Though critical to the nation’s power grid, large power transformers are some of the most vulnerable components in the system. Armed with a shared determination for resiliency, government, industry, grid owners, and academia are collaborating on every front—policy, technology, and business—to ensure that if disaster strikes, the grid will persevere.

If very casually, the North American electric operation and delivery system—collectively referred to as the grid—is compared to a human body, its 6,000 power plants serve critical digestive and pulmonary functions to convert fuel into energy and release it into the bloodstream. Large power transformers (LPTs) perform the significant cardiac function of stepping up voltage for efficient long-haul transmission over roughly 360,000 miles of lines until it is stepped down again for distribution suitable for end use. But, though so crucial to the bulk power system, LPTs—which a North American Reliability Corp. (NERC) definition limits to generation step-up (GSU) transformers on the high-voltage side (100 kV or higher, with a nameplate rating of at least 75 MVA) and transmission transformers on the low-voltage side (100 kV or higher, with a nameplate rating of at least 100 MVA)—are under a constant barrage of threats, both natural and manmade.

A number of entities have increasingly warned that along with historic weather events such as lightning strikes, tornadoes, derechos, and tropical storms, certain high-impact, low-frequency events, like severe geomagnetic disturbances (GMDs) or electromagnetic pulses (EMPs)—although rare—could damage multiple transformers, causing a cascading effect on the system (see sidebar). Physical threats are also ever-present. In April 2013, attackers incapacitated a number of power transformers at the Metcalf transmission substation in California using high-powered rifles. While a blackout was avoided through power redispatch, the incident caused more than $15 million in physical damages that took nearly a month to repair.

GMD and EMP Threats: Overblown?While government entities in the U.S. and Canada along with industry organizations have widely studied general threats posed to the grid from a severe geomagnetic disturbance (GMD) resulting from a solar storm, and to a lesser extent, threats posed by a high-altitude electromagnetic pulse (HEMP) resulting from the detonation of a nuclear device, consensus is that more research is needed to inform assessments for specific mitigation measures by generators and transmission providers. Most studies, however, agree that the vulnerable components with the greatest potential consequence in the event of loss are large power transformers (LPTs). Depending on the design of a transformer and the magnitude and duration of a GMD event, geomagnetically induced currents (GIC) could cause heat damage to the condition, performance, and insulation life of a transformer. However, studies offer mixed assessments of how widespread damage could be. The North American Reliability Corp. and the Department of Energy in June 2010 warned that while the failure of a large number of LPTs during a severe GMD event was unlikely, certain older generator step-up (GSU) transformers could be particularly susceptible to breakdown.

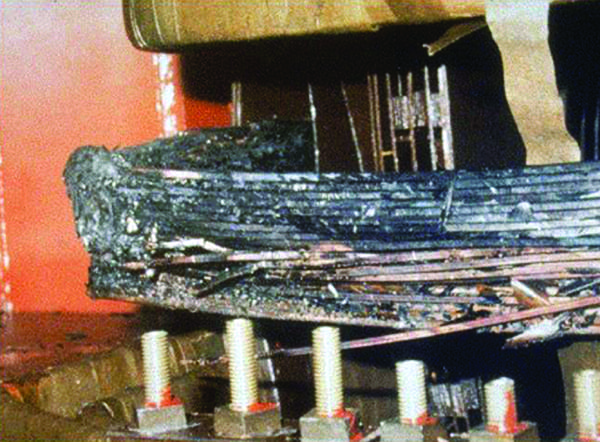

Such effects were apparent during the March 1989 geomagnetic storm, which resulted in a collapse of Hydro-Quebec’s system, leaving six million people without power for nine hours. The event also resulted in damage from hotspot heating to a GSU at Salem Nuclear Power Plant in New Jersey (Figure 2). A moderate intensity storm on April 3, 1994, meanwhile, resulted in the catastrophic failure of a GSU transformer at Zion Nuclear Plant and was likely responsible for GSU failures at Braidwood nuclear plant and Powerton coal plant within weeks of the event, an expert from electromagnetic environmental solutions firm Metatech Corp. said. A HEMP event, too, could interrupt service. But according to the Electric Power Research Institute (EPRI) the effects of an E3 event—the equivalent of a 1.4 megaton bomb detonated 250 miles above the earth (100 times more than the nuclear bomb dropped on Hiroshima)—would be limited to a regional level. As part of an ongoing three-year study to investigate HEMPs, EPRI concluded in February 2017 that though hundreds to thousands of transformers could experience GIC flows of greater than 75 amps/phase during an E3 event, only about three to 14, depending on the target location, could be at potential risk of thermal damage. The study also concluded that damaging levels of tertiary winding heating, resulting from the flow of harmonic currents generated by the resulting GIC flows, are unlikely to occur. Despite these findings, some generators and transmission owners are making changes to guard against GMDs and HEMPs. A number are replacing older transformers, opting for models that are more resilient to the effects of GIC. Others have added GIC-blocking series capacitors to their networks to enhance network efficiency and help stability and voltage regulation. Some have also moved to replace older electro-mechanical protective relays used in their grid control systems with newer digital relays that can be programmed to properly respond to conditions. Other measures include building hardened control centers, and installing high-frequency filters, grounding, and surge protection devices to guard against pulses. |

Meanwhile, as an added, significant complexity, the average age of installed LPTs in the U.S. was about 40 years in 2011—when about 70% of LPTs were more than 25 years old. The life expectancy of an LPT depends on how it is used, but clearly, “aging power transformers are subject to an increased risk of failure,” the Department of Energy (DOE) has warned. Industry, on the other hand, notes that GSU transformers are at a heightened risk of failure owing to a decline in available technical expertise, along with wear-and-tear as plant functions transform and more baseload plants are forced to operate in peaking mode.

A Vulnerable Heart

For NERC, which is working to ramp up measures to improve resiliency and recovery of the bulk power system, and guard against these and other threats, LPTs pose specific vulnerabilities.

LPTs are typically mammoth pieces of equipment weighing as much as 410 tons. Because they are tailored to customer specifications and require intricate procurement and manufacturing processes, lead times for obtaining an LPT often range between five and 16 months, but could stretch beyond 20 months to make them, according to a 2014 DOE estimate. They’re also usually not interchangeable, and worse, they aren’t typically produced for extensive spare inventories.

And they are costly. In 2017, an unnamed transformer maker told the Government Accountability Office that an LPT weighing between 170 and 410 tons could cost between $2 million and $7.5 million in the U.S.—and that likely did not account for costs of raw materials, which include substantial amounts of copper and steel, commodities that are increasingly stricken by price volatility owing to high demand in global markets. Nor does it account for transportation, which requires special modes, such as a specialized Schnabel railroad freight car (Figure 1). The DOE estimated that raw materials, transportation, installation, and other expenses could add another 25% to 30% to the price tag.

As critically, according to the DOE, though the U.S. has seen a growing demand for LPTs since the 1990s, it has historically suffered a limited domestic capacity to produce them. Since 2010, four new or expanded facilities have begun producing LPTs, including SPX Transformer Solutions’ facility in Wisconsin and Hyundai Heavy Industries’ facility in Alabama. Until at least 2013, 88% of imported LPTs came from seven countries—the bulk of which arrived from South Korea. However, that country is now embroiled in an LPT trade dispute with the U.S., announcing in February that it would challenge the Trump administration’s 61% anti-dumping duty slapped on Korean-made LPTs in March 2017.

Industry and Government: A Heartfelt Collaboration

The risks to reliability associated with the loss of one or more LPTs are so worrisome that nearly every stakeholder has jumped into action. The DOE recommended in its April 2015 Quadrennial Energy Review that the agency analyze the technical specifications of a potential transformer reserve and assess existing industry equipment sharing efforts as part of a broader initiative. Congress backed the measure in December 2015 with passage of the Fixing America’s Surface Transportation (FAST) Act, and the DOE is actively engaging with industry, transformer manufacturers, and other federal agencies on how to resolve the risks.

In a March 2017 report to Congress, while the DOE described the national importance of a strategic transformer reserve, it recommended that such a reserve be an industry-based option driven by voluntary industry actions and requirements under NERC’s critical infrastructure protection CIP-014-2 standard. Beginning in March 2018, the DOE will reassess whether that approach has made sufficient progress, and if it has not, whether the government should take action.

For now, resiliency gaps concerning transmission LPTs, at least, appear bridged. Citing a technical analysis led by Oak Ridge National Laboratory (ORNL), the DOE highlighted in its report to Congress that a number of spare LPTs are available to replace those contained in crucial substations on the grid operating at each interconnection’s highest voltage levels (765 kV and 500 kV in Eastern, 500 kV in Western, and 345 kV in Texas). The ORNL study, it noted, was based in part on a 2016 survey conducted by the Edison Electric Institute—the trade group representing all U.S. investor-owned utilities—the American Public Power Association, and the National Rural Electricity Cooperative Association of their members to determine how many spare transmission LPTs were available.

Individual utilities ORNL interviewed reported they are implemented a spare transformer strategy that includes stocking interchangeable spare transformers or ordering an extra inventory of conventional spares, or they are retiring transformers early to make spares available once new equipment is installed. Across the industry, efforts by several consortia and companies are underway to ensure adequate sharing of transformers and other equipment in the event of major grid disruptions (see sidebar).

Industry Leads Transformer Sharing EffortsSpare Transformer Equipment Program (STEP). EEI’s STEP involves a binding contract that requires participating electric utilities—about 56 which had signed on as of March 2016—to maintain (and sometimes to acquire) a specific number of transformers of up to 500 kV and share them in the event of a coordinated act of deliberate, documented terrorism that destroys a transmission substation, and the President declares a state of emergency. To participate in STEP, participating utilities pay enrollment fees of $10,000 and annual dues of $7,500, funds that are typically recovered in rates. SpareConnect. This less formal voluntary mutual assistance initiative spearheaded by EEI builds on existing communication channels to allow them to meet technical needs during an emergency or non-routine failure not connected to terrorism. Grid Assurance. The goal of this company, formed in 2016 by six power companies in 2016—Edison International, Berkshire Hathaway, Great Plains Energy, American Electric Power, Duke Energy, and Eversource Energy—and which became fully functional in January 2018, is to provide physical equipment, manpower, and logistics during disasters. Transmission owners subscribing to the service have access to inventory pools of at least 100 transformers that cost between $2 million and $10 million, storage, and transportation support. FERC in March 2016 backed the initiative, ruling that subscribers would not have to pursue full rate cases to recover costs but could instead use single-issue ratemaking. “We have transmission owners as subscribers and plan to place an equipment order later this year,” Michael Deggendorf, CEO of Grid Assurance, told POWER in March. “Current and potential subscribers tell us step-up transformers are an option they would like included in their resiliency efforts, so we are looking at adding step-up transformers to our solution.” Wattstock. Another private company, Wattstock maintains a member-based national transformer inventory program for spare coverage located at regional distribution centers that can be shipped within weeks of an emergency event. The inventory includes nine generator step-up transformer models, which represent 97% of the traditional MVAs in the market, five transmission models, and WattStock Flex Transformers for quick delivery and easy installation. RESTORE (Regional Equipment Sharing for Transmission Outage Restoratation). In November 2016, Southern Co., Louisville Gas and Electric Co., Kentucky Utilities Co., PPL Electric Utilities, and the Tennessee Valley Authority launched a regionally focused voluntary transformer-sharing initiative. Spare Equipment Database (SED). This NERC-developed initiative is a voluntary program that facilitates sharing of both transmission and generator step-up transformers. Grid operator initiatives. At a regional level, meanwhile, grid operators are pushing wholesale market participants to maintain spare transformer inventories or at least have spare equipment on hand. PJM, for example, has a regional transmission expansion program that requires owners and operators to procure a certain number of spare transformers based on a risk assessment. The Midcontinent Independent System Operator, meanwhile, requires owners and operators to provide descriptions of spare inventories, and the California Independent System Operator requests emergency operating plans and resources for responding to major events. |

However, the DOE noted in its report to Congress, major shortcomings still exist that could require federal intervention. Industry has urged the government to play a larger role in transporting spare LPTs, especially in emergency conditions. Industry has attempted to resolve the problem on its own, establishing in 2014 the Transformer Transportation Working Group at the request of the Electricity Subsector Coordinating Council. That group of 70 industry executives has been working to speed up LPT transportation, developing an emergency support guide with railroads, the heavy hauler industry, federal agencies, and the National Guard. Industry stakeholders also underscored that critical equipment and personnel are needed for adequate storage and installation of replacement LPTs, along with critical components like bushings and circuit breakers.

As critically, the study noted that a dearth of information exists for GSUs. While these components share manufacturing supply chains, material requirements, and transportation resource requirements, generating station vulnerabilities differed from those of network substations, the DOE noted. “More information will be needed to assess the need for additional spare GSUs, including their specific characteristics and vulnerability profiles of crucial power generating stations, comparative lead times to replace GSUs, and the availability of spare GSUs.”

Technology Is Transforming the Transformer

In the backdrop, industry is also developing a new generation of transformers that will address resiliency concerns. Armed with funding from the DOE’s Transformer Resilience and Advanced Components program, a handful of designs are making headway to increase sharing and accelerate recovery.

A Modular Controllable Transformer. Georgia Tech Research Corp., ORNL, Delta Star, and Southern Co. have teamed to design a modular controllable transformer that can be paralleled as needed to realize power ratings in the range of 100 MVA to 500 MVA. The transformer could support grid operations under single or multiple transformer failures, providing flexibility in configuration, load balancing, transportation, and faster restoration.

High-Frequency Link Transformer. NextWatt, the National Center for Reliable Electric Power at the University of Arkansas, and General Electric (GE) are developing a design for a solid-state, modular high-frequency link LPT rated at 100 MVA with a high-side voltage of 115 kV, variable low-side voltage, and variable impedance capability. According to the DOE, the concept is targeting an average cost of $15–$22/kVA, lifetime of more than 40 years, and an efficiency of at least 99%, which is comparable to current LPTs. Among the concept’s notable characteristics is that it could be a third the size and weight of a conventional LPT, easing transportation concerns.

Grid-Ready Flexible LPT. GE is also developing a separate flexible LPT capable of accommodating multiple standard voltage ratios in the transmission network as well as providing an adjustable impedance to match that of a failed transformer to be replaced. A three-phase LPT is proposed with power capacity ranging from 300 to 600 MVA, high-side voltage of 345 kV with configurable taps at the low-voltage side for operation at 115 kV, 138 kV, and 161 kV, and adjustable impedance from 4% to 12%. “The key innovations in this project include multiple transmission class voltage taps at the low-voltage side; a method for selecting the transformer impedance without changing the voltage ratio; and arrangement and connection of all the extra windings to minimize stresses,” the DOE noted.

Novel Flexible and Resilient LPT. Zurich-headquartered ABB, a global transformer supplier and innovator, and The University of Tennessee, Knoxville are investigating a design for an LPT comprised of easily transportable, standardized building blocks, which house several transformer modules. During the project, various design possibilities and system architectures will be explored to enable high-side voltages ranging from 115 kV to 500 kV, low-side voltages ranging from 69 kV to 230 kV, and power levels up to 500 MVA.

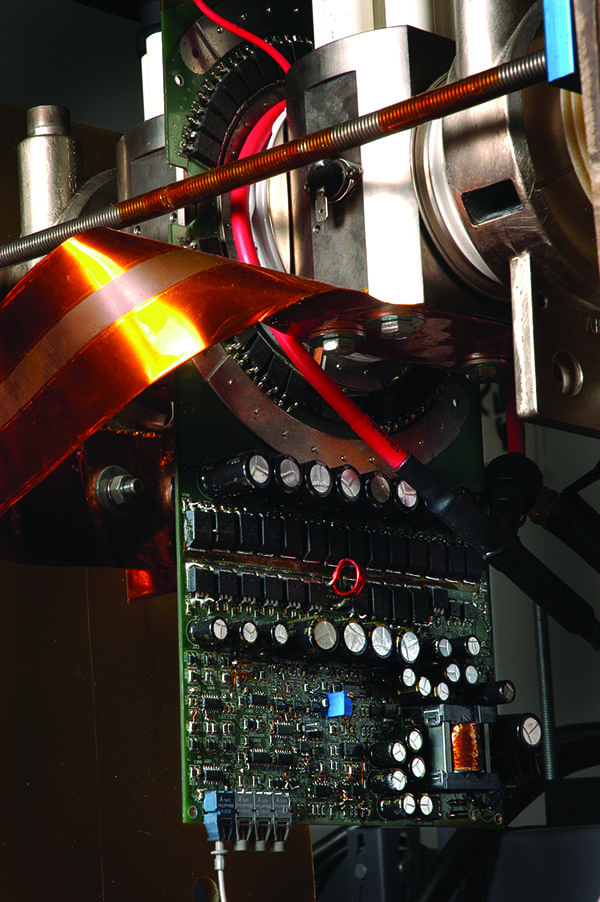

Flexible Solid-State LPT. North Carolina State University and Carnegie Mellon University are also developing a Flexible Large Power Solid State Transformer (Figure 3), a modular solution where flexible voltage ratings will be achieved by series/parallel connection of a basic building block (5 MVA). The blocks will comprise a power electronics-based medium-frequency transformer to achieve voltage isolation and variable step-up and step-down voltage ratios. “The use of standard building blocks can reduce manufacturing and inventory cost and enable greater interchangeability,” the DOE said.

Recovery Transformer (RecX). The Department of Homeland Security (DHS) Science and Technology Directorate (S&T) and the Office of Infrastructure Protection partnered with EPRI, CenterPoint Energy, and ABB to develop a 60-ton rapidly deployable extra-high-voltage transformer design that it successfully demonstrated for one year ending in March 2013 in Houston (Figure 4). According to the DHS, the three 345-kV/138-kV transformer prototypes were installed and energized in less than six days (106 hours), which included a 25-hour road journey from a temporary storage site at the ABB factory in St. Louis, Missouri, where they were designed and manufactured. The RecX transformers reached peak load of 330 MVA on August 9, 2013, which is approximately 55% of their 600 MVA design capacity. However, while RecX was deemed a suitable replacement for more than 90% of 345-kV to 138-kV transformers, no additional units have been sold or larger models manufactured.

In a report describing lessons learned from the RecX project, EPRI and the DHS lauded recent technology achievements and industry efforts to facilitate LPT sharing, but they noted a long-term strategy is needed. One recommendation they offered is that as stakeholders assess new transformers to replace the aging ones now in service, stakeholders should exploit the opportunity to adopt a “more broadly applicable transformer design” with rapid deployment characteristics to make replacements and spares easier to access and install.

To realize that vision, original equipment manufacturers (OEMs) would need to move toward design and manufacture of such a transformer for conventional use and for spares, giving industry “a better product” for its pressing needs. Regional grid operators and industry would also need to work closely with OEMs to define these designs, “with an eye towards migrating these design features into ‘conventional’ transformers that are installed as existing units are retired; and ultimately standardizing these designs first within utility service territories, and then within regions where possible,” the report says.

This may sound far-fetched, but all stakeholders have evidently come together to guard against disasters affecting their common grid, so perhaps a shared determination for resiliency will evolve into the heart of the matter. ■

—Sonal Patel is a POWER associate editor.