Gas

-

Coal

FERC Staff: Coal Generation Could See Comeback on Pricier Natural Gas This Summer

A much greater coal power burn is expected this summer in reaction to an anticipated rebound in natural gas prices, suggests a recent reliability assessment from staff at the Federal Energy Regulatory Commission (FERC). Among other key aspects of the new report is that while electric reliability for the rest of the nation will be adequate, Texas could see a significant chance of an energy emergency.

-

O&M

Improving Warm Weather Performance of the LM6000

The LM6000 is the most widely used aeroderivative combustion turbine (CT) in the world, with more than 1,000 installations. As with all CTs, power output and heat rate degrade markedly during warm weather. The ARCTIC (Absorption Refrigeration Cycle Turbine Inlet Conditioning) system eliminates this deficiency.

-

Gas

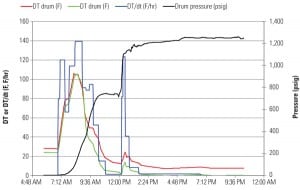

Fast-Start HRSG Life-Cycle Optimization

Modern heat recovery steam generator (HRSG) design must balance operating response with the reduction in life of components caused by daily cycling and fast starts. Advanced modeling techniques demonstrate HRSG startup ramp rates can be accelerated without compromising equipment life.

-

O&M

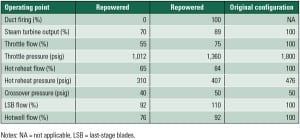

Repower or Build a New Combined Cycle Unit?

URS recently performed a combined cycle repowering study to determine the feasibility and economics of repowering an existing steam turbine that went into service in the 1950s. The competing option was building a new combined cycle unit. The results of the study provide insight for others considering the same alternatives.

-

Gas

New England Struggles with Gas Supply Bottlenecks

New England’s big push toward gas-fired power collided hard with its historical pipeline constraints this past winter, leaving multiple generators unable to respond to start-up requests from ISO-New England during a major storm. In the wake of the episode, the region is looking for some long-term solutions.

-

Gas

DOE Authorizes Second LNG Export Facility (Update)

Freeport LNG Expansion LP and FLNG Liquefaction LLC received conditional authorization on May 17 to export U.S. liquefied natural gas (LNG) from the Freeport LNG Terminal on Quintana Island, Texas, making it the second project to receive federal approval. Meanwhile, Canada is considering a proposed LNG export terminal in British Columbia.

-

Gas

BLM Releases Updated Fracking Rule for Public Lands

An updated fracking rule proposed by the U.S. Department of the Interior’s Bureau of Land Management (BLM) last week maintains a number of requirements from a previous draft—including that well operators should disclose all chemicals used in fracturing activities on public lands—but it will improve integration with state and tribal standards and increase compliance flexibility, the agency said.

-

Gas

NERC Calls for Gas Availability to Be Incorporated into Reliability Assessments

The North American Electric Reliability Corp. (NERC), in a special reliability assessment released on Wednesday, called for a number of changes to address the increased reliance on natural gas for power generation, among them incorporating gas availability and gas supply issues into electric reliability assessments.

-

Gas

AMP Freezes 873-MW Gas Peaking Facility on Financial Uncertainties

Plans to build an 873-MW natural gas peaking facility at FirstEnergy’s Eastlake Plant in Ohio have been frozen on uncertainties that affect project financing—including the federal "sequester"—its developers FirstEnergy and American Municipal Power (AMP) said last week.

-

Gas

FERC Announces Meeting on Coordination of Natural Gas and Electricity Markets

The Federal Energy Regulatory Commission (FERC) announced on May 9 that it will hold a commission meeting on May 16 to address the difficulties posed by inadequate alignment between how natural gas and electricity markets operate.