China has been battling—and losing—a “war” on air pollution for years. Stepping up its efforts, the country recently issued new policy measures, tougher even than those in the U.S. and European Union, that could have big implications for its coal power sector.

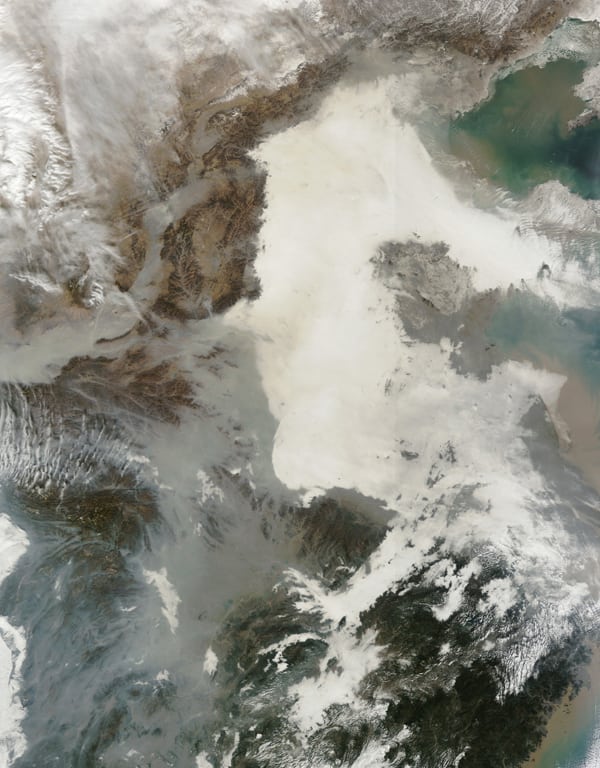

Reports that heavy smog has blanketed large swathes of China’s provinces have become so ubiquitous that it’s easy for readers halfway around the world to think of these episodes as just another passing crisis. But for China, worsening air pollution is an insidious, pervading plight that has scarred citizen health as well as its economy. In the northern provinces, including the capital, Beijing, hazardous fine particulate matter (PM) levels periodically exceed World Health Organization (WHO) limits by a factor of 20. Dense haze has grounded flights, closed highways, stalled construction, shut schools and factories, and even impeded photosynthesis and threatened agriculture in some regions.

Beyond the usual emergency measures, “smog panic” over more frequent “airpocalypse” events (see sidebar) has incited public protest—even prompting the first-ever citizen lawsuit against a local government for failing to rein in pollution this February. But the government, too, has recognized the crisis, decrying pollution’s long-term threats to livelihood and embarking on what the Ministry of Environmental Protection (MEP) calls a “herculean task.” The government has vowed to use an “iron fist” to win the “war on pollution.”

|

Over the past few years, the government has unleashed a bevy of laws, standards, regulations, action plans, and other policies at national and regional levels that are directly related to even broader policy measures, including for energy, energy conservation, industrial policy, and technology promotion. But China’s air pollution policies and related legal and administrative structure are so complex, “[m]any experts in China generally are knowledgeable only about policies related to their specialized area, so it is difficult to understand the overall picture, even by talking to a range of experts,” note Xinyan Lin and Mark Elder in their most recent assessment of China’s air pollution policies for the Institute of Global Environmental Strategies (IGES).

The 12th Five-Year Plans

Even so, it is apparent that China has steadily strengthened its formal policies on air pollution, making tremendous progress during the first half of its 12th Five-Year Plan (FYP) period. The set of plans that guide the nation’s course on social and economic measures from 2011 to 2015 prioritizes air pollution management more than in previous periods, but it allows local governments to formulate their own energy conservation, environmental protection, and emission reduction plans to reach national goals.

Total Emission Control Program. Among major tenets of the most important 12th FYPs for environmental protection are those calling for the control of energy consumption and promotion of non–fossil fuel energy. China also seeks to update emissions targets in the Total Emission Control (TEC) program—the policy first implemented nationally in 1996 that requires the central government to set mass emission targets and prepare control plans, but requires local governments to achieve them.

The TEC, which some deem China’s most important air pollution prevention program, backs the 12th FYP Master Plan goals for emission reductions of 8% for sulfur dioxide (SO2) and 10% for nitrogen oxide (NOx) and calls generally for a 16% energy intensity reduction. It also promotes the accelerated closure of old, inefficient facilities and the installation of denitrification equipment. Experts observe that compared to the 11th FYPs, which focused on desulfurization, current plans concentrate on denitrification. For example, since the start of 2013, coal power plants that have installed NOx controls enjoy subsidized pricing (when selling power to the State Grid Corp. of China) that helps them cover the costs of pollution equipment.

Prevention and Control of Air Pollution in Key Regions. Another noteworthy 12th FYP is the “Prevention and Control of Air Pollution in Key Regions” that was co-issued by the MEP, the Ministry of Finance, and the National Development and Reform Commission (NDRC)—the “super-ministry” directly under China’s highest administrative body, the State Council, that has responsibility for economic, energy, and climate change planning. That plan designates three major regions and 10 city clusters for the joint prevention and control of air pollution, mainly to deal with fine particulate and ozone emissions that travel over provincial borders. It also sets national binding emission reduction targets: SO2 by 12%, NOx by 13%, and PM by 10%.

Stemming from that plan, the State Council this May approved the “Airborne Pollution Prevention and Control Action Plan” that accelerates action in regions with the heaviest air pollution. The action plan requires two key economic regions—the Yangtze River Delta (comprising Shanghai, Jiangsu, and Zhejiang) and the Pearl River Delta—to reduce coal use by the end of 2017. The Beijing-Tianjin-Hebei area must also slash PM10 and PM2.5 emissions by 25% by 2017, while two large coal-consuming provinces to the northeast of Beijing—Liaoning and Jilin—must limit growth in coal use to less than 2% per year from 2013 to 2017. The action plan is reportedly backed by 1,700 billion yuan ($277 billion) in investments from the central government.

Blue Sky Science and Technology Project. One interesting aspect of China’s pollution-curbing measures is that the country is simultaneously striving to develop viable industries from pollution control technologies. A special 12th FYP, the Blue Sky Science and Technology Project, issued by MEP and the Ministry of Science and Technology, calls for new projects worth a combined $16 billion to expand the environmental protection technology market. Human resources and capability building are among the plan’s highest priority areas.

The State Council’s Action Plan

Perhaps the two most-referenced national policy developments to have been announced in the aftermath of the Beijing crisis (see sidebar) were Premier Li Keqiang’s proclamation of 10 major air pollution measures at a State Council executive meeting in June 2013 and the State Council’s September 2013–issued “Action Plan on Prevention and Control of Air Pollution,” a follow-up document that serves as guidance for national efforts to prevent and control air pollution now and in the future.

The September 2013 action plan envisions that heavy air pollution, specifically in northern China provinces, will be “improved markedly” by 2017 and “gradually eliminated” five years after that. It also sets, for the first time, a reduction target of 10% for PM10 nationwide, and it slashes the level of fine particulate matter in the Beijing-Tianjin-Hebei region, the Yangtze River Delta, and the Pearl River Delta by 25%, 20%, and 15%, respectively, and requires that Beijing keep its annual concentration of PM2.5 at 60μg/m3.

The 10 measures outlined include efforts to shutter small coal-firing boilers; accelerate construction of desulfurization, denitrification, and dust-removal projects in key sectors; hasten the removal of “old vehicles”; and promote public transport. The plan also requires China to keep a “firm grip on newly added production capacity in high-energy consumption and high-emission industries.” As with the Blue Sky plan, this action plan fosters technological reform of enterprises and the environmental industry.

The action plan also directly tackles energy policy adjustments: It requires an increase in the supply of clean energy and a decline of coal use to below 65% of total energy consumption by 2017. Notably, it requires “negative growth” of total coal consumption in the Beijing-Tianjin-Hebei region, the Yangtze River Delta, and the Pearl River Delta. It also requires raising thresholds to limit high-energy consumption in ecologically fragile areas.

The rest of the plan seeks to fortify China’s environmental policy regime, setting aside funds for subsidies, revamping policies on pricing and taxation to encourage private funds to participate in pollution control, and improving the legal system to ensure compliance.

Revising the Air Pollution and Control Law

On Sept. 9, 2014, as a new blanket of smog shrouded the capital, the Legislative Affairs Office of China’s State Council released the first draft of revisions to the 1987-promulgated Air Pollution Prevention and Control Law (Air Pollution Law), one of the country’s four bedrock air pollution laws. The release of the amended draft for public comment (which environmental groups lauded as a “big step” for government transparency) is a significant development. The Air Pollution Law has been amended only twice before, but the last revision made in 2000 still didn’t set specific details and mechanisms for enforcement, Barbara Finamore, an environmental law and energy policy expert who heads the Natural Resources Defense Council’s (NRDC’s) China Program, told POWER.

Discussions to revise the law were formally begun in 2006 but were stalled as focus shifted to the overhaul of another never-before-revised critical law, the 1990-promulgated Environmental Protection Law (EPL). China’s top legislature finally approved major amendments to the EPL in April 2014, making improvements that Finamore said are critical to pollution control efforts. As well as establishing a tougher penalty system (eliminating the minimal one-time fee system), they formalize a performance assessment system based on an official’s environmental protection record rather than solely on economic growth. “[The amendments that will take effect in January 2015 will give MEP] greater legal authority to regulate and penalize polluters,” said Finamore. And, uniquely, the amendments also allow for nongovernmental organizations to take legal action against polluters on behalf of the public interest.

Revisions proposed to the Air Pollution Law as outlined by the government in September bolster enforcement measures established in the EPL, Finamore noted. The draft law clarifies how emissions permits are granted and streamlines processes, establishes an air pollution source monitoring network, and demarcates key regions for pollution target implementation. Intriguingly, the amendments also call for (but do not set definitively) an increase in the scope of emissions caps and for new emissions control targets. They also ban construction of new projects in areas that exceed targets.

More significantly on a bigger plane, the draft seeks to “enshrine” in law tenets proposed in the September 2013 action plan, Finamore said. It essentially calls on the country to “establish a mid- and long-term coal consumption cap target, progressively reduce the proportion of coal in primary energy consumption, optimize the use of coal, and reduce the air pollution emissions from coal production, use, and transformation.”

Capping Coal Consumption

China’s first concrete measure to curb air pollution from its coal fleet—which produces about 73% of the nation’s power—came into force in January 2012. The “New Emission Standards of Air Pollutants for Thermal Power Plants” essentially requires that all pulverized coal combustion power generating boilers should met the emission standards for circulating fluidized bed boilers and that gas turbines of integrated coal gasification combined cycle units meet emission limit values for natural gas–fired turbines.

As of July 2014, that rule further tightens coal power plant emission limit values for particulates, SO2, and NOx, and from 2015, for mercury and mercury compounds. The IGES suggests that those standards are even stricter than comparable ones in the U.S., the European Union, and Canada.

For companies like the China Huaneng Group—the nation’s largest power generator and owner of 14% of China’s coal power fleet—the standards mean spending at least $1.61 billion this year alone on upgrades to equip its entire 111.4-GW coal fleet with desulfurization and dust removal equipment.

Moreover, in response to the 2013 Beijing event, several cities have passed measures to address air quality concerns beyond national efforts. As of June 2014, 12 of China’s 34 provinces have pledged to reduce their coal consumption by the end of 2017 compared to 2012 levels. Six of those provinces have absolute targets: Beijing by 50%; Chongqing by 21%; Tianjin by 19%; Hebei and Shaanxi each by 13%; and Shandong, China’s largest coal user, by 5%.

Soon thereafter, on Sept. 15, 2014, the national government set three new stringent quality thresholds that essentially ban the use of coal with more than 16% ash and 1% sulfur content in key population centers like Beijing and the Yangtze River Delta region. However, generators say the ban does not apply to coal consumption in power plants.

The combined measures could mean that nationwide, coal power’s share will fall from 73% (3,960 TWh) in 2013 to 58% (6,910 TWh) in 2030 and just 42% (5,870 TWh) in 2050, as the China Electricity Council projects in a March forecast.

Differing Views on Coal

But some observers note that China is already seeing a slowdown in coal consumption, because the country is moving toward greater reliance on the service sector than the industrial sector. Air pollution reduction targets combined with measures to address water scarcity issues afflicting the majority of China’s coal-fired power plant fleet (Figure 2) will only serve to steepen the decline of coal consumption, say financial specialists at nonprofit research group Carbon Tracker.

The organization, funded by U.S. and European charitable groups, warns that coal generators in China are facing a dismal future, and that at least 127 GW (about 40% of China’s 437-GW total) of existing capacity and 310 GW of expected future capacity will be at risk of stranding (uneconomic to run) by as early as 2020. It could also mean that about 1,030 million tons of annual thermal coal supply (56% of China’s demand in 2012) “may not have an end-market in 2020,” Carbon Tracker adds, pointing to possible repercussions for Australian and Indonesian exporters.

As consulting group Precergy points out, however, China is still expected to add 448 GW of coal capacity over the next decade, although this is 23% less than the 580 GW of coal power installed between 2004 and 2013 and less than the forecasted 535 GW renewables capacity additions over the next decade. Coal will continue to play a dominant role in China’s future power plans, the company says, pegging its claim on 2012 tariff reforms that it says make overnight capital costs for coal projects “relatively stable” and “greatly improve” project economics for coal plants.

The Carbon Proclamation

Because its economic prosperity is seemingly so highly dependent on coal, China’s pronounced signals in recent years to address carbon pollution are surprising. The country has already created seven regional cap-and-trade plans to trim emissions of greenhouse gases, and this August, a Chinese government official hinted that China was exploring the possibility of a nationwide cap-and-trade plan.

At the day-long United Nations (UN) climate summit in New York City this September, Vice Premier Zhang Gaoli announced that the country would adopt a national climate change plan—freshly approved by the State Council—to reduce the country’s carbon dioxide emission intensity (CO2 emissions per unit of gross domestic product) by between 40% and 45% by 2020, compared with the 2005 level. The announcement is significant for a country thought to emit almost 30% of the world’s CO2 emissions, the Global Carbon Project claims in a new study. However, the reduction may not appear so lofty considering that the NDRC estimates China’s carbon intensity already fell by about 29% between 2005 and 2013.

China is also reportedly studying a timeline for an absolute cap on carbon emissions in the 13th FYP period (2016–2020), which is certain to include a climate action plan, some experts suggest. At the same time, the Ministry of Finance is assessing the implementation of carbon taxes. According to the media, the National Energy Administration is drawing up a plan that will require China’s coal plants to meet a net thermal efficiency of at least 41% and emission levels similar to those of gas-fired plants. The plan may also require existing plants of 650 MW and larger to be upgraded within five years to meet those standards.

Other research institutes have proposed similar countermeasures that could come to fruition, considering China’s concurrent and equally severe water pollution and scarcity issues. Zhu Fa-hua, vice president of the State Power Environment Protection Research Institute in Nanjing, for example, recommends the nation develop its coal-fired power base in west China and transmit that power to east China.

On the periphery, the U.S.-based environmental group NRDC is working with 17 Chinese stakeholder groups to explore the possible implementation of a national coal consumption cap in the 13th FYP period. “What we’re looking at in this large research project is not just aspirational targets, but a mandatory and achievable cap that will cover the whole nation,” Finamore said.

Clear Gains

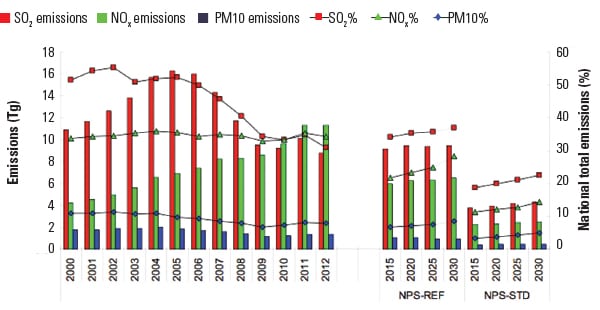

Most experts agree that the policy measures have paid off, somewhat (Figure 3). As of 2012, more than 90% of the electric power fleet and a large number of steel facilities were equipped with desulfurization technology. Data from the National Center of Climate Change Strategy and International Cooperation indicates that China has exceeded its SO2 reduction target (from power plants and other sources) by 123%.

Measures to shutter 77 GW of inefficient coal power capacity, as outlined in the 11th FYPs, are also on track, and the stricter emission standards for thermal power plants that went into effect in July 2014 are poised to shutter more by the end of 2015.

Also, notably, between 2004 and 2013, China installed 307 GW of new renewable capacity (constituting a third of all new capacity installed in that period), and the country is forging ahead with heavy investments in nuclear and gas power. That means that China’s total share of non-fossil energy reached 10% in 2013 (edging ever closer to the 15% goal announced at the September UN climate summit).

The country’s emissions future, too, appears less murky: Researchers from Tsinghua University in Beijing project in a recent study that China’s policies and an overall slowdown in the increase of energy consumption could result in an additional decrease of SO2 emissions by between 15% and 38% between 2010 and 2020, depending on the stringency of control measures. PM emissions from coal plants also could drop drastically over the same period, by nearly 40%, if small units and grate boilers are shuttered, as proposed, and wet flue gas desulfurization plays an important role in dust emission removal. However, China may continue to endure NOx pollution from power plants because insufficient NOx measures have been planned, the researchers claim.

Still a Cloudy Future

Yet other observers aren’t so optimistic that China can achieve its multiple, ambitious targets. One long-standing challenge lies in implementation. According to IGES, for example, MEP’s influence over provincial, regional, and municipal governments remains limited, forcing it to align policy efforts with a number of central government entities with more sway, specifically, the NDRC.

Beyond these measures, there’s much room for improvement, says Finamore, who was part of a team of environmental experts that in 2009 furnished MEP with an air pollution–curbing guidance document based on the U.S. experience.

The key difference between U.S. and Chinese standards is that U.S. standards are health-based rather than technology-based, she explained. “The key approach we would love to see in [China’s] air law amendments would focus on health. There’s also more room for specificity and stringency in air pollution law.” ■

— Sonal Patel is a POWER associate editor (@POWERmagazine, @sonalcpatel).