Finance

-

Energy Storage

What is the Future of Electric Utilities?

What’s the utility of the future going to look like within two or three decades? That was a question put to former Duke Energy CEO Jim Rogers, Great Plains CEO Mike Chesser, and former chairman of the Colorado Public Utilities Commission Ron Binz by the head of the Brookings Institute’s Energy Security Initiative (ESI) last […]

-

Legal & Regulatory

A Rising Tide of Regulation and the “Kick-the-Can” Gambit

A tidal wave of pent-up federal regulations could surge across much of the electricity industry in 2014. In recent years, Congress has been unable to enact new laws in energy, which has led a frustrated

Tagged in: -

Environmental

Black & Veatch Foresees U.S. and Global Opportunities

Black & Veatch expects sustained growth across global energy markets in 2014 with several ongoing themes continuing. Key market drivers supporting power infrastructure spend remain the same, centering on

Tagged in: -

Commentary

How U.S. Power Generators Are Preparing for 2014

The business environment for generating companies worldwide continues to become increasingly complex, and not just as a result of regulations. Even in the U.S., the concerns and constraints faced by generators

Tagged in: -

O&M

Day & Zimmermann Focuses on Flexibility

Now more than ever, we see the U.S. power market sharply focused on maximizing return on investment. We see power producers responding to economic uncertainty, high costs for new emission controls, and a

Tagged in: -

Legal & Regulatory

Europe Faces Capacity and Cost Challenges in 2014

This is expected to be the year when modest economic growth at last returns to a recession-hit Europe. Recent depressed power demand from industry has already allowed the 27 countries of the European Union

Tagged in: -

Gas

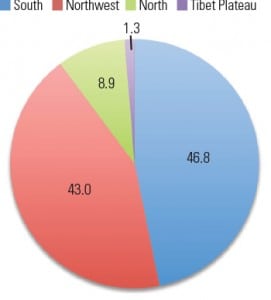

China’s Shale Gas Development Outlook and Challenges

Thanks to sustained and rapid development of China’s economy, demand for natural gas has been increasing. From 2000 to 2010, China’s demand for natural gas increased from 24.7 billion cubic meters (bcm) to

-

Finance

Trend: Banks Retreat as Regulators Advance

It seemed like a good idea at the time. About 10 years ago, large investment banks that had long traded in energy commodities and derivatives, including playing in the wholesale, organized electric markets regulated by the Federal Energy Regulatory Commission (FERC), concluded that it made sense to combine physical assets—power plants, pipelines, and the like—with […]

-

Finance

Master Limited Partnerships: Useful Tool or Green Finance Gimmick?

A legal tax avoidance tool for small investors in the oil and gas industry is getting a lot of buzz among renewable energy financial gurus and advocates. But are “master limited partnerships” a path to new piles of money for green energy, or just a passing fancy? And should MLPs replace the current panoply of lucrative tax gimmicks available for renewables, or be available on top of such items as the production tax credit, investment tax credits, accelerated depreciation, and state and local renewable energy mandates?

-

Legal & Regulatory

What Is Holding Back Offshore Wind?

The potential of offshore wind generation in the U.S. is being held back by a regulatory no-man’s-land.