Duke Energy is planning a new nuclear power plant at the Department of Energy’s (DOE’s) Portsmouth site in Piketon, Ohio, the company announced with partners AREVA, USEC Inc., UniStar Nuclear Energy, and the Southern Ohio Diversification Initiative (SODI) on Thursday.

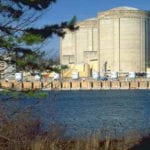

The DOE’s Portsmouth site in Ohio’s south-central portion is a 3,700-acre reservation that had been used to enrich uranium from 1954 to May 2001 for use in commercial and U.S. Navy nuclear power reactors. USEC, which holds a lease to the site, is currently building its new $3.5 billion American Centrifuge Plant at the site and expects to begin commercial enrichment operations in 2010.

The five-partner alliance said Thursday it would evaluate the DOE site as a potential location for a 1,600-MW AREVA EPR. Duke said it would manage the project, provide project oversight, and serve as the applicant for any Nuclear Regulatory Commission (NRC) licensing applications. UniStar Nuclear Energy, a joint venture between Constellation Energy and France’s EDF Group, is expected to provide a range of services to the project based on its “flexible business model and pursuit of standardized nuclear energy facilities.”

The Southern Ohio Clean Energy Park would be based on a DOE initiative to transform weapons sites for the production of nuclear power, reusing existing assets and helping clean up the site. The companies did not issue a timeline or range of costs for the project, though they said they had requested DOE funding for the initial phase of the project, which would include development of a generic Early Site Permit and review of site decommissioning plans.

Duke Energy CEO Jim Rogers told The New York Times that Duke would be able to fund the project. “I’m confident I can fund it,” he said in a telephone interview on Thursday. “Most of our fleet in Ohio, which is coal-fired, will be retired over the next 15 to 20 years, and we’re going to need to replace it, and this plant will be a good candidate to replace that capacity.”

The project announcement followed the DOE’s reported confirmation to The Wall Street Journal last week that it would divide $18.5 billion in federal nuclear loan guarantees between four companies: UniStar Nuclear Energy, NRG Energy, Scana Corp., and Southern Co. Seventeen companies had initially applied for $122 billion of federal loan guarantees for 21 proposed reactors. The guarantees are expected to enable these companies to begin building new reactors as early as 2011, with plants likely to come online by 2015. The DOE has yet to formally announce the likely winners.

Meanwhile, last week, Dr. Mark Cooper, a senior fellow for economic analysis at the Institute for Energy and the Environment at Vermont Law School, released a report that finds that price tags for proposed new nuclear reactors in the U.S. have quadrupled since the beginning of this decade. The report, titled “The Economics of Nuclear Reactors” (PDF), draws a parallel to the eventual sevenfold increase in reactor costs estimates that doomed the “Great Bandwagon Market” of the 1960s and 1970s, when half of planned reactors had to be abandoned or cancelled due to massive cost overruns.

Sources: Duke Energy, AREVA, USEC, UniStar, The New York Times, The Wall Street Journal, Vermont Law School