New reports released this week see big growth in renewables from the recently extended federal tax credits, but big uncertainty due to the possible end of the Clean Power Plan (CPP).

New York-based consulting firm Rhodium Group says investment plans in the power sector will be radically different if the Clean Power Plan doesn’t happen. Another new report from the National Renewable Energy Lab (NREL) sees renewables rising as high as one-third of U.S. power by 2030.

The report from Rhodium updates a January analysis that looked at impacts of the extension of the federal renewable energy tax credits. The production and investment tax credits (PTC and ITC) were renewed by Congress in December, for five years.

But on February 8, the U.S. Supreme Court (SCOTUS) put a stay on implementation of the Clean Power Plan. The CPP is being challenged in the D.C. Circuit Court by a coalition of 27 states and other groups that argue it goes beyond the Environmental Protection Agency’s authority to regulate CO2 emissions under the Clean Air Act.

While the Supreme Court stay doesn’t void the rule, it does suggest it could be in trouble if the District Court decision is appealed, as is widely expected. The recent death of Justice Antonin Scalia, whose last decision on the bench was to support the stay, as part of a 5-4 decision, has thrown Washington into turmoil, as Senate Republicans are refusing to hold hearings on any nominations from the Obama administration. It has put the Clean Power Plan on a roller coaster ride.

The court battles have put further uncertainty over the CPP, since a final SCOTUS decision is not likely until the middle of 2018, coming close to the final deadline for the submission of State Implementation Plans (SIPs).

Rhodium Report

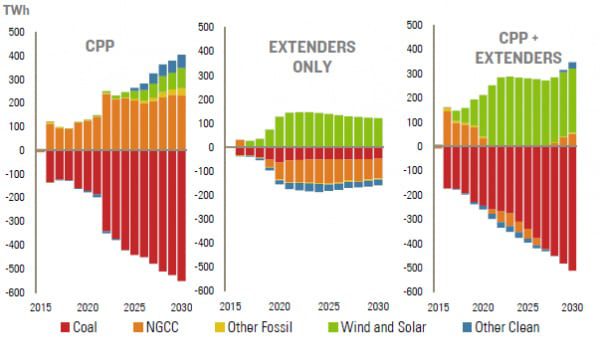

The updated analysis from the Rhodium Group looks at scenarios with and without the Clean Power Plan and the tax credits.

Their previous study found that without the tax extenders the least-cost CPP compliance approach is a shift from coal to natural gas combined cycle (NGCC). “Extension of the tax credits change this story dramatically,” they wrote, as wind and solar generation become the least-cost compliance option.

As shown in Figure 1, the CPP-only case (on the left) results in a massive shift from coal to gas generation. Wind and solar see some growth after 2020. In the case where the CPP is combined with tax credits through 2021 (on the right), wind and solar dominate growth, largely offsetting the coal retirements.

But in the new analysis, Rhodium has removed the Clean Power Plan. In the “Extenders Only” case, the massive wave of coal retirements is averted and new gas construction disappears. In fact, gas generation declines more than coal. The only growth is wind and solar, though at half the rate as under the Clean Power Plan with tax credits through 2021.

Loss of the CPP would mean wind and solar investments drop from 142 GW to 92 GW between 2016 and 2025. New gas investments also drop, but Rhodium did not quantify that number.

The timing of the tax credits and the CPP create their own dynamic. With subsidies in effect for the next five years, but CPP compliance not starting until 2022, utilities will have a strong incentive for early action.

John Larsen, lead author of the Rhodium analysis, thinks the long-term extension of the PTC, the first in its 24-year history, could have a big impact on the wind industry.

“Wind has been in boom and bust situations for so long,” he says. “It will be interesting to see how longer term certainty influences annual build.” The luxury of longer lead times may lead to more efficient construction and sourcing, he thinks, due to less pressure to get things done quickly. Likewise, solar projects are now eligible for the ITC when they “commence construction” instead of when they come online, giving them more time to complete projects.

All these changes could actually slow down deployment for the next year or two, Larsen says, as projects that were in hurry-up mode can now take their time.

NREL Analysis

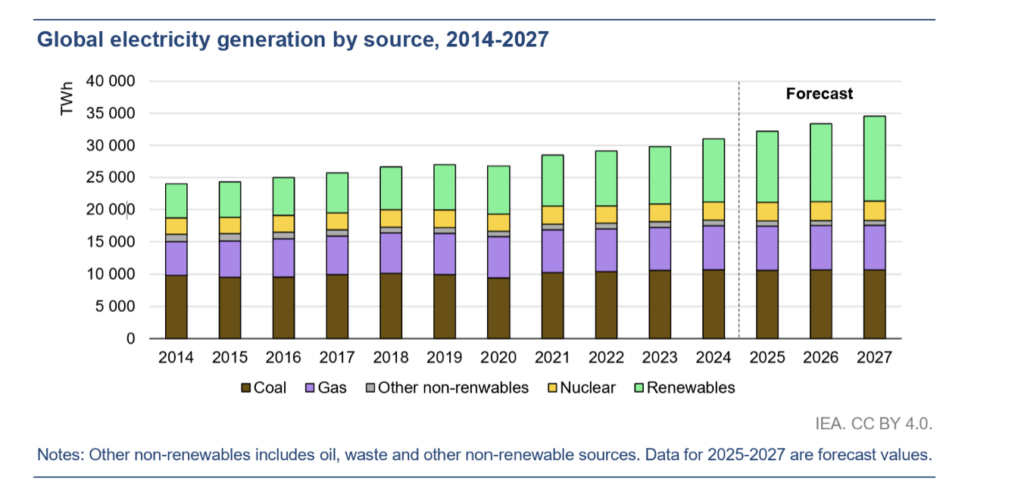

A new report from the National Renewable Energy Lab also forecasts the impacts of the tax credit extensions on the renewables sector, focusing especially on the impacts of gas prices. They assume the Clean Power Plan remains intact.

NREL estimates that wind power especially will see a big impact from tax credit extensions. Wind power market share could be almost twice as much by 2020 with the credits as without.

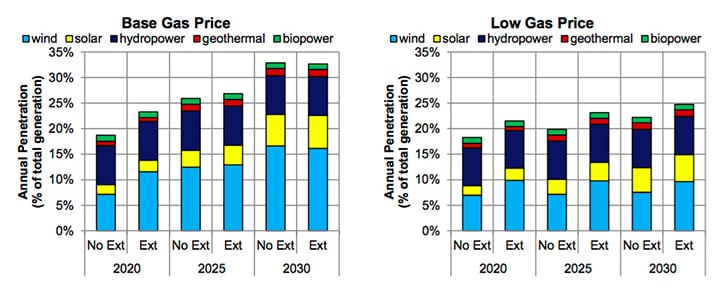

Overall, with “base case” gas prices (Figure 2), renewable market share is boosted in 2020 from 18% to 23%. By 2025, the effects of the tax credits wear off, but renewable technology cost reductions and rising fossil fuel costs, coupled with the Clean Power Plan continue to drive growth. By 2030, renewables rise to almost one-third of U.S. power supply.

|

| 2. Renewable penetration in the Base Gas Price (left) and Low Gas Price (right) scenarios. Courtesy: NREL |

With lower gas prices, renewables growth is slowed, especially after 2020. Wind growth is flat, while solar continues to rise. Altogether renewables rise to a high of 25% by 2030.

Interestingly, growth in solar is less affected than wind by changes in tax credits. This is partly because some solar growth happens behind the meter, and is driven by retail rates and customer choice.

But it is also true that the wind PTC is worth more than the solar ITC. As solar costs decline over time, the value of the ITC declines, since it is pegged to capital cost. The value of the wind PTC actually rises as wind turbine performance improves, yielding more production per dollar invested. And the wind PTC expires completely after 2019 while the solar ITC steps down to 10% after 2022.

NREL estimates that CO2 emissions will be cut by between 540 and 1,400 million metric tons cumulatively by 2030.

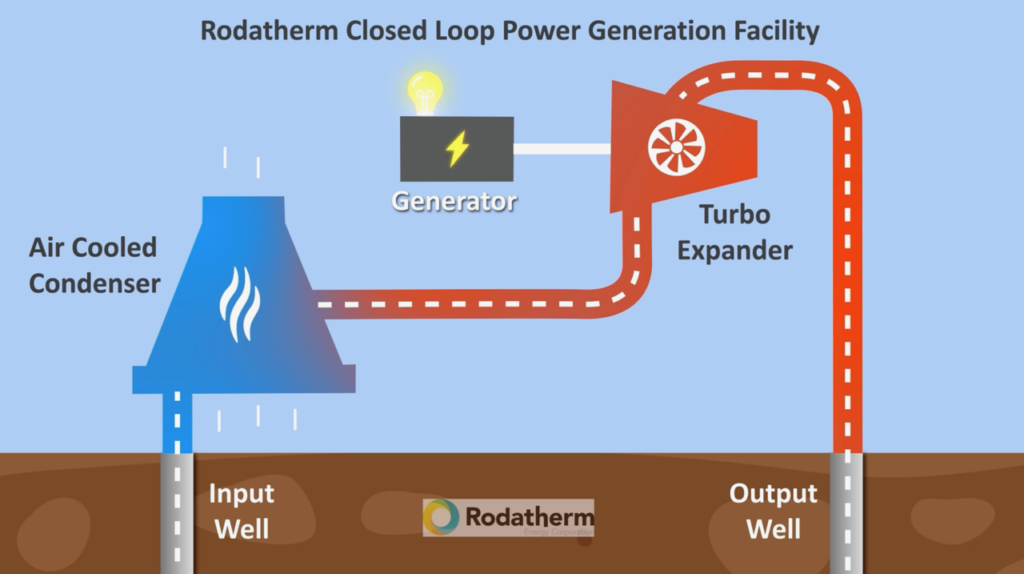

The outlook continues to be poor for geothermal, biopower, and hydropower, according to NREL. The value of the tax credits is lower for hydro and some biopower options, their credits were only extended for two years, and their costs are higher than wind, solar, and gas. Geothermal fares the best, gaining about 200 MW by 2018, but over the long run cheaper solar and wind drive some geothermal retirements.

In essence, both studies find that the extension of tax credits hurry deployment of renewables in the short run, but their long run growth depends on their competitiveness with natural gas power plants, and the survival of the Clean Power Plan.

—Bentham Paulos is a freelance writer and consultant specializing in energy issues.