While the Inflation Reduction Act (IRA) provides steps in the right direction by expanding renewable energy development and electrification incentives, it may also lead to a worsening duck curve and a larger proportion of variable power sources in the generation mix—putting significant pressure on utilities’ ability to maintain reliability.

U.S. utilities need to be proactive in adapting to the changing environment. To minimize the impact of worsening peak loads and a variable energy mix, they need to make strategic decisions and measures to manage future risks posed by key levers.

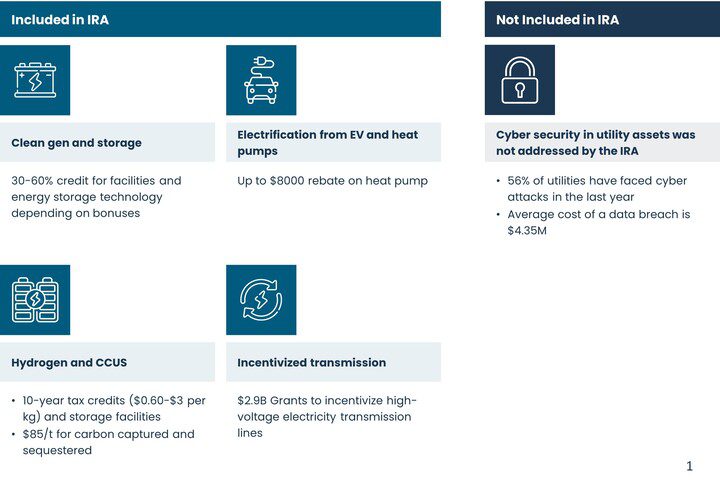

While the IRA offers incentives for renewable energy sources, clean hydrogen, carbon capture and sequestration, electric vehicles (EVs), heat pumps for homes, and more, transmission infrastructure was much smaller (about $3 billion) and may need expansion with future outlays, whereas funding for cybersecurity, a major concern for utilities, was non-existent (Figure 1).

Utilities Are Left with the Bill

Although the IRA addresses climate change, the electrification trend it accelerates will likely exacerbate issues already facing utilities.

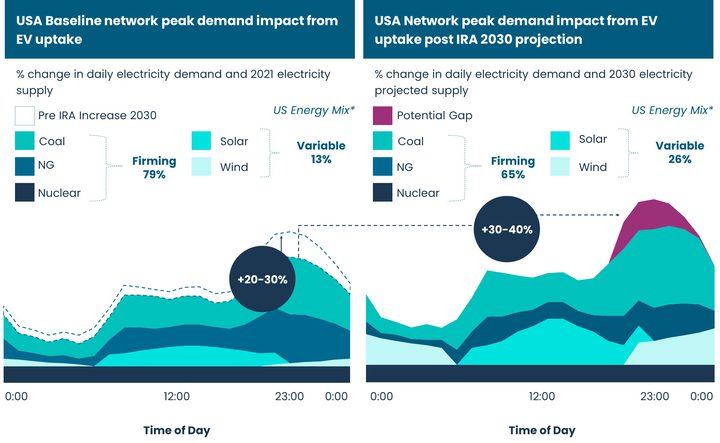

Worsening Duck Curve. Prior to the IRA, peak demand was forecasted to increase 20% to 30% by 2030 for regions of the U.S. with high EV penetration rates. The IRA incentives for purchasing an EV will likely intensify this “duck curve” phenomenon, leading to an increased peak demand of 30% to 40% by 2030. Greater heat pump penetration is also predicted, but unlike EVs the effect from these appliances will not be as concentrated during peak load times.

More Variable Generation Mix. By 2030, variable renewable sources, wind and solar, will make up approximately 25% to 30% of grid power compared to today’s 13%. By contrast, the two largest sources of firming power, natural gas and coal, will decline to 40% to 48% from today’s roughly 60%.

Coal’s decline is much discussed, but natural gas is also set to decline in relative share (30% to 32% from 35%). This is largely driven by the reduction in demand over the past 15 years, whereas demand for renewable sources has steadily increased. With renewables becoming more economical, downward pressure is put on natural gas infrastructure investment. Many U.S. cities are already phasing out natural gas in new construction to “green” their grids, eroding baseload capacity and making grids more dependent on variable sources of energy supply.

Tying It All Together. Grid power variability becomes clearer when combined with the duck curve effect. As peak loads spike, grids have less baseload capacity to rely on and risk not meeting demand during daily peaks (Figure 2).

Flipping the Right Switch

Utilities must decide which levers are the most effective in addressing the concerns of these emerging market dynamics, from worsening peak loads to more variable energy mix.

Lever 1: Generation and Storage Technologies to Deliver Clean Stable Power Throughout the Day

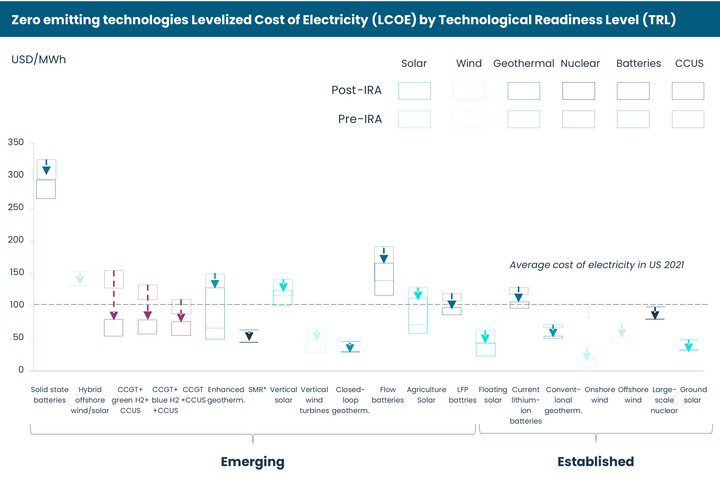

The IRA’s technology-agnostic incentives have broad implications for levelized cost of electricity for established technologies and emerging solutions (Figure 3). This can change how utility’s view generation and storage levers at their disposal while being aware of the need to de-risk many first-of-a-kind technologies.

Wind and Solar Commoditization. Solar and wind are the most economical sources of generation in many regions and are likely to keep decreasing their cost curves due to the IRA extending existing tax credits and adding “bonuses” for domestic material use and locating sites in low-income and fossil-fuel dependent/impacted communities.

Storage Increasingly Viable as Pairing with Variable Renewables. Existing lithium-ion technology paired with wind and solar becomes cost-effective in helping mitigate the intermittency of these energy sources—even if battery technology is not ideal for grid-scale use. Iron-phosphate (LFP) and flow batteries become more attractive alternatives as they mature technologically. More so, early-stage development zinc-based batteries from Canada-based e-Zinc have expanded storage duration to 50 hours.

Geothermal Showing Promise as Firming Power Alternative. Conventional geothermal stands to benefit from cost reductions. The coming advances in geothermal, with companies like Eavor developing closed-loop systems and Sage Geosystems testing enhanced geothermal systems with the hope to widen applicability into regions thought to be ill-suited for the technology, could broaden technological adoption to provide clean baseload power and support grid reliability.

Hydrogen Blends and Carbon Capture, Utilization, and Storage (CCUS) with Combined Cycle Gas Turbines (CCGTs) Will Need to Advance Quickly to be Impactful. While natural gas still has a key role in providing firming power, this will likely change with battery and geothermal technology becoming more viable and cost competitive. CCUS and hydrogen blending paired with CCGT—although theoretically promising with the new IRA incentives—needs to advance in technological readiness to be considered a utility-scale option.

Lever 2: Transmission & Distribution (T&D) to Shift Electricity Demand and Prevent Outages

Utilities have other downstream levers to mitigate the effects of increased electrical demand and potential grid instability from renewable intermittency.

Addressing discharge to grid, an emerging EV model uses time-of-use (TOU) rates and demand response (DR) programs to shift electricity usage to off-peak times. For TOU rates, utilities offer options with enough price difference between off-peak and peak times to encourage EV owners to shift charging to lower-cost periods. DR programs, a comparatively mature lever, have become more accessible to customers, with utilities incentivizing the installation of DR-enabling technologies and embracing third-party programs to manage thermostats, water heaters, and EVs in response to TOU rates.

With the rise of distributed energy resources (DERs), opportunities are emerging for virtual power plants (VPPs) to support better demand response by the grid. One example is Google-backed OhmConnect’s platform, providing customers incentives and benefits to organize electricity usage to avoid high-risk times by integrating appliances and devices from 30 companies and manufacturers.

Once a critical mass of DERs is reached, community microgrids can increase resiliency by disconnecting (“islanding”) and reconnecting to the overall grid. Critical infrastructure like hospitals and government facilities have successfully established microgrids to reduce energy spend and ensure continuity during extreme weather events. Utilities can be proactive by helping shape which customers adopt what technology in a particular service area.

Major investment in “traditional” T&D infrastructure is still needed. The American Society for Civil Engineers reports funding gaps of $95 billion for distribution alone by 2025 (more than two times the gap seen in transmission). Hardening infrastructure is another option to ensure grid resiliency as extreme weather events become commonplace. To illustrate, Florida’s three major utilities—Florida Power & Light, Duke Energy Florida, and Tampa Electric Co.—recently filed proposals for a combined $566 million in undergrounding, hardening of electrical systems, and vegetation management in response to more intense hurricanes.

Lever 3: Cybersecurity to Help Prevent Breaches and Outages

Cybersecurity concerns affect the entire utility value chain and are likely to increase in importance as grid infrastructure expands, the variety of assets on the grid increases, and as the two-way flow of information between utility and customer increases.

Cybersecurity is already a critical issue for utilities as data breach costs reach a high of $9.44 million with ransomware attacks increasing by 50% in two years. Recent attacks on the Colonial Pipeline and a Florida water treatment plant are two examples. Utilities must put cybersecurity at the center of designing, building, and operating their infrastructure.

Lever 4: Regulatory Refinement to Support Grid Flexibility and Infrastructure Development

As both the ownership model and role of utilities evolves, the regulatory environment must align with them. Utilities need to consider how to engage the stakeholder ecosystem to shape policy and meet customer needs for safe, reliable, affordable, and equitable power.

Ownership. Many utilities are adopting a “shared responsibility model” in EV charging infrastructure, with utilities providing capital for “make-readies” and the interconnection review process, while private charging companies own and operate charging stations. Utilities benefit from this partnership by protecting their system reliability and using the providers’ data to optimize charging. Pepco, Eversource Energy, Georgia Power, and Pacific Gas and Electric (PG&E) use this model, with PG&E having a dedicated EV team who significantly improved interactions with its third-party electricity provider, EVgo.

Role of Utility. The traditional role of utilities is shifting from building and maintaining infrastructure to orchestrating energy resources for optimized safety and affordability by utilizing cleaner and more affordable resources. For utilities to succeed in this new role, they need to leverage existing regulation, where possible, while learning from other markets on how to best shape policy in their own territories. One example is redefining how pilots are deployed. Connecticut’s Public Utilities Regulatory Authority (PURA) built an “innovation pilots” framework for scaling pilots or ending them—potentially limiting spend on projects not providing a return/benefit to rate payers.

Conclusion

The IRA offers new incentives for renewable energy development and electrification, while bringing fresh challenges for utilities and exacerbating existing ones. It could leave utilities with the bill for potentially worsening duck curves and more variable energy mix.

To ensure their future success, utilities must apply the right levers to address emerging market dynamics and their changing roles (Figure 4). The price of inaction means massive disadvantages by falling behind in energy transition and delivering inferior services, which could result in serious reputational damage with customers flocking to alternatives. Those who do act and leverage the right solutions will solidify their primacy as leaders in a rapidly changing market.

—Sarah Heitzman (sarah.heitzman@pip.global) is a partner, Energy Transition; Eric Powell (eric.powell@pip.global) is a director; and Chris Millican (chris.millican@pip.global) is a director, all with Partners in Performance, a global consultancy. The firm works in close collaboration with its clients to develop financially viable and actionable execution plans to achieve aggressive emissions reduction targets quickly and efficiently (http://pip.global).