In a financial climate that sees state-of-the-art combined cycle gas plants slated for closure, the diverse nations of Europe continue to make steady progress towards ambitious climate goals.

This is expected to be the year when modest economic growth at last returns to a recession-hit Europe. Recent depressed power demand from industry has already allowed the 27 countries of the European Union (EU) to meet their 2020 target of a 20% cut in greenhouse gas (GHG) emissions compared to 1990 levels, but the good news stops there. Power producers are suffering low or zero margins on their gas-fired plants, while their customers complain of the burden of green taxes.

The recession has been bad news for the EU’s wish to have integrated internal markets for electricity and gas in place by the end of 2014. Infrastructure investment to support the single energy market needs to increase by 30% for gas and 70% for electricity compared to 2010 levels, yet it is not clear where the money will come from. More importantly, a single market would have to unravel a patchwork of national regulations and support mechanisms (see below for examples from the UK). It could take decades.

Sooner to materialize could be an end to the deadlock that has paralyzed biofuels investment in Europe. In November, a consortium of six major car manufacturers and oil companies published a “biofuel roadmap” that links the oil and automotive industries and promises significant GHG reductions. This could help to overcome the fragmentation of national transport policies across Europe. It would also reassure the biofuels industry, which is fighting the European Commission over the extent to which biofuels should be allowed to displace food crops and natural carbon sinks.

As in previous years, decarbonization and loss of nuclear capacity are the main threads linking European energy policy and politics. As POWER went to press, the EU was close to publishing a first draft of its 2030 energy and climate framework, which will work towards a GHG cut of 80% to 95% below 1990 levels by 2050.

Accompanying the new policy is likely to be a change in the way the EU supports green energy research and development. The present system of funding for “strategic energy technologies” (the “SET-plan”) has helped to cut the cost of solar power and cellulosic bioethanol but has failed to make carbon capture and sequestration (CCS) happen. 2014 will see a new roadmap based instead on energy services—heat, light, transport—plus a new funding mechanism known as Horizon 2020.

Another reason for lack of investment in low-carbon technologies is the continuing failure of the EU’s emissions trading scheme (ETS). CO2 prices are now below €5/metric ton (mt), whereas a level of €40 to €55/mt would be needed before new coal-fired plants could justify CCS, experts say. The European Commission has now agreed that structural reform of the system is needed, so higher carbon prices are at last on the cards. The six options tabled for the reform include direct price management, perhaps similar to a scheme the UK adopted in 2013: a “floor price” of €18/mt, rising progressively to €83/mt by 2030.

Denmark, one of the countries furthest along the green track, plans by 2050 to get half its electricity from wind and to be free from fossil fuels altogether. Even France will cut the share of nuclear energy in its generating mix to 50% by 2025, from more than 75% at present. An investment package estimated at €592 billion (including energy efficiency and grid modernization) includes new offshore wind projects in the 500-MW class.

The UK and Germany face particularly interesting new years.

UK Tackles Capacity Crunch

Just in time to avoid a looming capacity crunch, the UK government has sorted out a financial mechanism that should at last persuade power companies to build new thermal generating plants. It’s no cheap fix, though, so energy politics are certain to continue making headlines through 2014.

Everyone agrees on the basics. Almost a fifth of Britain’s generating capacity—old nuclear and coal—will close by 2020, yet power demand is projected to double by 2050. Government regulator Ofgem says spare generating capacity could fall to just 2% to 5% in 2015–16, and that by 2020 the country will need to spend£110 billion on generation and networks to stave off blackouts. Bound by law to cut GHG emissions by 80% by 2050, all three main political parties agree that most of the new capacity will have to be low-carbon—chiefly wind and nuclear, with gas as a backup.

UK wind power looks set to continue doing fairly well. Total installed capacity reached 10 GW by November 2013, and on a weekday afternoon in the same month wind production met a record 13.5% of total electricity demand at the time.

Yet offshore wind plants are unlikely to be built fast enough to allow the country to meet either of two targets for 2020: 16 GW of installed offshore wind power and a long-standing plan to get 30% of electricity from renewables. The more likely figure of 8 GW to 10 GW risks losing the advantages of economy of scale in terms of both power prices and job creation, warns a recent report from RenewableUK.

At the end of November, RWE abandoned a plan to build the 1,200-MW Atlantic Array wind farm off the west coast of England, citing technical and economic challenges, though it is still working on offshore projects totaling up to 5.2 GW. Huub den Rooijen, head of offshore wind for the Crown Estate, which controls licensing, said that decisions of this kind would likely cut the UK offshore wind pipeline from a potential 40 GW down to 8 GW to 16 GW by 2020.

The power companies have also been reluctant to invest in new thermal plants. Obstacles include recession, high gas prices, the commercial risks of nuclear power, and fear that gas plants will become unprofitable when they are reduced to backing up wind turbines.

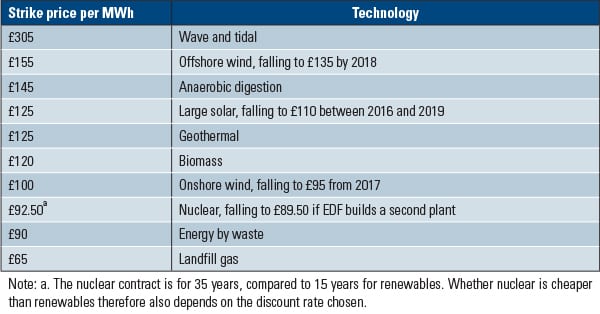

Desperate for new nuclear capacity, the government has therefore set minimum prices for all types of low-carbon power. The new Energy Bill, which is expected to be law by the end of 2014, sets out “contracts for difference” (CfDs), which guarantee a nuclear operator a “strike price” of£92.50/MWh (Table 1). The difference between the strike price and the average wholesale price—currently around£47.50/MWh—will be paid by electricity consumers (or refunded to them if the market price should fall above the strike price). Because they are funded from bills, not taxes, CfDs are not technically subsidies.

|

| Table 1. UK contracts for difference. Contracts for low-carbon generation may eventually be awarded by auction, making them independent of technology. Source: UK Department of Energy & Climate Change |

The government wants to see eight new nuclear plants built, all at existing sites. A Chinese-backed consortium led by EDF Energy has agreed to go ahead with two new EPR reactors at EDF’s Hinkley Point site, and possibly two more at Sizewell.

With no equivalent security yet in place for fossil-fueled plants, however, the “big six” suppliers—Centrica/British Gas, EDF Energy, E.ON UK, npower, Scottish Power, and SSE—are finding the business climate tougher when it comes to gas-fired generation.

In February 2013, when UK regulators had already approved 15 GW of planned new gas capacity, Centrica CEO Sam Laidlaw said his firm would hold off building any gas-fired plants for four years. The following month, Ian Marchant, CEO of SSE, announced earlier-than-expected plant closures and criticized the government for “lack of clarity” on the investment climate for gas plants.

What Laidlaw, Marchant, and others are hoping for are “capacity payments” to maintain the economics of combined cycle gas turbine (CCGT) plants against high fuel prices and increasing amounts of wind power taking priority on the grid. The earliest date for Ofgem’s first capacity auction is the fall of 2014; first delivery is planned for winter 2018–19, though this could be brought forward.

Meanwhile, energy users across the political spectrum are fuming at record profits posted by the “big six” on the back of inflation-boosting price rises. Conservative voters also complain loudly about the cost of renewables, even though the Department for Energy and Climate Change claims the consequences of the Energy Bill will be no more expensive than continuing to burn gas. Ed Miliband, leader of the opposition Labour Party, has promised to freeze energy bills if he wins the 2015 election.

Under pressure to cut energy bills, Prime Minister David Cameron is alleged to have said that the solution is to “cut the green crap.” He has launched a review of the green levies that make up around 8% of the average domestic energy bill, though the best he can hope for seems to be to transfer some of this burden to other green taxes. Energy-saving measures remain much talked about but ineffective.

Germany Battles Overcapacity and Renewables Costs

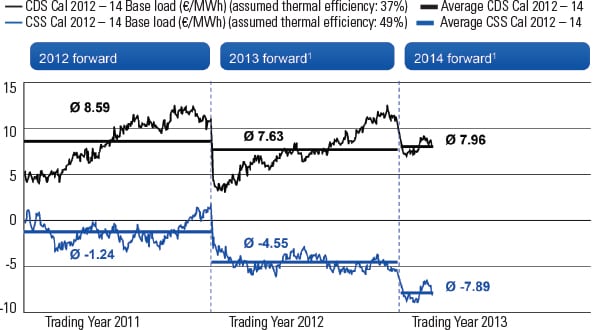

While the UK tries to keep the lights on, German power producers are more typical of those elsewhere in Europe as they struggle with overcapacity and narrow or negative margins for gas-fired plants. Wholesale power prices have fallen to half their 2009 values, and spark spreads are firmly negative (Figure 1).

|

| 1. Clean dark and spark spreads in Germany. Prices for 2013 are through February 13. Source: RWE Supply & Trading |

By August 2013, German energy giant E.ON had idled about 6.5 GW of capacity and was considering mothballing about 11 GW more. Four months earlier, the company even proposed shutting down its advanced Irsching 4 and 5 CCGT units, which have efficiencies close to 60%. Low power prices, cheap coal, and low carbon permit costs had made the units uneconomic, the company said. Discussions with Germany’s Federal Network Agency (FNA) and grid operator TenneT TSO yielded enough compensation for E.ON to keep the Irsching plants running.

The FNA has said that plants operating for more than 10% of the time on demand from transmission operators should be paid for this capacity service. When it comes to renewables, Germany is still “too fixated on megawatts,” said Johannes Teyssen, CEO of E.ON.

Also in August, Europe’s third-largest power provider, RWE, said it would take offline 3.1 GW of natural gas and coal power plants in Germany and the Netherlands. The company blamed “political intervention,” subsidized renewables, and low wholesale power prices. These shutdowns will continue through 2014. “Many of our power stations are now in the red,” said CFO Bernhard Günther. “This is the greatest crisis our industry has faced for many decades.”

With this background, the sudden loss of 5 GW of nuclear capacity in 2011 is not the most significant issue for Germany’s Energiewende. Nor, in itself, is the plan to get 80% of the country’s electricity from renewables and to cut GHG emissions by 80% to 95% by 2050; after all, the rest of Europe should be doing the same. The question is how to get the share of renewables in power production up from 20% now to 35% by 2020 without breaking the grid or upsetting the voters. A secondary challenge will be to avoid relying too much on coal—traditionally, an important fuel in Germany and the obvious fallback when gas is too expensive.

In February 2013, Federal Environment Minister Peter Altmaier met with disbelief and head-shaking when he suggested that the energy transition could cost one trillion euros by 2040. That’s still less than the estimated cost of German reunification in the 1990s—some might say another crazy scheme that, nevertheless, had to be carried through. Of course, Germany’s “big four” are all doing well out of green power. “Renewables are a mainstay of our earnings,” said E.ON’s Teyssen recently.

Following the election of September 2013, Germany’s new coalition government has confirmed a target of 55% to 60% electricity from renewables by 2035 and said it will reform the Renewable Energy Act ( Erneuerbare-Energien-Gesetz, EEG) by Easter 2014. The EEG’s targets for renewables penetration remain largely unchanged, but the high costs of supporting renewables will be pushed down. Changing the subsidies “will be the central project of the grand Merkel coalition,” Altmaier said, with policy becoming “more predictable and lastingly affordable.”

Germany’s photovoltaic (PV) power industry has crashed since 2011 as cheap Chinese solar panels have flooded onto the market, and tens of thousands of jobs have been lost. Yet PV growth continues to meet its ambitious targets, with 226 MW installed in October 2013 alone. By the end of that month, total PV capacity was 35 GW and the country was on course to meet its target of adding 2.5 GW to 3.5 GW each year. The new government says it will not change the support scheme for PV.

Support will be reduced for onshore wind power, whose installed capacity grew by 2.4 GW during 2012 to reach 31 GW by year end. Support will be unchanged for offshore wind, but capacity targets have been reduced to 6.5 GW by 2020 and 15 GW by 2030, down from 10 GW and 25 GW respectively, in recognition of the technical risks and shortage of capital. Offshore wind, although expected to form the mainstay of future growth, has not yet reached 400 MW installed capacity. Turbine manufacturer Siemens says it plans to cut the levelized cost of offshore wind power by up to 40% before the end of the decade, to less than €0.1/kWh.

Heavy grid investment will be needed for all this distributed generation, especially because wind power is concentrated in the north of the country while industry is biased towards the south. Fragmented grid management and considerable public opposition are making the job harder. To avoid the delays associated with getting overhead cables approved, Germany’s four transmission system operators are cooperating on four high-voltage direct current underground lines from north to south. ■

— Charles Butcher is a UK-based POWER contributing editor.