Although you’d be hard-pressed to find an expert who believes oil and gas companies will abandon exploration and production operations anytime soon, several oil and gas majors are expanding their businesses into the renewable energy sector—and some in a big way. Total has laid out plans that would have it outpace clean energy leaders Iberdrola and Ørsted on renewable power capacity by 2030. Hydrogen and carbon capture technologies are also likely to be part of growth strategies for the industry going forward.

Sustainability is a topic that many company leaders around the world are thinking about more and more these days. POWER published an article last month (see “The Hydropower Industry’s Sustainability Conundrum” in the March 2021 issue) outlining ways the hydropower sector aims to improve new and existing facilities through sustainability initiatives, but it’s not just power companies that are focusing on the topic; enterprises in nearly every industry are prioritizing sustainability.

The oil and gas (O&G) sector has taken a keen interest in the subject, as the shift away from fossil fuels gains momentum due to climate change concerns. Among the big names in the industry, European-based companies, such as Total, BP, Royal Dutch Shell, Equinor, Eni, and Repsol, are leading the way by adding renewable resources to their portfolios.

“This is a very Eurocentric story right now,” said David Linden, head of Energy Transition with Westwood Global Energy Group, a UK-based energy market research and intelligence firm that provides subscription-based data services, bespoke reporting, and commercial advice to clients around the world. “You’ve got clear themes that European-based businesses are thinking about decarbonization and diversification, while Asian and American oil and gas companies are less focused on that.”

Sustainability Pathways

Linden explained that many O&G companies have set net-zero carbon emissions targets. “You can do many different things to get to a net-zero business,” he said. “And actually, that’s sort of borne out quite interestingly through a lot of these different strategies.” For example, while Total and Shell are both trying to reduce the intensity of their emissions, the paths they’re taking differs markedly.

Total has indicated it intends to become a world leader in renewables, in line with its strategy to transition into an increasingly broader energy company by 2030. Since 2016, Total has invested $8 billion in renewable power, increasing its gross renewable capacity to about 7 GW. Going forward, the company has set a target of 35 GW of renewable capacity by 2025, with many of the additions already under construction or well along in development. Furthermore, Total recently announced an ambition to increase its renewable capacity to about 100 GW in 2030, which would place it ahead of Iberdrola’s existing targets and more than three times ahead of Ørsted’s announced goals. Iberdrola and Ørsted are global power companies that specifically focus on green energy.

Meanwhile, Linden pointed out that Shell hasn’t actually set any specific renewable energy investment targets. The company still plans to invest in a mix of solar, offshore wind, and onshore wind projects, but it is more focused on working with customers to accelerate the transition to net-zero emissions. Shell has developed a three-pillar strategy designed to transform the company. Its “Growth” pillar includes such things as service stations, fuels for business customers, power, hydrogen, biofuels, charging for electric vehicles, nature-based solutions, and carbon capture and storage (CCS).

Among the other big European O&G companies, BP aims to develop 20 GW of renewable capacity by 2025, and 50 GW by 2030. It’s starting from an installed base of about 3.3 GW at the end of 2020. Eni, which had 0.27 GW of renewable capacity at the end of the third quarter 2020, is somewhat unique in the granularity of its targets, having established short-, medium-, and long-term goals. Eni plans to have 3 GW of installed renewable capacity in 2023 and 5 GW in 2025. It’s targeting 15 GW in 2030, 25 GW in 2035, and more than 55 GW by 2050. Both Equinor and Repsol also have renewable energy targets. Equinor established a range of 4 GW to 6 GW by 2026, and 12 GW to 16 GW by 2035. Repsol (Figure 1) is aiming for 7.5 GW by 2025 and 15 GW by 2030.

|

|

1. Repsol is a stakeholder in the WindFloat Atlantic floating wind farm, which consists of three 8.4-MW MHI Vestas wind turbines—the world’s largest ever installed on floating platforms. The project was a POWER Top Plant award-winner in 2020. Courtesy: Repsol |

“So, it’s quite a diverging view as to how you get from A to B, and depending on what your overall theme is—where you think you can differentiate yourself—you’re going to see different targets being set by these players,” Linden said.

“I think with the European oil and gas majors, one theme that’s very clear is that they see themselves as broader energy providers,” Arindam Das, head of Consulting with Westwood Global Energy Group, told POWER. “Where they’re focusing today is really around becoming these broader energy companies, that is, providing different forms of energy to their customer groups—whether that’s oil and gas, that’s renewables in the traditional sense of solar and wind, but also, more importantly, looking at things like hydrogen, and also focusing on areas like carbon capture. So, it’s a broader theme.”

Das added, “Most of the energy companies, by and large, still see the oil and gas businesses as being substantial and actually driving, or generating the cash flow that drives, the diversification into renewables and other areas.”

Expanding Business

“When many people think of the integrated majors, they tend to just think, ‘Oh, they’re oil producers,’ but the other thing that these companies do really, really well is market and trade product,” said Kyle Reid, a partner with Grant Thornton LLP and leader of its Renewable Energy advisory arm. “They not only refine their own products, but also a number of other products, and they trade, ship, and deliver all these products. And so, I get the impression these companies always view themselves as trading and marketing companies. They see themselves as people that have a very good handle on energy demands in different markets, whether that’s domestic or abroad, and they’re very global, obviously.”

Reid continued: “So, as they see the transition, they fully recognize the world is heading toward a net-zero emissions environment by 2050. Many of these companies are European based. They’re very much in line with the Paris accord and they’re all pursuing that. How do they get there? Well, they have to shift to where the growth is going to come from.”

Among technologies that O&G companies seem particularly well-suited to capitalize on are geothermal, offshore wind, hydrogen, and CCS.

Geothermal. Many geothermal energy advocates see the development of hot dry rock geothermal systems as a game-changer for the power industry, but there are significant challenges in drilling deep enough, cheap enough. O&G companies obviously have a long history of innovative drilling advancements—perhaps the most notable improvement being the development of horizontal drilling techniques. Today, work to improve deep and ultradeep well-drilling technology continues. The experience O&G companies possess could be a difference-maker in bringing deep dry rock geothermal systems to market, although it could still be many years away.

Offshore Wind. O&G companies also have a lot of experience with offshore oil rigs, fixed platforms, and floating systems. “These companies have obviously worked extensively in offshore oil and gas, so they have a lot of history and background. They have taken a lot of risk historically in developing deep-water fields—complex geologies, geographies, for instance—and there’s a lot of industry-wide learning that’s come out of that,” Das said. “I think that’s probably an area where these companies can actually translate that experience into expediting the development of some of those new technologies from a renewables perspective, because they can probably bring some of those skills and also capital to the table, and help develop those technologies faster.”

Hydrogen. “Hydrogen is often spoken about by all of these players, because it fits really nicely with their core skillset of what they’ve done in the past,” Linden said. “It also allows them to reuse some of those assets and skillsets, and development services.”

Das agreed that hydrogen offers a great opportunity for O&G companies, but he doesn’t expect anything to happen overnight. He suggested it could take until 2030 or later before hydrogen technology is highly commercialized.

CCS. According to a paper written last year by Guloren Turan, general manager for Advocacy and Communications with the Global CCS Institute, the O&G industry was one of the earliest adopters of CCS technology, beginning back in the 1970s. “The industry originally developed and used many of the techniques integral to CCS: separating CO2 from natural gas is required before it can be transported by pipelines, and separated CO2 is occasionally pumped back into geological formations to reduce the emissions intensity of operations or into reservoirs to enhance oil production,” she explained.

“Whether as a driver of growth and business development or as a means of lowering carbon footprint of operations and products, CCS offers numerous synergies to the oil and gas industry. It is a versatile and well-understood tool in the oil and gas companies’ energy transition toolkit,” Turan concluded.

Investment Increasing

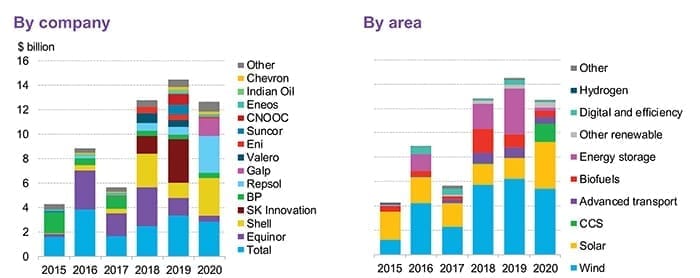

BloombergNEF (BNEF) has been tracking clean energy investment by 34 of the world’s largest O&G producers and refiners for several years. It said investment, including in specialist companies and low-carbon assets, declined by 12% year-on-year to $12.7 billion in 2020. Shell, Total, Repsol, and Lisbon, Portugal-based Galp accounted for the bulk of those investments (Figure 2).

|

|

2. This chart shows clean energy investment by oil and gas companies from 2015 through 2020. Investment decreased in 2020 due to the pandemic, but still remained well above the five-year average. Courtesy: BloombergNEF |

Over the past five years, total investment in renewables, storage, advanced transport, digital technologies, hydrogen, and CCS by O&G companies has been almost $60 billion, with wind, solar, and battery storage making up the majority. BNEF reported that total oil sector capital expenditure expense in 2020 was likely to be more than $200 billion, meaning clean energy investment would account for about 6% of the total, which it said was higher than in previous years.

“These large companies that have been traditionally carbon-based are going to pivot and figure out how to do this as well—their existence requires it. They’re not going to survive, if not,” Reid said.

—Aaron Larson is POWER’s executive editor.