A spate of major power companies—including American Electric Power (AEP) and Southern Co.—have acquiesced to investor pressure and announced drastic cuts to their generating fleet carbon emissions over the long term. Industry group Edison Electric Institute (EEI) this week launched an official industry-designed template to help its member utilities better inform investors about their environmental, social, and governance (ESG) and sustainability initiatives.

The EEI’s ESG/Sustainability reporting template launched August 27 is a voluntary resource aimed at helping the trade group’s investor-owned electric company members to provide the financial sector with more uniform and consistent ESG/sustainability data and information. Investors, asset managers, and ratings agencies say that information is increasingly important in assessing corporate performance and risk.

Explosion of Interest in ESG

ESG typically involves a range of factors used to evaluate companies and countries on how far they have advanced in their quest for sustainability. “Sustainability”—which industry observers note is often used broadly and abstractly—is defined by the American Institute of Certified Public Accountants with a “triple bottom-line” consideration: economic viability, social responsibility, and environmental responsibility.

Environmental considerations, often a focus in sustainability initiatives, could include contributions companies have made toward tamping down greenhouse gas emissions to combat climate change. Social considerations include human rights and labor standards, and governance relates a company’s internal controls, including leadership and shareholder rights.

As Georg Kell, chairman of ESG quant fund manager Arabesque, noted in a recent blog post for Forbes, ESG —a term first coined in 2005—has seen a remarkable rise on the investment front. “Today, ESG investing is estimated at over $20 trillion in [assets under management] or around a quarter of all professionally managed assets around the world, and its rapid growth builds on the Socially Responsible Investment (SRI) movement that has been around much longer.”

Interest in the power sector’s ESG initiatives, specifically, has ramped up of late, the EEI noted as it launched its template this week. The EEI said its template will help companies present qualitative information, including as it relates to ESG/sustainability governance and strategy. The template also is designed to help companies report quantitative information, including data on capacity and energy, pollutant emissions, and human and natural resources. As significantly, it could help companies inform investors about risks from stranded assets and regulatory issues, as well as capital expenditures, and potential investments in carbon-free resources, and future growth trajectories.

The EEI said Version 1 of the ESG template, launched as “the first and only industry-focused and investor-driven ESG reporting framework,” explicitly allows for flexibility in what is reported by each company. It stems from efforts by a broad working group the EEI assembled in 2016 to address growing requests by investors for company ESG and sustainability data. The working group is comprised of institutional investors who specialize in asset management, investment banking, and buy-side and sell-side research, as well as power company officials from accounting, finance, treasury, investor relations, and legal divisions, the EEI said.

The EEI rolled out a pilot template in December 2017, with more than a dozen major power companies incorporating the template in their financial reporting. Those companies included (names are linked to templates): American Electric Power (AEP), Alliant Energy, Ameren, DTE Energy, Duke Energy, Edison International, Entergy, Eversource Energy, Great Plains Energy, NiSource, Pacific Gas and Electric, PSEG, UNS Energy, and WEC Energy Group.

More companies participating in Version 1 of the EEI ESG template are expected “to publish their 2017 data in the coming weeks,” the EEI said. That information will likely be available on the investor relations or sustainability sections of company websites, it noted.

Duke Energy on August 27, for example, released an updated ESG report with 2017 data, based on the template, which the company said incorporated feedback from company investors. “We’re committed to transparency and engagement with investors, customers and other stakeholders,” said Mike Callahan, Duke Energy’s vice president of investor relations. “Our investors are increasingly focused on ESG and sustainability matters. We’re providing them with the information needed to better incorporate ESG into their investing strategies.”

WEC Energy Group on August 28 also released its 2017 data in a Version 1 release, a document that notes that the company “eliminated” more than 1 GW of coal capacity through retirements or gas conversion between 2000 and 2017—and that it will retire 1.8 GW more coal capacity between 2018 and 2020. The company plans to invest in more than 400 MW of gas generation within the next four years, and it has filed for approval to built its first 200-MW solar generation facility as well as a 150-MW solar project with battery storage. “We’ve adopted this template as part of our ongoing commitment to demonstrate accountability and transparency,” said Gale Klappa, WEC Energy chairman and CEO in a statement. “This template will make it easier for stakeholders to track our progress as we reshape our generation fleet and modernize our infrastructure.”

Brian X. Tierney, AEP executive vice president and chief financial officer, agreed on August 30. “As the demand for ESG disclosure continues to grow among investors, so does the need to provide accurate and consistent data that is relevant for AEP and our industry,” he said as the company released its updated ESG/sustainability report.

For now, according to some utilities, the payoff looks solid. Eversource Energy, for example, says it is actively engaged with ESG investors, reporting “that more than 100 ESG funds have recently added Eversource shares to their portfolios.”

Investor Signals Drive Industry Decarbonization

EEI’s launch of the template comes a week after the Trump administration proposed a rule governing greenhouse gas (GHG) emissions from existing coal-fired power plants, as debate swirls around the rule’s potential impact on coal-fired power plants, which have suffered economically owing largely to regulatory and market forces, including a surge in cheap natural gas and the widespread renewables build-out. A number of experts who spoke to POWER this week noted that the new rule, which would give individual states the power to determine how to regulate power plant emissions—or whether to regulate them at all—may not make a difference when it comes to the market for coal-based power.

As EEI told POWER on August 27, its member companies—which include all investor-owned electric companies in the U.S.—are more “focused on ensuring that they can continue to provide reliable, affordable, and increasingly clean energy for all customers.” To dodge the uncertainty posed by federal regulations or state policies, which often hinge on politics, power companies are leaning on shareholder and customer preferences to shape their futures.

Pointing to a latent shift in company attitudes toward investor-championed sustainability, a growing number of major companies have publicly announced transitions to low-carbon fleets in recent years:

- On August 2, Madison, Wisconsin–headquartered Alliant Energy announced a goal to cut carbon emissions 80% compared to 2005 levels and eliminate all existing coal from its energy mix by 2050.

- In April, Southern Co. announced a long-term goal of low- to no-carbon operations by 2050 on an enterprise-wide basis. As part of that goal, Southern will target a 50% reduction in greenhouse gas (GHG) emissions by 2030, saying it intends not to make investments in its existing thermal coal fleet unless the investment ensures safety, affordability, or reliability.

- Also in April, Exelon Corp. announced it would reduce its internal operation GHG emissions by 15% by 2022. That reduction primarily involves “driving down methane emissions from natural gas distribution systems, reducing losses from other GHG gas-insulated electrical equipment, and by investing in vehicle electrification.”

- In March, Duke Energy, one of the largest energy holding companies in the U.S., confirmed it is on track to meet a current goal to reduce carbon emissions 40% by 2030, which is consistent with a pathway to keep global warming below a science-based 2-degree-Celcius objective. On Tuesday, in its latest ESG update, the company said its gas-generated share, which was 28% in 2017, would rise to 42% by 2030, while coal’s share would drop from 33% in 2017 to 16% in 2030.

- This February, AEP, one of the nation’s largest power generators, launched a strategy to reduce its carbon emissions by 60% from 2000 levels by 2030 (and 80% by 2050). In its August 30–released ESG/sustainability report, AEP said it has already cut its carbon dioxide emissions by more than 57% from 2000 emission levels. AEP expects to achieve more reductions through “investments in renewable generation and advanced technologies; investment in transmission and distribution systems to enhance efficiency; increased use of natural gas generation; and expanded demand response and energy efficiency programs.”

- In January, PPL Corp. announced a goal to cut its carbon emissions by 70% from 2010 levels by 2050.

- Last year, Ameren Missouri announced a targeted 35% carbon reduction by 2030 (and a 50% by 2040) from 2005 levels.

- Detroit-based DTE Energy also announced a plan to slash its carbon emissions by more than 80% from 2005 levels by 2050. Xcel Energy, meanwhile, said it expects to see at least a 50% reduction companywide in carbon emissions from 2005 levels by 2022.

- FirstEnergy, en route to shedding its competitive arm FirstEnergy Solutions, has said it wants to slash its carbon emissions by 90% compared to 2005 levels by 2045.

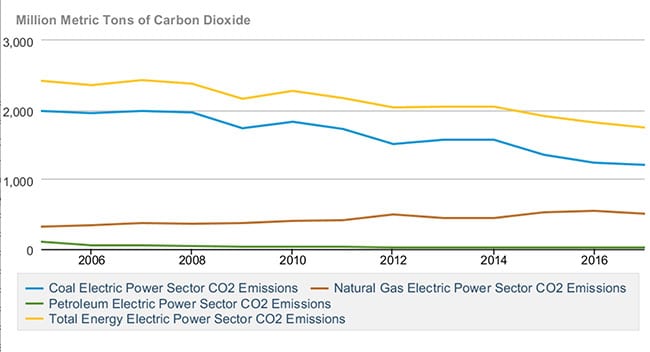

Industry’s efforts to implement “a clean energy future” have paid off. Power sector carbon dioxide emissions fell to nearly 27% below 2005 levels as of the end of 2017, even though the Obama-era Clean Power Plan was never implemented. Efforts to tamp down air pollution also reduced emissions of nitrogen oxides by 84% and sulfur dioxide by 92% compared to 1990 levels, the EEI noted.

Investor Perspectives on Carbon Reporting

But according to EEI President Tom Kuhn, the EEI’s pilot reporting template not only had a high level of member participation, it was also well-received by investors, key stakeholders, and customers. “The updated template will allow electric companies to present their ESG and sustainability-related efforts in an accurate, timely, and concise manner that is favored by investors,” he said on August 27.

Marisa Buchanan, deputy global head of Sustainable Finance for JPMorgan Chase, agreed, saying her firm was excited to see the template’s launch. “As ESG goes mainstream, the disclosure template will help lenders, investors, and EEI member companies engage on the most important ESG and sustainability matters for the electric power industry,” she said.

As credit ratings agency Moody’s Investors Service told POWER on August 29, ESG initiatives don’t constitute specific factors it routinely uses to determine credit ratings (or opinions) to gauge the creditworthiness of an entity. However, the agency noted that in June 2016, it identified four primary categories of risk associated with carbon transition that it has since used to assess credit implications for corporate and infrastructure sectors.

The risk categories include: policy and regulatory uncertainty regarding the pace and detail of emissions policies; direct financial effects such as declining profitability and cash flows owing to higher capital expenditure and operating costs; demand substitution and changes in consumer preferences; and technology developments and disruptions that could cause a more rapid uptake of low-carbon technologies. The ability of individual entities to mitigate these risks depends on their relative exposure and their financial, operational, and technological flexibility.

In the U.S., where about 35 GW of coal-fired and nuclear power generation capacity is set to retire over the next five years, one factor that could have a direct economic impact on generators, especially in deregulated markets, is excess power supply, Moody’s noted in a June 2018 report. About 32 GW of new generation capacity is under construction and due to be added by 2023—and most is gas-fired. About 72 GW of renewable generation is either in advanced development or under construction, and most of it will be in service by 2020, the agency noted. The negative impact of excess supply could be exacerbated by electricity usage, which could decline more than 2% a year over the next five years, the agency said, citing PJM.

Sustainability developments are also carefully watched by indices, which essentially serve as benchmarks for investors that integrate sustainability considerations into their portfolios. Some indices are the 1999-launched family of Dow Jones Sustainability Indices, and the 2009-launched Nasdaq CRD Global Sustainability Index, which measures the performance of 400 public companies, including, as of May 2018, AEP and Alliant Energy.

According to Michael Muyot, president of CRD Analytics, ESG reporting makes sound business sense. “We are in the midst of a major paradigm shift toward a low carbon future,” he noted in June. “The innovating business leaders are benefiting three-fold for their boldness; first they were forced to be more efficient which is translating into better profits margins, second, they are getting more investments from global banks and firms looking to reduce their long-term risk and third their brand is attracting top-notch talent in a highly competitive market for 21st Century workers.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)