It’s an article of faith in large parts of the U.S.—at least among power industry people—that organized and Federal Energy Regulatory Commission (FERC)–regulated “merchant” interstate power markets are the best way to ensure a sufficient supply of electricity, as well as to ensure fair and equitable prices for ratepayers. On that basis, large areas of the U.S. have, over the last few decades, stood up what are called Independent System Operators (ISOs) or Regional Transmission Organizations (RTOs).

Unlike vertically organized and regulated monopoly utilities, power markets were seen as a way to ensure competition for generation, sufficient power capacity to meet load, and create a reserve margin that would make users, state governments, and regulators comfortable that the system will hold even on the hottest and coldest days of the year. This paved the way for the creation of independent power producers (IPPs), companies that generate power and sell it into the market, but not directly interact with users and have no direct role in electric transmission and distribution.

Most of these plants were already in service, and under the Federal Power Act and FERC orders, their power plants had to be sold to separate them from the local distribution utility. Alternatively, in a few cases they were sold to an unregulated “affiliate” of that utility. But now as independent generators, they would participate in a market, taking merchant risk, and bidding into the market.

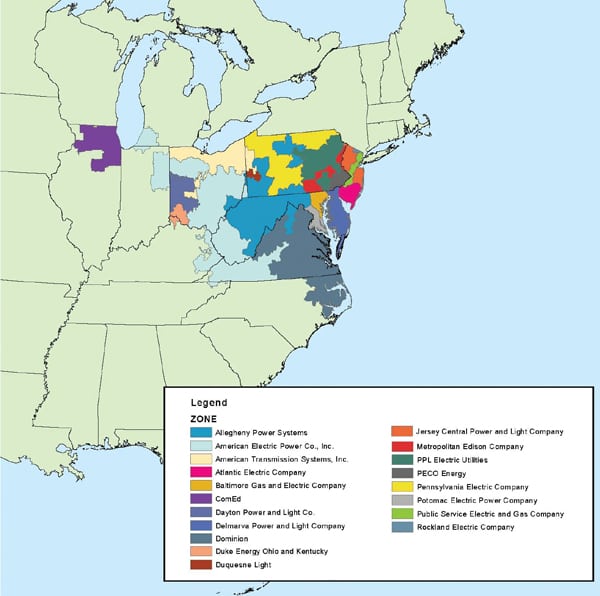

Most but not all (for example, ERCOT) of these regional organizations also recognized that many of these plants would not run 24/7, and certainly not always at their nameplate capacity. This means that unless the plants were selling their maximum output at or above a given price, they would be uneconomic and subject to closure. Thus was born in PJM, the largest electricity market in North America, the Base Residual Auction (BRA).

The BRA is intended to support the Reliability Pricing Model or RPM. Simply put, each plant bids the capacity to generate a certain amount of power over a one-year period, for delivery three years in the future. Any plant whose bid meets or is below the “clearing price” is accepted in merit order, up to the megawatt capacity that the RTO/ISO has determined it will need plus a reserve margin, called the demand curve. The price is set when supply meets demand. A few years ago, PJM specifically upped its requirements, including major penalties for accepting capacity payments but then unable to meet their capacity obligations on those payments when called upon.

Nonetheless, these auctions have been operating for more than two decades, and they generally work well by all accounts. Yet, because of a number of market concerns, deteriorating plant economics, state subsidies to specific generators— including nuclear units—proposed subsidies to clean and renewable energy, such as for offshore wind and utility-scale solar, some states are proposing that the generators within their boundaries opt out of PJM’s capacity market and instead participate in an alternative market called the Fixed Resource Requirement (FRR) market. And FRR has stirred the pot in a way that perhaps few other market proposals have. The idea of FRR is not new or revolutionary even though it is perhaps surprising and unsettling to some market participants and stakeholders that took capacity markets for granted. The PJM tariff, in fact, provides for an FRR alternative.

Why an FRR? Well, recent FERC decisions in December 2019 and March 2020 on the Minimum Offer Price Rule (MOPR), raised the floor prices for new resources that receive state subsidies—typically, renewables or other carbon-free generation. The interest and intrigue had actually started earlier in 2018, when PJM proposed market rule changes to FERC, to account for and offset concern about market price suppression, due in large part to zero-emission credits (ZECs) to nuclear generators, to value what they called unpaid-for environmental and societal benefits from non-carbon generation. FERC agreed that out-of-market payments such as ZECs distorted the competitiveness of the market, and that PJM’s existing MOPR failed to sufficiently address the problem under the Open Access Transmission Tariff (OATT).

Since then, ZECs have been established and are being paid in New York, Illinois, and New Jersey, and Ohio, and being considered in other states including Pennsylvania and Maryland. Legal challenges to them have failed in both their respective federal district and appeals courts by a consortium of competitive generators that had argued that price-setting for interstate power markets is the exclusive province of FERC, and that ZEC payments violated the Commerce Clause of the U.S. Constitution, among other things. FERC then ordered PJM to delay its BRA for the power year 2022–2023 pending new rules regarding out of market payments and subsidies.

As you might imagine, there’s been more than a little opposition to generation resources backing out of established competitive energy markets and opening to door to FRR. The Retail Energy Supply Association (RESA) said: “RESA is concerned that the FRR alternative will likely reduce market competition and have an adverse financial impact on customers as well as third party suppliers.”

And in a June 24, 2020 news release aimed at New Jersey, the Electric Power Supply Association (EPSA) said: “Pursuing an FRR would create new reliability challenges, reduce competition, and inhibit, not advance, the achievement of New Jersey’s goals, all while putting the risk of poor investments on the backs of New Jersey consumers.”

Similarly, as noted in an article in Energy Choice Matters, the New Jersey Office of Rate Counsel warned of “many unwanted and expensive consequences” and The New Jersey Large Energy Users Coalition “urges the Board not to pursue the Fixed Resource Requirement alternative, as this largely untested, uncertain and risky remedy would represent a clear case of the prescribed ‘cure’ being far worse than the disease.”

Others have a different view. Proponents say FRR will provide alternative revenue for new renewable energy resources that promote state clean energy goals, otherwise unavailable because of the new MOPR rules. Of course, they’ll have to do this with care; they’ll need to understand, and justify, the specific benefits to their states and the associated costs, and in they’ll be locked into FRR for at least five full years as required in the PJM Tariff.

As energy consultant and former FERC advisor Rob Gramlich told Utility Dive in 2018, “If the FRR opt-out can be made workable, that might be a good thing for clean energy and consumers.” Capacity markets, “which procure the wrong product and prevent full clean energy participation, are no friend of clean energy,” said Gramlich.

Interestingly, PSEG and Exelon Generation support a sort-of hybrid model with two tiers that they say will not inhibit retail generation. It will have a carve out for offshore wind and solar with a ceiling price. “The State would establish a limit on the all-in price it is willing to require customers to pay for capacity bundled with environmental attributes, to ensure the program remains affordable,” the companies said in a May 20 joint filing with the NJBPU.

Of course, it’s a curious coincidence that PSEG just announced its intention to get out of the competitive generation business with the exception of its nuclear fleet, now buttressed by $300 million in annual ZEC subsidies. According to POWER magazine, PSEG has become the latest major U.S. power company to seek an exit from the competitive generation business. Ralph Izzo, PSEG chairman, president, and CEO, said the company is “exploring strategic alternatives” for non-nuclear generating assets—which includes more than 6,750 MW—owned by the company’s competitive arm, PSEG Power. He made clear that “Our intent is to accelerate the transformation of PSEG into a primarily regulated electric and gas utility.”

PJM hasn’t issued a news release or a formal statement on the issue, but it does offer a one-pager on its website issued this January that says: “A party is eligible to elect the FRR alternative if they are an investor-owned utility, an electric cooperative or public power entity. And they must be able to demonstrate that they have sufficient resources available to meet the reliability requirement for the FRR service area, which is generally the projected future demand for electricity plus a reserve margin.”

One thing is for sure: there’s going to be a lot of back and forth in the halls of state capitals and in Washington over this issue, which has become an enormous controversy in North America’s largest competitive energy market.

—David Gaier is an experienced corporate communications professional and previously a spokesman for two major public energy companies. He has also worked in-house and in agencies across several industries and is a Marine Corps and Foreign Service veteran.