France, which counts on nuclear energy for roughly 75% of its power needs and is a leading nuclear technology exporter, has embarked on an energy transition to substantially diminish its reliance on nuclear.

On Oct. 15, the lower house of France’s parliament passed the so-called “Energy Transition for Green Growth” bill, culminating a debate that began in the National Assembly just two weeks earlier. The bill undergirds President François Hollande’s 2012 election pledge to cut the country’s nuclear generation share to 50% by 2025, but it also requires a 40% reduction in greenhouse gas emissions by 2030 and a 75% reduction by 2050, compared to 1990 levels. Additionally, it requires slashing overall energy consumption 30% by 2050 compared to 2012, as well as increasing renewable energy’s share of final energy consumption to 32% by 2050.

Predictably, the bill has been criticized by business groups, including the country’s nuclear fleet owner EDF. They point out that the country’s nuclear sector has produced some of the cheapest and most decarbonized electricity in Europe. Trade group the Union Française de l’Électricite, for example, forecasts that if nuclear’s share is reduced to 50%, and assuming renewables and conventional generation will fill the gap, prices could jump by €30 to €40/MWh.

Some entities suggest that the government’s shift in energy policy stems from considerations of how much it will cost to replace the nation’s 58-reactor fleet. Most reactors were built between 1978 and 1988 and are not far from reaching their 40-year-lifetime limit. One much-cited example is that costs to build EDF’s 1.6-GW, first-of-its-kind, third-generation EPR reactor at Flamanville in Normandy have soared to about $10 billion—two and a half times the original estimate—and the project has already been delayed by four years.

After parliamentary consideration, France could ratify the bill next year, ahead of the December 2015 United Nations Climate Change Conference in Paris, where an international agreement on climate change to replace the Kyoto Protocol could be adopted.

Hollande’s pledge to shutter France’s oldest nuclear power plant, Fessenheim, by the end of 2016, may not come to fruition, however. The National Assembly is vetting a parliamentary report from the Committee on Finance that suggests there is no technical reason for its early closure—and that if the plant were closed early, it could cost the state $6.3 billion (including $5.1 billion in compensation to state-owned generator EDF).

Yet, according to state-funded think tank CDC Climat, the proposed French energy transition likely won’t be cheap either. More than $27 billion is currently invested in low-carbon equipment and infrastructure. Investment in renewable energy for 2011 amounted to about $11.3 billion, backed by $1.25 billion in subsidies. Energy efficiency alone needed $10 billion in investment. During the eight-month-long national debates held last year to assess the possible new energy direction, it was estimated that about $63 billion would be needed to fund the energy transition. But CDC Climat estimates it would require an extra $25 billion per year—a “step up [that] is not so high,” said President Director General of CDC Climat Pierre Ducret in a statement.

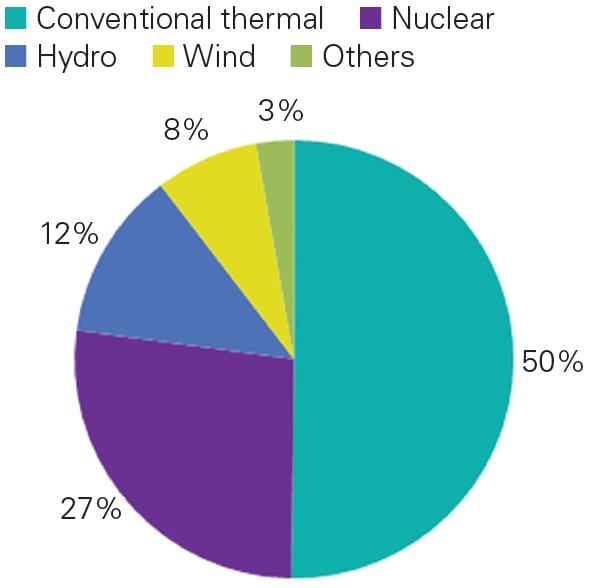

France’s proposed commitment to reduce nuclear’s share also has repercussions for the European Union (EU). The 28-country bloc’s leaders in late October endorsed a binding target to reduce greenhouse gas emissions by at least 40% by 2030, compared to 1990 levels (see POWER Digest, below)—but it shied away from setting a binding target for renewables and energy efficiency. Nuclear, which now provides about 27% of Europe’s power (Figure 1) and 53% of its carbon-free electricity, is expected to play a significant role in helping the EU reach those goals. But in the aftermath of the Fukushima accident, Germany has vowed to phase out nuclear power by 2022, Sweden’s new government is moving toward abandoning nuclear as well, and a new energy policy package in Switzerland that proposes the phase-out of nuclear is moving through parliament.

Anti-nuclear groups in the EU, meanwhile, suggest that fostering new nuclear projects will affect sanctions imposed by the EU on Russia as a result of the crisis in Ukraine. Russian state-owned nuclear firm Rosatom is involved in the expansion plans of Paks in Hungary, Belene in Bulgaria, Temelin in the Czech Republic, Akkuyu in Turkey, and a Fennovoima project in Finland.