Over the past two decades, Ecuador has added a lot of hydroelectric power to its mix. Going forward, natural gas generation is expected to play more of a role in maintaining reliability and adding flexibility. As more intermittent renewable resources are incorporated, reactive power assets will also be important.

Step into your DeLorean, set the controls for the year 2002, fire it up to 88 mph, and head to Ecuador. The electric grid of that time would be unrecognizable compared to that of today. Back then, a meager 7.9 GW of capacity could only provide power to a tiny portion of the population. An investment of nearly $5 billion over the decade that followed brought total capacity to more than 20 GW, and enabled an increase in household and small business electrification throughout the country. The bulk of that came from eight new hydroelectric projects that boosted its share of power production from 30% to about 90%.

Despite such massive progress, the job isn’t done. A shift in government policy in 2019 to allow foreign investment into the energy sector means that another 5 GW will be added over the next few years. This includes a 1-GW combined cycle plant for the Guayaquil area and two large hydroelectric plants, as well as major transmission upgrades.

|

|

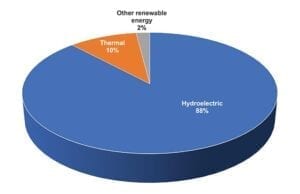

1. The electric generation mix on Ecuador’s grid is dominated by hydropower. Source: SSS Clutch Co. Inc. |

Renewables in Ecuador

Wind and solar are very much in their infancy in Ecuador. The International Renewable Energy Agency reports that Ecuador has 26 MW of photovoltaic solar. Most of this comes from a 20-MW project commissioned in 2014. Wind capacity trails with 18.9 MW, with 16.5 MW of that from the Villonaco I wind farm introduced in 2013. But wind and solar penetration are about to grow considerably as part of the latest governmental plans. The 200-MW El Aromo photovoltaic solar project, and the Villonaco II and III wind projects (46 MW and 56 MW) are under development. Each is being granted attractive 25-year power purchase agreement terms.

Still, hydroelectric power is destined to dominate the renewable energy picture for some time to come (Figure 1). Most of Ecuador’s existing hydro capacity is located in Azuay province in the south-central highlands. The 1.5-GW Coca Codo Sinclair is the nation’s largest hydro facility. It began operation in 2016. Next is Paute-Molino at almost 1.1 GW. Another 780 MW of hydro went online over the last couple of years.

Much more hydropower is planned over the next seven years. The Santiago Hydroelectric Project will amount to 2,400 MW, while the Cardenillo Hydroelectric Project will add 596 MW. Both are in the final design stages and already have environmental licenses. The Cardenillo project is the final stage of the Paute hydro complex, comprising the Mazar, Molino, and Sopladora plants. Construction will take 72 months and includes additional transmission lines.

The big player in the country’s power sector is Corporación Eléctrica del Ecuador (CELEC EP). In 2010, it operated 2.5 GW of power generation. This comprised two-thirds hydro with most of the rest coming from thermal generation (gas, steam, or oil). It had no wind generation in its portfolio at that time.

The company has increased its total capacity each year for the past decade. In that time, it almost tripled capacity to 6.36 GW. CELEC EP currently operates 14 hydro facilities (4.5 GW), 27 thermal generation plants (1.8 GW), and one 16.5-MW wind farm.

Thermal Generation

Small-scale fuel oil and diesel generation are widespread in Ecuador to compensate for lack of available grid resources. Out of more than 200 power plants operating in in the country, less than 100 provide power to the grid. Most burn fuel oil, but the government is implementing programs to gradually phase them out. Since 2014, petroleum derivative consumption for power has shrunk from more than 500 million gallons per year to about 150 million gallons. This was accomplished during a time frame when electricity consumption in the country tripled.

At the same time, plans for the expansion of natural gas-based generation are taking shape. Ecuador has a relatively small amount of available natural gas reserves, and lacks the infrastructure needed to capture and market its natural gas broadly. The primary source is offshore in the Gulf of Guayaquil. Gas from there is sent to the Machala natural gas combined cycle facility. This 130-MW plant supplies electricity to Guayaquil and its surroundings.

But the role of natural gas is set to grow. The government is studying the addition of a liquefied natural gas (LNG) import terminal and supporting infrastructure to turn LNG into power. The goal is to add 50 million cubic feet/day or more of LNG. This will be fed by pipeline and truck to power plants and other users.

Why the interest in LNG? Over-reliance on hydroelectricity places the nation at the mercy of changes in weather patterns. Power outages have occurred at times of low water. The government is looking to LNG as a means of compensating for periods when hydroelectric capacity drops.

One part of this plan is a 1-GW combined cycle plant to be built in two phases. About half of that capacity should be added by 2023 near the major load center of Guayaquil in the south west of the country. Ecuador also intends to build 232 MW of thermal energy plants in the vicinity of 10 oil fields in the Orellana and Sucumbíos provinces in the northeastern interior. This is part of an initiative to phase out its diesel-powered plants, which currently provide 108 MW of capacity. The country imports most of its diesel and wishes to cut energy costs by switching to natural gas. Some of these new facilities in the interior, however, may rely on oil due to its availability in the region.

A Need for Reactive Power

A drastic overhaul of the transmission network operated by government entity CELEC EP is an essential ingredient of ongoing upgrade initiatives. The country is adding 610 kilometers (km) of 500-kV system links and substations serving the Coca Codo Sinclair power station, the Quito region in the north, Tisaleo in the center of the country, and Chorrillos near Guayaquil. In addition, the Andean Electrical Interconnection System (SINEA), formed in 2011, has been steadily building up an Andean power corridor. The latest stage includes further integration between Ecuador and Peru—500-kV double-circuit lines between the nations will run for 211 km.

But with an area of about 250,000 km 2 with many of the dams far from major load centers in Quito and Guayaquil, and generation sources widely spread throughout its territory, Ecuador’s grid has experienced an increasing need for reactive power support. CELEC EP has been steadily adding reactive power support, converting some thermal generation facilities to be able to provide synchronous condensing. Some are operating purely for reactive support while others can provide backup power in the event that renewable generation becomes unavailable.

A case in point is Termopichincha’s Santa Rosa Power Plant near Quito, which was deemed to be a good candidate for more reactive power. It comprised three AEG Kanis Frame 5 gas turbine generators, well maintained and in excellent condition, which had been operating since 1977. Two had synchro self-shifting (SSS) clutches installed when originally commissioned. A third turbine was supplied without a clutch but one has recently been retrofitted.

By incorporating the clutch into the load gear, neither the gas turbine nor the generator had to be relocated. Adding synchronous condensing to the existing 40-year-old peak-load power plant enabled the generator to be used nearly continuously to provide reactive power to the CELEC EP grid while still maintaining the ability to switch quickly to power generation when needed. This helped the transmission operator to increase power flow from hydroelectric plants without having to install new or upgrade existing transmission lines. The conversion also increased Santa Rosa Plant’s overall utilization with minimal investment.

BHS-Sonthofen (part of Voith) replaced the existing load gear of the turbine generator with a new unit. A clutch was installed on the gas turbine side of the low-speed gear. A quill shaft through the center of the gear wheel connects to the generator. When the generator is operated as a synchronous condenser, the gas turbine and its load gear are stationary. Plant engineers made changes to the controls to accommodate these new modes of operation.

|

|

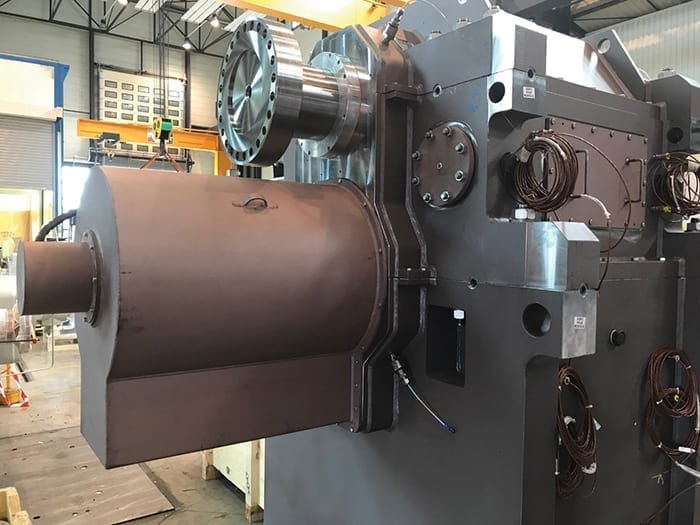

2. View of load gear with size 194T SSS clutch prior to shipment to Guayaquil, Ecuador, for installation in a GE Frame 6B gas turbine generator at Central Alvaro Tinajero. Courtesy: SSS Clutch Co. Inc. |

Following the success of that project a Frame 5 and a Frame 6 gas turbine generator in Guayaquil were also converted to synchronous condensing. SSS clutches were installed in the replacement load gear units in the same quill shaft arrangement as Santa Rosa’s retrofit. Lufkin load gears with clutches replaced the original non-clutched load gear units (Figure 2). The retrofitted turbines are being prepared for both synchronous condensing and power generation mode.

An Evolving Power Mix

Demand for electricity in Ecuador has grown fast in the first two decades of the 21st century. Hydroelectric power is likely to remain the main source of power for some time to come, but recent events such as reverse erosion of freshwater riverbeds, particularly the Coca River, the most important tributary to the Coca Codo Sinclair Hydroelectric Plant, are generating a backlash against hydro. This may help solar and wind gain a greater share of the market.

Careful planning is needed by national utility CELEC EP to avoid transmission bottlenecks and optimize power flows. Targeted investment in wind, hydro, solar, and LNG are expected to dominate the Ecuadorian power sector over the next few years, supplemented by the repurposing of older generation equipment.

—Frank Dougherty, PhD is regional director for Latin America at SSS Clutch Co. Inc., New Castle, Delaware, a manufacturer of the large clutches that are used in synchronous condensers.