Passage of the Inflation Reduction Act (IRA) in 2022 brought a major shift in the American clean energy industry, which became flush with government funding and incentives. Three summers later, another budget bill is reshaping clean energy in the U.S.

The “One Big Beautiful Bill Act” (OBBBA) rolls back many of the clean energy provisions in the IRA, striking heavy blows to government support of solar, wind, electric vehicles (EVs), and energy efficiency. The good news, limited though it may be, is that the bill leaves the central provision for energy storage intact, with the investment tax credit (ITC) still available until the 2030s.

This article is part of POWER’s annual special edition published in partnership with the RE+ trade show. This year’s event is scheduled for Sept. 8-11, 2025, in Las Vegas, Nevada. Click here to read the entire special issue, and if you’re attending RE+, be sure to connect with the POWER team at our booth on Venetian Level 1—V3046.

Batteries did not, however, escape the IRA dismantling unscathed. Operators eyeing new battery projects now must adhere to the challenging Foreign Entities of Concern (FEOC) requirements to qualify for the ITC. The OBBBA especially squeezes operators whose projects are to be co-located with solar, as they’ll now need to either begin construction by July 4, 2026, or have their site in service by 2027 to qualify for the solar ITC.

The new provisions ultimately mean that, even with the ITC for battery storage still in place, it is more paramount than ever that operators extract the most revenue possible from their batteries. Analytics is one way to do that.

Lowering Upfront Cost

Battery storage already requires a significant upfront investment well before any post-energization revenue generation begins, and that investment level could rise as operators seek domestic suppliers to meet the ITC’s new FEOC requirements. Analytics software can help reduce the cost of storage projects even before installation through processes known as modeling and digital commissioning.

Using modeling through analytics, operators can determine exactly what size system they need for their site with advanced predictive software. This avoids a scenario where an operator may order more storage than necessary for their planned use case, and enables them to optimize their battery choices for a deployment focused on revenue-generating market services. With the stricter requirements for the ITC, it is more essential than ever to avoid the unnecessary expense of an oversized system.

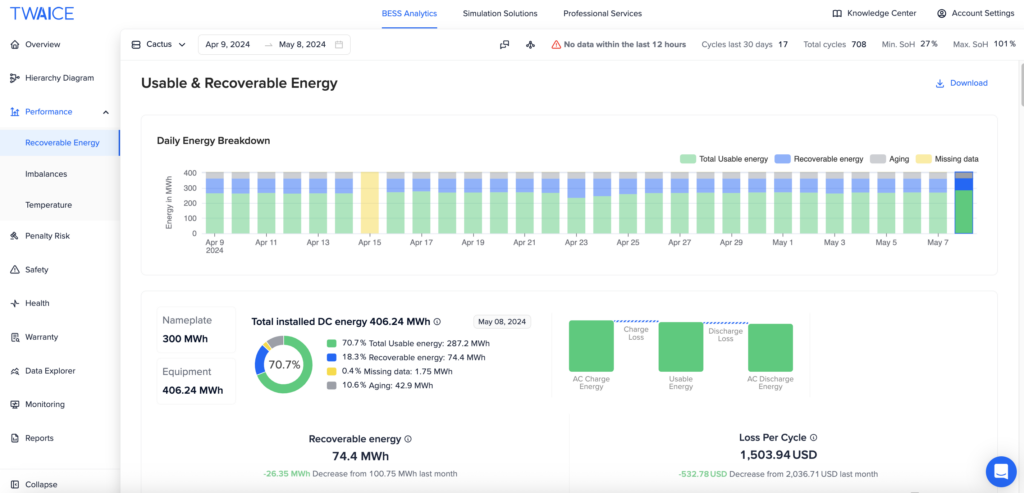

Digital commissioning enabled by analytics (Figure 1) offers more cost control in the OBBBA era. With the deeper access to system- and cell-level data, analytics software can identify issues that may go unnoticed by conventional on-site commissioning. Digital commissioning could, for example, detect a malfunctioning cell early, helping to prevent more significant and costly downtime further down the line.

Unlocking Greater Revenue

With the OBBBA increasing costs for operators, especially those planning a solar + storage system, energy market participation offers one of the most promising ways to increase revenue from battery storage. Though options differ across America’s independent system operators (ISOs) and regional transmission organizations (RTOs), battery energy storage system (BESS) operators can enroll their installations in services such as arbitrage, frequency regulation, demand reduction, peak shaving, and reserve capacity.

Navigating these various programs can be daunting. While many energy management systems (EMS) support dispatch and basic market participation, they often lack the depth needed to optimize performance across diverse ISO/RTO markets. BESS analytics can complement EMS by helping operators coordinate how each storage asset participates in trading while taking into account technical constraints like degradation, state of charge (SoC), and thermal behavior. As market rules and rate structures shift, BESS analytics can automate the evaluation of participation opportunities and recommend adjustments that protect both profit and asset health.

Easing the path to energy markets is just one way that analytics help operators increase the return on investment (ROI) of their storage systems. During regular operations, analytics continuously monitor battery performance for anomalies that operators can address before they escalate into a critical issue. Analytics will catch an issue early that an EMS would find only when it requires taking the entire battery out of operation—and out of revenue-generation.

Analytics also helps operators determine which operating strategies are best for long-term revenue. Storage operations often emphasize short-term revenue, which has the tradeoff of accelerating battery degradation, leading to lower revenue over the battery’s lifetime. Analytics provides the tools for operators to maximize the life of their batteries, ultimately resulting in greater total revenue over time. A short-term revenue strategy also often leads to operators exceeding their battery’s warranty without realizing it—a situation analytics will alert operators to well in advance.

Compared to an EMS, analytics better gauges the true SoC of a battery, a critical element for revenue generation, as it reflects the battery’s usable capacity. EMS platforms typically rely on aggregate battery management system, or BMS, data, which can become less reliable under real-world conditions such as degradation or high cycling. In contrast, analytics use advanced modeling to estimate SoC based on cell-level behavior. True SoC is critical for delivering promised energy in market trading and ancillary services; without it, operators risk underperformance penalties and a significant hit to revenue.

Storage Revenue is More Critical Than Ever

The OBBBA dealt a brutal blow to the clean energy aspirations set in motion by the IRA, but it need not serve as a death knell for a maturing industry. Solar, wind, storage, and more will all be essential to preserving the stability of the electric grid. Storage, which retains its expanded ITC, offers a rare policy foothold amid broader rollbacks. Even so, rising costs and growing uncertainties are likely to challenge storage operators. Now more than ever, tools like battery analytics will play an increasingly important role in helping renewable energy projects reach their full potential.

—Lennart Hinrichs is executive vice president and general manager Americas at TWAICE.