high-generation regions like Texas and California could unlock new value streams—if hydrogen production can be sited near existing transmission and permitted quickly. One application drawing increasing attention is fuel cells for data center backup. Multiple panelists flagged this as a promising near-term opportunity for stationary hydrogen, particularly given resilience requirements and increasing pressure to decarbonize digital infrastructure.

Addressing the Offtake, Certainty, and the Demand Gap

While policy risks loom large on the future of hydrogen, the industry is also grappling with sustaining demand. Developers lack committed offtakers, and in the power sector, interest remains largely speculative. Data from S&P Global Commodity Insights shows that early market demand is concentrated in refining, ammonia production, and heavy transport. Power-sector applications—like peaking support, firming renewables, or grid-scale storage—have garnered attention, but few have translated into contracted load. Utilities and grid operators remain cautious, preferring investments with near-term returns, clearer regulatory value, and less operational uncertainty.

Cost is the most immediate hurdle. While several utilities have launched hydrogen co-firing demonstrations or built new plants marketed as “hydrogen-capable,” according to a 2024 report from the Institute for Energy Economics and Financial Analysis (IEEFA), these projects may be oversold. “Any ‘hydrogen-capable’ gas-fired power plant is going to operate almost completely, if not completely, using methane” for the foreseeable future, the report noted, calling for more scrutiny on emissions, economics, and the risk of passing uncertain costs on to ratepayers.

Even so, hydrogen’s value proposition in the power sector may lie in optionality. Co-firing, long-duration storage, and system flexibility are becoming harder to price—but increasingly important as grid volatility and decarbonization pressures grow. Browning offered a pragmatic outlook. While acknowledging that hydrogen isn’t the biggest line item in the IRA, he noted that oil and gas interests are lobbying to preserve 45V—and that Republicans may ultimately improve rulemaking. “When all the dust settles, a modified 45V will likely survive,” his slide read. His advice to developers: “Focus on offtake [letters of intent] so you’re ready to go in two to eight months. Offer your offtaker any upside or downside from 45V changes.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).