Events over the past year—turmoil in the oil-rich Middle East and the Russian-Ukraine gas crisis—along with uncertainty for nuclear power and pervading energy poverty worldwide show that the energy system is “under stress,” the International Energy Agency (IEA) says in its freshly released World Energy Outlook 2014 (WEO-2014).

Despite technology and efficiency improvements, without actions from policy makers and industry, concerns about energy security and sustainability will continue through 2040, the annual report released on Nov. 12 concludes.

In the report’s central scenario, global energy demand slows to 1% per year after 2025, resulting from policy effects and a general shift in the global economy away from heavy industry and towards service sectors. By 2040, the WEO-2014 predicts that the world’s energy supply will be split almost equally into four parts: oil, gas, coal, and low-carbon sources.

However, electricity will be in short supply. About 7,200 GW of capacity will need to be built to replace existing power plants due to retire by 2040—which account for a stunning 40% of the current fleet. Building new capacity— thermal capacity as well as renewables—will require “adequate price signals,” says the IEA.

Other trends show a shift towards more capital-intensive technologies and high fossil fuel prices, which will in turn drive up average power supply costs and end-user prices in most countries.

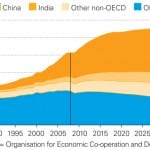

Natural gas will see the fastest rate of growth among fossil fuels. The report forecasts that demand for global gas will be higher mostly in part due to China and the Middle East, but also in countries that are members of the Organisation for Economic Co-operation and Development (OECD). Gas is expected to become the leading fuel in the OECD energy mix by around 2030, owing to rules in the U.S. curbing power plant emissions, says the IEA.

Coal, on the other hand, will see a 15% growth spurt through 2040, most of which will occur over the next decade. In the U.S., coal use for power generation could drop by a third, the IEA projects, though it will rise in India. India is poised to overtake the U.S. and become the world’s biggest coal consumer (and importer) by around 2020.

Nuclear capacity is slated to increase from 392 GW in 2013 to more than 620 GW in 2040. But its share of global power generation will rise just one percentage point to 12%, because almost 200 reactors of the 434 operational at the end of 2013 will be retired during that period. New capacity will be installed in markets “where electricity is supplied at regulated prices, utilities have state backing or governments act to facilitate private investment,” says the IEA.

The WEO-2014 also features a special report on power in sub-Saharan Africa, where an estimated 620 million people have no access to electricity. The region is seeing soaring economic growth, but it continues to suffer a crippling shortage of electricity.

The IEA recommends that sub-Saharan African countries should boost investment into their power sectors to reduce power outages by half and achieve universal electricity access in urban areas. Then, it calls for regional co-operation to increase power production from sources like large dams. Finally, it says that the continent’s energy future relies on how well government and industry can manage energy resources and revenues, stressing that transparency and efficiency will be integral to making improvements to Africa’s infrastructure.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)