Despite escalating growth over the past decade, the U.S. solar power sector faces potentially crippling issues concerning module supply, workforce deficiencies, and grid interconnection obstacles, according to industry experts attending an international solar and energy storage convention.

The country added an estimated 14.5 GW of new solar photovoltaic (PV) capacity in 2016, and by 2021, cumulative solar installations are slated to pass the 100 GW mark, driven by net metering, solar leasing, new power purchase agreements, the rise of solar communities, and federal and state policies and tax credits. But this rapid growth has been problematic on many levels, and the industry continues to face hurdles that could stymie future projections.

Here are 11 takes on the solar sector’s current and future standing from experts at Intersolar North America’s ninth annual event held last week in San Francisco, Calif.

- Solar Is Mainstream

“Solar is no longer a niche part of the energy spectrum,” declared Jesse Grossman, CEO of Tenaska’s solar project development arm Soltage.

Grossman noted that the recent extension of the federal investment tax credit (ITC) through 2021 is expected to spur a renewed market expansion, but “very fast rates” of growth will also be markedly fueled by new markets, particularly in the distributed utility solar, commercial and industrial (C&I) solar, and community solar sectors. Notably, larger utility-scale solar has been “dried out as interconnection and land opportunities are getting more and more scarce,” he said. But “distributed utility solar, where you are immediately connecting to medium high-voltage interconnection, selling mostly to utilities under long-term fixed contracts… those are also growing quite rapidly in the U.S.”

Solar’s rise is no longer anchored by uncertainty about whether the ITC will be extended or whether the price of panels will come down. A lot of those concerns have been allayed. “Now a lot of folks are just looking at each other saying we just have to execute. And that’s absolutely correct.”

But now, the sector’s hurdles appear to be rooted on the state level, he said. “In the first half of 2016, there were 100 different state policy actions across 39 states,” Grossman noted, including legislation on net metering, interconnection, and local tax laws. “And so, we just need to bear that in mind that a lot of the fights and work that we need to do is to go to the states to make sure we’ve got a real clean runway to continue the expansion of solar across the U.S.”

- Solar’s Rapid Growth Isn’t Always a Boon

However, it doesn’t always help that the sector is still in a state of upheaval. “The industry is growing very fast,” commented Dr. Alexander Levran, who heads ABB’s global solar industry initiative.

While the financial community is supportive, new players are entering the solar power sector, both utilities and end-users. Technology is changing, and so is the vendor base. Utilities have embraced the sector, in some cases (as in Europe), even divesting conventional generation in favor of renewables. Finally, competition is fierce and price erosion is in the double digits, he noted.

“This is why solar’s level of estimated cost is approaching natural gas. It’s a little too fast, but that’s the way it is.”

- Solar Is Suffering a Unique Revenue Catch-22

As it takes on an ever-larger share of the total generation mix, the solar sector has run into a unique problem whereby it is apparently sabotaging its own revenue stream, GTM Research pointed out in a white paper released last week at Intersolar.

“Solar is a zero marginal-cost resource, which means it will bid into wholesale power markets at zero dollars and take any price it can receive,” the market research firm said. “Add an increasing amount of solar to that market and prices decline overall, leading to lower revenue for each solar project. Since solar is non-dispatchable, project operators cannot strategically sell into the market at higher priced times—solar is purely a price taker (unless paired with energy storage). In fact, the more solar is placed on the grid, the less the grid needs power when solar production is highest—causing solar’s value to decline as its penetration increases.”

- Doing Business in a Fragmented Regulatory Landscape Is Risky

In providing a bigger picture of issues ailing the industry, Dr. Lidija Sekaric, who heads the Solar Energy Technologies Office within the Office of Energy Efficiency and Renewable Energy, noted that setbacks affecting grid integration were rooted in a problematic policy space.

“Integration with the rest of the grid, integration with storage, with demand and load is really going to take care of itself—and that innovation is already happening,” she said. “The actual obstacles that we’re seeing—and is always lagging—is the regulatory space, the policy space.”

That uncertainty has recently been alleviated to some degree she said (in the U.S. by the ITC extension and in the global arena by the Paris Accord last December). What will matter most is how different jurisdictions work to push down costs. “Cost is king,” she said.

- Solar’s Future Is Pegged to State Renewable Targets, Which Are in Flux

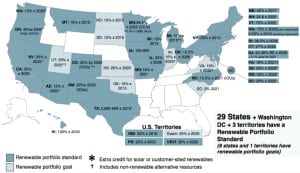

Galen Barbose, who is a research scientist at the Department of Energy’s Lawrence Berkeley National Laboratory, pointed out that renewable portfolio standards (RPS)—which exist in 29 states across the U.S., along with the District of Columbia (Figure 1)—collectively apply to 55% of total solar retail sales.

Renewable portfolio standard policies in the U.S. As of June 2016, 29 states and Washington D.C. had renewable portfolio standards, while eight states had renewable portfolio goals. Source: DSIRE

Reformed and revised over a span of two decades, some of those states are still in the process of increasing their targets, Barbose said. But even as they currently stand, they mandate a “pretty significant” ramp-up on the demand side of the market. On the supply side, meanwhile, about 55 GW of new renewable capacity will be needed to meet RPS requirements nationwide by 2030. “Just to put that into perspective, total renewable capacity in the U.S. right now is 100 GW,” he said.

But RPS policies still face legal challenges. Legal and legislative measures to repeal or rollback RPS programs keep “cropping up,” typically listing RPS compliance costs as a key concern. “By and large, those proposals haven’t come to fruition, but they continue to crop up,” Barbose said, adding that the directions states take to revise their RPS targets will be critical for the future of U.S. solar generation.

However, the sector’s future growth is also linked to how legal challenges affecting the Clean Power Plan play out, he said. The industry must continue to endure the uncertainty that shrouds the Environmental Protection Agency’s rule, which has been stayed by the Supreme Court until the D.C. Circuit can review its merits this fall.

- Energy Storage Is Critical for Solar’s Future

This year’s Intersolar North America conference and exhibition was co-located with ees North America, a stand-alone event focused on energy storage technologies and services. That alone was telling of the solar sector’s pronounced embrace of energy storage. And, it was even more apparent on the exhibition floor, where one in five exhibitors were from the storage industry.

Experts at both Intersolar and ees repeatedly suggested that pairing solar with energy storage, load control, and other distributed energy resources (DERs) could provide a greater value for the grid. This “DER aggregation” is already underway, with independent system operators looking to open up markets to distributed resources, they noted.

Utilities, too, may be more willing to put up more solar PV panels if a project is paired with an energy storage system, said John Jung, CEO of energy storage software and integration services firm Greensmith Energy Management Systems, which has installed 70 MW of large-scale energy storage projects for a number of utilities and independent power producers. Utilities are putting up solar installations to sustain state renewable targets, and energy storage could give them more control over that power, he said.

“Generally speaking, among about nine investor-owned utilities that we work with, predominantly in North America, they’re all very pro-combination of solar and energy storage,” he said. However, depending on the market in which they operate, utilities still grapple with rules about how much energy storage—if any—they can own.

- The Utility Market Is Snatching Up a Growing Role in Solar’s Future

According to GTM Research, the utility PV market continues to drive installation growth in the U.S. solar market, accounting for 43% of capacity installed in the first quarter of 2016. More than 10 GW of utility PV will be added this year, many developed before the federal ITC was extended in December 2015. And, as more utilities in both major and emerging markets procure solar as a hedge against natural gas price volatility, power purchase agreements are being signed at prices between $35/MWh and $50/MWh.

GTM Research estimates that the contracted utility PV pipeline currently totals 21.4 GW—and at least 30.7 GW of utility PV is in the announced/pre-contract stage. However, the research group said that a growing number of developers have delayed projects to 2017 owing to factors associated with interconnection delays.

- The Solar Sector Has a Bittersweet Relationship with Utilities

Still, a theme that surfaced repeatedly during panel discussions or was brought up during question periods was the solar sector’s bittersweet relationship with electric utilities.

Interconnection delays are at the heart of disagreements between solar developers and utilities, but as experts at Intersolar underscored, much of the feuding also stems from behind-the-meter net metering fights, which are unfolding in at least 20 states.

Utilities argue that net metering customers don’t pay their fair share of grid expenses, raising costs for non-solar ratepayers. Whereas, the solar sector says that utilities don’t fully account for distributed solar’s value to the grid, such as capacity value, transmission and distribution deferral, and line loss savings.

As she reviewed California’s surging solar growth—which is being fueled by demand in the agricultural sector and multifamily homes—Bernadette Del Chiaro, who serves as executive director for the California Solar Energy Industries Association, outlined a number of hurdles the sector is facing. Foremost among them is that investor-owned utilities Pacific Gas and Electric (PG&E) and Southern California Edison (SCE) had “ramped up some pretty negative interconnection battles,” especially with some C&I projects, she said. It has taken nine months, in some cases, to connect a system, and required distribution upgrades have proven costly, she added. The industry group, however, is hopeful that the state legislature will set up a third-party mediator at the Public Utilities Commission to arbitrate and oversee interconnection issues.

Meanwhile, the sector is also seeing a “major backlash from publicly owned utilities in California, which make about 20% of California’s ratepayer base,” Del Chiaro said. One of the more publicized battles has been with Imperial Irrigation District, which provides power and irrigation water to the lower southeastern portion of California’s desert. In February, the district abruptly shut down its solar net metering program, stranding more than 1,200 customers—”many with solar on their rooftops,” she said.

“We’re also seeing a lot of negative anti-solar movement from other publicly owned utilities,” she said. “It’s pretty bleak.”

- The Solar Sector Is Plagued by a Serious Workforce Crisis

As alarming to the sector is a looming labor shortage, even though more than 209,000 people worked in the solar industry in 2015—a 123% increase since 2010.

Andrea Luecke, president and executive director of D.C.-based The Solar Foundation summarized the problem: “Right now in the U.S., we’re experiencing a near-crisis level in terms of being able to match skilled workers with companies. We have a real gap between the supply and demand of skilled labor, and if that continues to persist, that’s the black eye we’re going to be seeing.”

The increase in solar installations paired with an aging utility workforce has created great demand for skilled workers, and emerging technologies and processes have called for new types of training and jobs. But, while a large portion of new workers have the training to fill jobs, employers seem to value experience over education. “It represents a big Catch-22 for solar job seekers,” Luecke said.

- Falling Costs May Have Consequences for Innovation, Quality

While growth is surging, the industry also lacks regulation that will ensure future quality of several components integral to solar systems.

“This industry had a very successful run in Europe and the U.S. We had IEEE codes, UL codes, IC codes that allowed us to structure the connectivity to the grid in a methodical way, but this effort needs to continue. We have no reliability standards being developed for all of the applications in the solar industry for inverters, transformers, substations, and other devices,” noted ABB’s Levran.

Grid-integration of solar will also require energy storage and DERs, but “without standards that help grid integration of storage, this will be a difficult task,” he added.

Mukesh Dulani, president of SolarWorld America suggested the sector needed to pour investments into making modules smarter and improving quality. Dr. Harry Lehmann, who is the general director of environmental planning and sustainability studies at Germany’s Federal Environment Agency, agreed that technology investment is necessary, but he cautioned that module quality would suffer if the industry continues its drive toward lower costs.

“Let’s slow down the cost [decrease], because we need quality. We need things that can be repaired. We need systems that can be remanufactured, systems that don’t go to waste after 20 or 50 years. If we don’t slow down, the cost to solve these other problems [will escalate],” he said.

- The Solar Sector Is Always in Flux—and Predictions Can Mean Little

A number of experts also brought up the prospect of a module shortage, which shows how resiliently the sector overcame the module glut it was suffering a few years ago that knocked several solar majors out of the business.

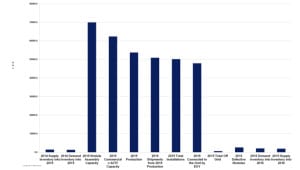

According to Paula Mints, who is the chief market research analyst for Solar PV Market Research, the global PV industry’s upward growth “line” has been smooth, but it “hides much nuance.” Real market behavior has strong demand, but not necessarily consistent demand, she said (Figure 2).

Figure 2. 2015 global solar photovoltaic industry metrics. Courtesy: SPV Market Research

In Europe, for example, poorly designed feed-in tariffs and market behavior “created a landscape that, in hindsight, looks like bad writing. Retroactive changes to [feed-in tariffs] in some markets [such as in Spain and the Czech Republic] created a landscape of bankrupt systems and legal wrangling, while developers in Greece may not receive expected [feed-in tariff] payments.”

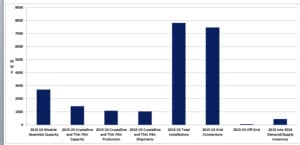

Meanwhile, even though it is growing faster than the global market, the U.S. is an import market, and that’s unlikely to change, Mint added. “Basically, in the U.S. we have twice as much module capacity as we do to sell, but the industry is limited by its semiconductor capacity.” What it has meant for the U.S. (Figure 3) is that “Installations lag module shipments sometimes by a year or two depending on the application. Grid connections lag installations depending on the utility and on the size of the installation,” she noted.

Figure 3. U.S. 2015 solar photovoltaic market metrics. Courtesy: SPV Market Research

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)