Is gas generation quickly going down the same path as coal? Will gas power generation built today be abandoned in 30 years? How can you be serious about climate change and still build gas power generation?

As governments, utilities, and private enterprises continue to set aggressive net-zero emissions goals, these are the hard questions being lobbed at the power industry and any player considering new gas power generation.

Admittedly, industry outlooks on the future of gas generation vary widely, with some predicting its imminent downfall. The costs of renewable energy and battery energy storage systems (BESS) continue to decline, and societal pressure to eliminate carbon dioxide sources is growing by the day.

Even with a solid, plant-specific pro forma, utility executives are grappling with increasingly unpredictable market scenarios as they assess the potential for a strong return on investment from carbon-emitting assets over their 20- to 30-year lifecycle.

Although these circumstances introduce a tangible element of doubt about the future of gas generation, the truth is that its demise is far from inevitable. Utility owners and operators can stabilize the forecasted value of their gas plants by designing new plants for future technology implementation, and by making steady, planned investments in existing facilities that will enable these assets to generate highly flexible, dispatchable power with decreasing—and eventually zero—carbon emissions (the net-zero scenario).

Meeting the Targets

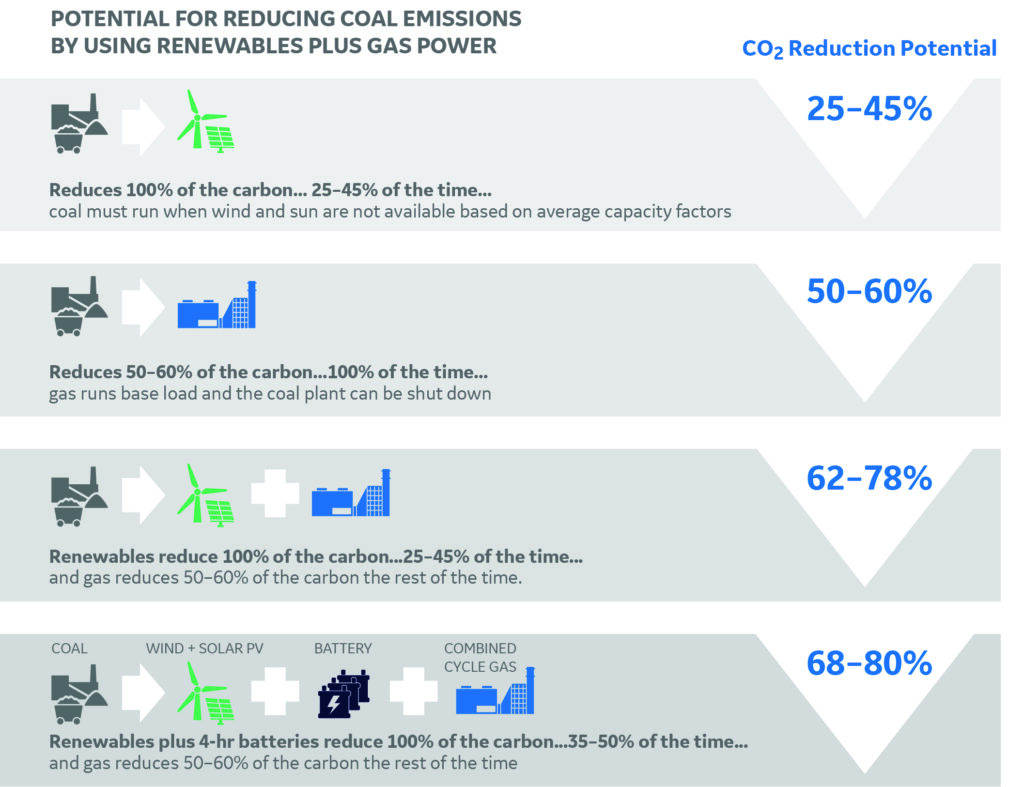

Many in the power industry remain confident as they continue to embark down the path towards achieving the first 70% of their planned emission reductions. Most utilities report that they’re going to retire their coal power stations—some of the largest CO2 emitters—and replace many of those assets with renewable generation.

While this serves the achievement of the net-zero objective, the downside is these utilities are replacing a reliable, dispatchable generation asset with an intermittent power source. So, in order to achieve a net-zero approach, the power industry must implement solutions that deliver highly flexible, dispatchable generation to maintain grid reliability and resiliency.

Today’s advanced gas turbine generator plants fill that need. In simple cycle, they can supply more than 400 MW to the grid in 10 minutes and are designed to reach full combined cycle load within 30 minutes to one hour. Gas plants can now turn down to exceptionally low loads— in some cases, less than 25% of their baseload capacity—and can ramp at 10% to 15% of their full load capacity per minute. Plus, gas turbine plants will begin exceeding 65% efficiency in the latter part of this decade.

Many industry projections forecast that gas prices will remain at historic lows for the next few decades, which makes gas generation a cost-effective fuel for flexible, dispatchable generation. This lower price point coupled with economies of scale results in lower per-kW pricing, which is reflected in the $2 to $3 price per million BTUs we’ve seen over the past few years.

The affordability of gas is even more compelling when considered with how well it complements solar and wind generation, offering a more balanced portfolio of electrical generation that both reduces carbon emissions and maintains a reliable power supply. Over the past five years, massive buildouts of gas, solar, and wind generation enabled massive coal plant retirements. As a result, in 2019 the U.S. had the largest absolute decline in carbon dioxide emissions—a reduction of 140 million tons, according to the International Energy Agency.

Considering its cost, flexibility, and emissions profile, gas turbine generation has a place in our fuel mix for years to come. It also has a clear path to become even cleaner, making it a technology that can help power providers make increasing contributions to their net-zero commitments.

Gas Generation’s Path to Net Zero

Future-proofing gas generation basically means designing a plant that will remain competitive in a net-zero world. So, carbon emissions will need to be reduced, but natural gas power plants may continue to operate beyond 2050 without a mechanism for carbon capture by employing alternative means of offset. This will be done by changing to low-carbon fuels such as hydrogen, or through carbon capture utilization and storage (CCUS). Future-proofing means including design provisions for both paths, while also designing in flexibility to operate across the gamut of energy storage to baseload service.

Hydrogen

The latest advanced gas turbines are capable of 30% to 50% hydrogen fuel content, and each of the major gas turbine manufacturers are making substantial progress on a path to firing 100% hydrogen fuel within this decade. In fact, large gas turbine plants can fire more hydrogen than current supply generally allows.

The latest advanced-class gas turbines, and multiple older models, will be retrofitted with newer hardware to realize higher hydrogen content, up to 100%. Many smaller gas turbines have significant hydrogen firing capabilities today, and it’s expected that OEMs will design upgraded technologies so the systems can be retrofitted into these machines.

In terms of achieving net-zero goals, gas turbine plants operating on hydrogen will maintain their world-class performance capabilities while emitting only water. So, when considering the potential for positive returns on a gas generation plant, utilities and investors alike should plan for conversion to 100% hydrogen, and other promising low-carbon fuels as alternatives.

Carbon Capture, Utilization, and Sequestration

Another technology sector making substantial progress is CCUS, which the Center for Climate and Energy Solutions (C2ES) maintains can harness more than 90% of the carbon dioxide emissions currently produced by power plants and industrial facilities.

Currently, commercialized amine-based carbon capture systems generally are not cost-effective to add to natural gas-fired plants. Many newer capture technologies are showing promise though, as are utilization technologies that produce carbon-based products with higher economic value than carbon dioxide. We anticipate carbon abatement mechanisms will start to achieve economies of scale by 2040 for natural gas power plants. Industrial facilities that have higher carbon dioxide concentration streams, such as cement and steam methane reforming plants, will begin to embrace CCUS systems a decade earlier, serving as a signpost for the power industry.

CCUS technologies can be readily accounted for in the layout of new plants and can generally be retrofitted onto existing plants. This flexible implementation and high rate of carbon capture make CCUS an attractive option for future-proofing gas generation plants.

Plant Design Requirements

Widespread adoption of low carbon fuels and CCUS will take time, but the groundwork is already underway. For example, the IPA’s Intermountain Power Renewal Project will be commercially guaranteed capable of blending 30% green hydrogen content at its 2025 commercial operation date, with plans to increase hydrogen utilization to 100% by 2045. There are also multiple plants in the U.S. considering carbon capture retrofits for enhanced oil recovery use.

While the economics and operational performance make hydrogen and CCUS attractive options for future-proofing gas generation assets, it’s equally important to account for necessary design elements that will aid long-term adoption of these innovative technologies.

First, the proper space should be allocated in the right locations to allow for the future additions of certain equipment that may be required for processing fuel or carbon (e.g., storage, blending, compression, treatment, etc.).

In addition to allowing for low-carbon fuel or CCUS retrofits, utilities should plan to allow for cost-effective performance upgrades, and design each plant to serve baseload, intermittent and ancillary markets over its life. Several key flexibility features that should always be considered include:

• Incorporating, at a minimum, moderate duct firing into the plant’s initial design allows for adopting gas turbine upgrades that may yield substantial performance improvements over the plant’s lifetime, keeping it near the top of the dispatch order.

• Looking beyond baseload heat rate, designing to maintain low heat rates across a broad operating range.

• Designing for ancillary services and grid reliability services, and possibly even as an energy storage facility beyond 2050.

- Consider configuration (e.g., consider multiple 1×1 trains vs. 2×1 and 3×1 configurations).

- Design and permit for ultra-low turndown, even considering “parking” loads to minimize emissions and operations and maintenance costs when rates are low.

- Design for quick starts and fast ramp rates.

- Include design allowances for future integration of promising thermal energy storage technologies.

Natural gas-fired plants provide unlimited energy storage capability to the grid, allowing for accelerated adoption of renewable energy generation. Properly designed natural gas-fired plants will continue to advance their world-class efficiencies beyond 65%, all the while lowering their emissions without any changes in fuel or adding carbon capture. As low-carbon fuel and CCUS technologies become more economically attractive over the next 10 to 20 years, gas turbine plants will maintain value as the foundational supply of electricity that ensures grid resiliency and reliability at a low cost.

The Clean Future of Gas

Black & Veatch believes strongly in the value of renewable energy, emerging technologies like CCUS, and natural gas as key contributors to building sustainable infrastructure on a global basis. Today’s high-efficiency natural gas plants deliver huge reductions in carbon dioxide relative to even ultra-supercritical coal-fueled plants. They deliver substantial reductions in emissions compared to gas plants that were built just 20 years ago. And, the growing sense of urgency to curb the effects of climate change will likely spur even more investment and focus on making gas cleaner than it already is.

Like any investment plan, research and planning is the key to success. So, as utilities evaluate where and how to best invest in their gas-fired generation assets, it is crucial that they develop assessments of technologies that will be coming into commercial viability in the next decade. There also is a need to develop plans detailing how to leverage these innovations with existing generation assets. In other words, design and construction of gas turbine power plants built today should include provisions to employ these emerging technologies to operate profitably in the renewable heavy generation mix of tomorrow.

—Jason Rowell, P.E., is an Associate Vice President and Global Technology Portfolio Manager for Black & Veatch’s global power business. He is responsible for developing projects and implementing industry-leading solutions through technology innovation. Jason uses his industry experience and technical acumen to align Black & Veatch’s portfolio of gas, coal, nuclear, plant modernization, decarbonization, hydrogen, supercritical CO2, waste-to-energy, biomass, and environmental and sustainability solutions for small-scale services engagements through large-scale engineering, procurement, and construction projects.