By Kennedy Maize

Remember the nuclear power renaissance coming any day soon now? Fugetaboudit.

While the stars seemed aligned for new nuclear power in the U.S. in 2005 when Congress passed the Energy Policy Act, it’s all turned brown and runny. The promise of some $15 billion in loan guarantees for new nukes in the U.S. in the subsequent four years turned into fool’s gold. While the cost for new nukes escalated dramatically, the Bush administration dragged its feet on loan guarantees. Nothing new has happened so far in the Obama regime.

As the promise of the 2005 act unfolded – very, very slowly — the world economy collapsed, The prospects that the private sector in the U.S. would finance new, untested nuclear plants with ever-rising price tags and uncertain markets essentially vanished. Nothing was working for the U.S. nukes. The financial markets disappeared. The regulators – the Nuclear Regulatory Commission – were characteristically slow in responding to new, allegedly-standardized, reactor designs. The U.S. Department of Energy was typically feckless in implementing the largely-incoherent 2005 energy act.

Meanwhile, the world nuclear energy industry – the French, for the most part – were establishing that they knew far less about nuclear engineering and economics than they had projected to the rest of the world over decades. Their hubris faltered in Finland, and followed in Flamanville, France.

The undoing of the French approach to the nuclear renaissance has come at the Olkiluuto project, adding a third reactor at an existing site. Areva, the French nuclear reactor builder, has been building a newly designed, 1,600-MW evolutionary pressurized water reactor at the site, with a sister station underway at the existing Electricity de France site at Flamanville. The new reactor is Areva’s nuclear future. It’s an uncertain prospect.

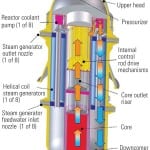

Areva has touted the new design as more robust, less likely to have accidents, and more capable of accident response relying on passive features such as gravity, convention, and natural circulation. While not yet approved in the U.S., Areva is pushing its third-generation reactor design to U.S. utilities, arguing that it is the only one of the new generation of reactors that is actually under construction. Baltimore-based Constellation Energy wants to put an Areva unit at its existing Calvert Cliff site on the Chesapeake Bay. But Areva’s pitch that it is the only “real” reactor among the contenders for the nuke revival may not be a really good sales point.

The reactor in Finland has long been over budget and behind schedule. The New York Times reported recently that the price of the reactor, originally pegged at $4.2 billion, is now at least 50% higher. Originally set to start up this summer, Areva is no longer willing to predict when the plant will generate commercial electricity. A clone of the “standardized” plant in France is also over budget and lagging in its schedule, the Times reported.

Noted energy economist Paul Joskow, no enemy of nuclear power, told the Times, “The rollout of new nuclear reactors will be a good deal slower than a lot of people were assuming.” The renaissance, at least in the U.S. and Europe, is largely stagnant. China and India may be a different story.

There are many aspects to why the dream of a new nuclear power revival in the West is unlikely. In the U.S., the notion of “standardized” plants is confounding. U.S. advocates and vendors of new nuclear reactors have cited the French experience, where the state-owned utility, EdF, built only one generation after another of largely cookie-cutter reactors (based on Westinghouse technology) as it rolled out its fleet of nuclear plant.

The U.S., by contrast, built one-of-a-kind plants, even with the same company’s technology. That, it turned out, was a big mistake, vastly increasing costs, complication reactor operations, and otherwise making life difficult for nuclear utilities and the federal regulators. The proliferation of nuclear technologies in the U.S. made a major contribution to the collapse of the nuclear power plant market in the late 1970s, although that was only a part of the problem.

So the U.S. vendors, as they contemplated the possibility of a new generation of reactors in the 21st century at the end of the 20th century, pledged themselves to standardization “down to the wallpaper and carpet” for new plants. Good idea. Hard to implement in practice.

What has that term “standardization” meant? The NRC has approve a handful of new generation of “standardized plant” designs over the past 20 years, suggesting that “standardized” means a bunch of different designs, varying by vendor. The agency has approved two pressurized water reactor designs, both from Westinghouse, two boiling water reactor designs, both from General Electric, and is considering a third PWR, Areva’s design. The Areva plant has not yet won approval for construction in the U.S.

Once construction begins, many nuclear engineers suggest that the notion of “standardization” will undergo another redefinition. “You can’t predict what real challenges a site will present. You can’t predict what will happen when it comes time to turn a blueprint into a real plant,” said one nuclear engineer. “’Standardization’ is a political term. It makes no engineering sense.”

The case of Areva’s Finnish plant, according to the Times, demonstrates that conundrum. The company has acknowledged serious errors in the analysis of the geology of the site and the construction of the basemat – the foundation – of the giant plant. There have also been errors in construction of the reactor vessel. According to the newspaper, Areva has acknowledged that the first-of-a-kind plant will come in at $8 billion, double the original price. Areva blames Finnish regulators for the delay and cost hikes. That’s probably bogus; the Finns have a worldwide reputation for savvy and effective nuclear regulation.

In France, according to the newspaper, regulators have found fault with the concrete basemat pourings and rebar reinforcements at the new plant. The state regulators have also charged that welders working on the reactor containment were not nuclear-qualified, the newspaper reported.

All of this is reminiscent of the bad old days of the 1970s and the first boom in nuclear power construction. A lot of bad work got done, much of it caught by nuclear regulators, but too much overlooked.

Today, far fewer new nuclear generating projects are proposed, and even fewer are underway. But the performance suggests that too few lessons from the past have sunk in.

Seeing the events of the past and the recent events, I suspect that investors will perceive what is going on in the current boomlet unfavorably. They will be unwilling to commit scarce funds in the midst of a worldwide recession to such questionable investments. Bye, bye, nuclear pie.