Companies tasked with tearing down, cleaning up, or repurposing a project site know the importance of strategic planning.

The retirement of older thermal power generation facilities, driven by a transition to cleaner forms of energy, has increased in recent years as utilities and other power generators mothball plants that are uneconomic or simply no longer needed. Renewable energy resources are not immune. A report from UK-based global insurance broker Gallagher Specialty last year noted, “A growing number of wind arrays are reaching their third decade of operation and starting to approach the end of their proposed lifecycle.” Meanwhile, some state and local governments are now requiring a decommissioning plan be part of the initial permitting process for solar farms.

Decommissioning a power plant—whether it’s a coal- or natural gas-fired station, nuclear plant, or a renewable energy site—is a complex, multi-year process. Companies involved in closures and teardowns must demolish or repurpose structures, and ensure the safety of workers. Closing a power generation site also may call for remediation of the area for its future use. And contractors must pay attention to local and state (and sometimes federal) environmental regulations. Nuclear plants, with radioactive materials, are particularly complex, with strict regulatory oversight.

“Power plants are decommissioned for a variety of reasons, often driven by a combination of economic, operational, regulatory, and strategic business factors,” said Mark Dittus, associate vice president and the Global Asset Engineering Manager within Black & Veatch’s Infrastructure Advisory group. “Decommissioning power plants, whether nuclear, coal, gas, renewables, or industrial, presents a range of complex challenges that require strategic planning, technical expertise, and stakeholder alignment.”

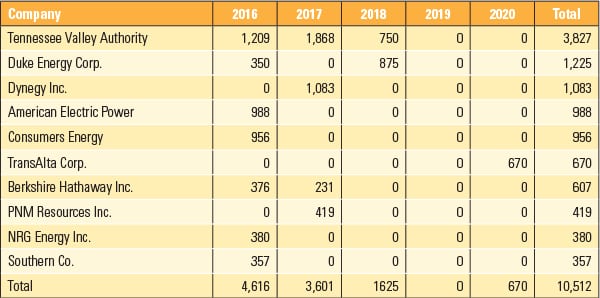

“All power plants have a finite design life,” said Dietrich Hoefner, partner at Womble Bond Dickinson. “Aging infrastructure may face reliability issues or safety risks if operated beyond its intended lifespan. Often, the primary reason [for closure] is that a plant is no longer economically viable. This can happen when operational and maintenance costs rise with the plant’s age. For example, in the U.S., many coal-fired units have closed in the last decade [Figure 1] largely because natural gas and renewables became more cost-competitive, causing coal’s share of generation capacity to substantially decrease. The economics of these units are often closely tied to environmental regulations that increase capital and operational costs.”

|

|

1. The Bruce Mansfield power plant in Pennsylvania was a 2.5-GW coal-fired facility. The plant came online in 1976, and was shut down in late 2019. Officials recently announced the facility will reopen as a natural gas–fired power plant as part of a $3.2 billion investment. Source: Bruce Mansfield Power Plant by Drums600, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons |

Dittus concurred. “One of the most common reasons for decommissioning is changing operational demands leading to lower capacity factors and therefore reduced economic viability for the facility,” he said. “Units designed for baseload operation are competing with newer generation and see limited operation, and this operation is often cyclical operation, which they weren’t designed for. Both of these factors lead to increased maintenance costs and equipment failures, making continued operation financially unsustainable.”

Dittus added, “Compliance with evolving environmental regulations and policy shifts can be cost-prohibitive for plants experiencing limited operation, prompting owners to shut them down. In some cases, the land itself becomes more valuable for other uses. Owners may opt to demolish a facility to repurpose the site, either for new energy projects or for sale. This is particularly common in urban or industrial areas where space is at a premium.”

Risks and Challenges

Matt DeCourcey, a vice president in Charles River Associates’ Energy Practice with two decades of experience in the regulated energy space, said his group’s focus on decommissioning is on regulatory oversight, utility decision-making, and financial considerations. “An important trend in recent years has been the decommissioning of certain types of thermal plants, particularly coal, before their planned retirement date. Doing so creates risks and challenges,” said DeCourcey.

“Plants are often retired ahead of schedule because changes in market conditions have rendered them obsolete. When it happens, a utility-owner may not have recovered all of the investments made in the asset [more formally, the asset would have an undepreciated balance],” said DeCourcey. “Utilities retiring plants ahead of the planned timeline must ask their regulators to authorize recovery of undepreciated balances in rates. Those requests tend to be controversial. To secure an approval, the utility must demonstrate that customers’ paying for a plant that is no longer producing energy is in their best interest because the economics of the facility had become so poor. Examples from among our recent consulting assignments in which this has been an issue include SWEPCO’s [Southwestern Electric Power Co.’s] decision to retire the Pirkey plant in Texas, [and] Empire District’s decision to retire Asbury, a plant in Missouri. Both were older, coal-fired plants that had become uneconomical as coal became less competitive in energy markets, giving rise to the retirement decision.”

|

|

2. This image shows the demolition of a reactor containment building at a nuclear power plant under the DECON (immediate dismantling) protocol. A facility is said to be in DECON when active decommissioning work is underway. Source: Nuclear Regulatory Commission |

Decommissioning a nuclear power plant (Figure 2) can involve either immediate dismantling—what’s known as DECON—or placing the facility in monitored storage, or SAFSTOR, for many years (see sidebar “New Trend: Restarting Closed Nuclear Plants”), allowing radioactivity to decay. Decommissioning a fossil fuel-burning plant may require managing materials such as coal ash and asbestos.

|

New Trend: Restarting Closed Nuclear Plants A trend has emerged with regard to closed nuclear power plants. Some U.S. nuclear facilities, such as the Palisades Nuclear Power Plant in Covert Township, Michigan, that were set for decommissioning now have plans to restart as operators seek ways to increase the supply of electricity at a time of growing power demand. NextEra Energy wants to restart the Duane Arnold nuclear power plant in Iowa, while Constellation Energy has plans to restart the Unit 1 reactor at the Three Mile Island site in Pennsylvania. Outside the U.S., Italy and Belgium are both reversing previous decisions to phase out nuclear energy. Germany, which shut down its last reactors in 2023, is seeing support for bringing some units back online.

Holtec International, a company with a history of decommissioning nuclear power plants, on October 20 of this year said the Palisades facility (Figure 3) has received new nuclear fuel—68 assemblies in total—as it prepares to restart. The 800-MW facility was shut down in May 2022. “The esprit de corps of our tirelessly toiling worker force, over 1,800 strong boosted by the stout support of federal, state, and local government as well as our industry partners, labor, and the Southwest Michigan community, is a testament to the national consensus and our collective will to harness nuclear energy to meet the galloping demand for power in our country,” said Dr. Kris Singh, Holtec’s CEO, in an October 20 news release. The U.S. Nuclear Regulatory Commission gave its authorization for a restart in late August of this year, enabling the plant to receive new fuel at the site. |

“For fossil and nuclear units, all residual fuels and process chemicals must be safely removed or secured,” said Hoefner. “Hazardous substances common in power plants are disposed of according to environmental regulations. Asbestos and PCBs [polychlorinated biphenyls, which are toxic chemicals], often present in older facilities, must be handled under strict rules.”

Hoefner noted that demolition work, including dismantling of boilers, turbines, cooling towers, and support buildings, “must comply with safety laws and environmental controls. Foundations and underground structures are typically removed to a specified depth [often 3 feet to 5 feet below grade] unless closed in place.

“All wastes generated are managed according to type,” said Hoefner. “Hazardous wastes must be transported by licensed haulers to authorized facilities, under RCRA [Resource Conservation and Recovery Act] requirements. Non-hazardous industrial wastes [concrete, scrap metal, etc.] are recycled or landfilled as appropriate. For example, metal equipment and piping are often recycled, while construction rubble might be used as fill. Special wastes like coal ash or solar panels require particular attention. Documentation of waste disposition is important to demonstrate regulatory compliance.”

Hoefner told POWER: “One of the biggest challenges [to decommissioning] is navigating the regulatory landscape, which can sometimes shift unexpectedly. For example, power plant owners might plan a [facility’s] retirement date years in advance, only to have regulators or government authorities intervene to alter those plans.”

Designing a Strategy

“Decommissioning a power generation facility is a complex, multi-phase process affected by several factors,” said Dittus. “No matter the complexity of the site, Black & Veatch follows a framework grounded in safety, regulatory compliance, and long-term site strategy. We approach decommissioning not just as demolition, but as a strategic transformation of energy infrastructure. At Black & Veatch, our goal is zero change orders, which we achieve through clear specs and thorough planning. Our first step is to determine the final use of the site, whether it will be mothballed, demolished, or repurposed; this decision drives all subsequent planning and engineering.”

Dittus told POWER, “Engineering teams assess structural, environmental, and regulatory factors to develop a site-specific roadmap. Demolition is executed by pre-qualified contractors to ensure safety and compliance. For nuclear and coal plants, fuel removal and hazardous material abatement are critical early steps. We also plan for how to manage debris and scrap responsibly. Selecting the right demolition contractor is critical. Companies must implement a rigorous pre-qualification process to avoid safety violations, delays, and legal liabilities. The wrong contractor can derail a project before it begins.”

| Case Study: A Natural Gas-Fired Power Plant in Nevada

The decommissioning and redevelopment of the Tri Center Naniwa Energy Gas Plant provides an example of environmental remediation and adaptive reuse of a power generation site. The Tri Center station, a 380-MW natural gas-fired facility in Storey County, Nevada, near Reno, was decommissioned and remediated under the direction of Consolidated Asset Management Services (CAMS), after the plant’s retirement from service. Previously owned by Morgan Stanley, the station had reached the end of its operational life and was identified for full demolition and environmental rehabilitation. CAMS was contracted to manage the dismantling of the facility, execute asbestos abatement in compliance with federal and state regulations, and prepare the site for future industrial redevelopment. The scope of work encompassed the complete demolition of all above-ground infrastructure, including turbine halls, control rooms, and auxiliary buildings. A comprehensive hazardous materials survey was conducted prior to demolition, enabling precise planning and risk mitigation. Licensed teams carried out asbestos remediation using specialized containment and disposal protocols, ensuring minimal environmental impact and maximum worker safety. Site restoration efforts included grading and stabilization to meet industrial reuse standards, while stakeholder coordination ensured alignment with regulatory bodies and the future site owner. CAMS employed an integrated project management system to oversee demolition, remediation, and regulatory reporting, promoting transparency and operational efficiency. Community engagement was prioritized through regular updates to local stakeholders, fostering trust and public support. The project was completed ahead of schedule and under budget, with zero safety incidents and full regulatory compliance. The property was ultimately sold to a telecommunications company, which is now developing the site into a state-of-the-art data center—demonstrating the value of strategic brownfield redevelopment. A unique challenge during the project was the proximity of the 2020 Caldor Wildfire in the Sierra Nevada mountain range, which burned less than 30 miles from the site. This introduced significant safety concerns, particularly regarding air quality, visibility, and the use of open-flame cutting torches in outdoor environments. CAMS responded with a suite of enhanced safety protocols. Real-time air quality monitoring was conducted using portable sensors and regional alerts, and work schedules were adjusted based on air quality index readings. Respirators were issued during periods of elevated smoke levels, and N95 masks were provided to mitigate inhalation risks. Fire risk mitigation strategies included strict fire watch procedures, deployment of fire safety personnel, and immediate access to extinguishing equipment. Emergency preparedness plans were developed in coordination with local authorities, and daily safety briefings incorporated wildfire updates and evacuation protocols. Additional personal protective equipment was issued for asbestos abatement under compromised air conditions, and shaded rest areas with hydration stations were established to reduce heat and smoke-related stress. Despite the environmental hazards posed by the wildfire, CAMS successfully completed the project without incident, underscoring its commitment to safety, adaptability, and operational excellence. Key lessons learned included the importance of early hazardous materials identification, close coordination with future site owners to streamline redevelopment, and transparent communication with regulators and the community to reduce project friction. This case exemplifies how strategic planning, environmental stewardship, and stakeholder collaboration can transform a retired energy asset into a platform for what is now a data center for a large telecommunications company. —Nick Kemper leads Business Development and Decommissioning and Brownfield Redevelopment at Consolidated Asset Management Services (CAMS). |

Dittus also noted that some project sites involve partial demolition, where one or more units are removed while others must be preserved. “This requires precise engineering, accurate drawings, and planning to safely isolate systems. The complexity increases significantly on multi-unit or industrial sites,” he said.

Nick Kemper, general manager of Deconstruction and Brownfield Redevelopment Director of Corporate at Consolidated Asset Management Services (CAMS), has more than 12 years of experience in leading and supporting the decommissioning of industrial facilities, including thermal power generation plants powered by natural gas, coal, and fuel oil, across diverse U.S. markets. His expertise spans the full lifecycle of decommissioning—from environmental remediation and demolition to equipment disposition and site redevelopment. Some of Kemper’s notable projects include:

- Tanner Generation Station (Lowell, Massachusetts). Decommissioning of an 84-MW natural gas plant near Boston, including environmental remediation and sale of used equipment and real estate.

- Tri Center Naniwa (Reno, Nevada). Led the complete deconstruction and remediation of a 380-MW gas-fired facility (see sidebar “Case Study: A Natural Gas-Fired Power Plant in Nevada”).

- Stateline Energy (Hammond, Indiana). Oversaw the dismantling, environmental remediation, and land sale of a 515-MW coal-fired plant on a 64-acre site near Chicago, Illinois.

- Werner Power Station (South Amboy, New Jersey). Managed the complete deconstruction, environmental remediation, and hazardous materials disposal of a 212-MW dual-fuel plant.

- Texas Portfolio. Directed redevelopment efforts for multiple gas-fired plants in Texas, including Lon C Hill (295 MW), JL Bates (292 MW), and Victoria Power Station, as well as the Cedar Bayou Transformer Project in Houston.

“The principal drivers behind plant decommissioning are our clients, most of whom represent private equity (PE) and major financial institutions,” said Kemper. “PE firms generally seek to maximize returns over a three-to-seven-year period. After generating value through strategies such as cost reduction, refinancing, or asset management, they may choose to close or divest facilities rather than invest in long-term improvements. Frequently, private equity acquires aging plants near the conclusion of a power purchase agreement and opts not to continue power generation.”

Kemper told POWER that to boost short-term profitability, “owners often reduce maintenance spending and staff. This accelerates equipment degradation, making continued operation unsafe or uneconomical. When new environmental regulations require expensive retrofits (such as emissions controls), PE firms often choose closure instead of reinvestment because it doesn’t align with their short-term ROI [return on investment] goals. PE-owned plants, especially fossil-fuel-based, are vulnerable to low wholesale electricity prices and competition from renewables. If margins shrink, PE firms may exit quickly.”

Kemper outlined several steps in the decommissioning process. The items are explained below.

Planning and Regulatory Compliance. The process begins with a robust decommissioning plan, which includes environmental assessments, hazard identification, and stakeholder engagement. Operators must secure permits for demolition, waste handling, and site remediation, while also notifying regulatory bodies and local communities.

Shutdown and Hazard Mitigation. Once planning is complete, the facility undergoes fuel removal and hazard mitigation. This includes draining chemicals, neutralizing hazardous substances, and safely handling materials like lead, asbestos, PCBs, and mercury.

Equipment Dismantling and Asset Recovery. The next phase involves disassembling major components such as boilers, turbines, and generators. Valuable metals and equipment are salvaged for resale or recycling first.

Demolition and Structural Removal. Controlled demolition of stacks, cooling towers, and buildings follows. Dust suppression and vibration control measures are essential to protect nearby communities.

Environmental Remediation. This phase addresses soil and groundwater contamination, often from coal ash ponds, fuel storage, and chemical leaks. Cleanup may involve removing or capping contaminated soil and ensuring compliance with Environmental Protection Agency (EPA) or state standards.

Waste Management. Proper waste management includes segregating hazardous and non-hazardous materials, recycling metals and concrete, and disposing of hazardous waste in compliance with regulations.

|

|

4. This solar farm in Tennessee is an example of a brownfield project. The array was built at the site of the abandoned Phipps Bend nuclear power plant project, and serves the Tennessee Valley Authority. Courtesy: United Renewable Energy |

Site Release and Redevelopment. The final step is obtaining regulatory clearance and planning for site reuse. Brownfield sites can be repurposed for solar farms (Figure 4), battery storage, data centers, or industrial parks. Federal programs like the Department of Energy’s Energy Infrastructure Reinvestment loans and Inflation Reduction Act tax credits can support these transitions.

Decommissioning and Demolition

Keith Kotimko, U.S. Decommissioning and Demolition Leader for WSP, which provides services for decommissioning, made a point that decommissioning is a separate activity from demolition. “Decommissioning is the specific activity that serves as the necessary precursor to demolition. It encompasses all steps required to prepare the plant for subsequent abatement and physical tearing down. This process includes fundamental actions such as cessation of generation, thorough emptying and cleaning of major systems [like ash and coal handling], draining all oils and fuels, purging gas systems, and complete removal of all stored hazardous and non-hazardous waste. It culminates in de-energizing the assets and separating them from transmission and distribution systems. Utilities often manage these preparatory activities internally as a ‘last outage event’ before vacating the site,” he explained.

Kotimko said that over the past 11 years he has been directly involved in planning and executing decommissioning of seven coal-fired power plants. His demolition experience is even broader, encompassing 24 plants of various types, including coal, oil, natural gas, hydro, and nuclear facilities.

“Successful decommissioning hinges on detailed preparation that goes beyond standard operating procedures,” Kotimko said, noting his group focuses on “critical topics upfront, which, if handled correctly, can reduce added contingency costs in contractor bids, prevent environmental releases, and minimize expensive change orders later.” Kotimko said there must be a recognition that decommissioning is not a standard plant outage.

“Although decommissioning shares activities with plant outages [like cleaning and draining], the required level of effort is fundamentally different. In decommissioning, it is unacceptable to leave hardened ash or unclean ductwork, even if that might be permissible during a temporary outage. When an owner performs only an ‘outage level’ of cleaning, the demolition contractor will inevitably find large, residual quantities of materials, triggering change orders and often leading to environmental releases onto the ground or into water systems.”

Kotimko told POWER: “Success in these projects must include safety being paramount alongside the prevention of change orders. Change orders are not an expected part of the project; they are typically the result of insufficient planning and scoping.” He said the most common change orders stem from four oversights.

Poorly Defined Cleaning Scope. Generalized requirements for material removal often fail to achieve the necessary level of cleanliness needed for demolition.

Inadequate Asbestos Surveys. Surveys must be intrusive enough to find hidden materials that will undoubtedly be discovered during demolition.

Insufficiently Detailed Site/Owner Requirements. These relate to differing expectations regarding operational standards, such as requirements for dust control and monitoring, or the acceptance process for required submittals.

Poorly Defined Below-Grade Removal Work. “Since contractors assess above-grade demolition visually, below-grade work must be explicitly defined using drawings that specify the horizontal extent and vertical depth of all utilities, foundations, and buried features to be removed,” said Kotimko. “This often-overlooked step requires combing through existing documents and potentially performing utility locating services.”

DeCourcey said there are lessons to be learned from his group’s recent work in the decommissioning space. “Utility decisions to retire thermal assets ahead of planned retirement dates can be risky and controversial. Demonstrating the benefits to customers is critical,” he noted.

“Growing [power] demand, rising [electricity] prices, and the potential for an erosion of environmental standards under the Trump administration’s EPA have led to the postponement of retirement decisions and the repowering of retired assets,” DeCourcey said. “Site repowering can generate significant economic value, depending on the configuration of assets at the site and its location. Repowering has the potential to reduce the cost of installing emerging technologies, such as hydrogen-powered generation or SMRs [small modular reactors].”

—Darrell Proctor is a senior editor for POWER.